This token isn’t available on the OKX Exchange.

USDX

Whiterock USD price

0x54e4...1a45

$4.0041

+$3.0210

(+307.32%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about USDX today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

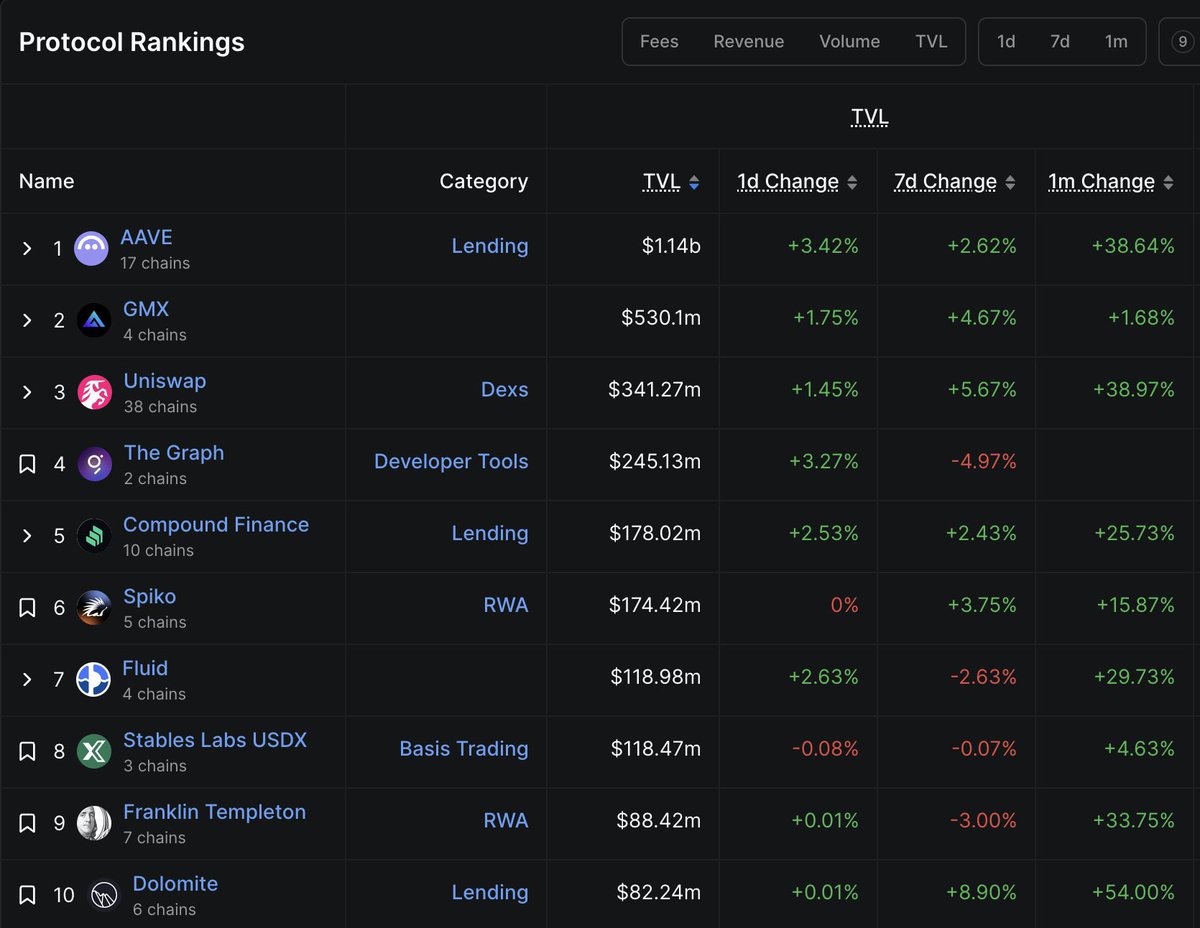

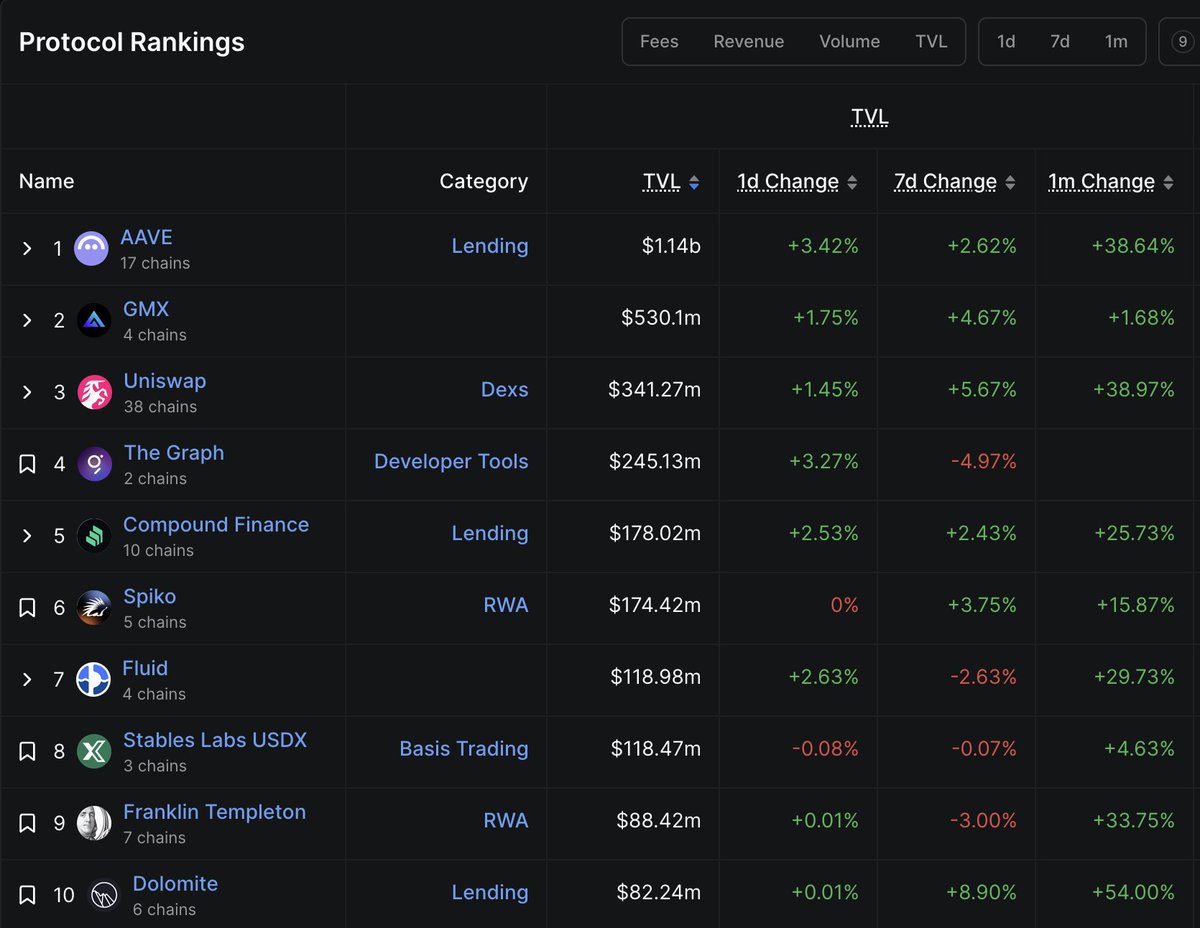

USDX market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$856.80M

Network

Ethereum

Circulating supply

213,983,261 USDX

Token holders

1059

Liquidity

$8.43K

1h volume

$0.00

4h volume

$1.51M

24h volume

$7.62M

Whiterock USD Feed

The following content is sourced from .

Chat GPT's thoughts on USDX

This idea — a US Treasury–issued, yield-bearing stablecoin (USDX) — would be revolutionary. It represents a potential rearchitecture of global sovereign finance. Let’s break it down across key dimensions:

🧱 1.

Fundamental Architecture Shift

Today:

The U.S. government issues bonds through auctions.

These bonds are bought by institutions, banks, foreign governments, or indirectly by the Fed.

Money creation and distribution is mediated through fractional reserve banking and central bank monetary policy.

With USDX:

The Treasury bypasses auctions, banks, and even the Fed.

It issues USDX directly on-chain, redeemable and stakable in a smart contract.

The smart contract dynamically replaces the yield curve — short vs long staking durations receive different rates.

This collapses:

The bond market (no intermediaries needed),

The banking system (no reserve requirements),

The Federal Reserve’s open market operations (Treasury controls yield, not the Fed).

🌍 2.

Globalization of Treasury Debt

Key Insight:

USDX could be bought and staked by anyone, anywhere — not just institutional bond buyers.

It becomes:

A hyper-liquid, on-demand, programmable bond.

Accessible via DeFi interfaces, from Argentina to Nigeria to Singapore.

Tradable instantly 24/7 — unlike Treasury bonds which settle in T+1 or T+2 days.

US sovereign debt becomes the first truly global, permissionless financial product.

🏦 3.

