This token isn’t available on the OKX Exchange.

USDC

Up Side Down Coin price

F4M4Px...2ffC

€0.0012086

+€0.00097437

(+416.07%)

Price change for the last 24 hours

EUR

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about USDC today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

USDC market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

€1.21M

Network

Solana

Circulating supply

999,998,754 USDC

Token holders

107

Liquidity

€55.18K

1h volume

€1.81M

4h volume

€1.81M

24h volume

€1.81M

Up Side Down Coin Feed

The following content is sourced from .

Just remember this isn't Circle's fault. Corporate blockchains didn't happen overnight.

It was the slow creep:

- delegating the job of running a node to a handful of corporations

- accepting fiat backed stablecoins as the default

- using Stage 0 rollups as if they were ready

- having a 4/9 multi-sig as the biggest oracle in the space

- watching as all of the builders, relayers, and validators centralize due to economies of scale

The solution isn't getting Circle to run on Ethereum, it's fixing our issues and building a system that doesn't want anything to do with tradfi

Circle

Introducing Arc, the home for stablecoin finance.

@Arc is an open Layer-1 blockchain purpose-built to drive the next chapter of financial innovation powered by stablecoins.

Designed to provide an enterprise-grade foundation for payments, FX, and capital markets, Arc delivers the performance, reliability, and liquidity builders need to meet global financial demands.

Arc features:

✅ USDC as native gas

✅ Built-in FX engine

✅ Deterministic sub-second finality

✅ Opt-in privacy

✅ Full Circle platform integration

Open, composable, and EVM-compatible, Arc is designed to interoperate seamlessly with the broader multichain ecosystem.

As part of our mission to advance blockchain infrastructure, we're excited to welcome the Malachite team and IP from @informalinc to Circle. Arc is built on Malachite’s high-performance consensus engine.

In line with our commitment to open-source development, the core software for Arc will be released under a permissive license, enabling the broader developer community to contribute, extend, and build on top.

Serving as foundational infrastructure for the internet, Arc will enable 24/7 global settlement that’s as seamless and native as messaging on the web.

Arc will enter private testnet in the coming weeks, with public testnet expected this fall.

Read the litepaper:

Let’s build the new internet financial system together:

How to Bid the Spot Ticker and Deploy Spot on HyperCore

Here we just help a project to get the ticker on hypercore ,and I found that there is still some part which is not quite clear on existing doc . But thanks for the dedicated core team member of HL @xulian_hl

and experienced ticker bidder @NMTD8

to answer lots of my questions .

Out of appreciation and also considering that there is not so many person can get 2k testnet Hype ,I believe that shared my experience would be helpful for anyone who want to get the ticker on hypercore and deploy the spot.

Ticker auction page on mainnet and testnet

Mainnet:

Testnet:

