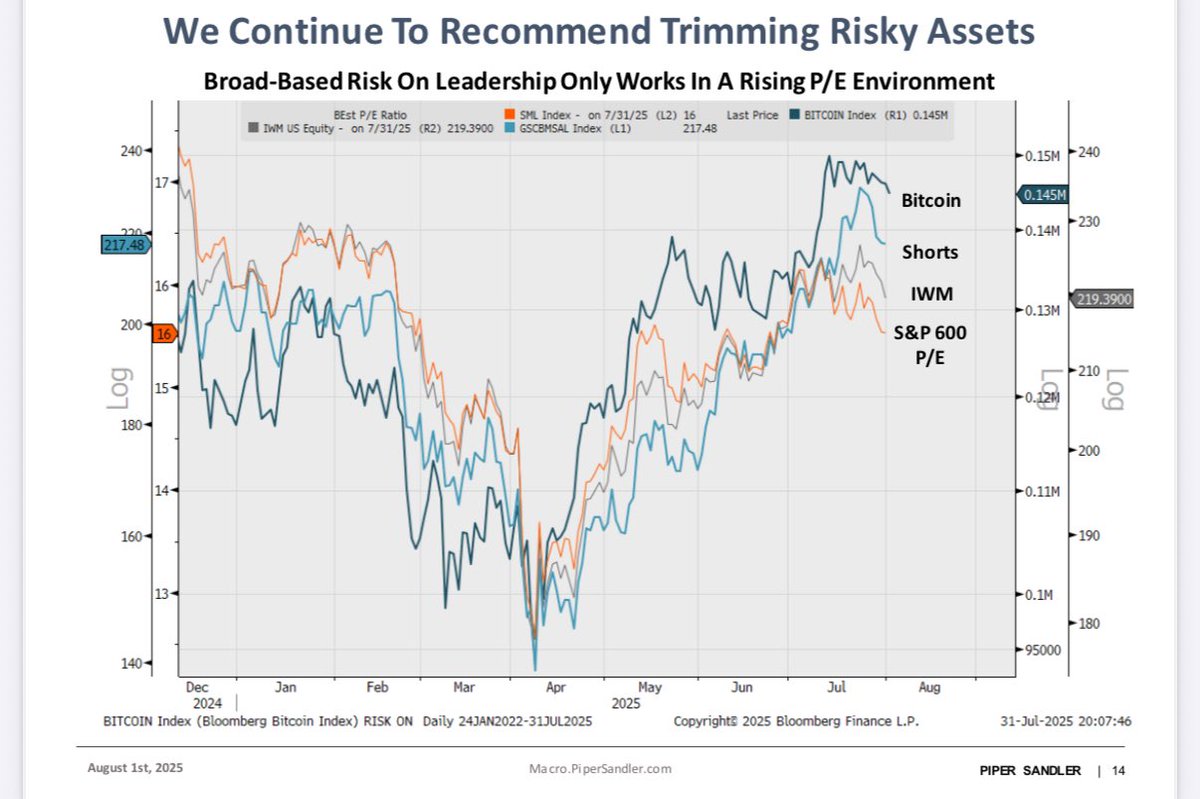

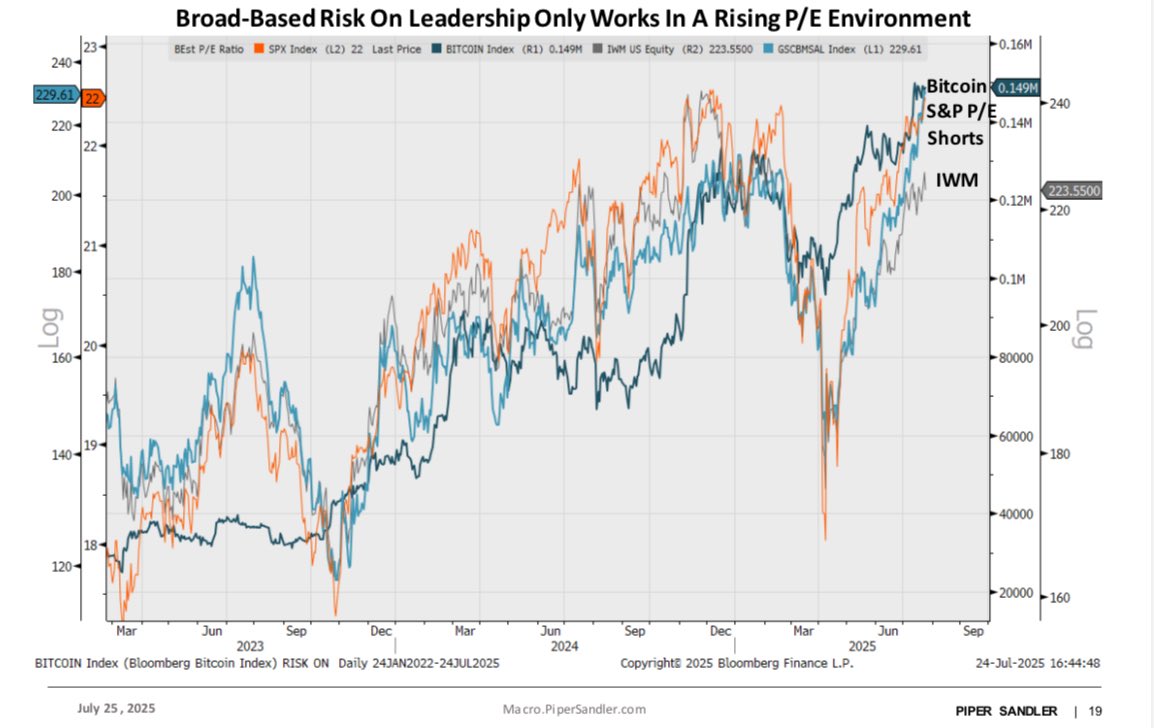

Too much Taco ingestion may result in risk-on indigestion. Irrespective of market moves, we think the period of risk-on outperformance has ended as macro risks, that got fully priced out, are beginning to normalize. Today’s market reaction to tariffs underscores my view that investors remain reactive rather than forward looking. Downside is greatest for securities that benefited from the rising tide of macro derisking (tighter spreads, valuation expansion) without improving fundamentals (or don’t have any). If markets correct more broadly alongside macro-risk repricing this only reinforces the point on portfolio repositioning. Looks like the server added too much refried beta in those Tacos.

Everybody is a genius [investor] when P/Es are going up. This is the part of the market cycle where you can throw darts and make money. Trees don’t grow to the sky and valuations eventually stop expanding when macro risks arise. Currently, the markets reflect very little to no risk. Enjoy it while it lasts.

14.99K

88

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.