This token isn’t available on the OKX Exchange.

DEX

DEX Screener price

DwBYXa...4ZGM

$0.000025505

+$0.0000097250

(+61.63%)

Price change for the last 24 hours

How are you feeling about DEX today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

DEX market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$25.50K

Network

Solana

Circulating supply

1,000,000,000 DEX

Token holders

548

Liquidity

$37.42K

1h volume

$1.80M

4h volume

$1.80M

24h volume

$1.80M

DEX Screener Feed

The following content is sourced from .

TechFlow

GMX is busy dealing with thefts, and Hyperlqiuid is busy doing business.

This time, Hyperliquid has made great strides into the Solana ecosystem, and unlike pure multi-chain deployments, this time it is through the Phantom wallet to provide liquidity support, and it is also surprising that Phantom chose Hyperliquid over Drift and Jupiter.

Compared with simply supporting Solana Chain and Phantom wallet login, Hyperliquid's idea is different from its predecessors such as dYdX and GMX, and is more like the on-chain version of Binance, that is, to become the ultimate source and destination of liquidity for all protocols and dApps, and to become the real on-chain cornerstone with super liquidity.

The third way

To understand Hyperliquid, you can't just talk about Hyperliquid itself.

It must be said in the comparison with spot DEXs such as Uniswap that the contract products from the spot perspective are gambling on borrowing money and speculating in coins, and liquidity is extremely difficult to maintain.

Uniswap can facilitate the participation of more assets in transactions through multi-chain deployment, and can promote the growth of protocol TVL even if it is only on this chain, but the contract DEX, whether it is dYdX, GMX or Hyperliquid, must "attract" liquidity in one place, which is also the natural advantage of CEXs such as Binance.

Centralization is naturally conducive to liquidity concentration.

It must be said in the comparison with peers such as dYdX and GMX that the Perp DEX from the perspective of GMX is a combination of on-chain matching, on-chain trading and liquidity tokenization combined with dYdX's order book, which is also the essence of GMX's crazy revenue in 2022, maintaining liquidity through the "inducement" of LP Token - > GMX Token.

The same is true for Hyperliquid, but the operation is more refined, the closed HyperCore is responsible for spot and contract transactions, which is the main basis for the centralization of Hyperliquid, and HyperEVM is responsible for the "blockchain" part, and the concept of operation is vague, which has long made Hyperliquid in a superposition state of decentralization and centralization, and super liquidity and matching efficiency are also hidden in it.

For the overall architecture of Hyperliquid, see Hyperliquid: 9% Binance, 78% centralized

Decentralization is naturally good for branding.

It is necessary to grow in the dynamic game and companionship with Binance, and to become the strongest liquidity, it is necessary to have centralized efficiency, decentralized experience, the improvement of dYdX's order book matching mechanism, GMX's liquidity token "bribery" mechanism, and the role of BNB Unicom BNB Chain and the main station – $HYPE Unicom HyperCore and HyperEVM.

In the end, Hyperliquid completed multiple contradictions that were difficult to couple in the past, and systems engineering once again worked its magic, stacking the existing technical elements to create the best PMF in the current market, and even improving Binance's thinking.

• Multi-chain deployment/centralized liquidity

• Bridging/Chain Abstraction/Aggregator/Intent

• Decentralized UI/Centralized UX

To become the infrastructure of the market, it is necessary to capture as many entrances as possible, and Phantom is very suitable as a guide to the Solana ecosystem, but it cannot be subsidized for the market, and profit sharing is a more sensible approach than token subsidies.

In the design idea of Phantom Perps, instead of logging in to dYdX or Drift in the past, Hyperliquid is embedded in its own interface, provided that the SOL on Solana is bridged into the Hyperliquid spot account and converted to USDC, and then transferred to the Hyperliquid contract account as margin.

Bridging may be supported by Hyperunit provided by the Unit protocol, but it is not entirely certain, additional information is welcome, and security assessment is also important.

