The Battle for On-Chain Finance: Who Will Design the New Order?

Original title: The Battle for On-Chain Finance: Who Will Design the New Order?

Original author: Tiger Research

Original compilation: AididiaoJP, Foresight News

Executive summary

· JPMorgan Chase began issuing deposit tokens on the public chain, superimposing blockchain technology on the existing financial order

· Circle applied for a trust banking license in an attempt to build a new financial order based on technology

· The two types of institutions are besieging traditional finance from different directions, forming a "two-way convergence" trend

· The ambiguity of the value proposition may weaken the competitive advantage of each other, and it is necessary to identify the core strengths and find a balance

The new competitive landscape of on-chain financial infrastructure

Blockchain technology is reshaping the basic architecture of the world's financial infrastructure. According to the latest report by the Bank for International Settlements (BIS), as of the second quarter of 2025, the scale of global on-chain financial assets has exceeded $4.8 trillion, with an annual growth rate of more than 65%. In this wave of change, traditional financial institutions and crypto-native enterprises have shown very different development paths:

JPMorgan Chase is represented by a traditional financial institution

Adopt a gradual reform strategy of "Blockchain+" to embed distributed ledger technology into the existing financial system. Its blockchain arm, Onyx, has served more than 280 institutional clients and processes $600 billion in annual transaction volume. The newly launched JPM Coin surpassed $12 billion in average daily settlements.

Crypto-native businesses represent Circle

A fully blockchain-based financial network has been built through the USDC stablecoin. At present, USDC has a circulation of $54 billion, supports 16 mainstream public chains, and has an average daily transaction volume of more than 3 million.

Compared to the fintech revolution of the 2010s, the current competition presents three significant differences:

1. The focus of competition has shifted from user experience to infrastructure reconstruction

2. The technical depth sinks from the application layer to the protocol layer

3. Participants shift from complementary relationships to direct competition

JPMorgan Chase: Technological innovation within the framework of the traditional financial system

J.P. Morgan has filed a trademark application for its deposit token "JPMD".

In June 2025, JPMorgan Chase's blockchain arm, Kinexys, began a trial run of the deposit token JPMD on the public chain Base. Previously, JPMorgan Chase mainly applied blockchain technology through private chains, but this time it directly issued assets and supported circulation on the open network, marking the beginning of traditional financial institutions to directly operate financial services on public chains.

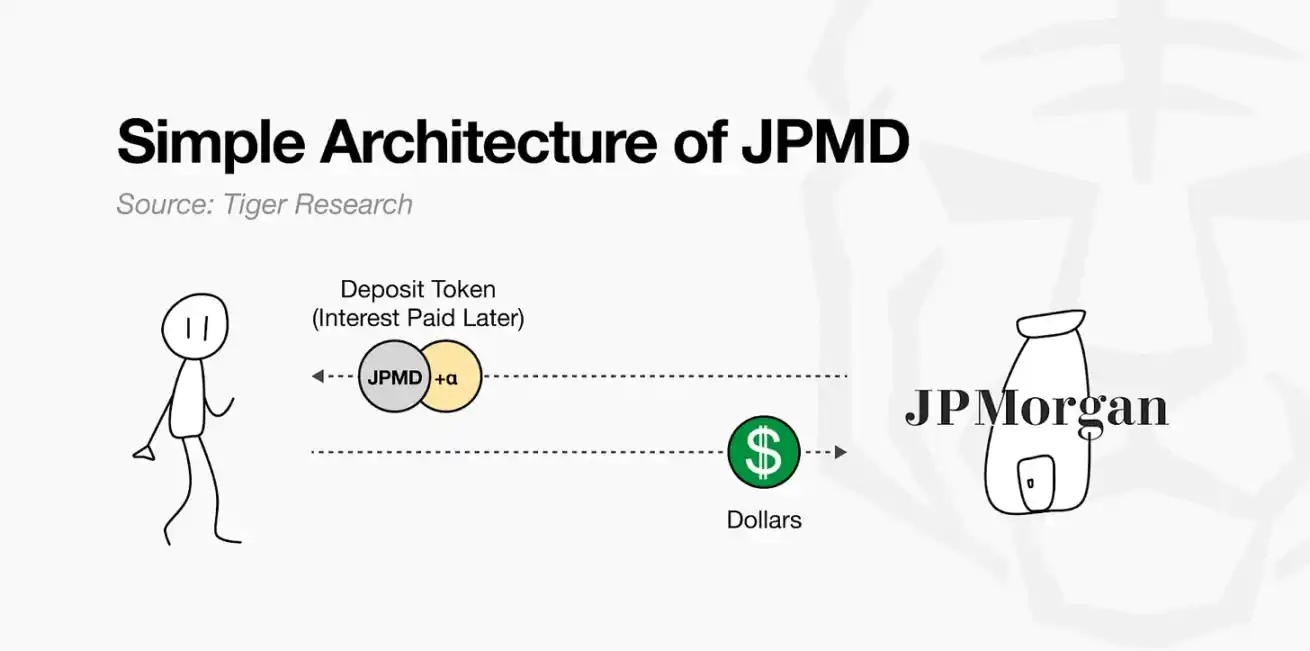

JPMD combines the features of a digital asset with the functionality of a traditional deposit. When a customer deposits USD, the bank records the deposit on the balance sheet and at the same time issues an equivalent amount of JPMD on the public chain. The token is freely circulating while retaining legal claims on bank deposits, and holders can exchange it 1:1 for US dollars and may enjoy deposit insurance and interest income. While the profits of existing stablecoins are concentrated in the issuer, JPMD differentiates itself by giving users substantial financial rights.

