Agora raises $50 million in financing, why does Paradigm spend money on "white label stablecoins"?

Agora, a stablecoin startup, has announced the closing of a $50 million Series A funding round led by Paradigm with Dragonfly following. The funds will be used to drive the global expansion and compliance of its core product, AUSD.

This is not the first time that Agora has been favored by capital. Back in April 2024, the company closed a $12 million seed round led by Dragonfly. The two rounds of financing totaled $62 million, making Agora one of the few platform-based projects in the current stablecoin track that has received continuous bets from top institutions.

Who is Agora? What's the origin?

Agora is a stablecoin startup founded in 2023 by three co-founders, Nick van Eck, Drake Evans, and Joe McGrady, committed to building a new platform-based stablecoin architecture, also known as "white label stablecoin".

Nick van Eck comes from a traditional finance background and is the son of Jan van Eck, the founder of VanEck, a well-known asset management firm. Co-founder Drake Evans was a core engineer at MakerDAO, while Joe McGrady brings engineering and operations experience in Bridgewater-style institutions.

Agora has completed two rounds of funding so far. In April 2024, Agora closed a $12 million seed round led by Dragonfly Capital to develop its core product, AUSD, and build a white-label issuance platform. In July 2025, Agora announced the completion of a $50 million Series A funding round led by Paradigm and followed by Dragonfly, which will be used to accelerate global expansion and compliance. Up to now, Agora has raised a total of $62 million, making it one of the few platform projects in the stablecoin track that has received continuous bets from top VCs.

White Label Stablecoin AUSD, New Story or Old Packaging?

Tether and Circle have dominated the stablecoin market for a long time, one relying on volume to dominate the exchange, and the other focusing on compliance to open up traditional finance. But Agora doesn't intend to be "another USDT or USDC".

But underneath the current, this pattern is being leveraged by a startup called Agora.

Founded by Nick van Eck, the son of the founder of VanEck Investment Group, and two crypto industry engineers, Agora is positioned differently from Tether and Circle. Instead of trying to make a "more compliant USDT" or "more decentralized USDC", it has chosen a new path of platformization: to build an infrastructure that everyone can use to issue their own stablecoins.

It launched AUSD, a dollar-pegged stablecoin backed by a pool of assets managed by State Street Bank and VanEck. Different from the single-token distribution of Tether and Circle, Agora uses AUSD as the underlying unified liquidation asset, and opens up white-label issuance services on this basis - any enterprise, whether it is a Web3 project or an overseas payment company, can quickly issue its own brand of stablecoins, such as "GameUSD" and "ABC Pay Dollar", all of which share the on-chain liquidity and fungibility of AUSD.

This line of thinking is actually a bit like the model when Paxos partnered with PayPal to issue PYUSD in the early days. However, Paxos builds an independent stablecoin system for its partners, while Agora's partners must build directly on top of AUSD. This unified underlying design makes it easier for the entire system to aggregate liquidity and run out of network effects.

This platform-based issuance logic not only lowers the threshold for corporate stablecoin issuance, but also establishes a stronger ecological stickiness and moat for Agora.

From the perspective of compliance and technology construction, Agora is not a start-up. It's highly tied to traditional finance: custody of assets is handed over to State Street, asset management is handled by VanEck, and custody technology introduces Copper's MPC approach. At the same time, Agora is in the process of obtaining a fund transfer license (MTL) from various states in the United States in preparation for its future entry into the U.S. market.

In terms of ecosystem cooperation, Agora has cooperated with Polygon Labs to promote the issuance of customized stablecoins based on AUSD, and has also completed the first over-the-counter transaction of Galaxy, a crypto asset management institution. AUSD is currently listed on LBank and has opened USDT trading pairs, and is also supported by projects such as Injective, Flowdesk, Conduit, and Plume Network. In terms of on-chain, AUSD has implemented multi-chain deployment such as Ethereum, Sui, and Avalanche through Wormhole; Agora has also partnered with Agglayer, a cross-chain aggregation protocol launched by Polygon, in an attempt to make AUSD its native stablecoin.

