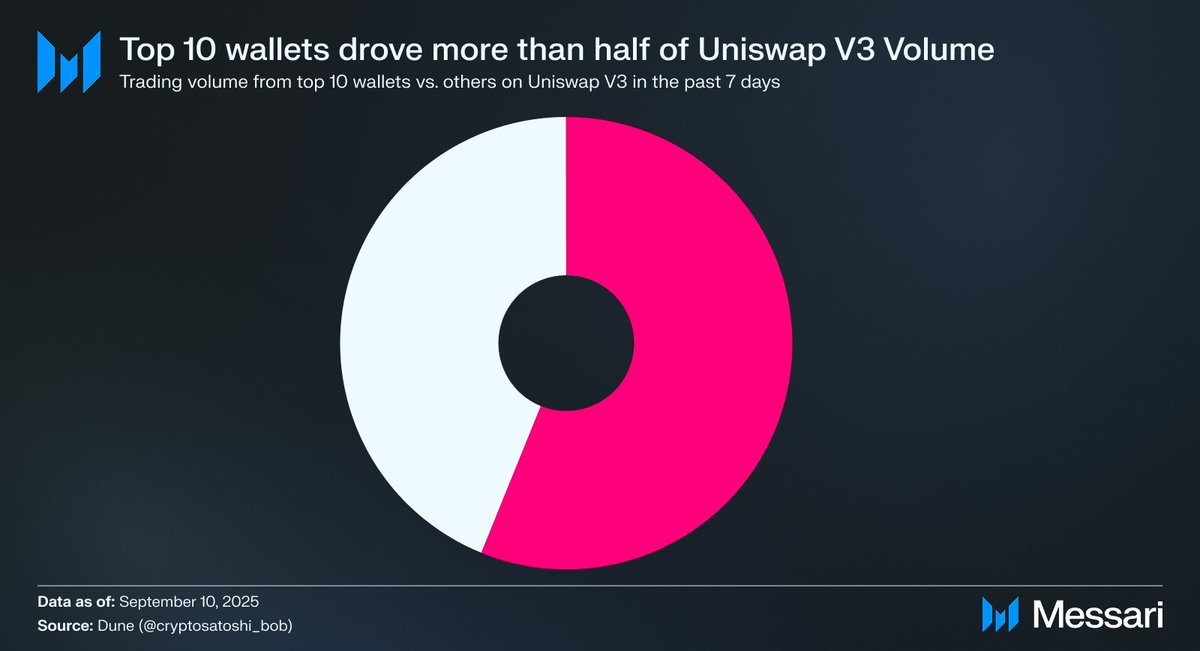

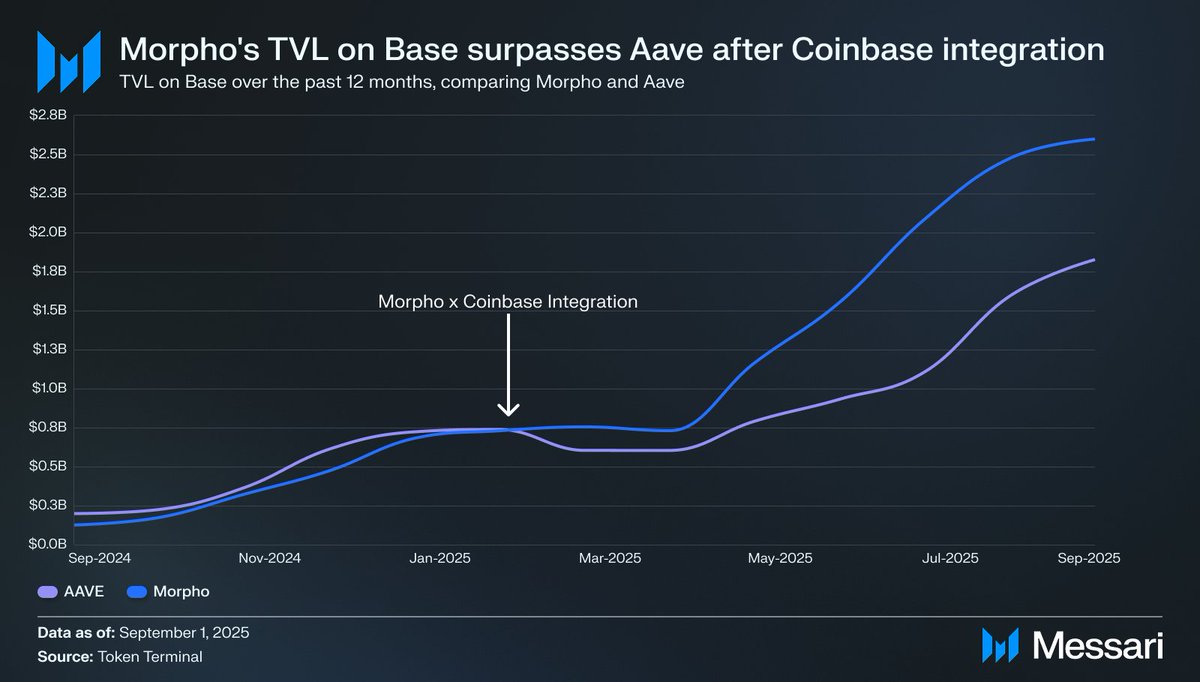

DeFi is facing a power-user problem. Consider the numbers: - On @Aave, the top 20 wallets drove 32.1% of all borrowing over the past year. - On @Uniswap V3, the top 10 wallets generated over half of trading volume in just one week. Robinhood’s early growth looked similar. By the end of 2020, only 13% of its users traded options, but they generated over 60% of the company’s revenue. The difference? Fintechs have regulatory moats. You can’t “fork” Robinhood overnight—it takes millions of dollars and months of licensing hurdles to replicate that business. DeFi, on the other hand, is open-source and forkable. Vampire attacks have shown how quickly liquidity can migrate to the next shiny protocol. 👉 Forkability makes DeFi fragile. But programmability provides a counterweight: distribution as a moat. What costs fintechs hundreds of thousands in compliance and API integrations is, in DeFi, just a plug-and-play smart contract. That’s why the @MorphoLabs x @coinbase partnership was so...

Show original

10.88K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.