My experience as an engineer in the Ethereum ecosystem has revealed a surprising fact: the chronic problem of MEV cannot exist on Cardano.

In fact, MEV is a fundamental issue that causes immense inefficiency in blockchains.

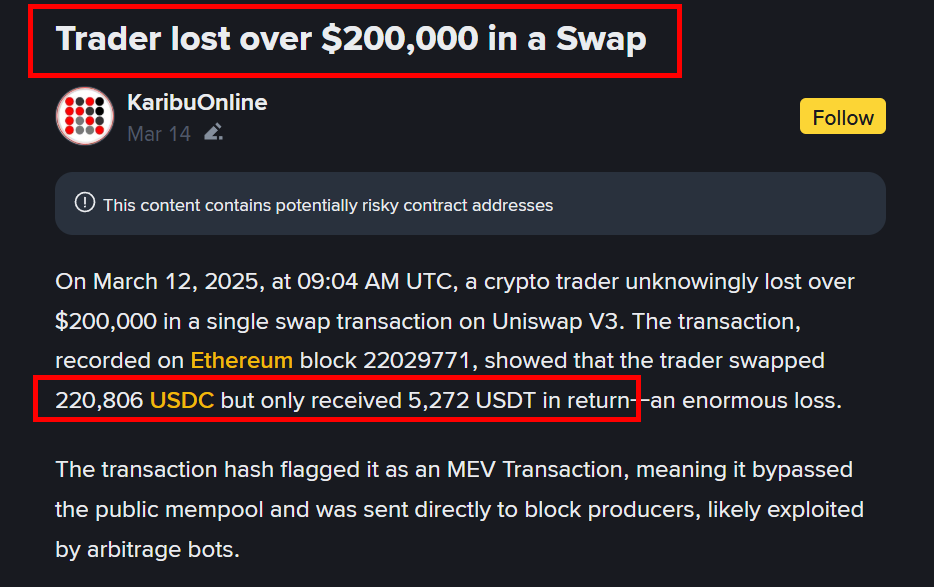

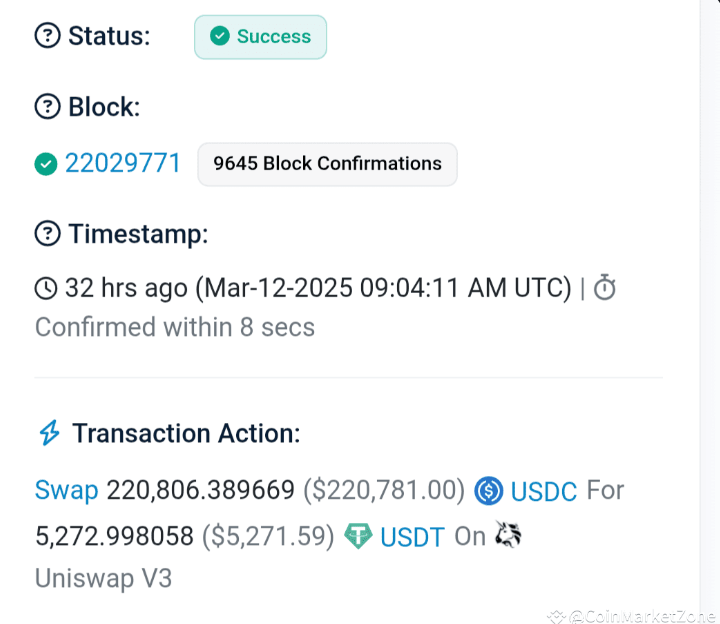

Recently, a shocking incident occurred where a trader suffered a staggering 98% loss while swapping USDC, a dollar stablecoin, for USDT🧵

(source: binance)

More specifically, on @Uniswap, a representative decentralized exchange on Ethereum, they swapped 220,764 USDC for USDT but received only 5,271 USDT. Since both coins are pegged to the dollar, they should have received 220,764 USDT, meaning essentially 215,493 USDT was stolen.

