This token isn’t available on the OKX Exchange.

HOOD

hamsterwifhood price

2hX8T7...pump

$0.0000084876

-$0.00023

(-96.47%)

Price change for the last 24 hours

How are you feeling about HOOD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

HOOD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$8,484.50

Network

Solana

Circulating supply

999,633,029 HOOD

Token holders

392

Liquidity

$10,598.54

1h volume

$637.38

4h volume

$2,560.19

24h volume

$1.70M

hamsterwifhood Feed

The following content is sourced from .

MooMs

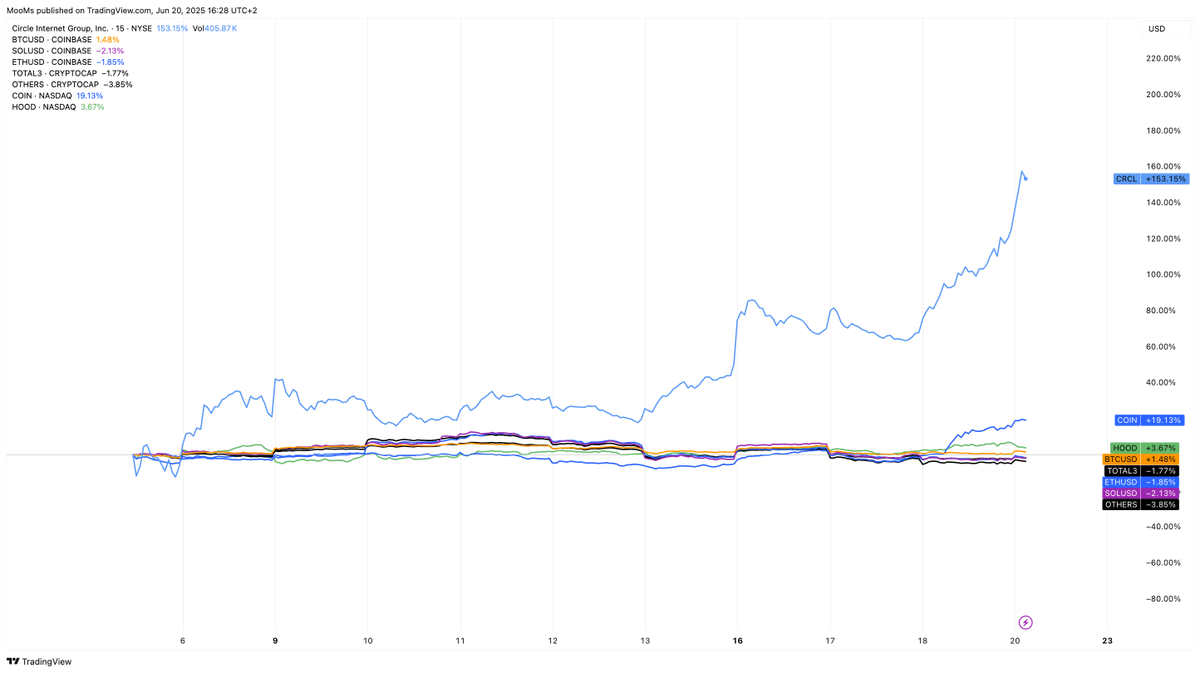

Two weeks later and $CRCL is trading like a 2021 altcoin.

$COIN and $HOOD are outperforming most of the market as well.

Wouldn’t be surprised to see a wave of new crypto IPOs and listings in the coming months, all getting the tradFi infinite bid.

At some point, one of these will mark the top.

And in hindsight, it’ll be obvious.

$SOL and $XRP ETF flows will give a good read on how the next few months will play out, once they are live.

9.75K

4

kaori35

Sometimes I think that perhaps the last breath of this generation of capitalism is to inject speculation into everything; after that, we will return to the starting point and revalue art and creativity—using capitalism more as a tool for driving substantial progress, and then around 2100, we will enter another peak super cycle of speculation.

The performance of $HOOD, $COIN, $HYPE (and some other assets) actually confirms this hypothesis as we contemplate the "super application of speculation."

In addition to the prediction market, which is both a tool for speculation and a prophetic mechanism leading to the real world, it may become another core module.

The essence of late capitalism is to try to lure retail investors into a cash harvesting mechanism, while retail investors are exceptionally eager and firmly believe they are not the ones being harvested.

Not trying to be contrary, but the current public market does feel a bit like there is a "top signal accumulation" (of course, it could just be short-term, so don't take it too seriously).

The stock market is approaching historical highs overall.

Those companies with the weakest fundamentals are actually rising the most (many companies have achieved 2x or even 10x increases in the public market over the past 90 days), coupled with high retail investor sentiment and aggressive entry.

Macroeconomic data may be weakening.

The Federal Reserve's rate cuts are also slower than many expected.

There is a disconnection between altcoins in the crypto market and the stock market. The funding flow structure of Bitcoin and Ethereum is quite different (possibly supported by a model similar to MSTR), while altcoins had previously followed the rise of U.S. stocks early on, but are now the first to pull back.

This may also be due to the complex situation in the Middle East, coupled with the higher leverage and further risk curve of altcoins, making them easier to scare off compared to retail investors who are "all in on stocks." But I haven't even mentioned everything happening in the private tech and AI sectors.

