This token isn’t available on the OKX Exchange.

USDT

Tether USD from Ethereum price

0x0cb6...1a2f

$0.99638

+$0.023922

(+2.46%)

Price change for the last 24 hours

How are you feeling about USDT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

USDT market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$8.48M

Network

PulseChain

Circulating supply

8,513,691 USDT

Token holders

0

Liquidity

$2.39M

1h volume

$10,491.64

4h volume

$56,628.85

24h volume

$944,508.10

Tether USD from Ethereum Feed

The following content is sourced from .

Adul✨ ℵ 🌪️🌴

@Official_Upbit At present, Upbit, the largest exchange in South Korea, has opened up support for users to deposit and withdraw USDT through the Aptos network.

Launch time: June 18, 2025

Congratulations~~ $APT

Aptos

🚨 @Official_Upbit Adds Support for USDT on Aptos

Upbit South Korea has officially added support for @Tether_to's USDT deposits & withdrawals via the Aptos network. Starting on June 18, 2025, 11:00 AM KST, users will be able to move USDT on-chain.

USDT Moves Better on Aptos 🌐

48

0

52Hz Database

Not loud, but the money flow is choosing #Ethereum

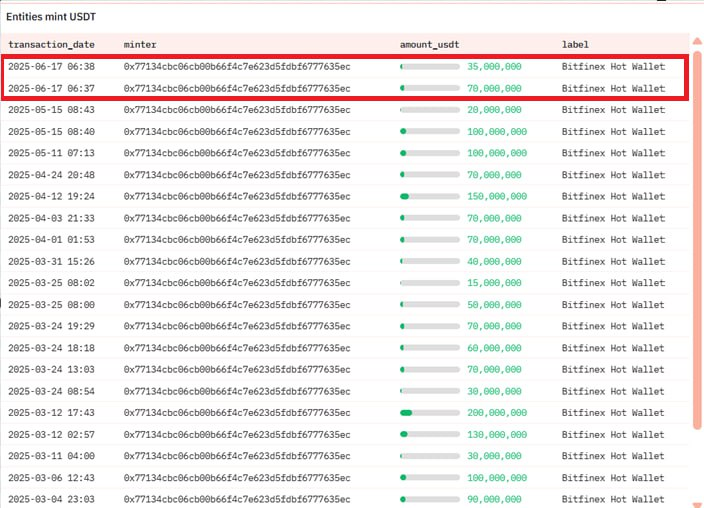

Yesterday, the Bitfinex wallet address minted 105M $USDT from #Tether – a notable figure at this time.

However, checking the source shows that Bitfinex is swapping $USDT from #Avalanche to #Ethereum, not minting directly on Ethereum.

Bitfinex does not frequently mint USDT, with the last time being on May 11 – also swapping from Avalanche to Ethereum.

The continuous transfer of USDT from Avalanche to Ethereum by Bitfinex during sensitive market times indicates that ETH remains a "safe haven" for institutional stablecoins, where they prioritize maintaining liquidity and executing large transactions.

The historical behavior of the Bitfinex wallet also records: each time USDT is brought back to ETH often coincides with major volatility phases, such as distribution or rebalancing of capital flows.

Although the chain swap action does not directly affect the price line, through this we can see that the money flow is being directed towards the $ETH system. This is positive information for the #Ethereum ecosystem.

Data:

Don't forget to join the 52Hz Database for discussion:

Show original

1.59K

0

比特金狗王 SO KING

Three adjustments have been made to the alpha operation details:

1. Replace the target with Ab every day

If you encounter the red line stage, don't brush it first, find a stable or upward stage and then brush it (green line), although Ab now has a daily trading volume of 430 million, but the risk of a crash cannot be ruled out, so you must buy and sell in seconds and do not expand risk exposure.

2. After swiping, you can exchange BNB to USDT

During the war phase, BNB has a certain downside risk, so you can buy it before each brush

3. It is recommended to put the brushing time around 9 or 10 o'clock in the morning

Every day after 8:00 is counted as today, if there are more people doing it at 2 pm, it may fail many times with 0.1 slippage. If it is too late, there will be a risk of fluctuations, so the best time is 8:30-12:00, of course, if the time is not enough to reach other times, I refer to the best time here.

I hope you know, if the subject matter will be notified separately

Show original

1.29K

1

DaDa | 蓝鸟会🕊️

[TRON's listing is not just a "micro-strategy" parody show, but a stablecoin version of the "Visa IPO" moment? 】

Recently, #TRON announced that it intends to establish Tron Inc for public listing through a reverse merger with NASDAQ-listed company #SRMEntertainment, which has sparked heated discussions in the market. While many have simply likened this move to a "crypto microstrategy", it would be a serious underestimation of TRON's significance in stablecoin payment networks.

This may not be a simple capital move, but a major outpouring of crypto infrastructure: TRON is poised to become the "Visa" of the stablecoin world – and in an investable form in traditional financial markets.

1. TRON: The most active underlying network for stablecoin trading in the world

At the on-chain transaction level, the TRON network carries more than 30% of the world's stablecoin trading volume, and USDT circulation is far ahead. A large number of cross-border payments, remittances, C2C OTC and grey foreign exchange transactions are increasingly concentrated on the TRON network.

