This token isn’t available on the OKX Exchange.

PPC

PepeCoin price

FKKfZm...NmE8

A$0.00013796

+A$0.000099307

(+256.95%)

Price change for the last 24 hours

AUD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about PPC today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

PPC market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

A$137.96K

Network

Solana

Circulating supply

999,999,174 PPC

Token holders

162

Liquidity

A$0.00

1h volume

A$4.41M

4h volume

A$4.41M

24h volume

A$4.41M

PepeCoin Feed

The following content is sourced from .

How Silk Road carved the fault line that separates ‘bitcoin’ and ‘crypto’

Greetings, and happy 41st birthday to Ross Ulbricht!

By now, rehashing the Silk Road timeline — from a secret psychedelics lab in an off-the-grid Texas cabin to a global clandestine operation with half a dozen employees — doesn’t seem totally useful.

Besides, long-time Bitcoin History readers have already walked through the events that led to Ulbricht’s dramatic 2013 arrest in a San Francisco public library.

Anyone who missed our email from last year can find it in our archives — it’s definitely still worth the read!

Keep in mind, though: That telling of the story misses its happy ending. It was written before President Trump pardoned Ulbricht earlier this year, releasing him from a double-life prison sentence after serving nearly a decade.

To celebrate Ulbricht’s first birthday since his release, let’s instead pay homage to the way he integrated bitcoin payments into Silk Road, for reasons that have been largely lost on modern-day crypto.

— Ross Ulbricht (@RealRossU) March 27, 2025

Onto this week’s Bitcoin Legend.

Silk Road founder Ross Ulbricht | Freeross.org modified by Blockworks

No turning back

Bitcoin was the obvious fit for Silk Road. It uniquely separates global payments from both governmental and corporate control, imbuing the user with financial self-sovereignty that goes beyond real-world cash.

“Every single transaction that takes place outside the nexus of state control is a victory for those individuals taking part in the transaction,” Ulbricht wrote in 2012.

It was bitcoin’s uncontrollable nature that matched his vision: a worthy complement to Silk Road’s hidden existence through Tor.

Ulbricht fully understood that bitcoin transfers are immutable. This property, combined with its pseudonymity, forms the basis for what makes bitcoin so interesting as the currency for underground activity: autonomy.

Applied in the right way — with stringent opsec in mind — bitcoin would enable true freedom of commerce on Silk Road.

