This token isn’t available on the OKX Exchange.

USDY

Ondo US Dollar Yield price

0x960b...USDY

€0.93294

+€0.0011182

(+0.12%)

Price change for the last 24 hours

EUR

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about USDY today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

USDY market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

€15.00M

Network

SUI

Circulating supply

16,079,478 USDY

Token holders

5793

Liquidity

€2.23M

1h volume

€29.39K

4h volume

€711.50K

24h volume

€2.00M

Ondo US Dollar Yield Feed

The following content is sourced from .

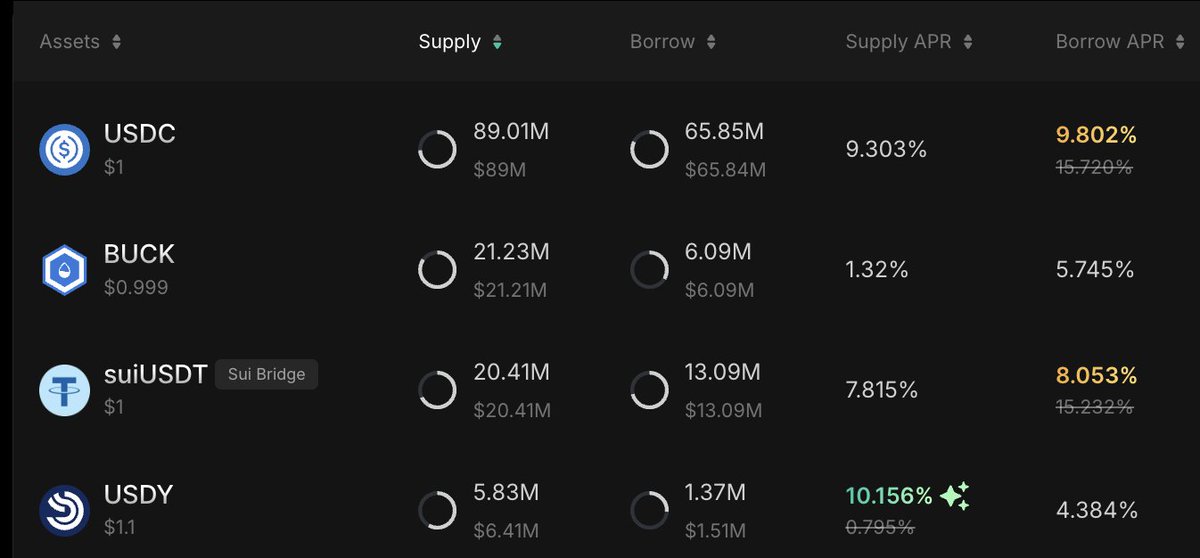

stablecoin borrow rate varies due to market inefficiency, trust, and liquidity availability - this poses a great advantage for arbitrageurs.

to put it in laymen's terms, we noticed that - sometime @OndoFinance usdy or @bucket_protocol buck borrow rate is way lower (5%) than @circle usdc - how can I switch my usdc borrowing position to usdy or buck take advantage of that 5% apy?

now one can do that with one-click migration to optimize borrow position with the most optimized rates. #iykyk

NAVI Protocol

New Migration Feature Now Live on NAVI!

Effortlessly migrate your positions with the latest feature:

🔹 Separate Supply & Borrow Positions Migration

🔹 Integrate Other Lending Protocols’ Positions and APR Data

🔹 Full Integration with NAVI Monitor

Move assets across pools seamlessly and track them in real time with NAVI Monitor!

Start migrating today!

🔗

H1'25 @Aptos check-in: real adoption, real throughput

• 10M+ accounts in 30 days, half active in a given month.

February 11th recorded a peak of 18M

• DAU above a million: average daily tx volume between February and May was 2.6-3.2M, with June at 4.2M as an average and 5.2M as the peak.