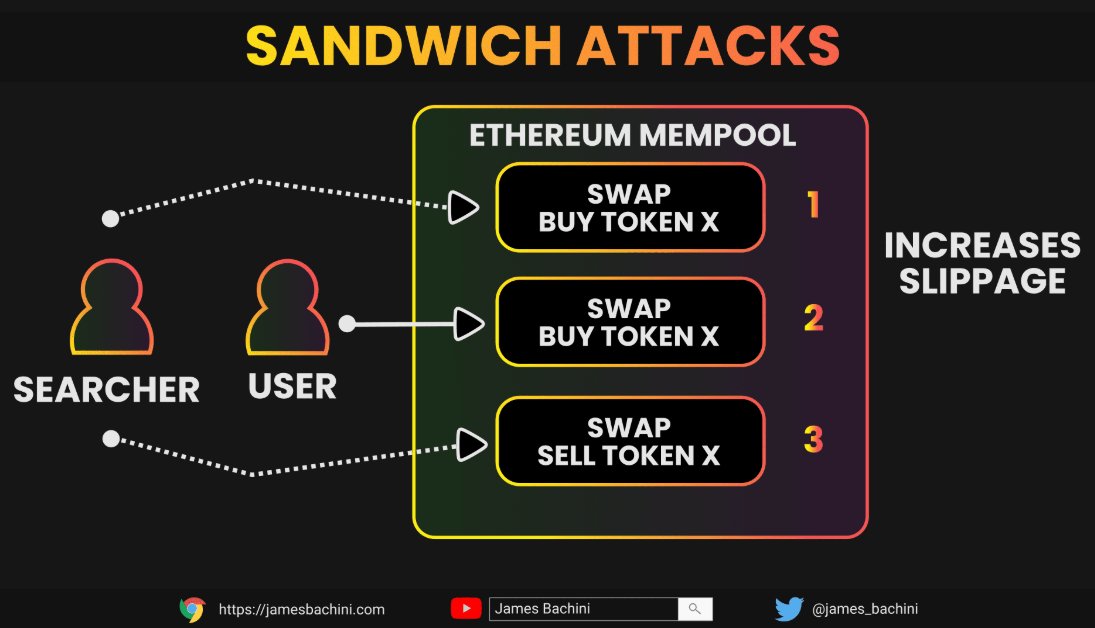

The root cause of this problem is the 'Account Model' adopted by Ethereum. In account-model-based blockchains, the exact outcome (state change) of a transaction cannot be fully predicted until it is included in a block and executed.

Furthermore, the order of transactions within a block significantly impacts the final result, leading to numerous attacks exploiting this vulnerability. MEV bots utilize this structural flaw to extract assets from traders through 'sandwich attacks.'

This issue is prevalent and ongoing, with countless projects investing significant resources and efforts to mitigate it.

Ultimately, this means that unnecessary resources are being wasted trying to solve a problem inherent to the account model.

(source: jamesbachini)

To fundamentally resolve MEV, the core accounting model (Account Model) of the blockchain itself would need to be changed, which is practically impossible at this point.

With an already massive ecosystem built, altering the most fundamental model of the blockchain would incur immense costs and create severe compatibility issues.

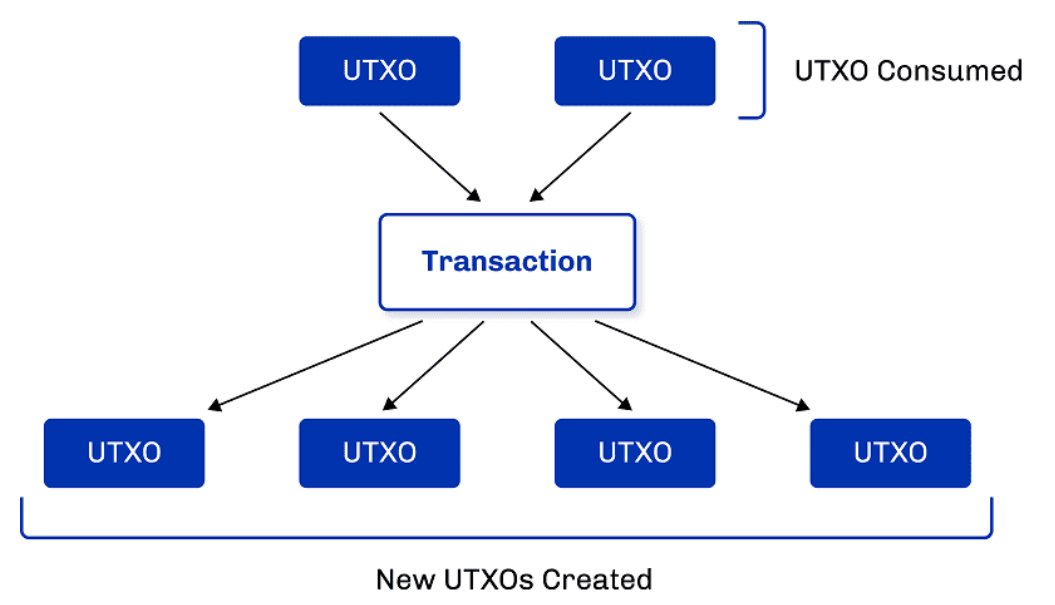

In contrast, Cardano uses the 'Extended UTXO (EUTXO) model.' Cardano's transactions possess inherently independent and deterministic characteristics.This means the order of transactions has almost no impact on the outcome, and consequently, MEV itself does not occur.

When using Cardano-based DeFi, it's exceedingly difficult for MEV bots to extract your assets. This allows resources that would otherwise be wasted on solving MEV to be utilized more effectively for other innovative aspects of the Cardano ecosystem.

Ultimately, Cardano is structurally designed in a superior way, and there are almost no other blockchains besides Cardano that offer robust smart contract functionality while utilizing a UTXO model.

(source: Cardano docs)

The crucial point is that, from my observations working in this industry, many players outside the Cardano ecosystem perceive MEV as a natural byproduct of blockchain, almost as if its existence is a given.

This is likely because they haven't experienced a model other than the account model (like EUTXO). Not only Ethereum, but also Ethereum Layer 2s, Solana, Aptos, and most other major blockchains use the account model.

If they were to clearly understand the structural advantages of the EUTXO model, the narrative of 'MEV-free blockchain' would rapidly sweep the market. While I've only mentioned MEV here, the EUTXO model also offers tremendous advantages in terms of parallel processing capabilities, security, and stability.

The market is not yet fully aware of these facts. Therefore, we must understand that the market's current assessment is not an absolute standard.

21.58K

195

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.