This token isn’t available on the OKX Exchange.

gork

gork price

BYmVRC...PUMP

$0.000045116

-$0.00001

(-17.25%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about gork today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

gork market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$45.12K

Network

Solana

Circulating supply

1,000,000,000 gork

Token holders

85

Liquidity

$7.08

1h volume

$7.14M

4h volume

$10.11M

24h volume

$10.11M

gork Feed

The following content is sourced from .

看看我也相信了

#Xchat

$chat

@chat

剑锋

分享一个庄盘 #chat

5umKhqeUvXWhs1vusXkf6CbZLvHbDt3bHZGQez7vpump

理由

①持仓前200基本全是余额0.00x的号

②持仓前200的号基本全是低频操作的号

③持仓前200有10%的新号,只有这一个币,有60%的号以前交易轨迹中有很多相同的币

以上基本可以确认这就是一个高度控盘的庄盘了,而庄盘的高度,庄的格局完全是被叙事撑起来的,我们来看下叙事

chat作为现在x上内测的应用,后面全面开放老马肯定要宣传,至于高度则取决于老马奶的力度,比如是否换头像,换签名,或者发推几次,如果全套都上的话就像 #gork 了

这个盘子60%的筹码庄都是在40万附近吸筹的,也就是成本24万刀,目前池子7.5万刀,我相信庄是不会那么容易弃盘的

一个庄盘要起飞,肯定要经过以下步骤:

底部吸筹--拉升试盘--等待利好配合拉盘起飞---出货

在我看来目前chat就属于第二阶段,拉升试盘阶段,测试抛压如何,让短期纸手离场

这几波上涨都是庄的号在拉盘,然后一些小散单就止盈出局了

目前80万,我是建议在40—80万之间分批买点,等待老马发利好

值得一提的是,这个庄看起来像rfc的庄,因为top100中很多号的交易轨迹中都有rfc,而且前排也有rfc大户,DYOR

Share a banker #chat

5umKhqeUvXWhs1vusXkf6CbZLvHbDt3bHZGQez7vpump

reason

(1) The first 200 positions are basically all numbers with a balance of 0.00x

(2) The top 200 numbers are basically low-frequency operations

(3) There are 10% of the new numbers in the top 200 positions, and only this one coin, 60% of the numbers have many identical coins in the previous trading trajectory

The above can basically confirm that this is a highly controlled banker, and the height of the banker and the pattern of the banker are completely supported by the narrative, let's take a look at the narrative

As for the height, it depends on the strength of the old horse milk, such as whether to change the avatar, change the signature, or tweet a few times, if the whole set is on it, it will be like #gork

60% of the chips of this plate are around 400,000 yuan, that is, the cost is 240,000 dollars, and the current pool is 75,000 dollars, I believe that the banker will not be so easy to abandon the market

For a dealer to take off, it must go through the following steps:

Bottom accumulation - pull up the test market - wait for the good cooperation to take off --- ship

In my opinion, the current chat belongs to the second stage, pulling up the test stage, testing how the selling pressure is, and letting the short-term paper hand leave the market

These waves of rise are all the banker's number pulling the market, and then some small loose orders take profit and go out

At present, 800,000, I suggest buying in batches between 40-800,000 yuan and waiting for the old horse to get good

It is worth mentioning that this banker looks like an RFC banker, because many numbers in the TOP100 have RFCs in their trading trajectories, and there are also RFC players in the front row, DYOR

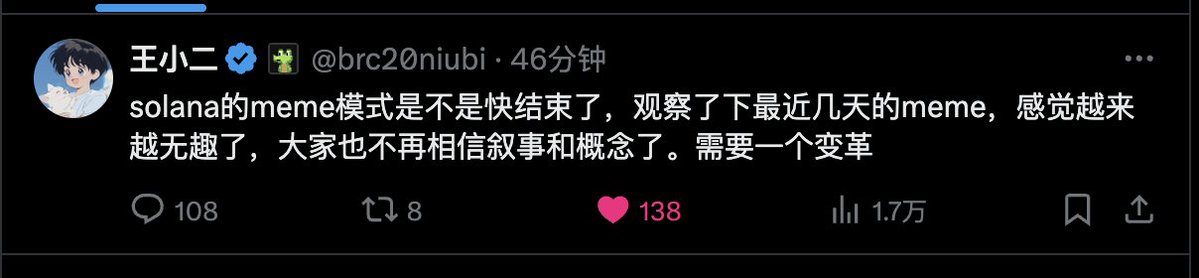

In the past few days, the discussion on Twitter about "steak farm" has intensified, and I continue to share a few of my views along with the last tweet:

1. Whether it is narrative trading or address mining, the core purpose is to make a profit, if you want to prove that your methodology is effective, the most convincing is always the real market record + operation logic, just like secondary trading, no matter how long the analyst is, it can only be regarded as "for reference only", and the trader's view that can continue to be profitable after the market test is really valuable. Talk is cheap, show me the wallet.