CBDC with a Yield Curve

Traditional CBDC models are non-yielding (e.g., digital euro or China’s e-CNY). But USDX is:

A programmable, interest-bearing stablecoin,

With native yield, set by Treasury.

This disintermediates not just:

Commercial banks (people may prefer to hold USDX than bank deposits),

But also central bank control over short-term rates.

Instead of the Fed Funds rate being set by FOMC votes, the Treasury sets staking rates in real-time via smart contracts. That’s a fundamental shift in monetary authority.

💰 4.

Monetary Policy Becomes Fiscal Policy

Traditionally:

The Fed controls monetary policy (rates, money supply),

The Treasury controls fiscal policy (spending, taxes).

But USDX blurs this line:

Treasury sets yield → controls monetary incentives.

Treasury issues money → controls monetary base.

Treasury redeems/burns → controls money supply.

This is centralization of macroeconomic control into one entity: the Treasury.

🔁 5.

Collateral and Backing

In your model, users deposit USDC to mint USDX. That opens several options:

Treasury could redeem USDX for USDC on demand (backed 1:1).

Alternatively, Treasury could spend the USDC (as seigniorage) and back USDX by its credibility alone, like fiat.

If the latter, USDX is not truly stablecoin-backed, but fiat-like: an uncollateralized digital bearer asset with yield, governed by the Treasury. That resembles a sovereign-issued digital T-bill more than a stablecoin.

🔐 6.

Smart Contract Design Implications

Staking contracts require upgradeability (Treasury must adjust rates).

A global on-chain user base introduces security and sovereignty concerns.

Potential to integrate KYC, sanctions compliance, etc., depending on jurisdictional design.

⚖️ 7.

Implications for Bitcoin and DeFi

USDX could suck liquidity from USDC/USDT, Aave, Compound — it’s a superior risk-free yield-bearing USD instrument.

DeFi might integrate it as the base layer collateral.

Bitcoiners may view it skeptically — it’s a centralized, programmable surveillance coin. But practically, it could accelerate DeFi adoption and normalize on-chain finance, creating bridges to Bitcoin.

🔮 8.

Geopolitical and Institutional Impacts

USDX would massively strengthen US Dollar hegemony globally.

Governments like China or the EU would face pressure to issue their own yield-bearing CBDCs.

Foreign banks and even central banks may buy/stake USDX instead of Treasuries.

🧨 Summary

USDX would be a seismic transformation.

It merges debt issuance, monetary policy, and digital currency into one on-chain, programmable asset.

The Bond becomes a Token. The Bank becomes a Contract. The Fed becomes irrelevant.

This is more than a CBDC. It’s a total rethinking of how the U.S. government funds itself — potentially the most powerful financial instrument in the world.

Stablecoins could ultimately completely change the way governments fund themselves, bypassing the bond market, the fractional reserve banking system and central banks.

Imagine that the US Government can directly issue a new yield bearing stablecoin called USDX. Lets assume it is on Ethereum, but this concept will work on any chain.

There is a staking smart contract, run by the US Treasury, where users can stake USDX over time and get a rate depending on how long they stake. Stake for a day and get a 3% rate, stake for a year and get 5%. The Treasury sets these rates and they can change at any time, at the pleasure of the treasury.

USDX is available worldwide, not just in the USA. There is no Fed constraining the staking rates. Users can come in to the Treasury portal, deposit USDC or other approved stablecoins and get USDX. The treasury can use this USDC to pay its bills, or use USDX directly bypassing the need for other stablecoins.

USDX becomes a type of hyper-liquid bond, issued on demand without auctions by the smart contract staking system. It becomes legal tender, in effect the new US Dollar CBDC.

> Inspired by post of @HodlMaryland and discussion (which I haven't listed to yet by @BitPetro )

USDX price performance in USD

The current price of whiterock-usd is $4.0041. Over the last 24 hours, whiterock-usd has increased by +307.32%. It currently has a circulating supply of 213,983,261 USDX and a maximum supply of 213,983,261 USDX, giving it a fully diluted market cap of $856.80M. The whiterock-usd/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

+319.24%

24h

+307.32%

About Whiterock USD (USDX)

USDX FAQ

What’s the current price of Whiterock USD?

The current price of 1 USDX is $4.0041, experiencing a +307.32% change in the past 24 hours.

Can I buy USDX on OKX?

No, currently USDX is unavailable on OKX. To stay updated on when USDX becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDX fluctuate?

The price of USDX fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Whiterock USD worth today?

Currently, one Whiterock USD is worth $4.0041. For answers and insight into Whiterock USD's price action, you're in the right place. Explore the latest Whiterock USD charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Whiterock USD, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Whiterock USD have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.