With the surge of BTC and ETH, the signs of a recent recovery in the altcoin market are becoming increasingly evident. Many projects that were previously on the watchlist are starting to show movement, and @AethirCloud is definitely the most important one among them!

Those who have been following my tweets know that I have been closely tracking Aethir. After all, in the DePIN sector, there are not many that can stand firm with real revenue, and its recent upward trend is quite stable, which makes me firmly believe: could this be the biggest potential player in this bull cycle?

1: First, let's look at the core: What supports its high income?

1) Aethir's @AethirMandarin revenue of $61 million in the first half of the year is not just talk; the core lies in its grasp of the pain points of enterprise-level computing power—high-end GPUs are hard to obtain, and centralized cloud services are problematic.

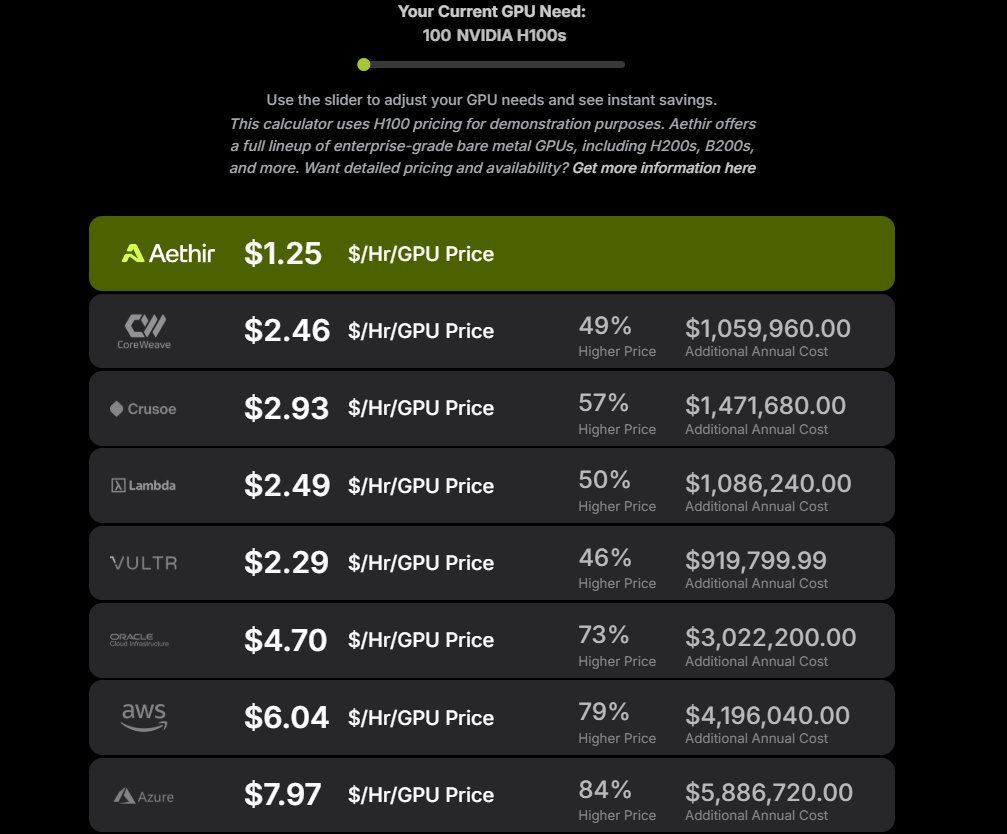

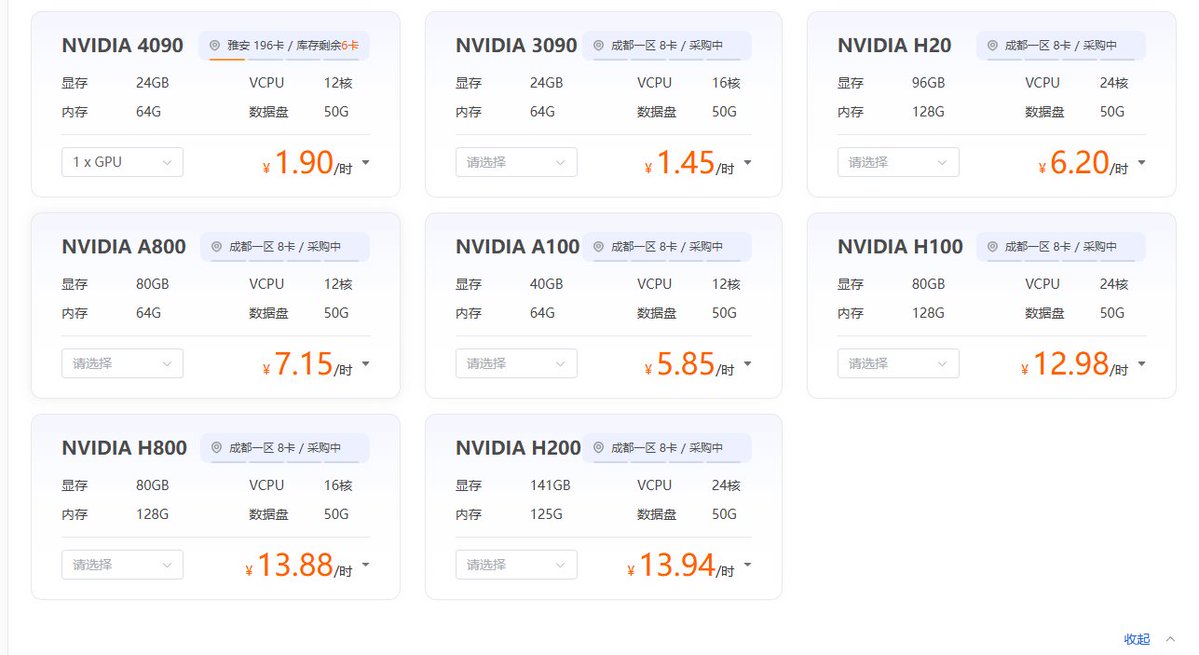

Now, in China, trying to get top-tier graphics cards like NVIDIA H100 or H200 is not only expensive but also requires queuing and competing for them, and due to supply chain constraints, they may not even be available. As for the cloud services of big companies like AWS and Google Cloud, the price fluctuations are significant, and there are many hidden fees (like data transfer fees), making the costs for enterprises exorbitant.