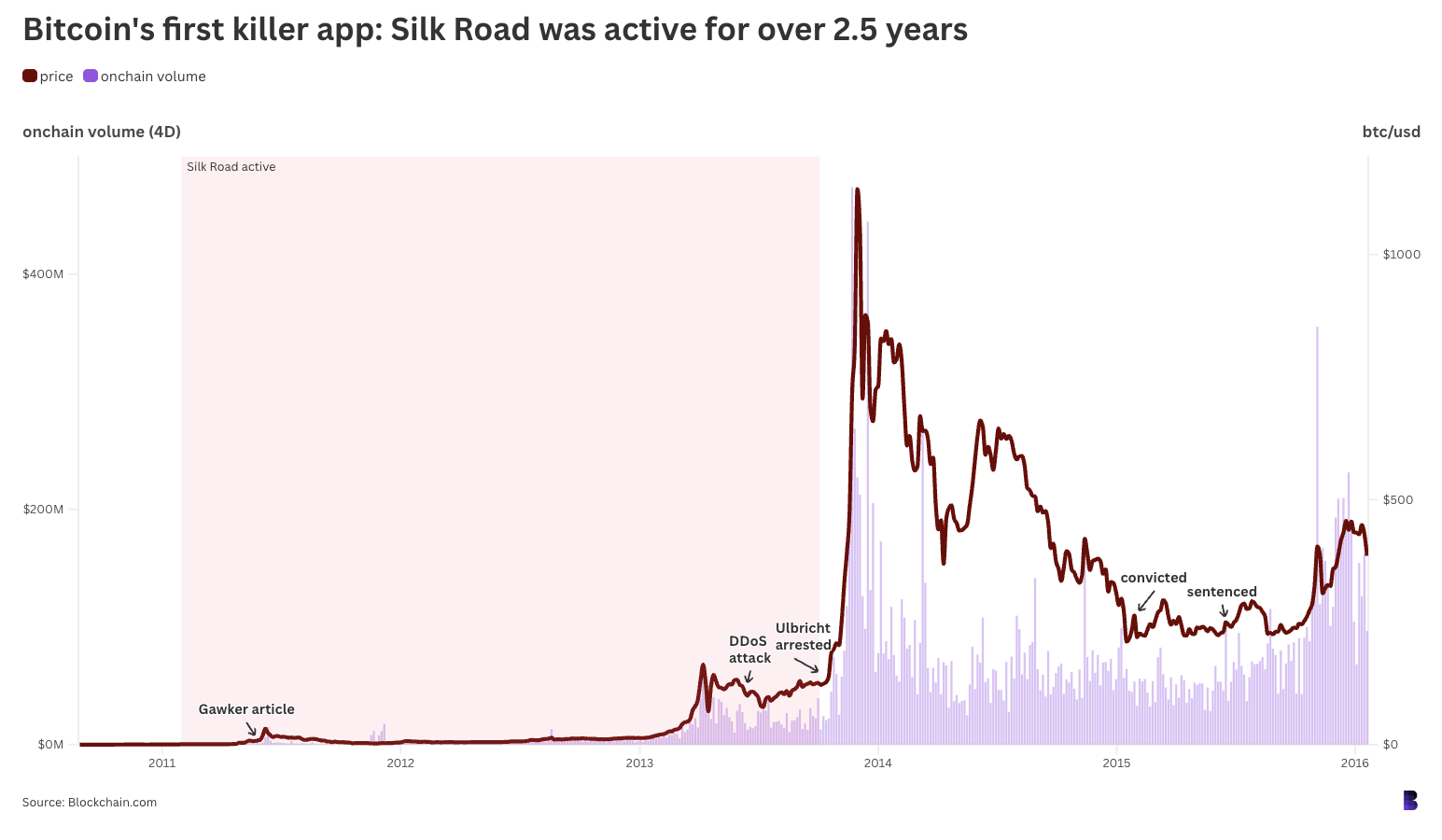

Silk Road was active during one of bitcoin’s first great bull runs, but was taken down just before it hit $1,000 for the first time. (Onchain volume = total onchain volume, not just on Silk Road.)

Ulbricht intended the platform “to be about giving people the freedom to make their own choices, to pursue their own happiness, however they individually saw fit,” and not the “convenient way for people to satisfy their drug addictions” it had partly become, as he once put it.