After the transaction process and liquidation, Phantom and Hyperliquid roles are reversed, the Phantom interface is only displayed, and the actual operation is completely controlled by Hyperliquid, which is also the biggest difference with dYdX and Drift, user funds will really enter the Hyperliquid system.

Specifically, USDC needs to be converted from the Hyperliquid futures account to the spot, then converted to SOL in the spot, and then bridged back to the Solana chain, and finally displayed in the form of SOL in Phantom.

The advantage of this is that there is more freedom of funding.

After the user's SOL enters Hyperliquid, he can trade any currency supported by Hyperliquid, and choose a maximum leverage of 40x leverage according to the amount of funds.

The downside of this is that the system is less secure.

Bridging the entry and exit of assets is put to the test during times of extreme market volatility.

During the transaction process, users need to trust Hyperliquid, which essentially needs to reach the same trust level as CEXs such as Binance, that is, the exchange will not embezzle users' assets and will complete the matching according to user instructions.

Hyperliquid is not simply cooperating with Phantom, but hopes to use it as an ally to infiltrate and control Solana, which is undoubtedly an active attack on Solana's native DEX.

BNB outperforms any exchange token by far representing Binance's mastery of liquidity, and the same is true of Hyperliquid, which is a make-or-die charge, from spot to Perps, Ethereum to Solana.

Emerging revenue points

Hyperliquid isn't cheap, in other words, it's super profitable.

Compared with dYdX and Binance, Hyperliquid has never won by cheapness, and coincidentally, Phantom is also a small profit expert, from SOL staking to trading, from single chain to multi-chain, with strong business diversification capabilities.

MetaMask is already a distant myth in the wallet world, and Phantom is a reality.

But it's not enough to call the future, Backpack still wants to play in the same room on Solana, OKX Wallet is a strong opponent on the side, since the fusion of CEX and DEX is the main axis of this cycle, then Binance + Pancakeswap, OKX main site + OKX Wallet, Backpack Wallet + Backpack Exchange all have their own opportunities and ways of playing.

Stablecoins will continue to exist, it is unknown how long meme and on-chain issuance and trading tools can last, public chains and DEXs need to find their own growth points again, Hyperliquid itself is the repository of public chains, DEXs, stablecoins and memes, but it lacks wallet tools, or in other words, to reach more retail investors and a more popular market.

It's counterintuitive, but whales are the main players in Hyperliquid, and although the amount of funds is large enough, it is difficult to run stablecoins, memes, and even RWA and other higher-frequency, daily products without a sufficient number of retail investors.

The significance of retail investors is to carry out marginal innovation and mass reach, a sufficient amount of data can "emerge" intelligence, and randomness can trigger all possibilities of evolution.

It just so happens that Phantom has enough retail investors, at least as Solana is the number one.

In addition, the cooperation between the two sides is also profitable, in all angles and entrances and exits, there are intimate set up charging anchors, Phantom and Hyperliquid two gates will be charged, I wonder if the competitors have a good idea of speeding up and reducing fees, HL+Phantom will also become a dragon?

epilogue

HL decided to acquire more new users through the wallet, and Phantom wanted to move beyond the stereotype of Solana wallet and into a more mainstream market.

CEXs compete for coin stocks, and DEXs actively acquire customers, which can be glimpsed that Crypto traffic has reached a bottleneck period, and a simple product type can no longer support its own business, and mutual competition, acquisitions and attacks will become more and more frequent.

Each cycle will be an arena for exchanges and public chains, this time, will it be Hyperliquid vs. Binance, and Solana vs. Ethereum?

