"The news of microstrategy fundraising is out, how much can BNB rise? 》

After today's post, some people have been asking which shell of the BNB microstrategy may be, I don't know at the moment, maybe not many people on the market know about it, but it is true that I heard that fundraising is extremely hot and sought after.

However, for us and other small scatters, we don't need to know which shell company it is, because in the end they all want to buy $BNB which is also good for $BNB.

In fact, referring to the previous BMNR and SBET routes, micro-strategy coins seem to give institutions that cannot directly intervene in $BNB an opportunity to eat dividends, which is a bit similar to leveraged $BNB.

Everyone increases their positions in BNB, or increases their positions with low leverage, which is actually not much different.

This morning I calculated the amount of funds needed to rush 1,000 $BNB, and it happened that Miss Lin Wanwan sorted out the current WINT and the unnamed regular army fundraising scale, which has locked in nearly $1 billion, exceeding the $880 million demand I calculated in the morning.

Portal:

So theoretically, it's only a matter 😍😍😍 of time before $BNB exceeds 1000 (not financial advice, I have a stake, don't scold me if you lose)

~~~~~~~~~~

But don't forget, this is only the buying power of Micro Strategy, how big is the market buying volume driven by this buying process?

If all these funds come to buy $BNB, how high can the price go?

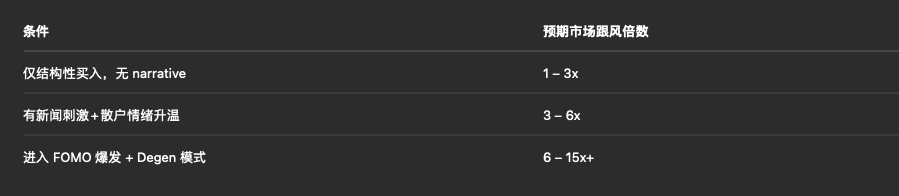

Let's not pat our heads, model and derive according to the previous data of the ETH microstrategy, I asked ChatGPT to do this for me:

Prompt : "As a senior US securities expert and cryptocurrency expert, if BNB Microstrategy companies start to buy BNB continuously, referring to the cases of SBET and BMNR, what is the approximate ratio of market buying to microstrategy buying?"

There is a lot of content, pick the key points:

If a buying scale of 100M/day begins to appear, it can account for about 5% of the market and enter the "superimposed FOMO" stage.

If the FOMO state begins, the market buying will reach 5.5-17X of the original microstrategy funds.

According to this logic, let's take the number and continue to deduce:

Assuming that BNB MicroStrategy invests $500 million to buy BNB in the next month, triggering 6 times the market to follow the trend ($3.5 billion in total), how much can the price of BNB rise?

Conclusion:

BNB is poised for a +24% to +36% increase in a month, with price targets in the $1,050–$1,150 range. (The prerequisite is that the market does not collapse, there are no various black swan events, and BNB Micro Strategy can invest 500 million yuan to buy spot in the market)

BNB pension monsters like to run big 🥰🥰🥰

~~~~~~~~~~

Finally, this conclusion is only a superficial modeling deduction based on the current limited information and cannot be used as rigorous investment advice.

If the market is so simple and predictable, then AI will not let go of let me wait for mortals to spend a little money at will. In "Awe of the Market"

Under the premise of doing a good job in investment planning and risk control, and increasing your winning margin is the recuperation that you need to continuously improve.

I wish you all good money from $BNB

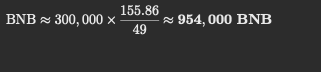

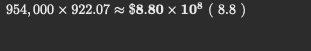

Based on last night's data, I just calculated how much funds will be needed and how many BNB will need to be purchased if $BNB rises to 1,000.

Yesterday, about 300,000 BNB → pulled up $49 (796→845).

Now it's about $844.14, and it's $155.86 short of $1,000.

Linear estimation using the same "volume-price elasticity":

If the shock unfolds linearly along the way, the average transaction price is about 844.14 + 0.5*155.86 = $922.07,

The additional funds are as follows:

The conclusion is:

It also needs to purchase about 954,000 BNB, a net buying volume of about $880 million.

Compared to $ETH's microstrategy, SBET alone spent $1.3 billion (they just spent 296 million over the weekend), and BMNR held more than $20 in ETH through stock swaps and market purchases.

In my opinion, the same micro-strategy model may have a better boost to the currency price than $ETH$BNB's micro-strategy.

Why?

🫰BNB's chip concentration is significantly higher than ETH's, and the historical selling pressure (fossil/diamond hands) is significantly smaller than ETH.

🫰ETH is inflationary, but BNB is actually deflationary.

The total BNB issuance was initially 200 million, and half of it has been released through buybacks and burns (the remaining cap is 100 million).

Every quarter, Binance will use 20% of the current net profit to buy back BNB and burn (burn), and eventually permanently burn the remaining 100 million BNB, and will not continue to issue additional money.

🫰 Binance's ability and efficiency are much higher than those of EF, which is undergoing a high-level restructuring and trying to break through fundamentals. Binance's profit increase is transmitted to the BNB currency price, and the currency price is transmitted to the microstrategy book profit to increase the stock price rise, and then gain stronger financing capacity and more capital favor, and the flywheel takes off

🫰 Currently, retail investors in the U.S. market cannot buy and hold $BNB. Even though the BNB/USD pair is available on Kraken, Americans cannot buy it. BNB microstrategies can not only attract retail investors, but may even attract traditional funds that cannot directly hold cryptocurrencies. This is a very direct increase in purchasing power.

So, hold on to $BNB and wait for the wind to come~!

43.92K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.