This token isn’t available on the OKX Exchange.

USDtb

USDtb price

0xc139...ac1c

$1.0000

+$0.00029992

(+0.03%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about USDtb today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

USDtb market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$1.46B

Network

Ethereum

Circulating supply

1,459,699,769 USDtb

Token holders

322

Liquidity

$20.04M

1h volume

$40.17K

4h volume

$52.68K

24h volume

$3.78M

USDtb Feed

The following content is sourced from .

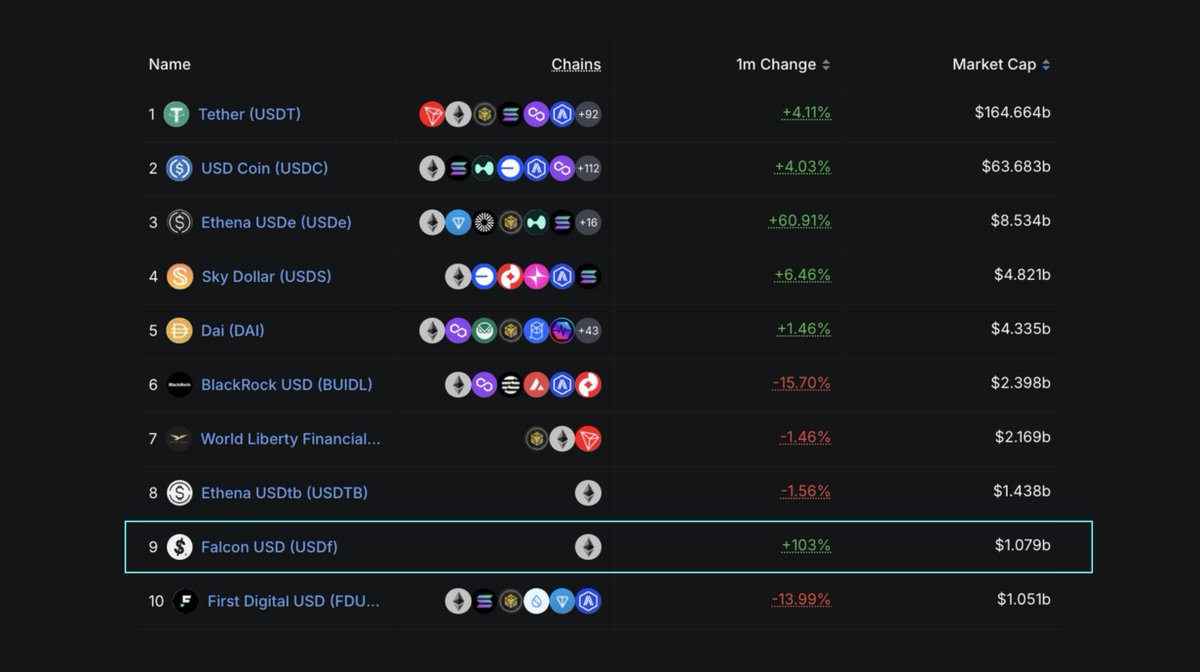

Stablecoin Market Cap Soars 4.87% to $261B Following 22-Month Growth Streak

The stablecoin sector achieved another milestone in July, with total market capitalization reaching a new all-time high of $261B, representing a 4.87% monthly increase.

This achievement extends an unprecedented twenty-two consecutive months of growth for the stablecoin market.

According to the latest Stablecoins & CBDCs Report from CoinDesk, stablecoin pair trading volume on centralized exchanges reached $1.60T in July, coinciding with a broader digital asset rally driven by surging corporate adoption.

Source: Coindesk Research

The report reveals that Tether (USDT) maintains its sector leadership position, with market capitalization climbing 3.61% to $164B in July, marking its twenty-third consecutive monthly expansion.

Despite this growth, USDT’s market dominance experienced a slight contraction in July, declining from 62.5% to 61.8%.