Show original8.06K

0

Coblin(코블린)(✧ᴗ✧)

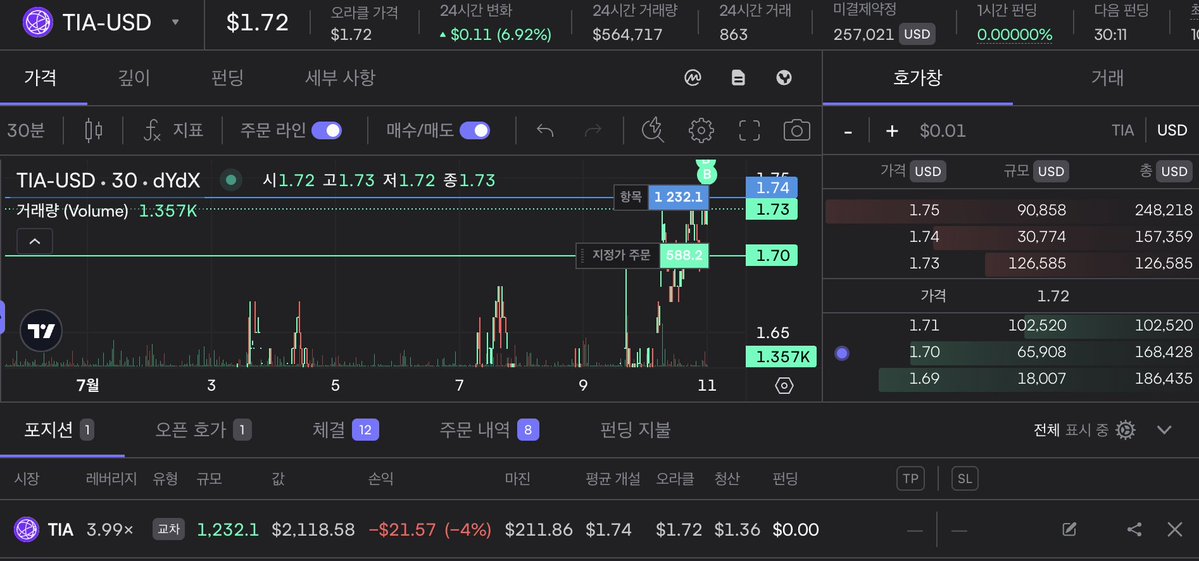

.@celestia with @dYdX

I've been completely hooked on the "CLOBs on Blobd" narrative lately — so naturally, I aped into a $TIA position on the best decentralized perp DEX out there: dYdX.

My Yapfing bounty challenge isn't over yet. Still going strong 🫡

Oh and btw, deposits on dYdX? Insanely fast. And free.

Got any thoughts on my position?

Coblin(코블린)(✧ᴗ✧)

Could Celestia's CLOB be the savior of $TIA?

The narrative that the Celestia team has been emphasizing lately is "CLOBs On blobs".

What does this phrase mean if we break it down?

A Blob is a unit for storing and processing data in Celestia, and this Blob allows rollups to publish and validate data. Simply put, it’s Celestia's way of efficiently storing and sharing rollup data.

CLOB can be thought of as a CEX. It’s fast and efficient, but implementing a CLOB on the blockchain in a DeFi environment has been too inefficient, leading to the use of AMMs as an alternative.

So, if we combine these ideas?

It means that Celestia aims to realize a CEX's CLOB system on the blockchain using its Blob (DA).

CLOB needs to process a massive amount of transaction data quickly, and at this point, Celestia's Blob helps store this data and allows for immediate processing on rollups or other layers.

Personally, I wondered if this is something only Celestia can do. Can’t Avail or Eigenlayer do it? However, according to DSRV Emperor's content, Celestia is the only one that can realistically support an on-chain order book with its DA.

So, who is using this? Perp DEX @hibachi_xyz has introduced Celestia's CLOBs On blobs through the Wynn upgrade. (With @SuccinctLabs)

Now, let’s return to $TIA.

As more DeFi protocols adopt CLOBs On blobs,

The demand for Celestia DA will increase,

And as demand rises, the consumption of $TIA will increase.

However, the $TIA received as Blob fees will return to validators and stakers. Of course, they say they will introduce a fee-burning model in the future and significantly reduce inflation through the next major upgrade.

And although it's late, they also plan to lock up interest on the locked $TIA through the upgrade.

As retail investors, $TIA is more important to us than Celestia, but could CLOBs On blobs be the savior of $TIA?

