. ݁₊ ⊹ . ݁˖ . ݁VAULT OF THE DAY. ݁₊ ⊹ . ݁˖ . ݁

Why are whales quietly parking tens of millions in vaults with 2% APY?

Today's @gauntlet_xyz vault of the day might look basic on the surface. However, it's one of the most powerful yield tools for passive capital in the market right now, powered with @MorphoLabs to endure and grow through various market conditions.

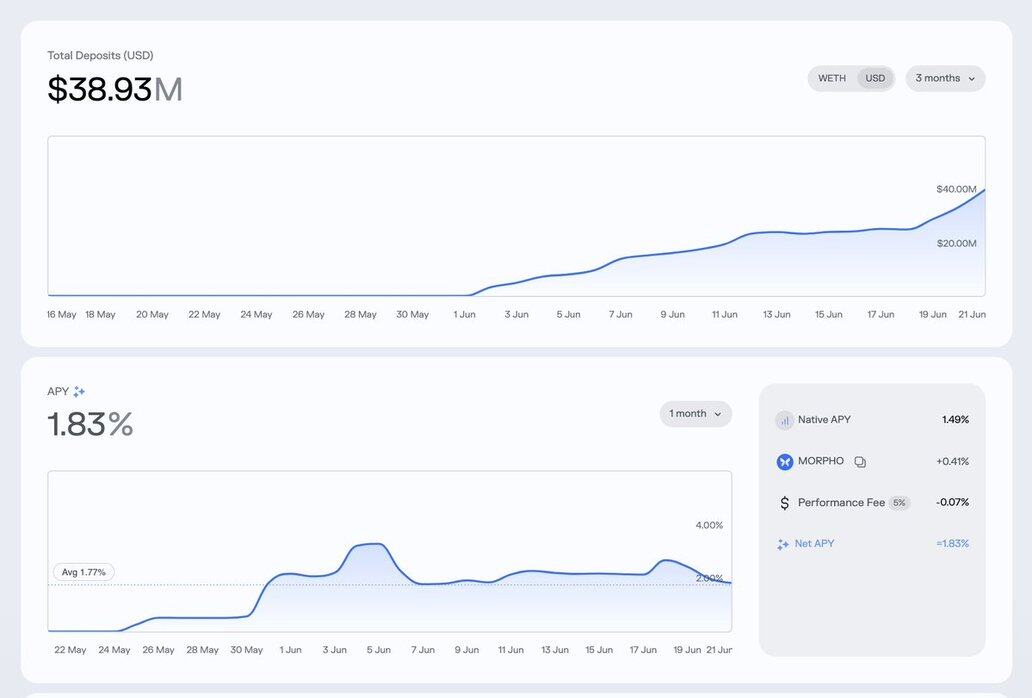

This is Vault Bridge WETH, launched in May 2025 by Gauntlet and live on Morpho. It currently holds over $38.9M in deposits with $21M in active liquidity.

It doesn’t rely on risky directional strategies or degen yield hopping. Instead, it aims to optimize risk-adjusted yield across large market cap and high liquidity collateral markets.

The strategy is simple, reliable, and capital-efficient.

Users deposit WETH, which is lent out to borrowers using ETH LSTs (like wstETH and weETH) or assets like cbBTC as collateral. Yields are generated from interest paid by borrowers and rebalanced automatically based on risk.

Here's what matters:

→ Net APY is currently 1.83%

→ Zero idle capital

→ Top LTVs: wstETH 96.5%, weETH 94.5%

→ Major allocation to staked ETH collateral (94%+)

→ Full integration with Gauntlet risk simulations +

@MorphoLabs optimizer

This makes it ideal for users who want predictable, passive ETH denominated yield.

Vault supply has been climbing steadily since launch. From $0 on May 23 to $38.9M by June 21.

Utilization on key collateral markets like weETH and cbBTC is consistently over 90%, showing high capital efficiency without liquidity risk.

The vault is also protected by @gauntlet_xyz 's simulation engine, which stress tests loan health under thousands of volatility and correlation scenarios. Collateral is never unmanaged, and risk parameters are tuned daily.

This adds resilience to the strategy.

There’s no complex yield flow to follow. No need to worry about protocol hopping, impermanent loss, or depegs.

Users simply deposit WETH and earn yield from a diversified, overcollateralized, high liquidity lending market, auto-optimized by Morpho and Gauntlet.

What makes this vault special isn’t the raw APY, it’s the structure behind it. A vault like this is a cornerstone for sustainable passive yield in the Ethereum ecosystem.

Smart money isn’t always chasing the highest number. It’s chasing what lasts.

Explore the vault on @MorphoLabs

View allocations, metrics, and APY history on @gauntlet_xyz and discover other vaults

2,284

22

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。