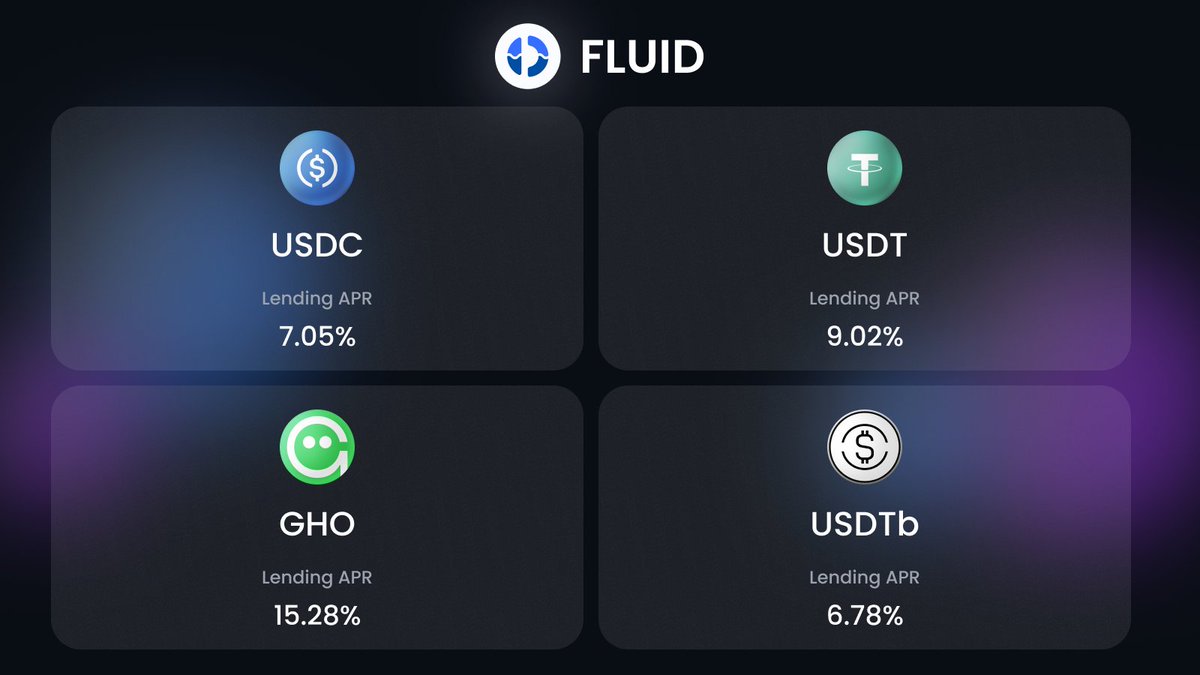

Meanwhile, USD Coin (USDC) showed strong performance with a 3.78% increase to $63.6B, while Ethena USDe posted remarkable growth of 43.5% to reach $7.60B in market capitalization.