2) Aethir just fills this gap: it has over 430,000 high-performance GPUs across 94 countries, forming a shared pool where enterprises can rent by the hour at prices 40%-90% cheaper than centralized clouds, without the messy additional fees.

More importantly, the GPUs it has are "ready to use"—it is almost impossible to gather so many resources distributed across 94 countries in a short time, creating a barrier to entry.

Clients can also illustrate the point: Mondrian AI in South Korea uses its computing power for medical image analysis; an AI medical company relies on it to screen clinical trial patients, completing in minutes what used to take months.

These are solid Web2 enterprise clients, not just random "filler users." Retaining them indicates that Aethir's services meet enterprise-level needs—this is not a small-scale retail business but a B2B model that can continuously generate repeat purchases.

3) The business loop is also running smoothly: enterprises pay rent in $ATH tokens, and GPU owners (individuals or small institutions) who connect to the network can earn 80% of the rent (locked for 45 days to ensure quality), with the remaining 20% going to the foundation to support the ecosystem. Enterprises save money, GPU owners make money, and the platform has stable cash flow, creating a win-win situation for all three parties. This model is much more solid than many DePIN projects that are still "telling stories."

Some data on the GPUs can be seen:

2: Now let's look at the valuation: as the leader in decentralized cloud computing power, how high is its ceiling?

In the first half of the year, it earned $61 million, while the fully diluted market cap of $ATH is only $280 million, with an expected annual revenue of $156 million—its earning speed is faster than the price increase of the token, and the revenue curve and token price even seem to move in the "opposite direction."

But rather than saying it is "undervalued," we should focus on how high its ceiling can be as the leader in decentralized cloud computing power. The global trend is now centered around AI development, and high-end computing power is fundamental for training AI models—without sufficient high-end GPU computing power, everything is just talk.

Aethir's over 430,000 high-performance GPUs precisely hit this core demand, and this "urgent need + scarcity" determines that its value far exceeds what the current market cap can measure.

Those in the know understand that when assessing the value of Web3 projects, the income / FDV ratio is an important reference. A horizontal comparison shows:

Aethir's income / FDV ratio is around 11%

IO is about 3.9%

Akash is about 0.35%

Render is only 0.03%

What does this data mean?

Aethir is leading with an 11% ratio, indicating that its income capability is more aligned with its market cap. In the crypto market, while this ratio cannot be completely equated to the traditional market's "price-to-earnings ratio," it at least shows that its real profitability has not been fully reflected in its market cap.

After all, the $61 million in half-year revenue is real money paid by enterprises, not propped up by speculation. The market may not have fully reacted yet, but this situation of "high earnings, low market cap" often signals potential during a bull cycle.

3: What is the core confidence: multiple "firsts" in the DePIN sector

Aethir's ability to stand firm in the enterprise-level computing power field is also due to its numerous "firsts" in DePIN, which directly solidify its leading position:

The first DePIN to launch the NodeFi model, combining nodes with financial attributes.

The first DePIN to establish a secondary market for nodes, with the current floor price at 0.17eth.

The first DePIN to initiate GPUFi (on the Pendle platform), splitting $eATH into PT principal and YT yield, directly converting GPU assets into RWA and extending to DeFi strategies.

The first DePIN focused on RWA AI infrastructure, linking computing power with real-world asset demands.

The first DePIN to initiate an AI upstream and downstream alliance, bringing together over 20 Web3 AI companies to build an ecosystem.

These "firsts" are tangible ecological barriers. NodeFi has activated the liquidity of semi-solid assets like nodes in advance and extended into the DeFi field, allowing GPUs to generate income and better retain participants.

4: Finally, where is the trend?

The global demand for high-performance computing power is increasing rapidly, with AI training, medical research, and game development all lacking GPUs. The shortcomings of centralized cloud services are becoming increasingly apparent, while Aethir's decentralized enterprise-level cloud computing power precisely aligns with this trend.

An important point is that it has built a bridge between Crypto and Tradfi, where enterprises pay rent, GPU owners earn stablecoins, and with partnered crypto credit cards and loan products, ATH can be used as collateral to borrow stablecoins without selling assets—this actually narrows the gap between the crypto world and traditional finance.

Some say Gamefi is no longer viable, but Aethir's core is Depin + AI + Gaming, with Gaming being just one part. The real strength lies in the B2B business of enterprise-level computing power.

With the popularity of stablecoins, this model of "physical assets (GPUs) + token economy + enterprise payments" could very well become the key to bridging RWA and DeFi.

Overall, Aethir's rise is not coincidental: solid revenue, a promising ceiling as the leader in decentralized cloud computing power, ecological barriers, and it has hit the trend of enterprise-level computing power going on-chain.

In the context of the altcoin bull cycle, projects that have "real business, cash flow, and are positioned in the AI computing power demand sector" are worth keeping an eye on. I will continue to track it, and those interested can follow along!

Show original

17.37K

54

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.