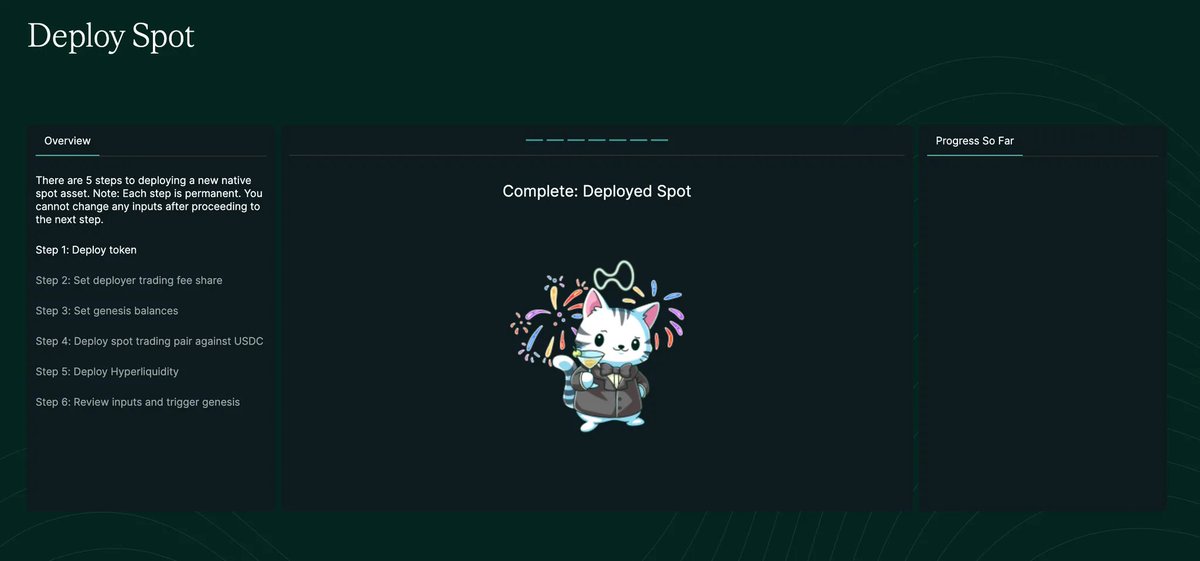

First of all ,there are 6 steps from ticker bidding to hyperliquid deployment on hypercore for spot order book

Step1 , Name & Decimals:

1. Name (6 chars max) & Full Name (Optional): it can be any name as long as the ticker has not been taken on hypercore .

2. Size Decimals: The size here is trading size on hypercore order book to control minimum trade increments.

For example, if your “size decimal” setting is 0.1, you cannot place an order for 1.02 tokens—it must adhere to the chosen size granularity.

3 . Wei Decimals: it defines the smallest indivisible unit of your token (like “wei” for ETH). This ensures granular control over how tokens are counted and transferred.

Note according to hyperliquid spot bid side ,the wei decimals should be between 0 ~8

Important note : Once you click the "Deploy Token" then it means that you gonna to pay the $HYPE token as gas for ticker auction . When it shows "Registered token" in the corner of your page ,it means that you are successfully to get the ticker.

Once you get the ticker ,and then you need to set further parameters such as fee sharing ,genesis balance ,trading pair deployment and hyperliquidity .But you can deploy it anytime as long as you complete the step1 and win the gas auction.

Here I recommend you to bid the ticker first and then go to @HyperliquidX 's discord to get the ticket for requesting the testnet Hype with your txn of gas auction.And then you can get enough Testnet HYPE token to test the deployment on testnet .

Step2 , Setting the deployer trading fee share

it is a simple step just to type into the number as percentage of the trading fee you (deployer) would like to share .