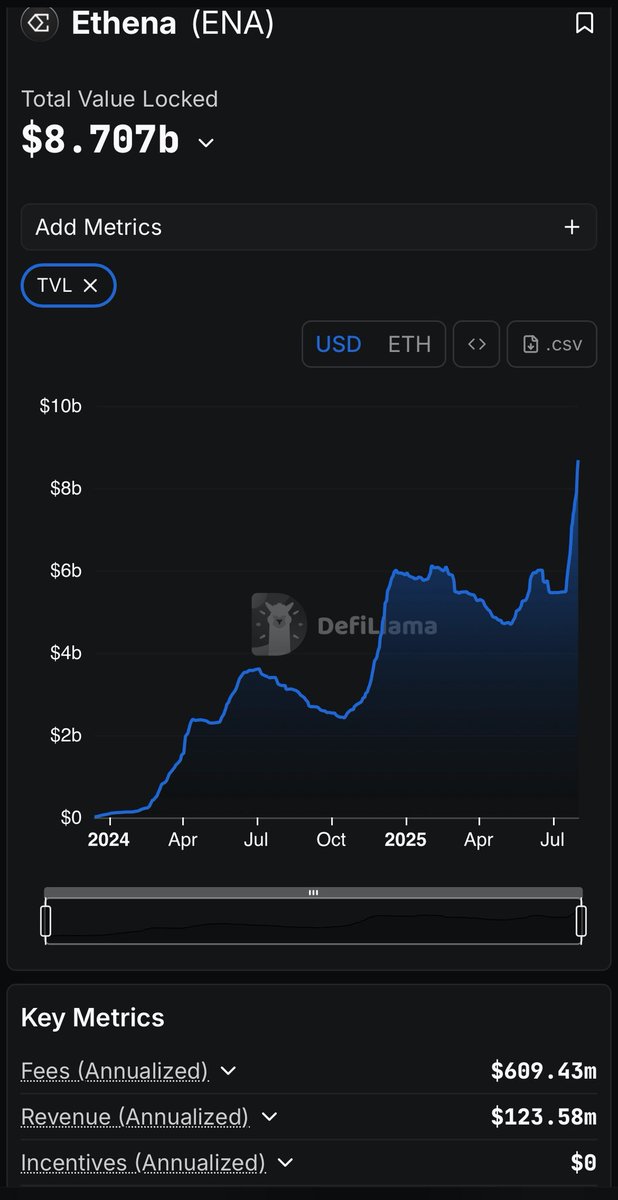

Ethena is experiencing the fastest growth in Q3 2025

It's up $4.02 billion this quarter, and we still have 60 days left in this quarter.

Compared to other stablecoins like USDT, USDC, and USDS, Ethena has low transfer volume compared to its market cap. The transfer… pic.twitter.com/RYb2UI7ebP— Heechang (@xparadigms) August 4, 2025

Ethena USDe’s expansion proves particularly noteworthy, occurring despite a significant decrease in staked USDe APY from over 20% to 9.79%.

A surprising finding from the report shows Falcon Finance’s USDf, which recorded the highest market capitalization increase among the top 10 stablecoins, surging 121% to $1.07B.

Conversely, BlackRock’s BUIDL and First Digital Labs’ FDUSD experienced the steepest declines, falling 15.9% and 8.54% to $2.40B and $8.54B, respectively.

Source: Coindesk Research

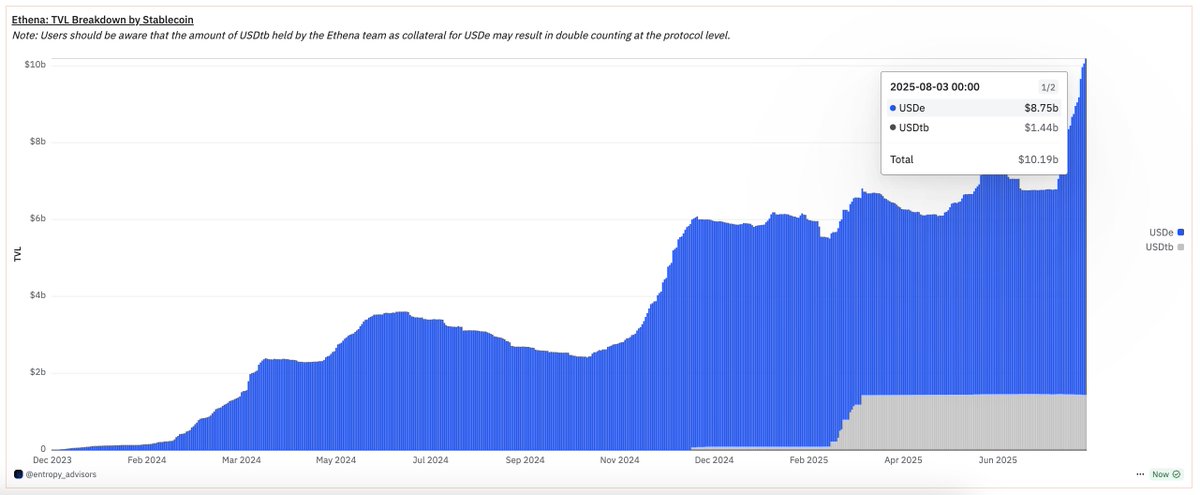

The report ranks the top 10 stablecoins by market capitalization as follows: Tether (USDT), USD Coin (USDC), Ethena USDe, Sky Dollar, Dai, BlackRock USD (BUIDL), World Liberty Financial USD (USDD), Ethena USDtb, First Digital USD, and Falcon USD.

Tron Network Captures 50% of Total USDT Supply As GENIUS Act Establishes Federal Stablecoin Framework

The stablecoin ecosystem on the Tron network reached a new all-time high in July, climbing to $81.9B.

For the first time since August 2024, Tron now commands over 50% of the total USDT supply across all blockchain networks.

USDT Has a New Home: It’s TRON.

