Don't worry, next week I'll share the July auctions for 1-year, 10-year, and 30-year U.S. Treasuries. Let's see if there's a significant increase in the issuance of U.S. Treasuries!

I usually communicate with Cinnamon a lot, but we all know what the other person is talking about. This time, I think it's the head shape, in addition to the good mentioned above, for those reasons. Another very central argument is the liquidity of US bonds. One of the most important points after the passage of the Great Beauty Act is to raise the ceiling of 5 trillion US debt, which will be enough to spend two years at the previous rate of more than 2 trillion per year, and the debt will be issued one after another.

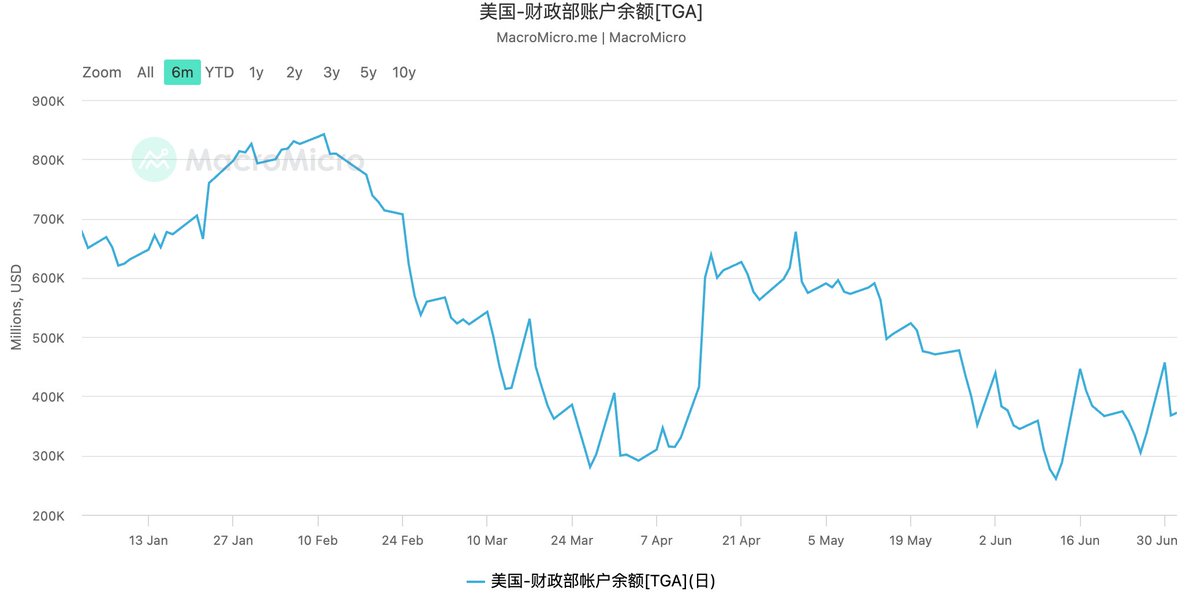

Then, at a time when the balance of the TGA account is decreasing and the Fed has not yet released water, once the new US bonds are issued and introduced to the market, it will inevitably lead to a lack of liquidity, and the original market reservoir (the currency circle is also part of this reservoir) will be pumped continuously until the Fed cuts interest rates and releases water. The market is very fragile at this interval, and it is easy to flash crash quickly in the short term due to some unexpected events.

Therefore, in the position where the price is relatively high, I think it is more cost-effective to short at low times, and it is not beautiful to wait until the market risk is completely cleared and then come in at a low price and backhand.

Looking at the decreasing balance of this TGA account, it is inevitable to sell bonds to cover in the future. There is a stone in the world, U.S. bonds occupy eight buckets, U.S. stocks occupy one bucket, and the currency circle and other subject matter share a bucket and are still used by the old demon of Montenegro to suck blood from time to time, so how can the currency circle now have its own objective conditions for breaking away from the fundamentals and rising alone?

U.S. Treasury yields have also begun to rebound with the promotion of the Big Pretty Act, and the subsequent signal of U.S. Treasury encroachment on liquidity is very obvious

While Matt Brill, head of North American investment-grade credit at Invesco Fixed Income, believes that up to $7 trillion in money market funds are providing support, how much of the $7 trillion is money in the crypto circle, and how much of it could have been money that could have been prepared to buy a pie? If this money is siphoned off to buy U.S. bonds, will there still be money in the currency circle?

9.64K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.