According to CoinMetrics and CoinGecko data, the number of USDT daily active addresses, transactions, and amount on the TRON network are much higher than those of Ethereum and Solana. Especially in Latin America, the Middle East, Africa and other regions where traditional financial infrastructure is not perfect, TRON+USDT has become the "new dollar" for private payment and asset preservation.

As market analyst Sam Reynolds (@thesamreynolds) puts it:

"Tron + USDT is the same for South America and other emerging markets as Visa and Mastercard in the West, or Alipay and WeChat Pay in China."

2. It's not about issuing coins, it's about operating the network: TRON's structural advantages over Circle

At present, there are two core participants in the stablecoin market: one is the issuer (such as Circle's USDC) and the other is the operating network (such as TRON). The revenue paths of the two are completely different:

(1) Issuers such as Circle rely on asset custody interest margins, but are limited in terms of on-chain transaction frequency and infrastructure stickiness;

(2) TRON directly controls the public chain itself, can obtain transaction fees and ecological sticky income, and participates in resource regulation through the TRX/energy mechanism.

This difference determines that TRON is more like a "payment infrastructure provider" in the traditional sense than Circle.

3. Beyond listing: TRON's ecosystem is building a stable "on-chain country"

TRON's potential goes far beyond the payment network, behind which is a complete set of blockchain financial ecosystems that have been commercialised:

(1) JustLend and JustStable have built on-chain lending and stablecoin minting systems;

(2) SunSwap and PoloniDEX provide on-chain exchange and liquidity support;

(3) BitTorrent Chain (BTTC) enables cross-chain asset bridging;

(4) More importantly, TRON is one of the few networks that can support large-scale USDT transmission at a very low cost, forming a natural DePIN-level payment channel.

The common denominator of all of this is that $TRX ecology is deeply bound to it.

4. HTX: Undervalued "TRON Preferred Equity Holders"

The listing of #TRON may not only drive the attention of native assets such as $TRX, but also reshape the market positioning of #HTX exchanges:

(1) #HTX has long been one of the main fronts of the TRON Chain ecosystem, with USDT (TRC20) deposits/withdrawals accounting for 70%+ on HTX;

(2) Justin Sun's decision-making participation in HTX has enabled the exchange to naturally obtain the priority integration right of TRON-related innovations;

(3) With the compliance and brand upgrade of Tron Inc, HTX is expected to become the initial listing platform for "stablecoin asset trading" and "TRON infrastructure assets", reshaping the core value logic of the exchange.

Under the multiple regulatory crackdowns of Binance, Coinbase, and Kraken, HTX may be one of the few central platforms that truly embeds TRON, a "new stablecoin payment network", into the trading experience, with first-hand traffic and markets.

5. The listing of Tron Inc is the "Visa IPO" moment in the stablecoin world

Through SRM's reverse merger, Tron Inc may not only hold $TRX, but also control a payment chain with a real revenue model.

This model is the same as that of Visa and Mastercard: instead of issuing currency, it provides a clearing and settlement network, fee structure and compliance portal, which is more scalable and adaptable.

It can be said that this is not a "crypto microstrategy", but a "stablecoin version of Visa IPO".

Sixth, the ceiling of TRON is not only Web3, but also points to the rewriting of the global financial structure

TRON's move is not just a technical aversion to SEC risk, nor is it simply an imitation of MicroStrategy's "asset wrapping" approach. What it really stands for is:

(1) From on-chain transaction networks → cross-border payment infrastructure → global dollar alternative paths;

(2) Listing entities from TRON Network → Tron Inc → HTX trading and traffic hubs;

and (3) opening up asset pricing power from Web3 closed narrative → to global financial infrastructure.

In other words: if BTC is digital gold, then TRON is the digital dollar channel, and HTX is the first exchange to bet on this channel.

@justinsuntron @trondao @HTX_Global @HuobiGlobal @HTX_Molly @BitTorrent #TRON #TRONEcoStar #HTX #火币

Show original

10.87K

26

USDT price performance in USD

The current price of tether-usd-from-ethereum is $0.99638. Over the last 24 hours, tether-usd-from-ethereum has increased by +2.46%. It currently has a circulating supply of 8,513,691 USDT and a maximum supply of 8,513,691 USDT, giving it a fully diluted market cap of $8.48M. The tether-usd-from-ethereum/USD price is updated in real-time.

5m

-0.52%

1h

+0.68%

4h

-0.04%

24h

+2.46%

About Tether USD from Ethereum (USDT)

USDT FAQ

What’s the current price of Tether USD from Ethereum?

The current price of 1 USDT is $0.99638, experiencing a +2.46% change in the past 24 hours.

Can I buy USDT on OKX?

No, currently USDT is unavailable on OKX. To stay updated on when USDT becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDT fluctuate?

The price of USDT fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Tether USD from Ethereum worth today?

Currently, one Tether USD from Ethereum is worth $0.99638. For answers and insight into Tether USD from Ethereum's price action, you're in the right place. Explore the latest Tether USD from Ethereum charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Tether USD from Ethereum, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Tether USD from Ethereum have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.