1H 2025 Recap: Stablecoin Capital Has Moved

➾ USDT on TRON: $80.8B (ATH)

➾ Ethereum: $73.8B

➾ +$21B growth in 2025 | +35% YTD

TRON now settles more USDT than Ethereum — it’s not catching up, it’s leading.

Why it matters: TRON is the new… pic.twitter.com/VIYgga4Ome— Dark cookies (@ayo30bg) August 2, 2025

The stablecoin sector’s consistent growth coincides with enhanced regulatory clarity. Most significantly, the GENIUS Act became law when President Trump signed the legislation on July 18.

This groundbreaking framework establishes the first federal regulations for “payment stablecoins,” mandating full 1:1 backing by cash or liquid U.S. Treasuries, while enforcing monthly reserve disclosures and auditing requirements.

These developments have accelerated adoption within the stablecoin sector as builders, users, and stakeholders gain increased confidence in its utility and efficiency.

For example, in July, the combined market capitalization of non-USD stablecoins, including euro and ruble-backed tokens, exceeded $1 billion for the first time.

Source: Coindesk Research

These trends have encouraged countries and traditional financial institutions to soften their stances toward crypto stablecoin adoption.

On August 1, Hong Kong’s licensing regime announced plans to permit HKD- and CNY-pegged stablecoins to compete in Asian settlement markets currently dominated by USD.

Just Yesterday, payment processor Remitly disclosed intentions to integrate stablecoin functionality into its global payment network.

Industry Split on Stablecoin Market Growth Projections: $2T vs $500B

The stablecoin wave of adoption and innovation has prompted industry leaders like Ripple CEO Brad Garlinghouse to project explosive sector growth, suggesting the market could expand from its current $261 billion valuation to as much as $2 trillion in the near future.

Speaking on CNBC’s “Squawk Box” in July, Garlinghouse characterized the potential expansion as “profound,” citing institutional momentum and evolving regulatory frameworks as primary catalysts.

Stablecoins To $2 trillion!

Treasury Secretary Scott Bessent said that dollar linked stablecoins could hit $2trn and could help cement dollar dominance. pic.twitter.com/U30W4VuUP4— Coin Bureau (@coinbureau) June 12, 2025

However, JPMorgan has expressed skepticism regarding bullish stablecoin projections, forecasting more modest growth to $500B by 2028 and cautioning that trillion-dollar estimates are “far too optimistic.”

The banking giant cited limited mainstream adoption and restricted use cases beyond cryptocurrency trading as significant barriers to explosive growth.

Over the past month @ethena_labs has been crushing it🔥

> $USDe supply has surged 75% to $9.3B

> $3.1B+ in the last 20 days

> The fastest growing YBS based on TVL (3rd largest stablecoin by mcap)

> DeFi's 6th largest protocol by TVL

> Utilization of @BlackRock BUIDL fund based RWA via $USDtb

> Working with the institution level through @convergeonchain

$106.59M (2.7% of CS) of $ENA is getting unlocked tomorrow.

Một trong số những lý do mình chọn $ENA làm token để #DCA dần trong tháng 8 này:

👉 Phân tích cơ bản mạnh + technical setup với base tích cực, volume tăng mạnh

Risk Reward hấp dẫn: 150-100%

👍 Chỉ trong tháng 7 TVL của dự án tăng trưởng vượt trội >40% với #ATH là 7.9B đô.

👍 Khi $ETH và $BTC confirm vào sóng tăng trưởng mới, Ethena là dự án được hưởng lợi nhờ nhu cầu sử dụng stable coin cao, funding rate dương

Thị trường lên thì nhu cầu đòn bẩy sẽ cao, Ethena sẽ được lợi từ việc hưởng funding rate dương.(Hiểu nôm na là khi bạn chơi future, bên mua chiếm ưu thế sẽ phải trả phí cho bên bán. Mà Ethena thì luôn mở vị thế short, theo cơ chế Delta-hedge. Hiểu nôm na là khi $ETH và $BTC được thế chấp để mint USDE, vì lo sợ rủi ro $ETH và $BTC sập mạnh, nên dự án mở vị thế short $ETH và $BTC trên các sàn giao dịch để cân bằng lời/lỗ, tránh bị mất thanh khoản như LUNA vừa rồi).