• $1B TVL in about 30 DeFi apps: TVL+LS ~$1.1-1.5B Borrowed: $1.5-$2.1B

• Staking over time becomes more decentralized as delegated stake increased from 37.5% to 47.1% and validators from 41 to 75.

• Commission rates are heavily clustered at 5% with a 10% level as a secondary peak.

• Liquid staking TVL: Amnis $168M, Thala $56.5M, Trufin $51.5M, KoFi $21.5M.

• Stablecoin TVL: USDT $431M -> $850M, USDC native to $276M, sUSDe ~$45M.

• RWA hit $537M(3rd among chains): PACT ~$420M, BUIDL $47.7M, BENJI $21.7M.

• Infra sprint: Raptr 250k TPS @~450ms, Shardines 1M+TPS, Zaptos ~40% less latency at sub-second finality.

• Governance: AIP-119 amended to slower cuts of staking rewards to protect decentralization.

Aptos is forming the Global Trading Engine: cheap, deep liquidity, production-ready speed.

H, time for building. More builders, more actual users ahead.

More read:

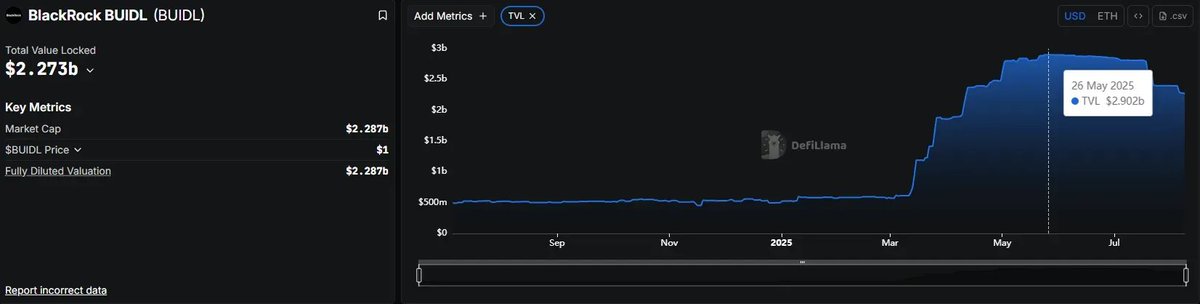

Where does capital hide when narratives are quiet and price is chopping?

I think the quiet rotation’s already underway… ETH ETF is live, BTC’s stuck in a crabwalk, and DeFi yields are limp.

So where’s the “safe” yield flowing?

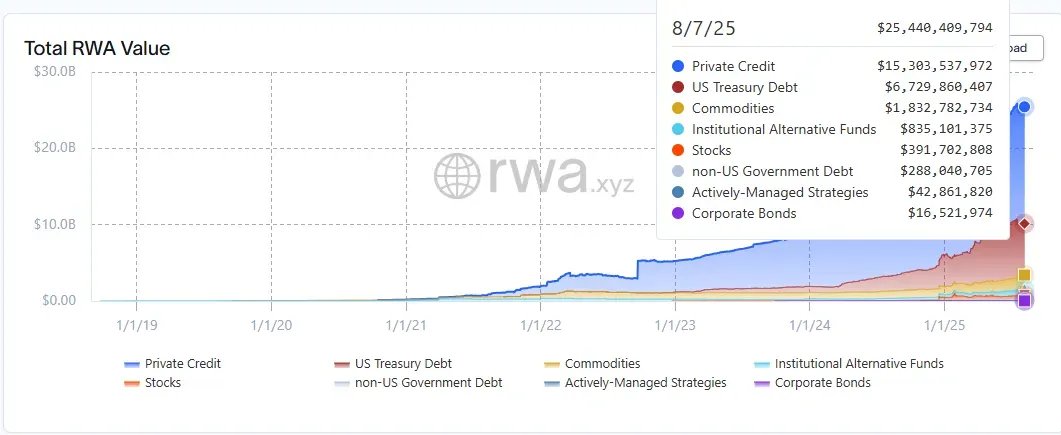

#RWAs might be creeping back into the conversation and I’m already seeing signs:

– Total RWA Onchain now $25.45B

– BlackRock’s BUIDL ballooned to nearly $3B

– #Ondo’s products gaining traction across degen DeFi, DAOs, and institutional allocators

– Tokenized Treasuries yielding ~4.5%

Meanwhile, LSDs sit around ~3%. Curve and Aave are still flat unless you’re chasing boosted pools.

