The revenue meta is not a short-term, transitory conversation. It is the sign of a market trending towards efficiency.

Our latest story breaks down our reasoning behind this, with data from @tokenterminal

According to data from DeFiLlama, there are ±300 L1s and L2s. Of these, barely 10 have a TVL north of $1 billion. There are just as many with a daily protocol fee beyond $200k. From a price to sales perspective, Arbitrum and Optimism trade at healthy levels between 60 and 80. But consider the sea of protocols that trade above 1000, and you will understand why traditional allocators are now focused on revenue.

Enterprises like Oracle and Microsoft contribute to open-source software because they build products atop it. AWS may not exist if it were not for Linux. Google requires Android to fill the gaps it has in building mobile hardware. However, the same cannot be said about late-stage protocols today. The incentives to contribute code, talent, or resources simply do not exist. In the absence of wealth effects like the one ETH showed in 2017 (up ±200x) or Solana in 2024 (up ±20x from bottom), it is unlikely that the marginal token in crypto catches bids.

So what do founders do? They focus on niche, vertical markets where margins are higher.

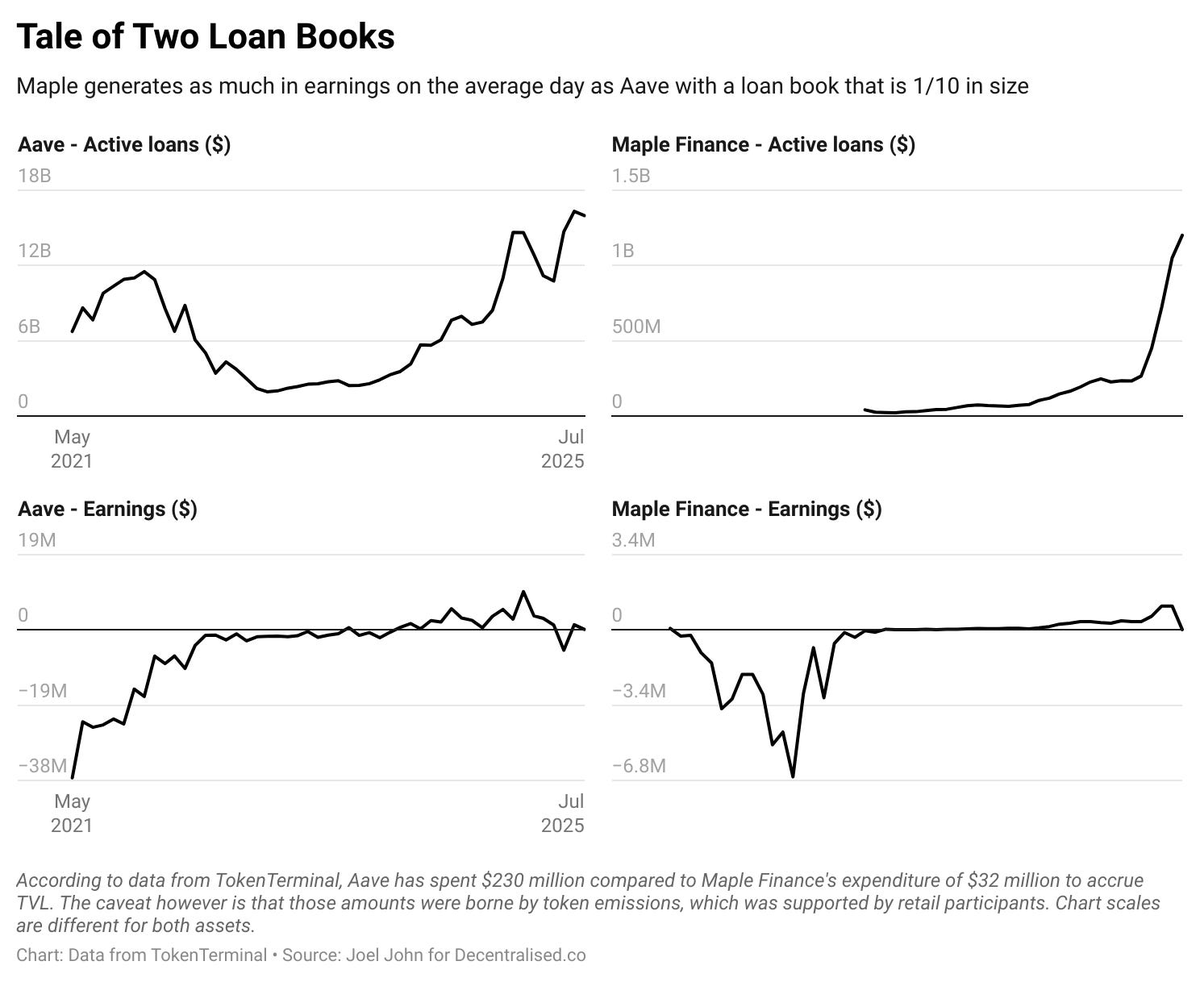

Consider @maplefinance, for instance. According to TokenTerminal, they do $1.2 billion in their loanbook compared to Aave’s $16 billion. But the two of them do roughly the same in monthly earnings at this point in time. They are able to do this by pursuing corporate pools of capital and generating yield on Bitcoin. Niche. Vertical. Sticky.