👍 Ngoài ra, dự án còn có USDtb là stable coin mới, "truyền thống" hơn USDE, được mở rộng và hợp tác với quỹ BUILD của BlackRock (được bảo chứng bởi tài sản thực RWA do BlackRock quản lý).

Ethena cũng phát hành 1.5 tỷ USDtb, cũng mở đường cho việc tuân thủ luật GENIUS Act, trở thành stable coin đầu tiên tuân thủ luật liên bang.

=> một cách "lách luật"?

Ptkt hấp dẫn với volume + CVD tăng mạnh, mình sẽ lựa thời điểm giá giảm để #DCA dần trong tháng 8, target 100-150%

p/s: bài viết ko phải shill, hay lời khuyên đầu tư. Tất nhiên vẫn có những rủi ro như chiến tranh, BTC, ETH sụp thì $ENA cũng ko tránh khỏi

Ngoài ra mình cũng biết sẽ có các rủi ro như:

👉 Lực bán mạnh từ việc unlock hàng tuần (tuy đã có buy back từ team)

👉 Token có sự tập trung trong tay whale

Fed ko giảm ls trong tháng 9 (bị om vốn/lỗ tạm thời,…)

Tuy nhiên mình vẫn chọn bag ENA, risk reward là xứng đáng, và mình vẫn còn port hold chính $eth hỗ trợ.

USDtb price performance in USD

The current price of usdtb is $1.0000. Over the last 24 hours, usdtb has increased by +0.03%. It currently has a circulating supply of 1,459,699,769 USDtb and a maximum supply of 1,459,699,769 USDtb, giving it a fully diluted market cap of $1.46B. The usdtb/USD price is updated in real-time.

5m

+0.00%

1h

+0.02%

4h

+0.01%

24h

+0.03%

About USDtb (USDtb)

Latest news about USDtb (USDtb)

Ethena Taps Anchorage to Issue $1.5B USDtb Stablecoin Under GENIUS Act

Ethena's token ENA was up 10%, outperforming the broader crypto market that saw many altcoins plunging overnight.

Jul 24, 2025|CoinDesk

Anchorage Digital and Ethena Labs team up to launch first GENIUS-compliant stablecoin in the US

Anchorage Digital and Ethena Labs have teamed up to launch USDtb, which the companies tout...

Jul 24, 2025|Crypto Briefing

Learn more about USDtb (USDtb)

Ethena's Synthetic Stablecoin Revolution: How USDe and USDtb Are Reshaping Crypto Finance

Introduction to Ethena's Synthetic Stablecoin Protocol Ethena, a synthetic stablecoin protocol launched in 2024, has rapidly positioned itself as a transformative force in the cryptocurrency ecosystem

Jul 29, 2025|OKX

Ethena and Anchorage Digital Partner to Launch GENIUS Act-Compliant Stablecoin USDtb

Ethena's Partnership with Anchorage Digital: A Game-Changer for Stablecoins Ethena, a pioneering stablecoin-focused cryptocurrency project, has announced a groundbreaking partnership with Anchorage Di

Jul 28, 2025|OKX

Ethena Labs Faces Regulatory Hurdles: MiCA Compliance, ENA Token Buyback, and USDtb Launch

Ethena Fund Repurchase: Strategic Moves Amid Regulatory Challenges Ethena Labs Faces Regulatory Hurdles Under MiCA Oversight Ethena Labs, a leading innovator in the stablecoin and decentralized financ

Jul 28, 2025|OKX

USDtb: The First GENIUS Act-Compliant Stablecoin Reshaping DeFi and Global Markets

Introduction: USDtb and the GENIUS Act Revolutionizing Stablecoins The stablecoin market is undergoing a transformative shift with the introduction of USDtb, the first stablecoin fully compliant with

Jul 25, 2025|OKX

USDtb FAQ

What’s the current price of USDtb?

The current price of 1 USDtb is $1.0000, experiencing a +0.03% change in the past 24 hours.

Can I buy USDtb on OKX?

No, currently USDtb is unavailable on OKX. To stay updated on when USDtb becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDtb fluctuate?

The price of USDtb fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 USDtb worth today?

Currently, one USDtb is worth $1.0000. For answers and insight into USDtb's price action, you're in the right place. Explore the latest USDtb charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as USDtb, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as USDtb have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Socials