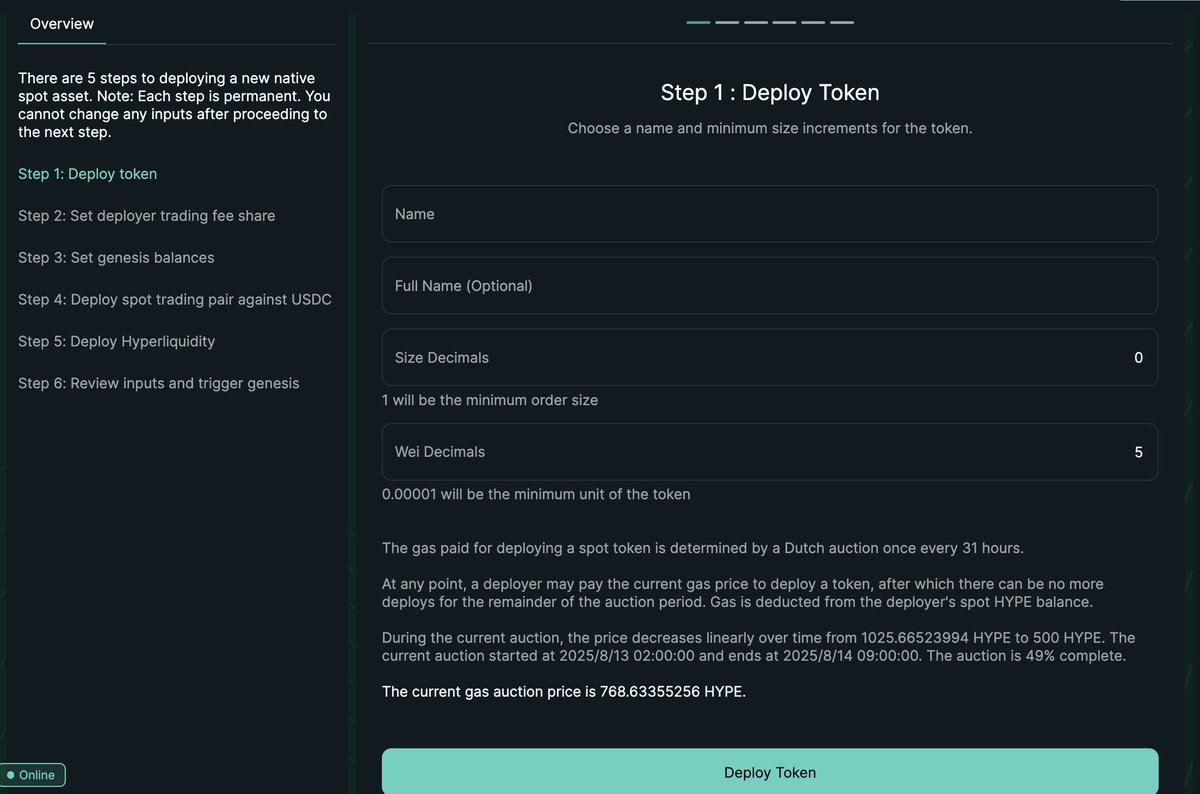

Step3, Get Genesis Balances

To note ,the HIP1 token on hypercore is the token with the fixed hard-capped amount which can't not be updated after the genesis balances setting.

So if your token has already been deployed on the other chain , I will recommend to use the largest amt of your token's tts to ensure that all the token on hypercore is enough to do bridge implementation .

usdt0 is a good case study :

Step3-1 : choose the user or existing token you can choose to type the user's address or id of existing token on hypercore

- User : input the user’s address

- Existing token : put the id of the existing token on hip1.

Step3-2 : enter the amount the user can get

Step3-3 : Register User Genesis

once you click the rester user genesis it means that you have already completed the setting to distribute the genesis token to that user .

And then you can keep adding user genesis for multiple times until you complete all the users/existing token's holder's genesis distribution .

If all the distribution is done then we can click the "Complete User Genesis".

Step 4: Deploy spot trading pair against USDC

here they only have a click to let you " deploy spot ",click it and go to the next step .