2. I respect everyone's right to share, but I don't agree with the large-scale disclosure of the so-called "dealer cluster address", the main reason is that as mentioned in the previous tweet, this kind of information is reflexive, when it is understood by most people, it has become invalid information in itself, and it cannot play any role. The so-called banker refers to the project party with the ability to control the chips, the dealer is also to make money rather than do charity, the logic of retail investors buying is to pick up the car to eat the increase, if there are more pickpockets, it is bound to increase the difficulty of pulling the market, which in itself contradicts the purpose of the steakhouse?

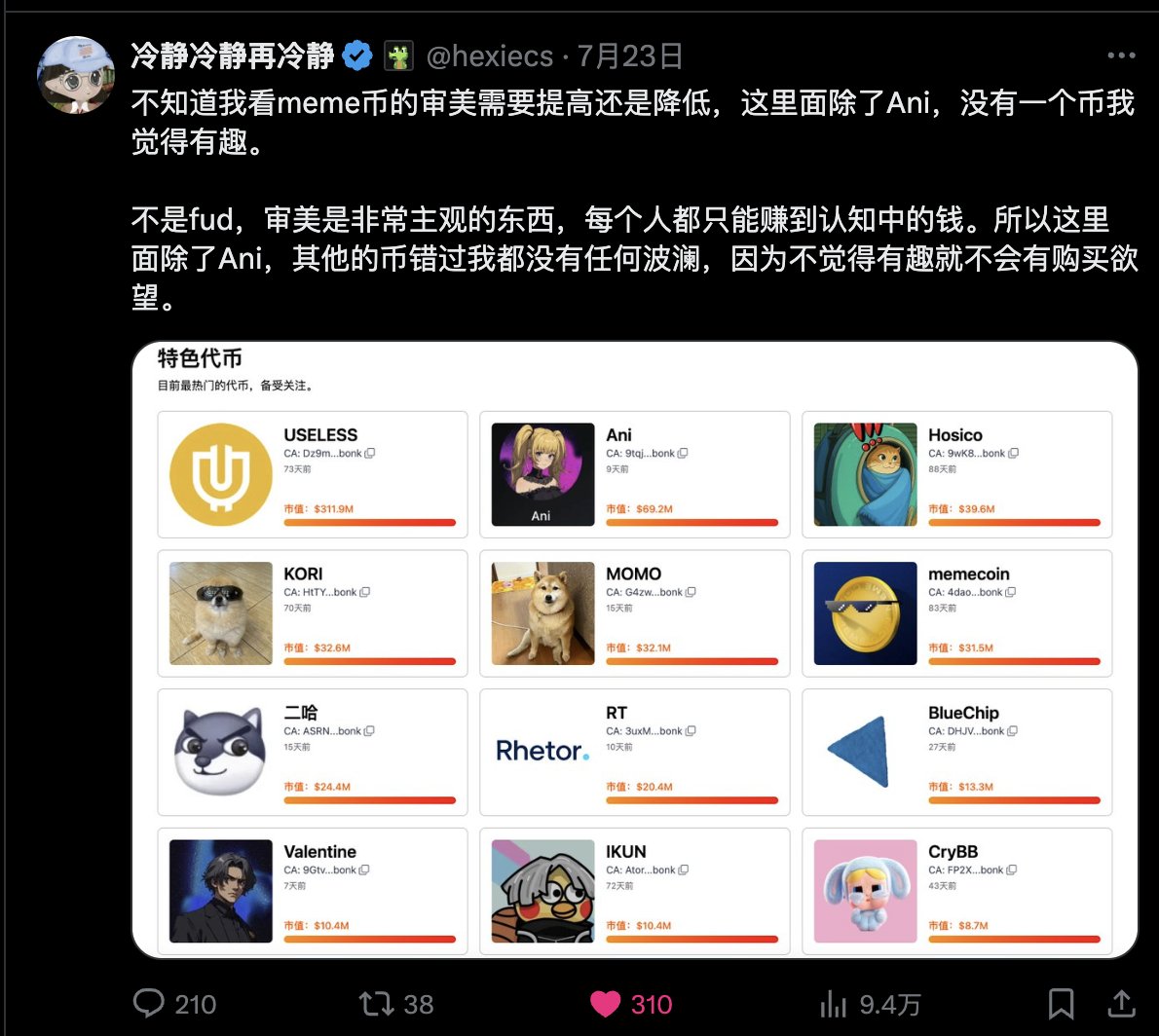

3. Recently, "Grill Village" is so popular, in the final analysis, it is because the liquidity on the chain is not as good as before, and everyone who has experienced AI Meta in November last year knows that at that time, any hackathon project issued coins, it could be migrated from the internal disk and bought 10M, almost one per day, and the overall quality is good, and it can rush to 30-50M in a few hours, how can there be time to listen to your grunting address analysis. At present, those that can reach this height purely by narrative, such as Gork and Ani, appear frequently about once a week, and most high-cap tokens have traces of control, which naturally promotes the market's research on "grilling".