2.01K

17

Coblin(코블린)(✧ᴗ✧)

Could Celestia's CLOB be the savior of $TIA?

The narrative that the Celestia team has been emphasizing lately is "CLOBs On blobs".

What does this phrase mean if we break it down?

A Blob is a unit for storing and processing data in Celestia, and this Blob allows rollups to publish and validate data. Simply put, it’s Celestia's way of efficiently storing and sharing rollup data.

CLOB can be thought of as a CEX. It’s fast and efficient, but implementing a CLOB on the blockchain in a DeFi environment has been too inefficient, leading to the use of AMMs as an alternative.

So, if we combine these ideas?

It means that Celestia aims to realize a CEX's CLOB system on the blockchain using its Blob (DA).

CLOB needs to process a massive amount of transaction data quickly, and at this point, Celestia's Blob helps store this data and allows for immediate processing on rollups or other layers.

Personally, I wondered if this is something only Celestia can do. Can’t Avail or Eigenlayer do it? However, according to DSRV Emperor's content, Celestia is the only one that can realistically support an on-chain order book with its DA.

So, who is using this? Perp DEX @hibachi_xyz has introduced Celestia's CLOBs On blobs through the Wynn upgrade. (With @SuccinctLabs)

Now, let’s return to $TIA.

As more DeFi protocols adopt CLOBs On blobs,

The demand for Celestia DA will increase,

And as demand rises, the consumption of $TIA will increase.

However, the $TIA received as Blob fees will return to validators and stakers. Of course, they say they will introduce a fee-burning model in the future and significantly reduce inflation through the next major upgrade.

And although it's late, they also plan to lock up interest on the locked $TIA through the upgrade.

As retail investors, $TIA is more important to us than Celestia, but could CLOBs On blobs be the savior of $TIA?