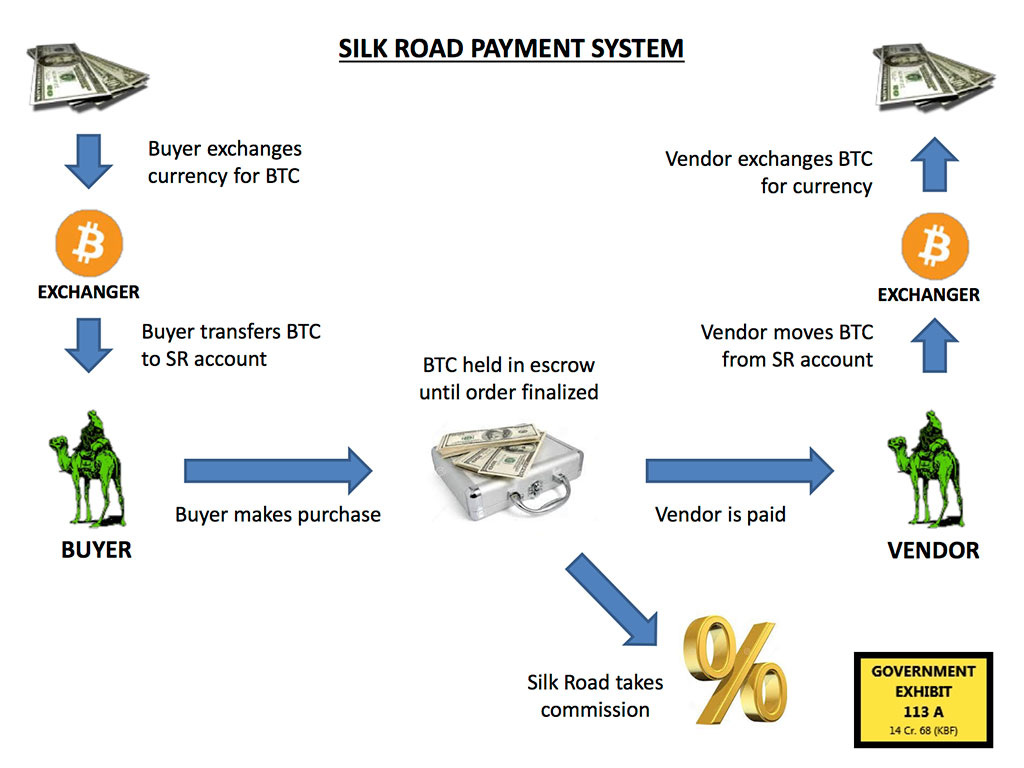

Silk Road needed guardrails if it was to solely accept bitcoin for payment. Quality control was crowdsourced via a public review system, and to protect users from fraud, Ulbricht positioned Silk Road as mediator for all transactions on the platform.

That meant escrow. In an automated system, any time a purchase was made, the buyer’s bitcoin payment was temporarily held in a wallet controlled by Silk Road admins, including Ulbricht.

Silk Road then notified the seller that payment was received, and the seller could then proceed with shipment. Once the package arrived on the other side, the buyer would lodge a confirmation on the Silk Road site, after which the bitcoin was released to the seller, who could then withdraw the coins to their own wallets.

Moderators manually handled disputes on a case-by-case basis via a ticker system, similar to how Amazon, eBay and Airbnb operate today.

There’s no question that these processes were riddled with trust assumptions. Both buyers and sellers were required to trust that Silk Road wouldn’t simply vanish with all their bitcoin, and that Silk Road was well equipped to safeguard user funds at all.

This Silk Road payment flowchart was Exhibit 113 A during Ulbricht’s trial

Users also had to believe that moderators would manage disputes appropriately. At times, mods required users to submit potentially-incriminating photographic evidence, including shipping labels and tracking information, which would also need to be protected against leaks and theft.

Regardless, the system worked. By the time the Feds shuttered Silk Road, it had processed 9.5 million BTC in sales — 80% of bitcoin’s circulating supply at the time — and earned 600,000 BTC in commissions, which in September 2013 was equivalent to $1.2 billion and $80 million, respectively.

Still, Silk Road largely integrated bitcoin in all the right ways. The platform automatically generated a new bitcoin address for every transaction — making them harder to trace. All transactions also took place over Tor, which, when used correctly, can keep IP addresses hidden.

If Silk Road had been built today, maybe it might’ve held escrowed coins in a multisig wallet. At least that would spread some of the trust around. Bitcoin multisigs wouldn’t be enabled until April 2012 — more than a year after Silk Road first launched.

Fit for purpose

Setting aside those concerns, bitcoin and only bitcoin could do what Ulbricht needed.