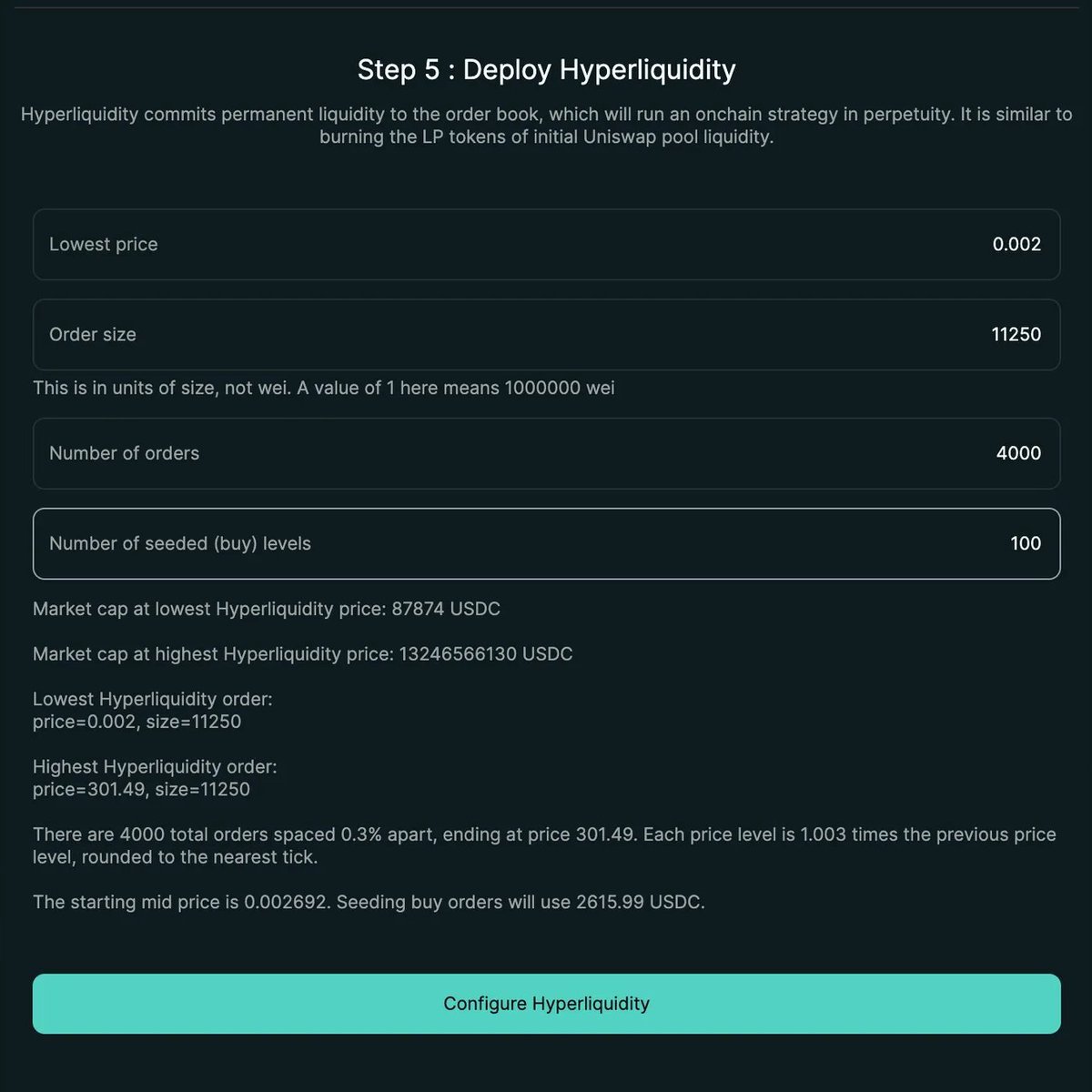

Step 5: Deploy Hyperliquidity

For this step ,the main propose is deploying the hyperliqidity according to HIP2

to note : the liquidity on hypercore order must be more than 1% of tts.

Here we have 4 parameters to fill in this step

1. Lowest price

- It is the lowest price on hypercore orderbook you would like to set at the genesis hyperliquidity

2. Order Size

- Order size here is the unit of each trading size. For example if ordersize is 10000 it means that each trading size is 10000 tokens .

3. Number of order

total order from maker and taker initially

4. Number of seeded buy levels

Number of seeded buy levels is for initial maker order book setting (here it also charged the payment of usdc ). For example ,if we set 100 levels there would be ,then there will be 100 order book on buy side .And such USDC is the liquidity which you require to pay here .

Can check my math in the google sheet :

And also recommend to read the well explaining of hyperliquid wiki .

