Behind the U.S. stock chain: the narrative is very lively, the market is very cold, can old bottles of new wine become the second curve engine of the bull market?

By Frank, PANews

The listing of U.S. stocks on the chain has become a hot topic in the recently deserted market.

On March 8, Swiss tokenization issuer Backed launched the Coinbase stock token wbCOIN on the Base chain, which users can trade with USDC through CoWSwap and claim that it is pegged 1:1 to the value of $COIN shares and has legal claims. Although Backed emphasized that he has no official connection with Coinbase, the move has sparked heated discussions in the community: will the tokenization of US stocks usher in a new growth cycle? In the context of the continued downturn in the market, can the "new bottle of old wine" of stock tokenization become a new narrative to build the bottom?

Narrative first, value second: the hot and cold contrast of U.S. stock tokenization

With the pro-crypto Trump administration coming to power, the SEC's litigation relationship with Coinbase has also ended. In early 2025, Jesse Pollak, head of the Base protocol, said on X that Coinbase is considering introducing tokenized $COIN shares to the Base network for U.S. users. But it will take time for Coinbase to launch this business compliantly.

Backed's swift movements were one step ahead. Founded in 2021 and initially backed by investments from institutions such as Gnosis and Semantic, Backed's headquarters and operations are mainly geared towards the global market, and its products are issued under the EU regulatory framework, meet the compliance requirements of MiFID II, and have passed the EU prospectus.

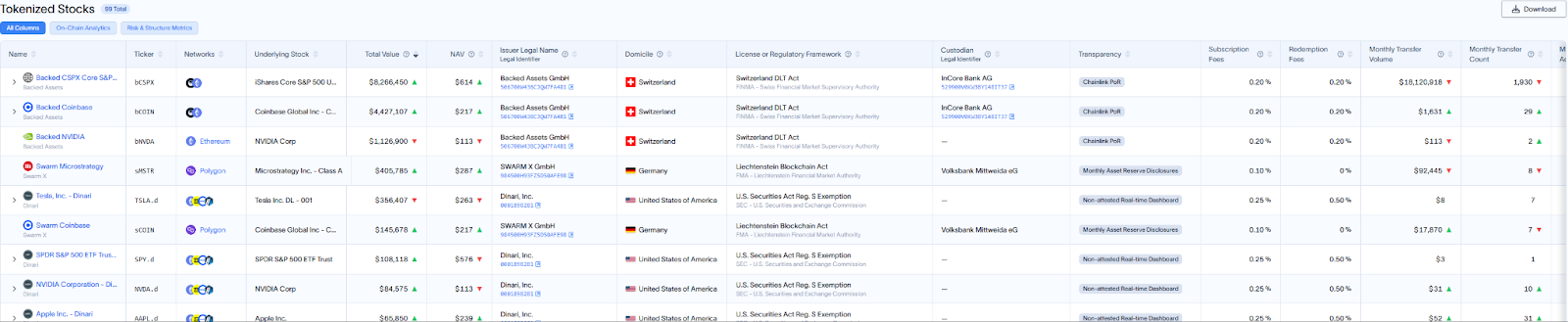

However, wbCOIN is not Backed's first stock tokenization product, as back in July 2024, Backed launched NVIDIA's tokenized stock trading with INX. In addition, Backed has also launched tokenized products with a variety of stock assets such as S&P 500 and Tesla. It's just that the focus of the market on the tokenization of securities is not on the topic of security tokenization when these products are launched, and today's market urgently needs some reasonable narrative to rebuild confidence.

However, it's not just that Backed's products aren't available for the U.S. market or that the market is sluggish. The trading popularity of wbCOIN after its launch is obviously not as hot as the topic. As of March 11, wbCOIN's TVL was about $4.42 million.

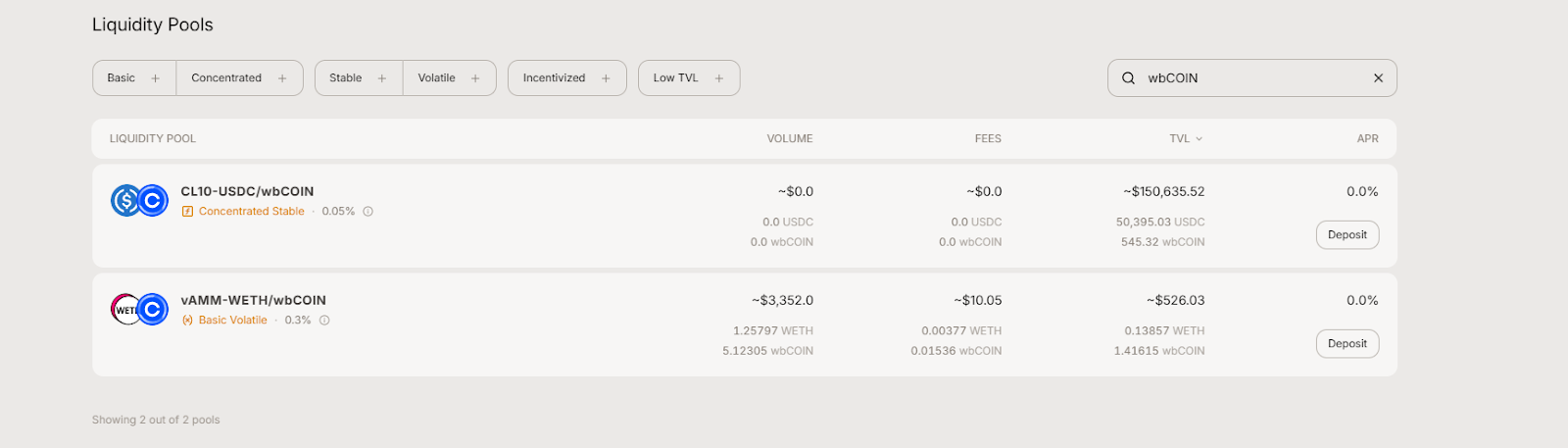

According to Aerodrome, its trading volume is also only $3,352. It's not even as hot as a newly issued MEME coin.