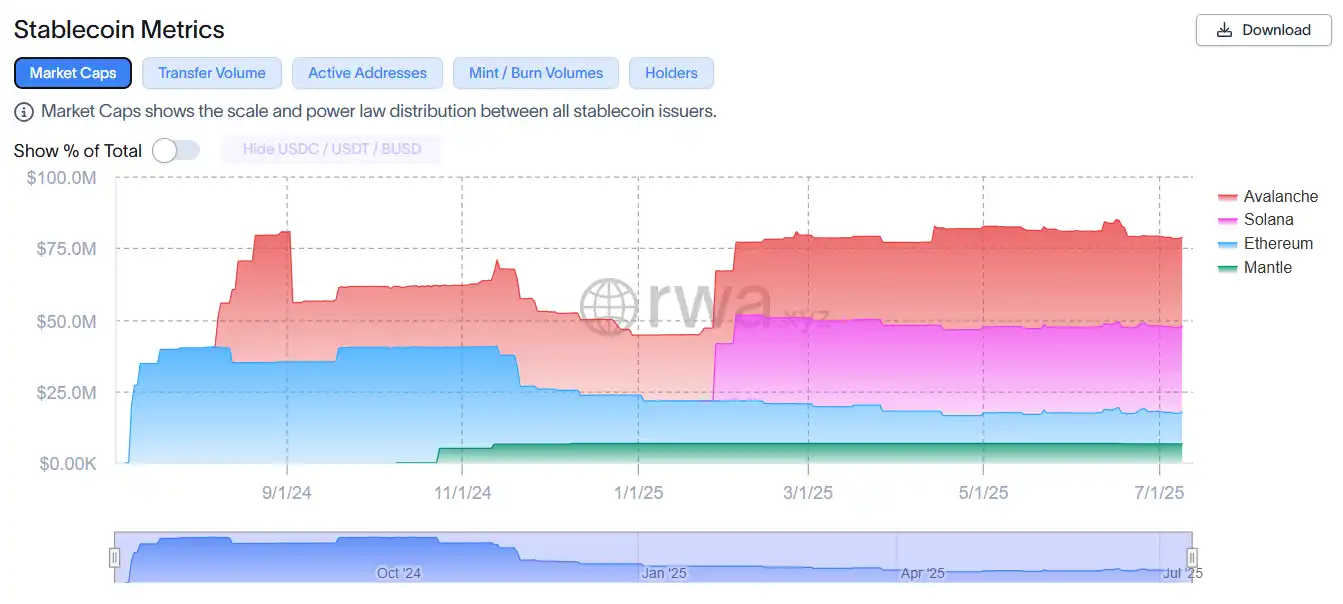

Source: rwa.xyz

Of course, the total market capitalization of AUSD is still less than $200 million, which is still an order of magnitude away from USDT's 159.1 billion and USDC's 62 billion. But in the eyes of top institutions such as Paradigm and Dragonfly, Agora's platform logic may mean a structural restructuring of the stablecoin market: stablecoins are no longer just products, but can become platforms where every institution can have its own on-chain dollar.

If the logic of stablecoins in the past was "I'll send one for you", Agora's logic is "I'll send one to you". Tether and Circle are the "products" of stablecoins, while Agora is more like the "AWS" of stablecoin issuance.

Source: coingecko.com

What does a Multi-State Money Transfer Permit (MTL) mean to seize the U.S. market?

Applying for a multi-state money transfer license (MTL) is not only a "passport" for stablecoin issuers to operate in compliance, but also a key to unlocking the door to the huge market in the United States. MTL not only gives companies the right to legally carry out fund transmission and stablecoin issuance in multiple states, but also greatly enhances the trust of banks, exchanges and institutional investors, and becomes the basis for cooperation. At the same time, MTL requires companies to strictly comply with multiple compliance obligations such as anti-money laundering (AML), customer identification (KYC) and regulatory reporting, so as to ensure the transparency and security of their business and lay a solid foundation for the launch of innovative products and services in the future. Because of this, MTL is not only a solid shield against legal and regulatory risks, but also a strategic capital for stablecoin companies to gain a foothold in the U.S. market and continue to grow.

Currently, major stablecoin issuers such as Circle, Paxos, Gemini, and TrustToken have been licensed to transfer funds in multiple states.

As the issuer of USDC, Circle has extensive MTL coverage, which provides a solid guarantee for its recognition by mainstream financial institutions and banks.

Paxos is also actively deploying compliance, holding multi-state MTLs, and promoting stablecoin issuance through partnerships with PayPal, Binance, and others.

Gemini's GUSD is one of the first stablecoins in the industry to be licensed by the New York Department of Financial Services, and its issuer also holds a multi-state money transfer license.

TrustToken has obtained MTL in multiple states to support the legal issuance and circulation of its multi-asset-backed stablecoins.

In addition to these stablecoin issuers, several digital asset custodians and trading platforms such as Anchorage Digital, BitPay, and Kraken have also applied for and received multi-state MTLs. Typically, licensed institutions prioritize covering states that are highly regulated and have active crypto operations, such as New York, California, Texas, and Florida. Obtaining an MTL requires meeting strict capital adequacy, anti-money laundering (AML), customer identification (KYC), and compliance reporting requirements. Overall, holding multi-state MTL has become a key compliance threshold for stablecoin products to gain market recognition and institutional cooperation. Agora is in the process of applying for a multi-state MTL with the goal of entering this compliance camp and opening the door to the U.S. market.

As a rising star, Agora is actively applying for a multi-state MTL, which is an important step towards its legal and compliant operations, integration into the mainstream U.S. financial system, and market expansion. Through this move, Agora not only shows that it attaches great importance to compliance, but also sends a strong signal: it is determined to become a new force to be reckoned with in the stablecoin field, win the recognition of the market and institutions, and open a new chapter in its global layout.

Betting on Agora, Paradigm is not following the trend

Paradigm's investment logic has never been to follow the trend, but to bet on projects that can reconstruct the logic of infrastructure. Agora hits the ground running in a few directions that Paradigm is focused on:

Convergence path of traditional finance + blockchain: Agora leverages State Street and VanEck to embed compliance trust into on-chain products and build an institution-friendly issuance network.

Reshaping the distribution logic of stablecoins: from "I issue coins and you use them" to "I build the system and you send them", no longer just to be a stablecoin, but to provide the ability to issue stablecoins and improve network effect and capital efficiency.

Product design to adapt to regulatory trends: Proactively applying for MTL and accessing the financial regulatory framework will give Agora a first-mover advantage in the upcoming U.S. regulatory cycle.

Charlie Noyes, Partner at Paradigm, said in an interview, "Agora's product is a 'built-in battery' stablecoin system that allows businesses to start a stablecoin business immediately without hiring ten engineers. "