Dynamic E-CLPs are now live on Ethereum mainnet.

ETH/USDT and ETH/USDC are bootstrapped with GYD incentives.

Designed for:

- Real yield from highly efficient swap fees

- Fully passive liquidity

- Efficiency and safer wide range liquidity of the E-CLP

The same pools on Base have already been outperforming for passive LPs 👇

Thanks to a wide range strategy that lowers concentration risk and dynamics that avoid costly rebalancing and maintain invariant protection (limits downside) in most settings.

How are @GyroStable's new Dynamic Pools doing?

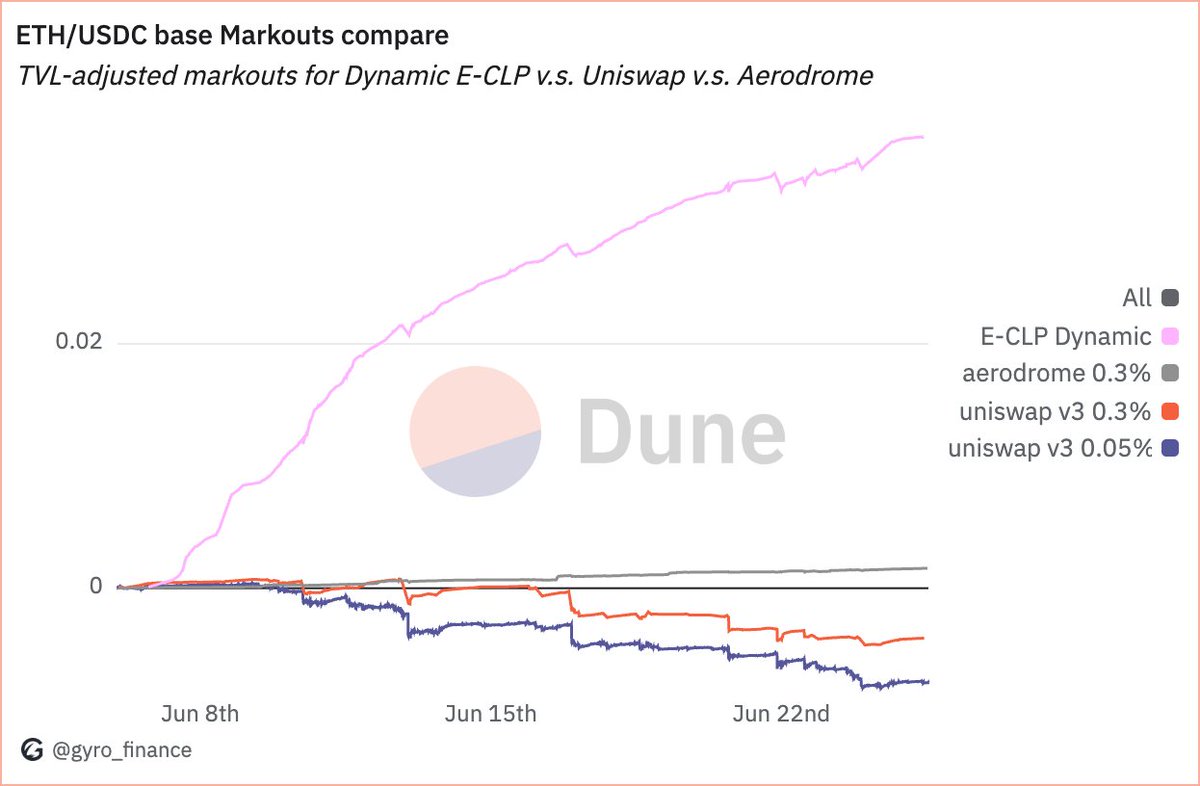

Here's ETH/USDC on Base measured by market making PnL (TVL-adjusted markouts).

Noticeably the best performance for this pair at the pool level. And it serves passive LPs.

Let's walk through what this means 👇

Why markouts?

Markouts compare the execution prices LPs receive in a liquidity pool against the ‘true’ prices on CEXs.

- Positive markouts means LPs are making a trading profit.

- Negative markouts means LPs are leaking value to arbitrageurs.

Other components to LP profitability

LPs can also earn a return from 'volatility harvesting' if prices mean revert / wiggle around for a period of time.

You can think of this in a simple way as effectively buying low and selling high over time (if the pool can achieve this) *while* prices wiggle back and forth.

If a pool captures volatility harvesting, it can add profitability on top of markouts.

- A pool with positive markouts and volatility harvesting will do even better.

- If a pool has large negative markouts, it will be very hard to overcome this even with volatility harvesting.

The only pools today that really 'guarantee' volatility harvesting are pools that preserve the 'constant function' property of static AMMs. And then only while prices wiggle back and forth. Pools in which LPs constantly shift positions (e.g., most concentrated liquidity) give up this property and lock in IL at each shift. In which case, LPs must shift liquidity in sophisticated ways if they want to achieve volatility harvesting or conceivably lose money on this component too.

Dynamic E-CLPs

Gyroscope's Dynamic Pools are designed to capture volatility harvesting by preserving the 'constant function' property in most settings (liquidity updates are designed to be rare). They're designed to move with the market but settle into regions in which they have a shot at volatility harvesting.

Which means that Gyro LPs benefit from good positioning both on the empirical markouts performance above and volatility harvesting.

Explore the new Dynamic E-CLPs on Ethereum at

Read more on how Dynamic E-CLPs work:

3.79K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.