What’s interesting is how the macro is on RWA’s side.

ETH ETF approval → institutional flows inbound → yield-seeking capital needs clean, scalable wrappers → RWAs are one of the few crypto-native primitives that don’t rely on retail FOMO to make sense.

The playbook now looks something like this:

– Park idle stables in Ondo’s USDY or #OpenEden’s tokenized T-bills and collect ~4.5% like it’s an onchain robo-managed money market

– Stack higher yield with #Maple or #Centrifuge pools, earn 8–12% if you’re down to take curated credit risk

– Or blend it with LSDs and RWA collateral loops if you’re comfy with leverage and smart contract spaghetti

Institutions want yield with stability and they’re comfortable parking capital in RWA wrappers that behave like money market funds.

So when farming without a strong trend, I’d argue the Q3 meta is about capital preservation with optionality:

→ 50% in tokenized Treasuries (USDY, BUIDL, OUSG) for ~4.5% base yield

→ 30% in stETH for ~3%, possibly restaked

→ 20% in volatile upside

If ETH pumps off ETF flows, I’m still long. If nothing happens for 3 more months, I’m still farming 5–7% with minimal risk.

Long boring might just outperform fast dumb again.

🟥◻️🟥◻️🟥◻️🟥----🍜

Many detailed accounts are written very well, and they are not written by AI. They still take away others' rankings, which is quite crazy, quite inhumane, and quite on9.

Today, I will write about @SeiNetwork in my own language, however I want to write it~ Let's reason through the on9 algorithm~

I just saw that @SeiNetwork has now launched native USDC and CCTP V2. This update is quite crucial. Previously, the USDC used on Sei was mostly the bridged version, which can be used, but it added an extra layer of risk and fees, and there were some annoyances. This time, Circle directly issued the native USDC on Sei, which means the most significant and regulated stablecoin has been moved to the super-fast L1, eliminating the need for bridging, reducing some risks, and significantly improving capital efficiency.

With the addition of CCTP V2, the native USDC can be transferred 1:1 across 13 chains without loss, with no slippage and no liquidity issues. This is great for traders, arbitrageurs, and developers working on cross-chain applications.

╭─────✦✦─⋆⋅☆⋅⋆───╮

I personally think this combination is quite good:

• The speed of @SeiNetwork (completed within 400ms) + the stability of USDC = the last wall of speed and liquidity has been torn down.

• Institutions can use Circle Mint to directly convert fiat ↔ USDC on Sei, which is much more convenient.

• Ordinary users can directly use native USDC through service providers, so they don't have to worry about "is this USDC really bridged out?".

The Noble version of USDC (USDC.n) that was previously on @SeiNetwork will still be retained, but the ecosystem should gradually guide everyone to switch to the native version~ This step is a significant boost for Sei's goal of building core infrastructure for cross-chain finance.

I feel that this is not just about #Sei having more USDC, but rather bringing together "speed" and "global stablecoin circulation". In the future on Sei, the market can really move capital quickly and cleanly.

In short, it used to be fast, but with limited liquidity; now it is fast and can directly connect to the global capital pool.

Udon🍜うどん(🌸, 🌿) $M|🐜

🟥◻️🟥◻️🟥◻️🟥----🍜

I've always really liked the @SeiNetwork chain, I really miss that hot period of SEI NFTs~

Back then, I was the community CM, helping to negotiate whitelist spots and getting everyone involved in the project, drawing whitelist spots one by one. I still remember Webump and YAKA are still in my wallet, the entire #SEI community was lively, and I tried many new play styles on SEI.