This sluggish performance is not only due to the short time wbCOIN has been online for a short time - another product that went online earlier, BNVDA, with a trading volume of only $113, was also unpopular.

Despite the hot concept, the current U.S. stock tokenization market is still in its early stages, with very limited size and activity. Perhaps, the tokenized products from Coinbase may trigger even more trading heat.

Tokenized U.S. stocks: old bottles of new wine, compliance is the primary threshold

In fact, the idea of putting U.S. stocks on the blockchain is not new. Prior to this latest wave of attempts, the crypto industry and traditional financial institutions had been exploring for a long time, but most of them ended in failure.

The FTX exchange, which was once in the limelight, also provided tokenized trading services for U.S. stocks, including Tesla, GameStop, etc., from 2020 to 2022. However, the collapse of FTX in 2022 brought this business to an abrupt halt. Rumors later questioned whether FTX's stock tokens held the corresponding shares in full, further undermining the market's trust in the exchange's tokenized shares.

In 2021, Binance also tried to launch tokenized stock products corresponding to US stocks such as Tesla, Coinbase, and Apple, where users can buy fractional shares of these stock tokens. Within weeks of Binance's launch of the stock token, financial regulators in the UK and Germany warned that the products could violate securities regulations. Less than three months later, Binance announced the removal of all stock tokens.

In addition to this, Bittrex Global, an exchange that once featured its offer of tokenized stock trading, also chose to shut down the trading platform and go into bankruptcy liquidation after experiencing regulatory pressure and SEC lawsuits.

It can be seen that in the last round of attempts, compliance hurdles were the main reason for the failure of the exchange to issue U.S. stock tokenization. Nowadays, the market is re-mentioning the tokenization of U.S. stocks, and there are the following factors:

1. With the Trump administration's emphasis on and support for crypto, the tension between cryptocurrencies and regulation has also been eased.

2. The market has entered a period of weakness, and the market needs some narrative return supported by real value.

3. The technology and compliance scheme is more mature. Compared with the previous brutal growth, today's crypto market pays more attention to compliance design and technical assurance. In the case of Backed, for example, each of its tokens receives an EU-approved prospectus prior to issuance, specifying the token holder's interest in the underlying shares. In terms of technology, the performance of oracles and public chains has been improved by an order of magnitude.

1 in 1,000 vs. trillion-dollar expectations: The reality of tokenized stocks

Despite the impressive growth rate, there is still a huge gap between the actual market size of tokenized stocks and institutional forecasts. Essentially, whether it is the tokenization of U.S. stocks or other securities products, they can be classified as RWA asset types. It's just that cryptocurrencies and U.S. stocks are both highly volatile and highly liquid financial assets, and the trading scale and capital volume of U.S. stocks, as well as the high-quality fundamentals of U.S. stock assets, are what the crypto world craves.

The industry is extremely optimistic about the future of equity tokenization, with some authorities predicting that the tokenized asset market could reach trillions of dollars around 2030: for example, the Boston Consulting Group (BCG) estimates that global tokenized assets could reach $16 trillion by 2030. The Security Token Market report even predicts that $30 trillion in assets will be tokenized by 2030, with stocks, real estate, bonds, and gold being the main drivers.

As of March 11, the total on-chain assets of global RWA were about 17.8 billion US dollars, of which the total value of equity assets was about 15.43 million US dollars, accounting for less than one thousandth, and the trading volume of the whole month was only 18 million US dollars. Obviously, stock tokenization is still an immature market in the RWA track.

However, from the perspective of growth rate and anti-risk ability, tokenized stocks are still competitive. In July 2024, the total on-chain value of tokenized shares was only about $50 million, an increase of about 3 times in half a year. This growth rate is significantly higher than the growth rate of funds in other copycat assets in the same period.

Recently, the crypto market has ushered in a sharp correction, Bitcoin has fallen below 80,000, and the market capitalization of the entire crypto market has retraced to the level of the first half of 2024, with a decline of 30% in the past three months. However, tokenized stocks have significantly performed much better over the same period, remaining at historically high levels. It can be seen that the overall volatility of the U.S. stock market is much less affected by a single asset than the crypto market, and the volatility of different types of assets is out of sync, resulting in a more stable overall market. This also provides a new value anchor for tokenized stocks.

For today's investors, tokenization of U.S. stocks is neither a bear market savior nor a short-lived concept. It's more like a seed that needs to be patiently waiting to break the ground - with the triangular support of compliance, technology and market sentiment, the answer to whether this seed can grow into a towering tree may be hidden in the next policy release of the SEC, the next compliance move of Coinbase, or the flow of funds from retail investors and institutions in the next bull market. The only thing that is certain is that this experiment is far from over.