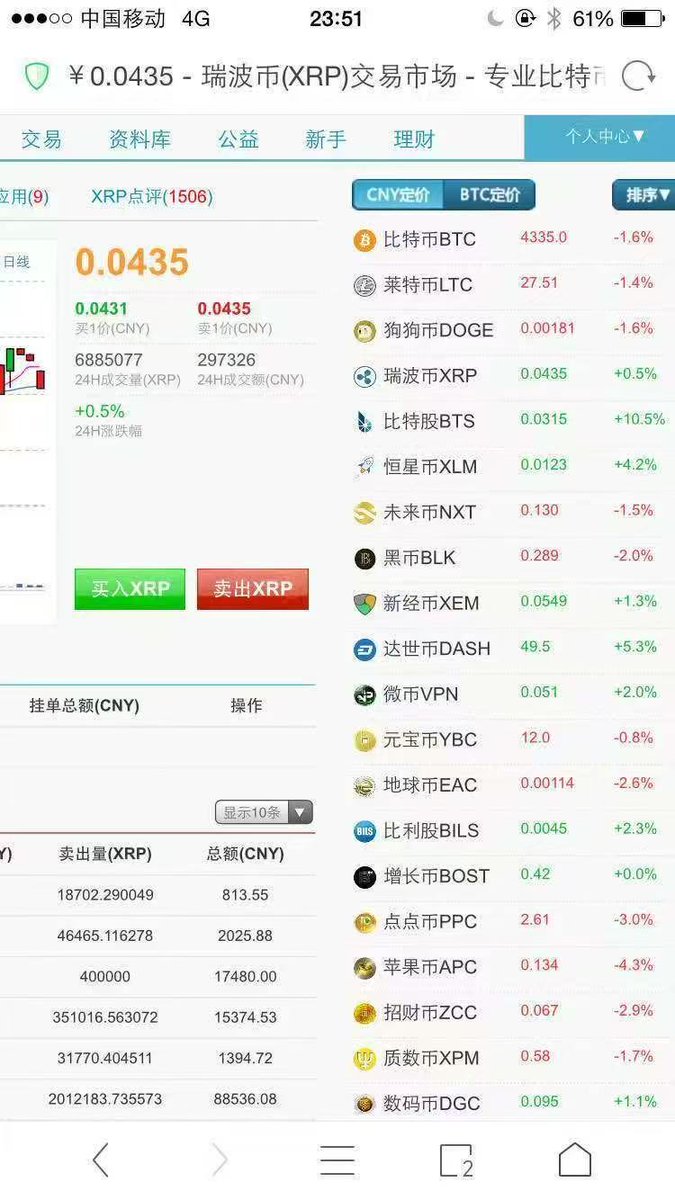

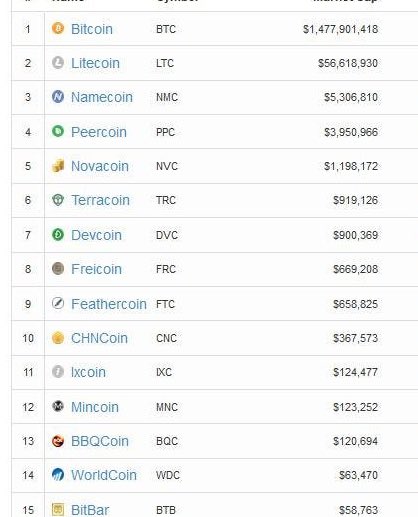

This is especially true, considering there were only a handful of alternative cryptocurrencies in Silk Road’s heyday, including Litecoin, Peercoin and Namecoin, all of which had a tiny fraction of bitcoin’s market cap and liquidity.

Let’s say Silk Road was launched on Ethereum in 2025. Perhaps for faster payments, more flexible escrow functionality, or stablecoin support (Silk Road actually allowed users to lock the dollar value of their bitcoin at time of purchase to minimize the impact of price volatility).

If that was the case, hypothetically, one OFAC sanction on Silk Road’s contracts would immediately make it somewhat harder for its transactions to be processed — 31% of all Ethereum blocks right now are configured to uphold OFAC directives through censorship. In November, that figure was over 70%.

Not to mention, practically all major stablecoins have in-built functionality that allows their issuers to freeze and confiscate tokens at will, which they regularly do upon request from law enforcement.

— The Bitcoin Historian (@pete_rizzo_) November 30, 2024

Such features clearly clash with the notion of an independent, libertarian marketplace, regardless of the power held by Ulbricht and the rest of the Silk Road team on the platform.

Silk Road’s legacy is then this: For all the philosophical distance separating “bitcoin” from “crypto” today, the idealistic platform that Ulbricht built was the divergence catalyst. It was a schism point that cracked open the massive fault line now dividing the space.

Through bitcoin, Silk Road undermined the traditional financial system and, even more critically, the entire social order. Ulbricht acted as a freedom maximalist building freedom tech, with none of the cosplay.

It’s a goal far removed from the compliant commerce that stablecoins and their smart contract platforms — which emerged in the wake of Silk Road’s demise — aspire to serve.