These features provide asset managers and investors with very attractive practical value, and can even ignore some legal risks. For example, on-chain assets such as BlackRock's BUIDL fund can be redeemed 24 hours a day if JPMD is used as a redemption payment tool. Compared with existing stablecoins, which need to be exchanged for fiat currencies separately, JPMD supports instant cash conversion, while providing deposit protection and interest income opportunities, which has significant potential in the on-chain asset management ecosystem.

JPMorgan Chase & Co. launched the deposit token in response to the new funding flow and income structure formed by stablecoins. Tether has annual revenues of about $13 billion, and Circle also generates significant returns by managing safe assets such as Treasuries, which are different from traditional deposit-loan spreads, but have a similar mechanism for generating income based on customer funds as some banking functions.

JPMD also has limitations: it is designed to strictly follow the existing financial regulatory framework, making it difficult to achieve full decentralization and openness of the blockchain, and is currently only available to institutional clients. However, JPMD represents a pragmatic strategy for traditional financial institutions to enter public chain financial services while maintaining the existing stability and compliance requirements, and is regarded as a representative case of the connection between traditional finance and on-chain ecological expansion.

Circle: Blockchain-native financial refactoring

Circle has established a key position in on-chain finance through the stablecoin USDC. USDC is pegged 1:1 to the U.S. dollar, with reserves in cash and short-term U.S. bonds, making it a practical alternative for corporate payment settlement and cross-border remittances with its technical advantages such as low rates and instant settlement. USDC supports 24-hour real-time transfers, eliminating the need for complex processes on the SWIFT network, helping businesses break through the limitations of traditional financial infrastructure.

However, Circle's existing business structure faced multiple constraints: BNY Mellon managed USDC reserves, and BlackRock managed assets, an architecture that delegated core functions to an external agency. Circle earns interest income, but has limited effective control over its assets, and its current profit model is highly dependent on a high-interest rate environment. Circle needed more independent infrastructure and operational authority, which was necessary for long-term sustainability and revenue diversification.

Source: Circle

In June 2025, Circle applied to the Office of the Comptroller of the Currency (OCC) for a national trust bank license, a strategic decision that went beyond the need for mere compliance. The industry interprets it as Circle's transformation from a stablecoin issuance to an institutionalized financial entity. The trust bank status will enable Circle to directly manage the custody and operation of reserves, which will not only strengthen the internal control of the financial infrastructure, but also create conditions for expanding the scope of business, and Circle will lay the foundation for institutional digital asset custody services.

As a crypto-native enterprise, Circle adjusted its strategy to build a sustainable operating system within the institutional framework. This transformation will require acceptance of the rules and roles of the existing financial system, at the cost of reduced flexibility and increased regulatory burdens. Specific authority in the future will depend on policy changes and regulatory interpretations, but this attempt has become an important milestone in measuring the extent to which on-chain financial structures are established within the framework of existing institutions.

Who will dominate on-chain finance?

From traditional financial institutions such as JPMorgan Chase to crypto-native enterprises such as Circle, participants from different backgrounds are actively laying out the on-chain financial ecosystem. This is reminiscent of the competitive landscape of the fintech industry in the past: technology companies entered the financial industry through internal implementation of core financial functions such as payments and remittances, while financial institutions expanded users and improved operational efficiency through digital transformation.

The point is that this competition breaks down the boundaries between the two sides. A similar phenomenon is emerging in the current on-chain financial sector: Circle directly performs core functions such as reserve management by applying for a trust bank license, while JPMorgan Chase issues deposit tokens on the public chain and expands its on-chain asset management business. Starting from different starting points, the two sides gradually absorb each other's strategies and fields, and each seeks a new balance.

This trend brings new opportunities as well as risks. If traditional financial institutions forcibly imitate the flexibility of technology companies, they may conflict with the existing risk control system. When Deutsche Bank pursued a "digital-first" strategy, it crashed into legacy systems and lost billions of dollars. On the other hand, crypto-native companies may lose the flexibility to support their competitiveness if they overextend the system and accept it.

The success or failure of on-chain financial competition ultimately depends on a clear understanding of its own foundation and advantages. Companies must achieve an organic integration between technology and institutions based on their "unfair advantage", and this balance will determine who wins in the end.

Link to original article