. ݁₊ ⊹ . ݁˖ . ݁VAULT OF THE DAY. ݁₊ ⊹ . ݁˖ . ݁

Why are whales quietly parking tens of millions in vaults with 2% APY?

Today's @gauntlet_xyz vault of the day might look basic on the surface. However, it's one of the most powerful yield tools for passive capital in the market right now, powered with @MorphoLabs to endure and grow through various market conditions.

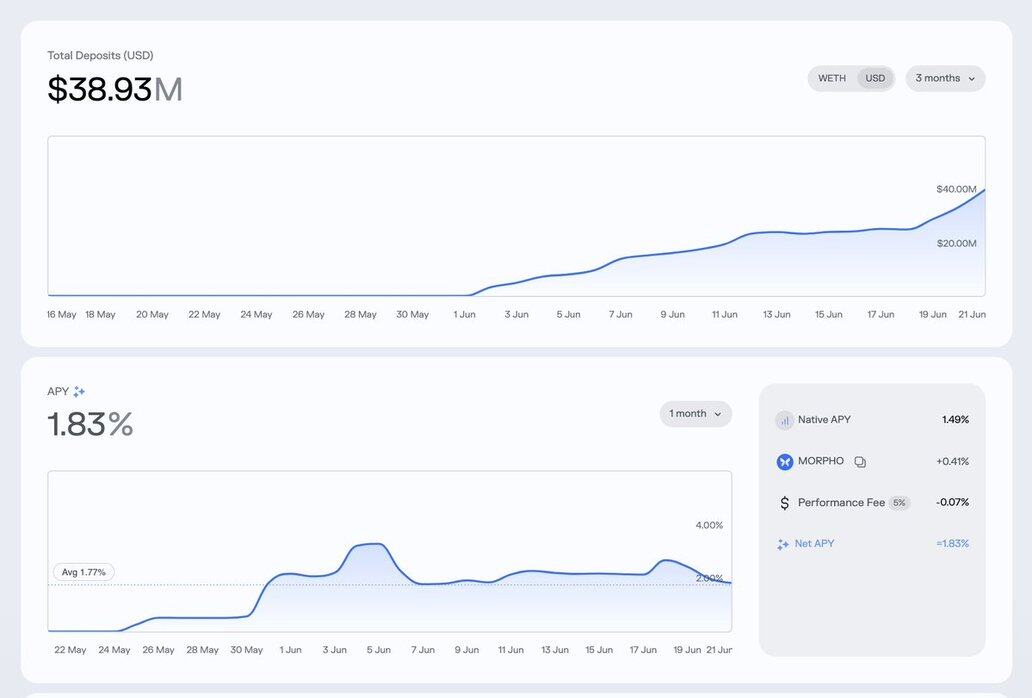

This is Vault Bridge WETH, launched in May 2025 by Gauntlet and live on Morpho. It currently holds over $38.9M in deposits with $21M in active liquidity.

It doesn’t rely on risky directional strategies or degen yield hopping. Instead, it aims to optimize risk-adjusted yield across large market cap and high liquidity collateral markets.

The strategy is simple, reliable, and capital-efficient.

Users deposit WETH, which is lent out to borrowers using ETH LSTs (like wstETH and weETH) or assets like cbBTC as collateral. Yields are generated from interest paid by borrowers and rebalanced automatically based on risk.

Here's what matters:

→ Net APY is currently 1.83%

→ Zero idle capital

→ Top LTVs: wstETH 96.5%, weETH 94.5%

→ Major allocation to staked ETH collateral (94%+)

→ Full integration with Gauntlet risk simulations +

@MorphoLabs optimizer

This makes it ideal for users who want predictable, passive ETH denominated yield.

Vault supply has been climbing steadily since launch. From $0 on May 23 to $38.9M by June 21.

Utilization on key collateral markets like weETH and cbBTC is consistently over 90%, showing high capital efficiency without liquidity risk.

The vault is also protected by @gauntlet_xyz 's simulation engine, which stress tests loan health under thousands of volatility and correlation scenarios. Collateral is never unmanaged, and risk parameters are tuned daily.

This adds resilience to the strategy.

There’s no complex yield flow to follow. No need to worry about protocol hopping, impermanent loss, or depegs.

Users simply deposit WETH and earn yield from a diversified, overcollateralized, high liquidity lending market, auto-optimized by Morpho and Gauntlet.

What makes this vault special isn’t the raw APY, it’s the structure behind it. A vault like this is a cornerstone for sustainable passive yield in the Ethereum ecosystem.

Smart money isn’t always chasing the highest number. It’s chasing what lasts.

Explore the vault on @MorphoLabs

View allocations, metrics, and APY history on @gauntlet_xyz and discover other vaults

2,28 тыс.

22

Содержание этой страницы предоставляется третьими сторонами. OKX не является автором цитируемых статей и не имеет на них авторских прав, если не указано иное. Материалы предоставляются исключительно в информационных целях и не отражают мнения OKX. Материалы не являются инвестиционным советом и призывом к покупке или продаже цифровых активов. Раздел использует ИИ для создания обзоров и кратких содержаний предоставленных материалов. Обратите внимание, что информация, сгенерированная ИИ, может быть неточной и непоследовательной. Для получения полной информации изучите соответствующую оригинальную статью. OKX не несет ответственности за материалы, содержащиеся на сторонних сайтах. Цифровые активы, в том числе стейблкоины и NFT, подвержены высокому риску, а их стоимость может сильно колебаться. Перед торговлей и покупкой цифровых активов оцените ваше финансовое состояние и принимайте только взвешенные решения.