In the public market, the only uncertainty left is whether institutional investors (mainly hedge funds) have taken the wrong side in this round of the market—so we may still see a wave of "fear of missing out" funds coming in, accompanied by short covering and more incremental inflows.

In any case, as we have often said in the past few years, investing is supposed to be difficult. We may be heading towards a market with greater volatility and more differentiated performance. But right now, these changes are becoming increasingly hard to ignore, and the market may be undergoing a turning point.

Michael Dempsey

not to be that guy but kinda feels like the top signals are piling up in public markets (might just be short-term fwiw).

equities pushing into ATHs across the board.

the least fundamentally driven companies aggressively pumping the most (2x-10xs abound across last 90 days in public markets) paired with retail aggro positioning

perhaps weaker macro data

fed slower to cut than many think should

disconnect between alts in crypto and equities in which crypto (non-btc/eth which have structurally different flow dynamics and are possibly benefitting from the MSTR-ification). Alts front-ran a lot of the equities move with similar violence before selling off.

this could just be middle east complexity and furthest risk curve with leverage (crypto alts) thus gets scared off more than people yoloing into equities...but i haven't even mentioned all the things happening in private tech and AI land.

The only uncertain dynamic on public side is that institutional investors (HFs mostly) are supposedly quite offsides on this move and so you could have a secondary wave of flows come in as people FOMO, are forced to close out shorts, and more.

anyways as we've said often the past few years, investing is supposed to be hard and we're likely moving towards significantly more dispersion but right now these things are getting harder to ignore as a changing market

3.95K

5

Foxi 🦊

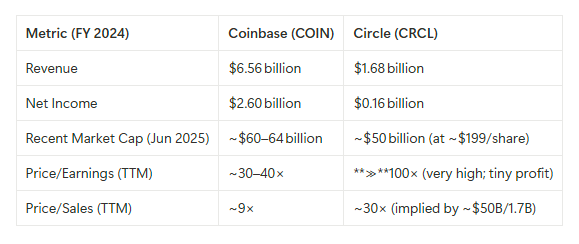

Why I’m buying $COIN but not $CRCL now.

Let's first look at the basic matrix (photo).

From a trading perspective, we can ignore the Circle’s extremely high PE, as trading is all about momentum and hot money. However, as I have sold my $CRCL too early and it’s mentally hard to buy it back, I’m considering buying $COIN as a fundamental play.

Per Circle’s IPO filings, Coinbase receives fully 50% of the interest income on currently ~$61B USDC reserve (after Circle’s base costs). Coinbase earns more if users hold USDC on the Coinbase platform, and slightly less for off-platform circulation – but broadly, Coinbase gets ~50% of USDC reserve income in most cases.

Coinbase earned $297 million in USDC interest revenue in just the latest quarter (Q1 2025). In Q1 2025, stablecoin interest accounted for roughly 15% of Coinbase’s total revenue (>$297M of $2.03B)

As part of restructuring their USDC partnership, Coinbase also obtained an equity stake in Circle. According to disclosures, Coinbase received ~8.4 million shares of Circle (presumably Class A) in late 2023. That stake is now worth on the order of $1.6–1.7 billion at Circle’s recent ~$200 stock price. This is a substantial hidden asset on Coinbase’s balance sheet. (For context, Coinbase’s entire market cap is ~$60B, so the Circle stake alone might equal ~3% of Coinbase’s value

I don’t expect CRCL to be that strong, but now I realize I’m wrong. I will start buying $COIN as TradFiMoney finds some crypto proxy on the stock market. $COIN will still be strong in the foreseeable future. I may also consider $HOOD as well.

830

4

Evan

All these stocks hit new 52 WEEK HIGHS at some point today

Robinhood $HOOD

$IBM

Raytheon $RTX

Cloudflare $NET

Charles Schwab $SCHW

Roblox $RBLX

Take-Two $TTWO

$ASTS

Alnylam $ALNY

Antero $AR

BNY Mellon $BK

Cardinal Health $CAH

Crown Cork $CCK

Mr. Cooper $COOP

Credo $CRDO

Corteva $CTVA

Expand Energy $EXE

Flextronics $FLEX

Kratos $KTOS

MP Materials $MP

Newmont $NEM

Seagate $STX

$TD

67.29K

156

HOOD price performance in USD

The current price of hamsterwifhood is $0.0000084876. Over the last 24 hours, hamsterwifhood has decreased by -96.47%. It currently has a circulating supply of 999,633,029 HOOD and a maximum supply of 999,633,029 HOOD, giving it a fully diluted market cap of $8,484.50. The hamsterwifhood/USD price is updated in real-time.

5m

-5.68%

1h

-14.61%

4h

-15.68%

24h

-96.47%

About hamsterwifhood (HOOD)

HOOD FAQ

What’s the current price of hamsterwifhood?

The current price of 1 HOOD is $0.0000084876, experiencing a -96.47% change in the past 24 hours.

Can I buy HOOD on OKX?

No, currently HOOD is unavailable on OKX. To stay updated on when HOOD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of HOOD fluctuate?

The price of HOOD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 hamsterwifhood worth today?

Currently, one hamsterwifhood is worth $0.0000084876. For answers and insight into hamsterwifhood's price action, you're in the right place. Explore the latest hamsterwifhood charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as hamsterwifhood, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as hamsterwifhood have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.