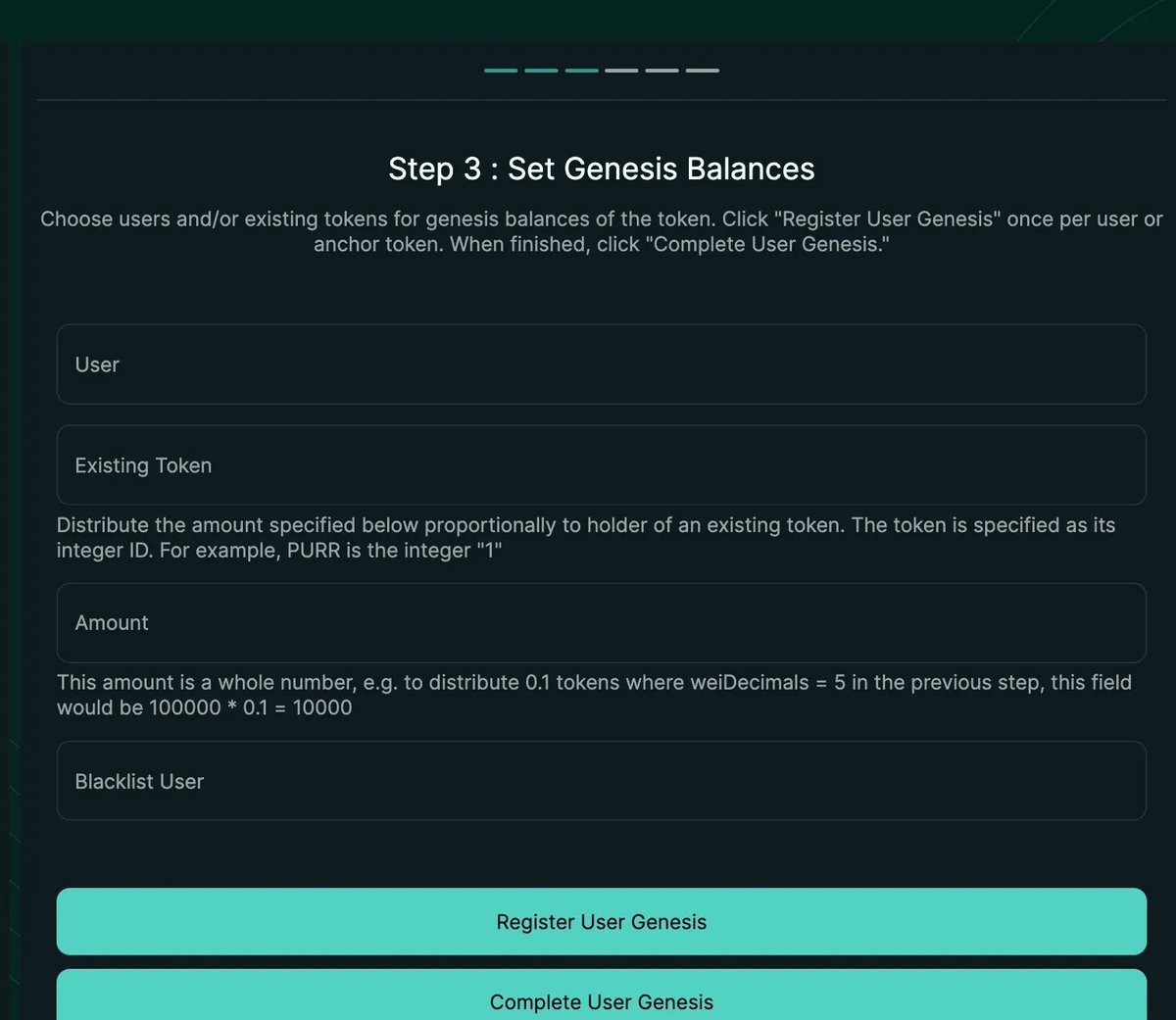

Once you complete the hyperliquidity configure, then the interface would ask you to review inputs and trigger genesis. When you finish it, you can see a Purr finally and show the "Complete" for your spot deploy !

Final note : As far as I know that both @LayerZero_Core

and CCIP powered by @chainlink support the token bridge between HyperEVM and HyperCore . P

ls do check and follow the instruction of those crosschain solution . For example ,Layerzero ask to use their sdk for the step2 ~ step 6 instead of hyperliquid spot deploy interface .

LZ's doc

Recommended reading :

Finally ,when I am writing my post ,I also found a tutorial from @monprotocol.

What an amazing piece !

📖 Some light $PEAS reading material for daytime and nighttime enjoyment:

- Peapods Leveraged LPing (aka Leveraged Volatility Farming) and why it's superior:

- Lending on Peapods: Best real yields in DeFi on $USDC, $ETH, $OHM and other tokens:

- Overborrowing: How to utilize Peapods for custom leverage strategies:

- Revenue efficiency: Peapods achieves more bang per buck vs. other DeFi protocols (and $PEAS / $vlPEAS holders directly profit from this)

- Case studies: Some IRL of Leveraged Volatility Farmers stats to prove our points:

Or start earning already here 👇

USDC price performance in EUR

The current price of up-side-down-coin is €0.0012086. Over the last 24 hours, up-side-down-coin has increased by +416.07%. It currently has a circulating supply of 999,998,754 USDC and a maximum supply of 999,998,754 USDC, giving it a fully diluted market cap of €1.21M. The up-side-down-coin/EUR price is updated in real-time.

5m

-13.11%

1h

+416.07%

4h

+416.07%

24h

+416.07%

About Up Side Down Coin (USDC)

USDC FAQ

What’s the current price of Up Side Down Coin?

The current price of 1 USDC is €0.0012086, experiencing a +416.07% change in the past 24 hours.

Can I buy USDC on OKX?

No, currently USDC is unavailable on OKX. To stay updated on when USDC becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDC fluctuate?

The price of USDC fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Up Side Down Coin worth today?

Currently, one Up Side Down Coin is worth €0.0012086. For answers and insight into Up Side Down Coin's price action, you're in the right place. Explore the latest Up Side Down Coin charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Up Side Down Coin, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Up Side Down Coin have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.