Show original

2.9K

21

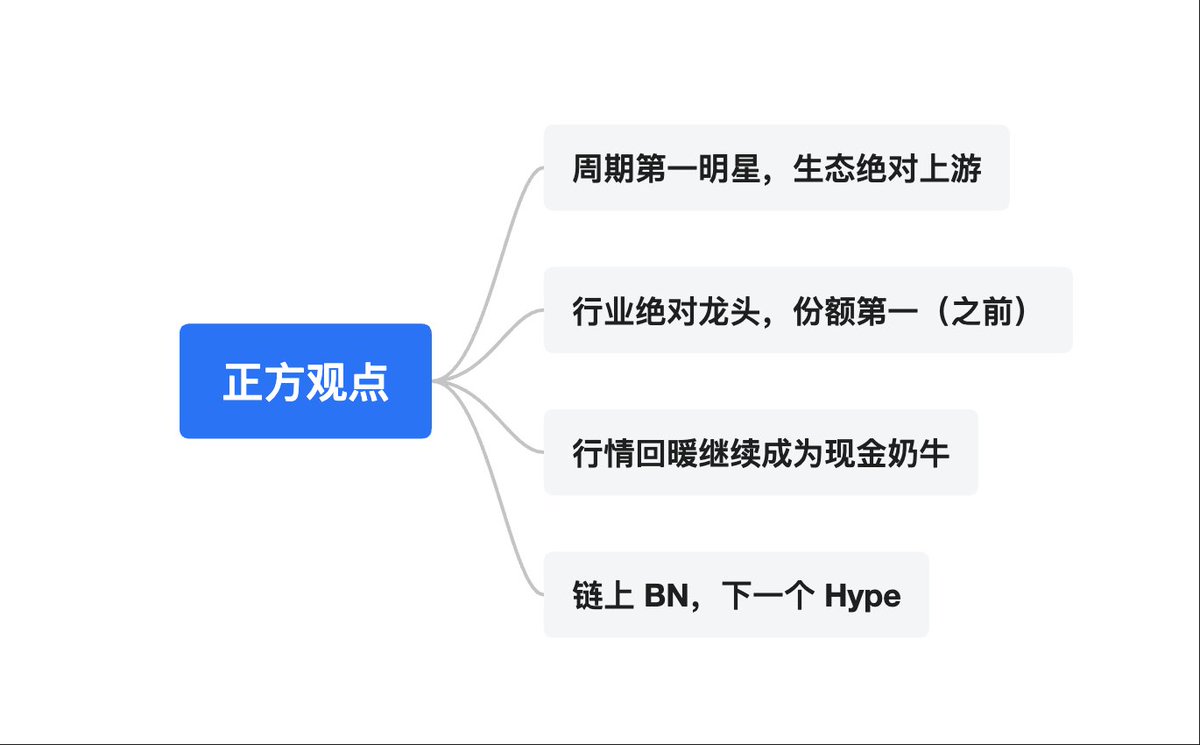

MemeGo

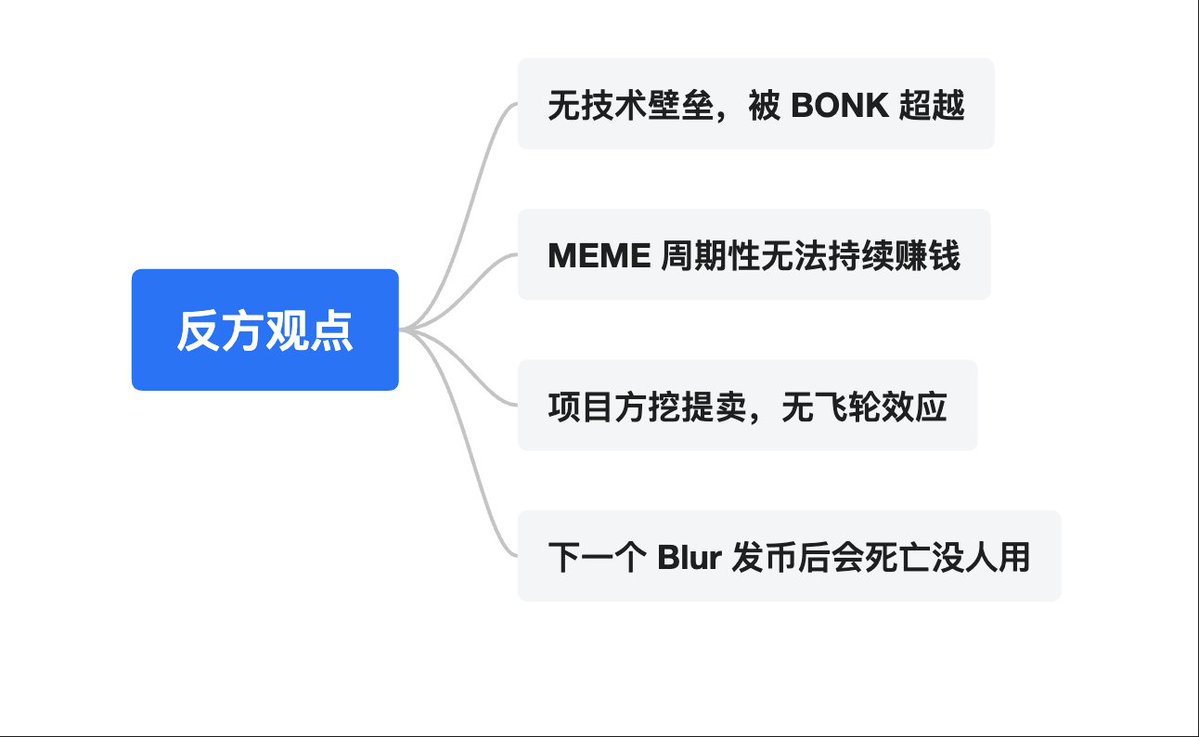

Pumpfun is a TOP 3 earning project in the first half of the year.

It really is impressive.

pumpamm has already earned half of ray's income in just one quarter.

It used to be like this.

If the stock market is the future ROI valuation model,

the TGE in the crypto world is based on past data for reference valuation.

Pumpfun is indeed the biggest narrative of this cycle.

