The "1995 Moment" in the Crypto World: History Is Repeating Itself, But the Playbook Has Changed

Written by: Oliver, Mars Finance

We are in a divisive moment in the crypto world. On the one hand, there is an unprecedented institutional boom: Wall Street giants such as BlackRock and Fidelity have embraced Bitcoin in an unprecedented manner, and their spot ETF products have absorbed tens of billions of dollars of traditional capital like a pumping machine; Sovereign wealth funds and state pensions have also begun to quietly incorporate crypto assets into their vast portfolios. This wave makes the narrative of "cryptocurrency going mainstream" sound extremely real.

But on the other hand, the crypto world has never seemed so far away to the general public. Aside from the wild price fluctuations and the stories of a few speculators, it has almost no presence in everyday life. The once noisy NFT market has fallen silent, and Web3 games, which once had high hopes, have failed to "break the circle". This huge temperature difference constitutes a core contradiction: on the one hand, there is a feast for the financial elite, and on the other hand, the mainstream world is watching the fire. How do we understand this disconnect?

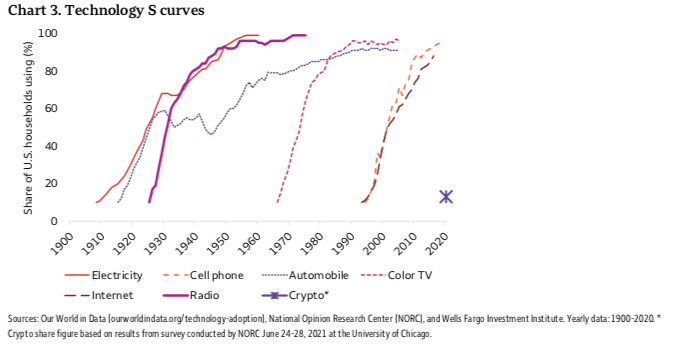

It is against this backdrop that Visa executives, including its CEO Alfred F. Kelly Jr., have made a profound judgment on several occasions: cryptocurrencies are in a stage similar to "e-commerce in the early 90s", and although it is not yet fully understood by the public, its underlying technology and ecosystem are maturing rapidly and are about to usher in a "super inflection point" of the adoption curve. Research from Wells Fargo and other institutions provides data to support this metaphor. Research reports show that the user adoption curve for cryptocurrencies is strikingly similar to the internet in the early 1990s. Even though the Internet was born in 1983, less than 1% of the world's population was using it until 1995. This number is similar to the percentage of cryptocurrency users today. History shows that disruptive technologies need to go through a long, slow, and confusing climb period before they explode.

However, this seemingly perfect analogy may obscure a deeper truth. History is not a simple repetition. Today's crypto world, the evolution of the playbook is being completely rewritten by two unimaginable variables - the entry of the financial "regular army" and the rise of artificial intelligence (AI). This is not only a repetition of history, but also an accelerated and very different evolution.

A giant of the Old World, a pioneer of the New World

The e-commerce revolution of the 1990s was a classic game of "disruptors". Amazon, eBay, and PayPal were all "upstarts" who rose from the fringes of the mainstream business world, challenging traditional giants such as Walmart and Citibank with new rules. It was a heroic era for garage entrepreneurs and venture capitalists, and the main line of the story was "subversion" and "replacement".

Today, the story of cryptocurrencies presents a very different narrative. The most striking pioneers are no longer just those cypherpunks wearing hoodies, but also financial "regular troops" in suits and leather shoes from Wall Street and Silicon Valley. They are not trying to destroy the old world, but to try to "transport" the entire old world to the new technological bottom. The breadth and depth of this "inside-out" change will be vividly demonstrated in 2025.

BlackRock CEO Larry Fink's prophecy of "asset tokenization" is accelerating. Following the success of Bitcoin spot ETFs in 2024, BlackRock has partnered with Securitize to launch its first tokenized fund, BUIDL, on Ethereum, turning shares in traditional money market funds into tokens that can be circulated 24/7 on the blockchain. Meanwhile, the number of businesses using crypto assets as strategic reserves, known as DATCOs, has surged, with the total amount of crypto assets held on their balance sheets historically surpassing $100 billion.