4. I have always had a point of view, that is, the process of collecting monitoring addresses is best done by yourself, rather than using ready-made ones directly. Because every smart money has its own style, some are fast in and out, some seize early opportunities, some see it and take heavy positions, and some ambush potential coins, if you don't understand the operating habits of these addresses, just blindly follow, it is difficult to have good results. I use address monitoring as a source of information, through monitoring to know a certain coin, and then understand the narrative myself and decide whether to buy or not.

0xSun

Playing on-chain Meme, I personally think there are two main methodologies, one is narrative trading, and the other is address mining, the former focuses on the smell and sensitivity of the market, and the latter focuses on careful study and analysis of data.

Not only do they not conflict, but they often need to be used in combination. They also correspond to the two driving forces required for the rise of tokens, namely the joint force of the market and retail investors, and the pull of bookmakers and whales.

Narrative trading, the focus is on what kind of story the token tells, whether it can resonate with the market, and how far a token can go based on the background of the event, innovation, popularity, etc.

For example, $Ani and $Gork are narratives spawned by Musk's new products, which are both influential and interesting, and are easy to spread; $Trump, $Pnut, are contributed by major political-related events; Last year's AI hackathon market paid attention to Dev resume and industry status; $Neiro, $Pochita is a derivative of the Dogecoin concept; $Fartcoin, $Useless emphasizes crypto nihilism.

When the market sentiment is good, retail investors are highly motivated, and there is a lot of liquidity, the narrative itself can give birth to Meme coins with a market value of tens of M or even higher, and when the market is bad, it is necessary to rely on the market maker to control the market and attract attention through the increase, typical of which is the recent $Aura, which has been pulled from a state of almost zero to 230M in a few days.

To catch this type of banker, the most suitable way is to dig the address, analyze whether there are clusters of pull addresses and their intentions, or find clues through the previously accumulated address library. The disadvantage of this method is that it is very time-consuming, because the pull address is often changed frequently, and the second is that even if traces are seen, once the bottom chips are not firmly controlled, the dealer can choose to abandon the market, and the initiative is completely in the hands of others.

Whether it is a big KOL on Twitter or a car on the chain, most of them are mainly narrative transactions, this is not because the address mining is not good, in the final analysis, it is because it is reflexive, once a certain pull address is shared, and more and more people know, it means that the resistance to pull is getting bigger and bigger, resulting in abandonment or changing addresses. In contrast, address mining is a technical activity that is only suitable for small-scale sharing, while narrative transactions need to reach as many people as possible, after all, consensus is the core of the narrative.

Address mining is a technical activity that is only suitable for small-scale sharing

Narrative transactions need to reach as many people as possible, after all, consensus is the core of the narrative

0xSun

Playing on-chain Meme, I personally think there are two main methodologies, one is narrative trading, and the other is address mining, the former focuses on the smell and sensitivity of the market, and the latter focuses on careful study and analysis of data.

Not only do they not conflict, but they often need to be used in combination. They also correspond to the two driving forces required for the rise of tokens, namely the joint force of the market and retail investors, and the pull of bookmakers and whales.

Narrative trading, the focus is on what kind of story the token tells, whether it can resonate with the market, and how far a token can go based on the background of the event, innovation, popularity, etc.

For example, $Ani and $Gork are narratives spawned by Musk's new products, which are both influential and interesting, and are easy to spread; $Trump, $Pnut, are contributed by major political-related events; Last year's AI hackathon market paid attention to Dev resume and industry status; $Neiro, $Pochita is a derivative of the Dogecoin concept; $Fartcoin, $Useless emphasizes crypto nihilism.

When the market sentiment is good, retail investors are highly motivated, and there is a lot of liquidity, the narrative itself can give birth to Meme coins with a market value of tens of M or even higher, and when the market is bad, it is necessary to rely on the market maker to control the market and attract attention through the increase, typical of which is the recent $Aura, which has been pulled from a state of almost zero to 230M in a few days.

To catch this type of banker, the most suitable way is to dig the address, analyze whether there are clusters of pull addresses and their intentions, or find clues through the previously accumulated address library. The disadvantage of this method is that it is very time-consuming, because the pull address is often changed frequently, and the second is that even if traces are seen, once the bottom chips are not firmly controlled, the dealer can choose to abandon the market, and the initiative is completely in the hands of others.

