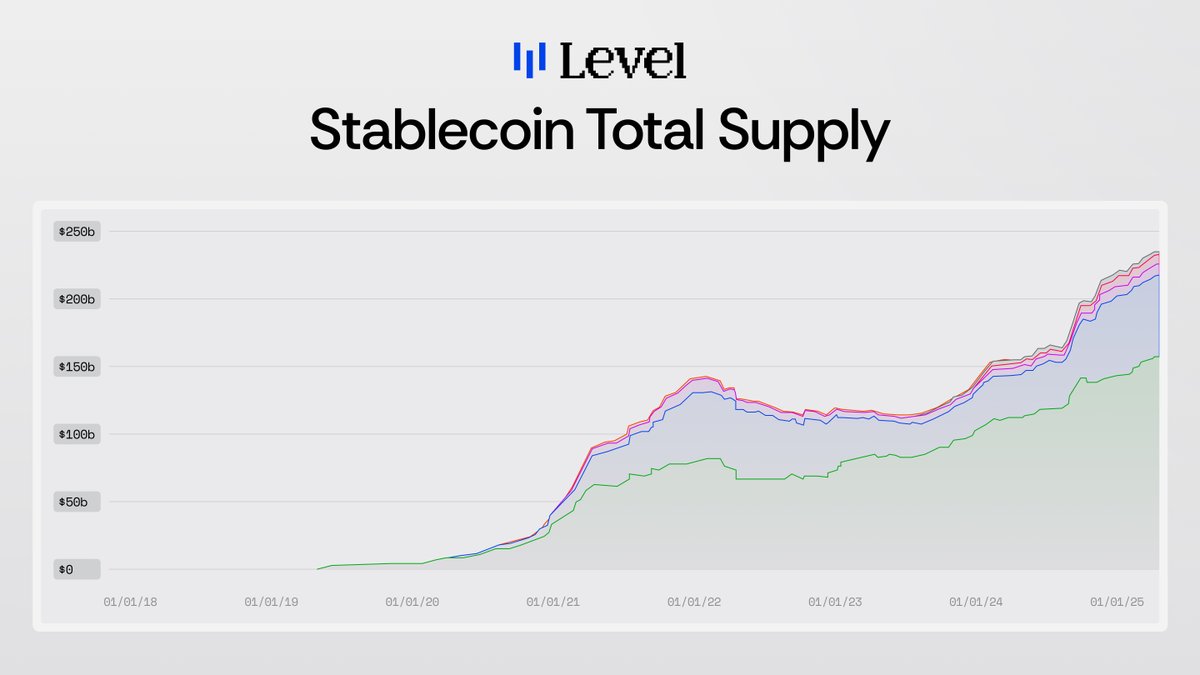

📈 Stablecoin Supply Keeps Climbing

Stablecoin supply has risen steadily since early 2023 and now hovers near $250 B. Regulatory tailwinds in the US, Japan and elsewhere are turning stablecoins into crypto’s first clear product-market fit for institutions and mainstream users. Borderless dollars that settle in seconds already power trading, payments and collateral.

Yet >90 % of that value sits in USDC & USDT: high-liquidity cash rails with no yield. In a capital-efficient world, leaving $200B+ idle is the inefficiency to fix.

That gap is closing. Yield-bearing stablecoins, such as slvlUSD from Level, are carving out space on the supply chart. Some (e.g., slvlUSD) serve as onchain savings accounts, while others provide hedging or structured-yield plays.

Different mechanics, same mission: make dormant dollars productive.

As adoption grows, an ecosystem that pairs checking-like liquidity (lvlUSD) with savings-style yield (slvlUSD) gives users familiar, bank-grade tools, without the banks.

Same dollars, now working: earning, composable, borderless.

Stablecoins aren’t just expanding in size; they’re evolving from passive rails into yield-bearing, programmable money. The blend between safety, transparency, and returns will shape the next era of onchain banking.

Data Font: @tokenterminal

3.64K

31

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.