A more critical variable comes from a shift in the attitude of the U.S. government. The ambiguous and sometimes hostile regulatory environment of the past is taking a decisive turn in 2025. The U.S. government has not only become a significant holder of Bitcoin itself (nearly 200,000 bitcoins have been confiscated through law enforcement), but more importantly, it has begun to establish clear "rules of the game" for the industry. The GENIUS Act, signed in July, is the first comprehensive federal regulatory framework for stablecoins in the United States, providing a compliance path for a market with a market capitalization of over $250 billion. Immediately afterwards, the executive order allowing $9 trillion worth of U.S. pension funds to invest in alternative assets such as cryptocurrencies opened up huge incremental capital entrances for the market. This top-down recognition has completely changed the risk-return calculation of institutional entry, and has also made the foundation of this change extremely solid.

AI: Finding "new species" in native economic soil

If the entry of financial giants paves the highway to the real world for the crypto world, then the explosion of artificial intelligence has brought the first true "natives" to this new continent.

The Internet in 1995 solved the problem of connecting "people" and "information" and "people" and "goods". The essence of e-commerce is to digitize and online the business activities of human society. The next era we are entering will be an era of economic collaboration between "AI" and "AI". AI as a new productivity force is creating digital content, code, design, and even scientific discoveries at an unprecedented rate. These values created by AI urgently need a matching and native economic system.

Encryption is just for this. Imagine a scenario: an AI design program creates a unique piece of art on its own. It can be minted into an NFT (non-fungible token) through a smart contract, thereby obtaining unique, verifiable ownership. Subsequently, another AI marketing program can discover the NFT and independently decide to pay a small cryptocurrency fee to promote it on social media. If an AI sourcing agent for a clothing brand takes a fancy to this design, it can directly interact with the smart contract holding the NFT, automatically pay the licensing fee, and obtain permission to produce 1,000 T-shirts. The entire process does not require any human intervention, and the creation, confirmation, circulation and distribution of value are completed instantaneously on the chain.

This is not science fiction. Ethereum founder Vitalik once pointed out that the combination of AI and encryption can solve each other's core problems: AI needs trusted rules and asset ownership, while the crypto world needs a "user" who can act autonomously. This symbiotic relationship is giving rise to new application scenarios. For example, decentralized computing networks like Akash Network allow AI developers to rent idle GPU computing power worldwide for cryptocurrency; On-chain AI models attempt to build more transparent and censorship-resistant intelligent systems through token economic incentives.

This AI-native economic activity can be much larger and faster than human business activities combined. What it needs is a globally unified, low-friction, programmable value settlement layer. This is the core value of crypto technology, and it is also a grand vision that the Internet of the 90s could not reach.

What we are looking for, is it the next "Amazon" or "TCP/IP"?

In the face of such changes, investors and builders often ask: Who will be the "Amazon" or "Google" of the crypto world?

This question itself may be limited by historical experience. Amazon's success is built on the platform economy model of Web 2.0 - a centralized company that provides excellent services and attracts a large number of users, ultimately forming a winner-takes-all network effect. However, the spiritual core of the crypto world lies in the "protocol" rather than the "platform". Its goal is to create an open, neutral, and permissionless public infrastructure like TCP/IP (the underlying communication protocol of the Internet).

Therefore, the future winner may not be a closed business empire, but an open ecosystem or a widely adopted underlying standard. What we see may be that a Layer 2 network (such as Arbitrum or Optimism) has become the actual carrier layer for most applications due to its excellent performance and developer ecosystem. or it may be a cross-chain communication protocol (such as LayerZero or Axelar) that becomes a "value router" connecting all blockchains; Or a decentralized identity (DID) standard that becomes a unified passport for all users to enter the digital world.

The winners of these "protocol" layers will have a very different business model than Amazon. Instead of profiting by charging high platform taxes, they capture the value of the entire ecosystem's growth through their native token. They are more like public utilities such as urban roads and water supply systems than a dominant supermarket.

Of course, this does not mean that the application layer has no chance. On top of these open protocols, great companies will still be born. But the key to their success will no longer be to build closed moats, but how to better utilize these open protocols to create unique value for users.

Finally, back to that quote: If you're willing to see Visa's CEO's judgment as a signal rather than a decision, the more important question is "how do we turn the signal into practice?" For enterprises, this is a comprehensive project from strategic docking, compliance preparation to product landing; For individuals and institutional investors, it is to clearly distinguish between long-term perspectives and short-term fluctuations, neither blindly follow nor passively avoid them, and look for on-chain use cases that can generate value in the real economy.

History gives us two things: one is a mirror image, allowing us to see possible trajectories; The second is a lesson to remember that the ultimate winner is often not the fastest speculator, but the infrastructure and platforms that are persistent, real and can span cycles. Today's crypto is writing two parts of the script at the same time - a lively market short story and a slow-forming infrastructure long story. If Visa is true, the next decade will be a key decade for the latter to accelerate into the mainstream.