Those systems have grown to augment legacy finance rather than free us from it in the ways Ulbricht had hoped.

Unexpected results

Of course, even Bitcoin’s robust censorship resistance was not enough to protect Ulbricht from the US government. The same goes for other Silk Road operators and power users.

In total, more than 144,000 BTC ($26 million then, $12.6 billion today) was seized from wallets initially controlled by Ulbricht, plus an additional 120,000 BTC from two hackers who’d separately stolen bitcoin from Silk Road while it was active.

It’s likely that tens of thousands more coins were seized from Silk Road users in less high-profile cases over the years.

Therein lies the rub. Bitcoin is clearly resistant in digital space, and Ulbricht was brilliant enough to understand that Silk Road could be the very first killer crypto app. In many ways, there’s been no second-best to this day.

The same can’t be said in our physical meatspace. Ulbricht’s coins were literally taken from him by force and sold for relative pennies on their current dollar value.

— Ross Ulbricht (@RealRossU) March 19, 2025

In turn, the US government response to the Silk Road case has formed the playbook for what’s become the Feds’ strategic bitcoin reserve.

Seized coins may never be sold again, and at this stage, the only way the reserve can get any bigger is for authorities to seize even more coins from even more sovereign individuals, no doubt landing some in prison for a sentence comparable to the time Ulbricht served.

And those coins are only valuable, in part, due to the implicit promise that they can’t be tampered with under normal circumstances.

Nothing can square that irony in any way that’s satisfactory, and when bitcoin does indeed become a boon to the Treasury Department, then it will awkwardly have Ulbricht and Silk Road to thank.

Luckily for Ulbricht, he’s just received a gift far greater than any bitcoin stash — freedom — leading to what I can only imagine is the happiest of 41st birthdays.

To Ross. Bitcoin could never be what it is today without him.

— David

Rizzo’s take, from the Bitcoin Historian

“What did you get done this week?”

Such was the subject line for Elon Musk’s now infamous emails to the US government, but as David points out above, that same email could be sent to the crypto industry today.

Or I’d imagine that might be Ross Ulbricht’s reaction to his realization this week that eBay is slow on verifying his identity, a fact that is momentarily keeping him from auctioning his belongings.

Is it real user friction? An elaborate troll? On today’s hyper commercialized internet, where Snoop Dogg might “give up smoke” and then sell you a grill, perhaps you can forgive the incredulity. Ross, I would hope, has skipped the web’s descent into a maze of ref-links.

Still, one can’t help but think that Ross might be wondering what bitcoin and crypto have accomplished in his absence, perhaps now more than ever. As the eBay example shows, online commerce frictions remain substantial, despite bitcoin’s initial promise to quell them.

Indeed, there were a host of social commentators who suggested as such, proposing that Ross should relaunch the Silk Road or something like it.

Certainly if there’s someone who could help us chart a course forward, it would be Ross. Far-fetched? Maybe. Then again, so was the idea that any president would pardon him in the first place. If there’s anything I’ve learned in bitcoin, it’s to expect the improbable.

— Rizzo

PPC price performance in AUD

The current price of pepecoin is A$0.00013796. Over the last 24 hours, pepecoin has increased by +256.95%. It currently has a circulating supply of 999,999,174 PPC and a maximum supply of 999,999,174 PPC, giving it a fully diluted market cap of A$137.96K. The pepecoin/AUD price is updated in real-time.

5m

-7.40%

1h

+256.95%

4h

+256.95%

24h

+256.95%

About PepeCoin (PPC)

PPC FAQ

What’s the current price of PepeCoin?

The current price of 1 PPC is A$0.00013796, experiencing a +256.95% change in the past 24 hours.

Can I buy PPC on OKX?

No, currently PPC is unavailable on OKX. To stay updated on when PPC becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of PPC fluctuate?

The price of PPC fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 PepeCoin worth today?

Currently, one PepeCoin is worth A$0.00013796. For answers and insight into PepeCoin's price action, you're in the right place. Explore the latest PepeCoin charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as PepeCoin, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as PepeCoin have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.