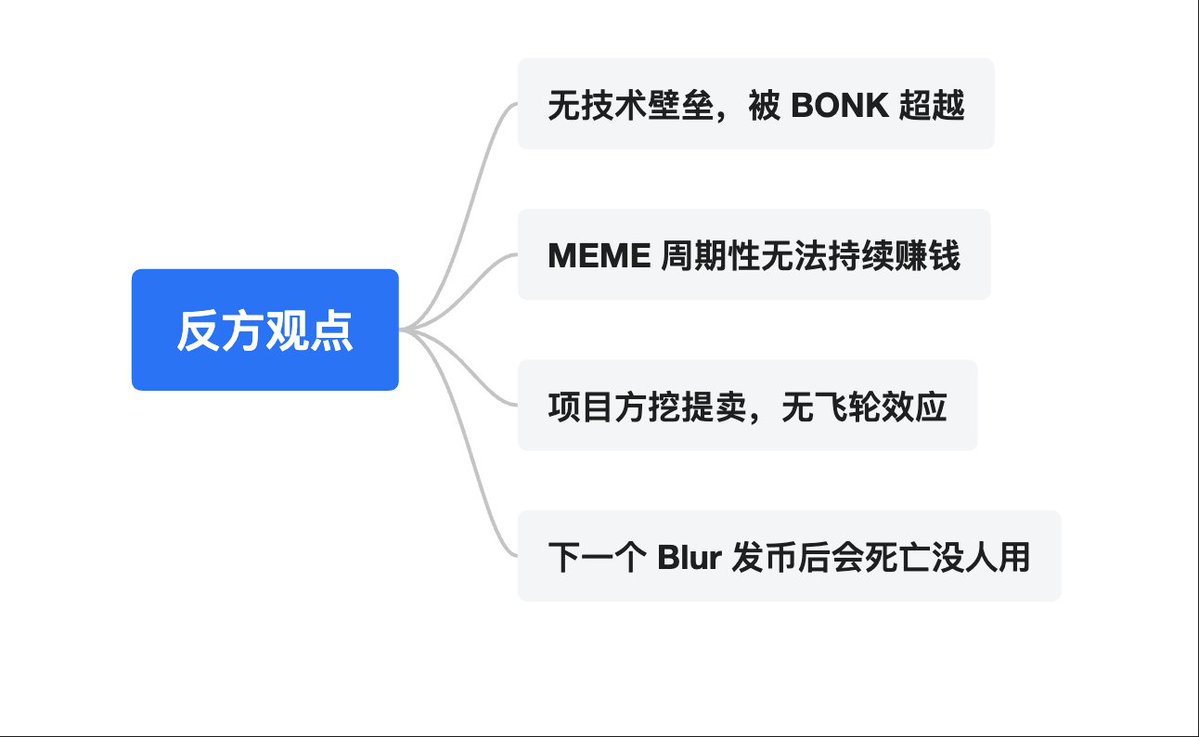

However,

memes cannot be sustained and have been disproven.

Will meme szn come back again?

Can pumpfun reclaim the lead?

I can't help but continue to question my soul.

MemeGo

Is PF really worth it?

In fact, many people don't care at all

They only care if they can get a good price at the opening.