Take a look at my Webump, cool right? HEHEHE 😎

And now looking back, SEI is definitely not just about NFTs anymore, many people haven't realized its changes, but the data is really impressive.

For instance, the daily trading volume of stablecoins has surged to 4.6 billion USD, and USDC's native issuance exceeded 100 million in its first week. Only players couldn't have these numbers; there must be institutions behind the scenes.

╭─────✦✦─⋆⋅☆⋅⋆───╮

Several key institutional moves are also worth noting:

🔸Circle holds 6.25 million SEI, which is their largest position on-chain. The company behind USDC is making such a heavy bet, indicating they see potential in SEI in the stablecoin layer.

🔸CoinShares launched the world's first SEI ETP (institutional product), and it has a 0 management fee.

🔸Wyoming in the US has chosen SEI to test a national stablecoin, and even Japan's FSA has approved SEI. These are all signs of government-level trust.

╭─────✦✦─⋆⋅☆⋅⋆───╮

I think @SeiNetwork has a solid technical foundation:

🔸Transaction confirmation time is compressed to below 400ms, transactions are super fast, smoother than many chains~

🔸TPS started at over 10,000 (12,000), and it's expected to reach 200,000 in the future.

🔸The recent GIGA upgrade has directly increased overall performance by 50 times.

🔸USDC native support + 156 cross-chain paths, allowing funds to flow freely between multiple chains, which is super important.

╭─────✦✦─⋆⋅☆⋅⋆───╮

Now @SeiNetwork has captured the three most critical modules:

🔸Stablecoins: 4.6 billion in daily trading volume, directly playing the role of a clearing layer.

🔸RWA (Real World Asset Tokenization): Ondo has already issued 680 million USDY (4.25% annualized) on it.

🔸Gaming: Among all EVM chains, SEI ranks second in active wallet numbers, meaning there are indeed users playing and interacting.

I feel that this timing is really right, stablecoins are entering the mainstream, RWA is starting to go on-chain on a large scale, and institutions are gradually entering the market. There is a real need for a fast and stable chain to support these demands ✅

The transformation of @SeiNetwork is quite obvious, so I am also building my $SEI position, feel free to pay attention. I believe the #SEI infrastructure is very good and has great potential~

Seamless crosschain liquidity.

Stargate

Stargate on Solana.

Move stablecoins like USDC, USDe, USDY, PYUSD, USDG

or tokens like PENGU, HEMI, SEI, XDC, CAKE and more.

Enter or exit Solana with no slippage, no fees. Just perfect 1:1 execution from a global liquidity layer spanning 80+ chains.

Stargate is the standard for moving money.

USDY price performance in EUR

The current price of ondo-us-dollar-yield is €0.93294. Over the last 24 hours, ondo-us-dollar-yield has increased by +0.12%. It currently has a circulating supply of 16,079,478 USDY and a maximum supply of 16,079,478 USDY, giving it a fully diluted market cap of €15.00M. The ondo-us-dollar-yield/EUR price is updated in real-time.

5m

+0.01%

1h

+0.00%

4h

+0.25%

24h

+0.12%

About Ondo US Dollar Yield (USDY)

USDY FAQ

What’s the current price of Ondo US Dollar Yield?

The current price of 1 USDY is €0.93294, experiencing a +0.12% change in the past 24 hours.

Can I buy USDY on OKX?

No, currently USDY is unavailable on OKX. To stay updated on when USDY becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDY fluctuate?

The price of USDY fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Ondo US Dollar Yield worth today?

Currently, one Ondo US Dollar Yield is worth €0.93294. For answers and insight into Ondo US Dollar Yield's price action, you're in the right place. Explore the latest Ondo US Dollar Yield charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Ondo US Dollar Yield, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Ondo US Dollar Yield have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.