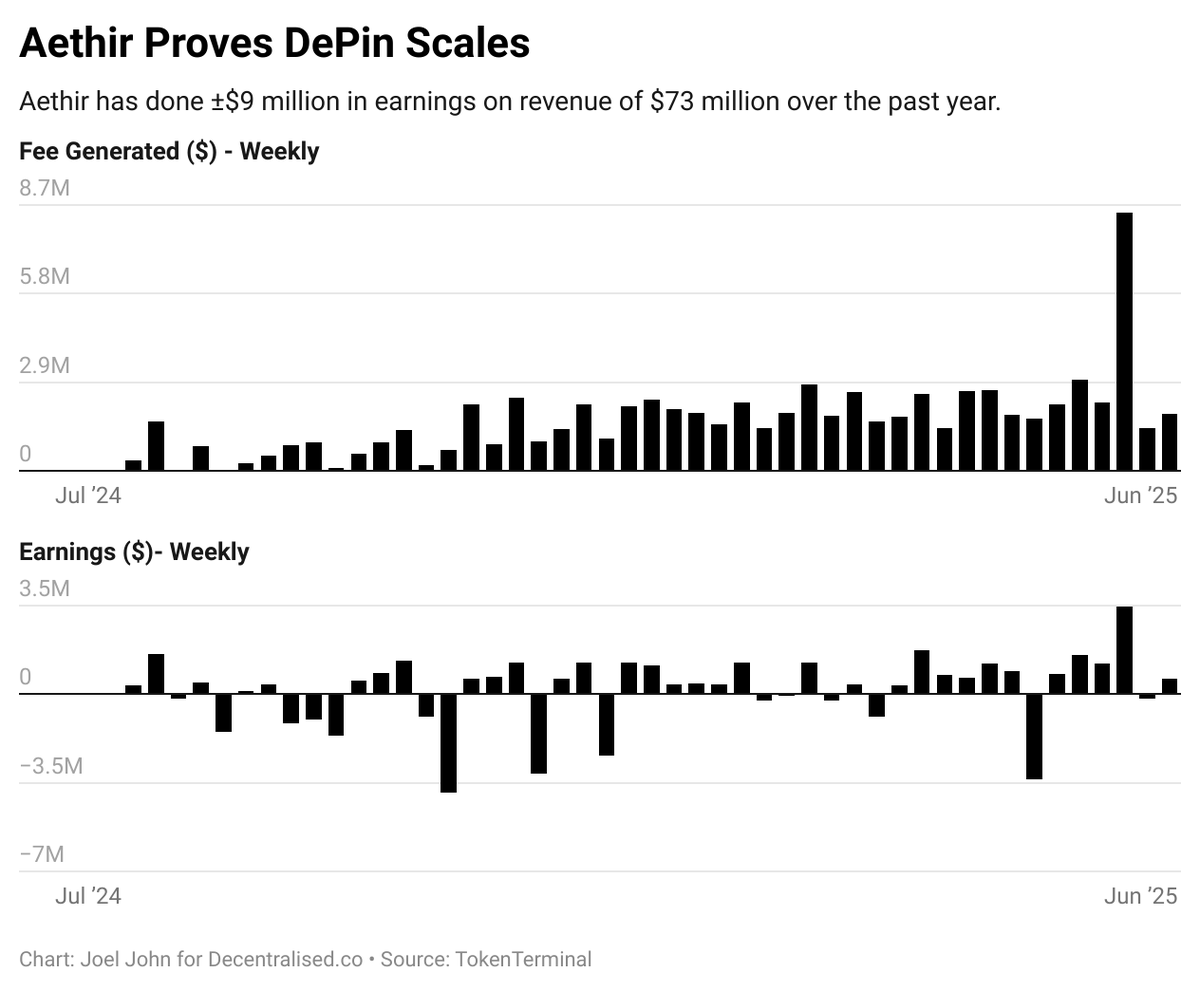

Similarly, over the last year, @AethirCloud has done ±9 million in fees on revenue of about $78 million. They offer a distributed network of GPUs for niche use cases like training LLMs and gaming. They cater to a real, sticky and niche need which is often not discussed within Web3. In the process of pursuing that, they have validated that DePin networks can scale.

Why does any of this matter? In an age where there are endless assets, economic fundamentals will be a driving factor for setting a base price for assets. This has been the core thesis behind prominent liquid fund investors like @arthur_0x and @noahtrader. In the absence of these fundamentals, we will simply be trading hypothetical hopes and dreams.

An alternative approach is to simply focus on generating revenue and never tokenise. @AxiomExchange has done close to $140 million in revenue YTD. @phantom has crossed $394 million in cumulative fees. These are numbers unheard of in other industries. But given the capital velocity in Web3, it is possible to build a trading interface and capture fees so long as you have enough distribution.

Between the recent acquisition spree, revenue meta and assets being wrapped around equities, what we are witnessing is a great divergence. Between the old playbook of crypto and economically sound assets. Between playing perception games and having a base case for how an asset should trade.

Read our latest in the story for field notes on how we think the situation would evolve.

5.83K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.