Whether it is a big KOL on Twitter or a car on the chain, most of them are mainly narrative transactions, this is not because the address mining is not good, in the final analysis, it is because it is reflexive, once a certain pull address is shared, and more and more people know, it means that the resistance to pull is getting bigger and bigger, resulting in abandonment or changing addresses. In contrast, address mining is a technical activity that is only suitable for small-scale sharing, while narrative transactions need to reach as many people as possible, after all, consensus is the core of the narrative.

Lately everyone has been talking about methodology

Narrative analysis On-chain analytics

1. Narrative analysis The ceiling I have seen My master

A trader's accuracy of 20-30% of the narrative is excellent

But my master's accuracy in the narrative I think it can be 80%

Basically, every time I send my CA, it's a big gold CA at the bottom

The strength is terrifying, low-key, and the pure narrative transaction is A9 early

2. On-chain analysis of the ceiling I've seen Lei Group

On-chain fund tracking and analysis for project side actions

Approve contracts, add pools, transfers, etc. can be accurately monitored and analyzed

When the project party is ready to sell, they can sell it to the project party

The project is ready to pull the market, and they can buy the front of the project party

It really conquered me with strength and pattern

Recently, many people should step on empty nihilism and Chinese ticker

I also have a lot of time out of the air, and I feel that I have only made no progress in BSC

I swiped a lot of ETH and BASE teachers' tweets

For example, @memekiller365 @0x_CryptoAu @Y_babyshow

Most of them are analyzed and researched, and the results are very enviable

SOL is a combination of the two except for @0xXQ1 @0xN10N

Most of it is pure construction and finding angles to pvp

EVM chains feel more like investment research

Low multiplier large position and large market capitalization return

SOl chains feel more like casinos

The income of high multiplier small positions and small market capitalization

Saw @Mirro7777's tweet

After the web2 star group harvest last year, I thought the meme was over

But then there was an AI wave, a BSC wave, and a BONK wave.....

The route of on-chain analysis and investment research is always evergreen

If you only look at the narrative angle afterwards, it may be difficult

0xSun

Playing on-chain Meme, I personally think there are two main methodologies, one is narrative trading, and the other is address mining, the former focuses on the smell and sensitivity of the market, and the latter focuses on careful study and analysis of data.

Not only do they not conflict, but they often need to be used in combination. They also correspond to the two driving forces required for the rise of tokens, namely the joint force of the market and retail investors, and the pull of bookmakers and whales.

Narrative trading, the focus is on what kind of story the token tells, whether it can resonate with the market, and how far a token can go based on the background of the event, innovation, popularity, etc.

For example, $Ani and $Gork are narratives spawned by Musk's new products, which are both influential and interesting, and are easy to spread; $Trump, $Pnut, are contributed by major political-related events; Last year's AI hackathon market paid attention to Dev resume and industry status; $Neiro, $Pochita is a derivative of the Dogecoin concept; $Fartcoin, $Useless emphasizes crypto nihilism.

When the market sentiment is good, retail investors are highly motivated, and there is a lot of liquidity, the narrative itself can give birth to Meme coins with a market value of tens of M or even higher, and when the market is bad, it is necessary to rely on the market maker to control the market and attract attention through the increase, typical of which is the recent $Aura, which has been pulled from a state of almost zero to 230M in a few days.

To catch this type of banker, the most suitable way is to dig the address, analyze whether there are clusters of pull addresses and their intentions, or find clues through the previously accumulated address library. The disadvantage of this method is that it is very time-consuming, because the pull address is often changed frequently, and the second is that even if traces are seen, once the bottom chips are not firmly controlled, the dealer can choose to abandon the market, and the initiative is completely in the hands of others.

Whether it is a big KOL on Twitter or a car on the chain, most of them are mainly narrative transactions, this is not because the address mining is not good, in the final analysis, it is because it is reflexive, once a certain pull address is shared, and more and more people know, it means that the resistance to pull is getting bigger and bigger, resulting in abandonment or changing addresses. In contrast, address mining is a technical activity that is only suitable for small-scale sharing, while narrative transactions need to reach as many people as possible, after all, consensus is the core of the narrative.

gork price performance in USD

The current price of gork is $0.000045116. Over the last 24 hours, gork has decreased by -17.25%. It currently has a circulating supply of 1,000,000,000 gork and a maximum supply of 1,000,000,000 gork, giving it a fully diluted market cap of $45.12K. The gork/USD price is updated in real-time.

5m

-11.32%

1h

-84.38%

4h

-17.25%

24h

-17.25%

About gork (gork)

gork FAQ

What’s the current price of gork?

The current price of 1 gork is $0.000045116, experiencing a -17.25% change in the past 24 hours.

Can I buy gork on OKX?

No, currently gork is unavailable on OKX. To stay updated on when gork becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of gork fluctuate?

The price of gork fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 gork worth today?

Currently, one gork is worth $0.000045116. For answers and insight into gork's price action, you're in the right place. Explore the latest gork charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as gork, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as gork have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Socials