This token isn’t available on the OKX Exchange.

AUSD

AUSD price

0x0000...012a

€0.86012

+€0.0073339

(+0.86%)

Price change for the last 24 hours

EUR

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about AUSD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

AUSD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

€33.90M

Network

Avalanche C

Circulating supply

39,415,005 AUSD

Token holders

Liquidity

€854.64K

1h volume

€7.85K

4h volume

€53.18K

24h volume

€2.13M

AUSD Feed

The following content is sourced from .

Officially about 80% allocated into positions.

Funny enough, for the first time ever, mostly in DeFi protocols/new projects.

Here's been my strat the last week for anyone who cares. I'm no whale, but DeFi allows you maximize returns with a smaller port.

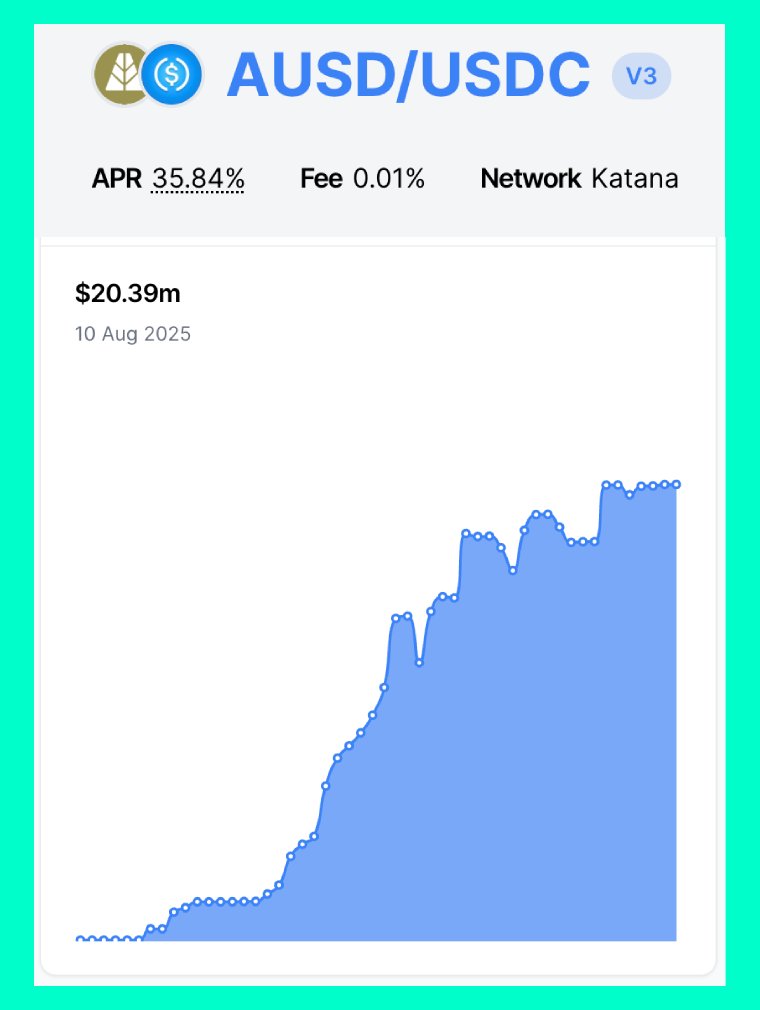

1. Earning insane yield on AUSD vaults on @katana

2. Staked POL (@0xPolygon) in validators to earn airdrops from 5+ different projects

3. Native staking on @HyperliquidX

4. in kHype/Hype pools on @prjx_hl

5. Staked Hype on @hyperlendx

6. Staked Hype -> kYhype -> vkHype on @kinetiq_xyz

7. 5x Long on Hype

Have also been playing around with new markets:

- Pre IPO perps on @ventuals_

- Perps trading via mobile app on @liquidperps (Just got a code, bout to test out but looks incredible)