263.4K

10

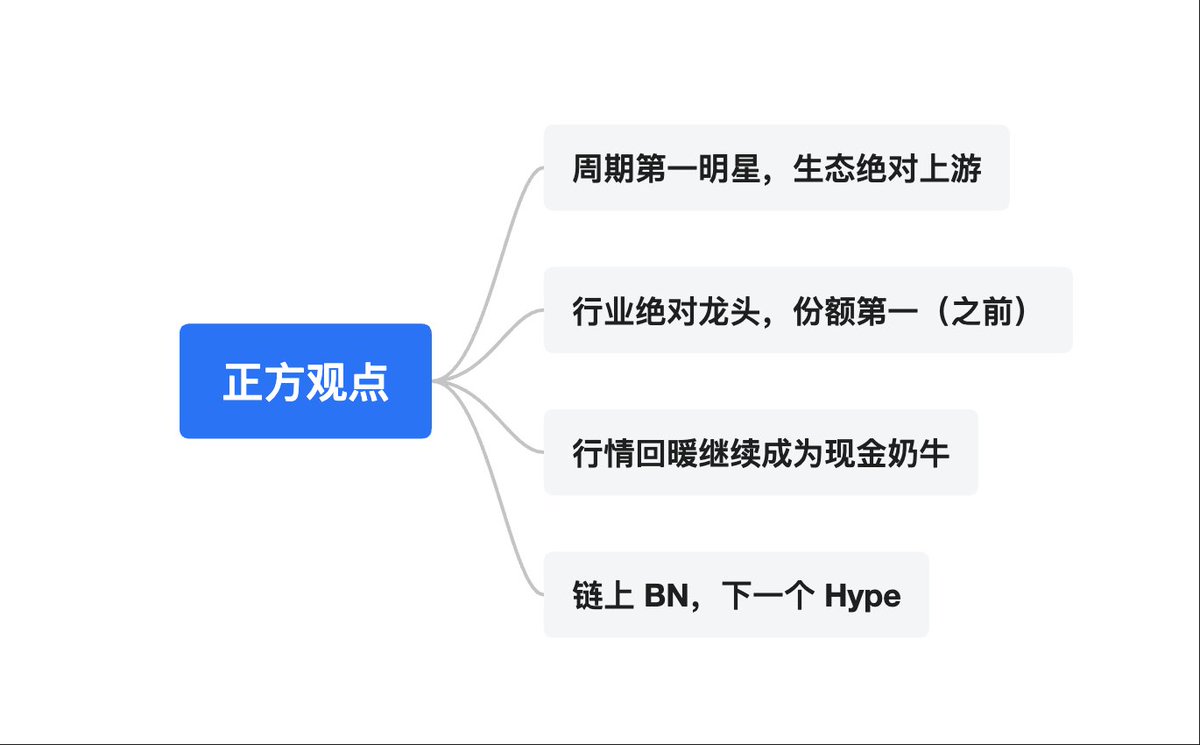

MemeGo

Pumpfun is one of the top 3 earning projects in the first half of the year.

It really is impressive.

Using Pumpfun for a quarter already equals half of Ray's income.

It used to be like this.

If the stock market is the future ROI valuation model,

the TGE in the crypto world is based on past data for reference valuation.

Pumpfun is undoubtedly the biggest narrative of this cycle.

But,

memes are unsustainable and can be disproven.

Will meme season come back again?

Can Pumpfun reclaim the lead?

I can't help but continue to question my soul.

MemeGo

Is PF really worth it?

In fact, many people don't care at all

They only care if they can get a good price at the opening.

220.06K

6

DEX price performance in USD

The current price of dex-screener is $0.000025505. Over the last 24 hours, dex-screener has increased by +61.63%. It currently has a circulating supply of 1,000,000,000 DEX and a maximum supply of 1,000,000,000 DEX, giving it a fully diluted market cap of $25.50K. The dex-screener/USD price is updated in real-time.

5m

+6.67%

1h

+61.63%

4h

+61.63%

24h

+61.63%

About DEX Screener (DEX)

Learn more about DEX Screener (DEX)

How to use DEX Screener: top tips to find and trade low-cap gems

If you're active on crypto social media, you're likely to come across users boasting about huge gains when trading low-cap crypto gems. While some may claim that replicating such success in crypto tra

Apr 24, 2025|OKX|

Intermediate

DEX FAQ

What’s the current price of DEX Screener?

The current price of 1 DEX is $0.000025505, experiencing a +61.63% change in the past 24 hours.

Can I buy DEX on OKX?

No, currently DEX is unavailable on OKX. To stay updated on when DEX becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of DEX fluctuate?

The price of DEX fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 DEX Screener worth today?

Currently, one DEX Screener is worth $0.000025505. For answers and insight into DEX Screener's price action, you're in the right place. Explore the latest DEX Screener charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as DEX Screener, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as DEX Screener have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.