- Trying out predictions on @Polymarket

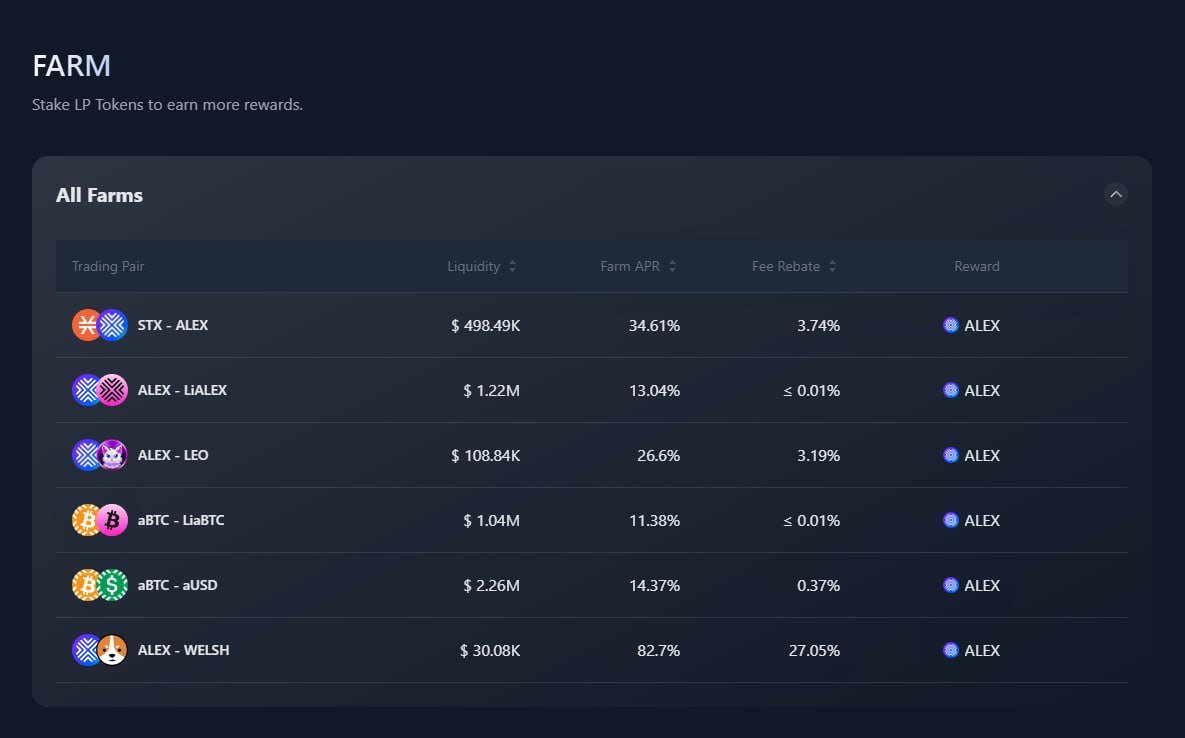

⌛️ 17 Hours Left to Join Cycle #307 Rewards ⌛️

Less than 17 hours remain to the join the next rewards cycle 🔗 🧑🌾

Current Farming Yields + Fee Rebate for cycle #307 👇

$ALEX - $WELSH 100% APR 🥇

$STX - $ALEX 38% APR 🥈

$ALEX - $LEO 30% APR 🥉

$aBTC - $aUSD 14% APR

$ALEX - $LiALEX 13% APR

$aBTC - $LiaBTC 11% APR

Reminder that fees and yields are dynamic and can change up to the last moment.

🐶 $WELSH @Welsh_Community dominating the #1 spot with triple digits rewards of 100%! 👀

AUSD price performance in EUR

The current price of ausd is €0.86012. Over the last 24 hours, ausd has increased by +0.86%. It currently has a circulating supply of 39,415,005 AUSD and a maximum supply of 39,415,005 AUSD, giving it a fully diluted market cap of €33.90M. The ausd/EUR price is updated in real-time.

5m

+0.00%

1h

+0.37%

4h

-0.18%

24h

+0.86%

About AUSD (AUSD)

AUSD FAQ

What’s the current price of AUSD?

The current price of 1 AUSD is €0.86012, experiencing a +0.86% change in the past 24 hours.

Can I buy AUSD on OKX?

No, currently AUSD is unavailable on OKX. To stay updated on when AUSD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of AUSD fluctuate?

The price of AUSD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 AUSD worth today?

Currently, one AUSD is worth €0.86012. For answers and insight into AUSD's price action, you're in the right place. Explore the latest AUSD charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as AUSD, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as AUSD have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.