DeFi isn’t just about capital - it’s about flow. But sometimes we do get stuck on one chain, isn't it?

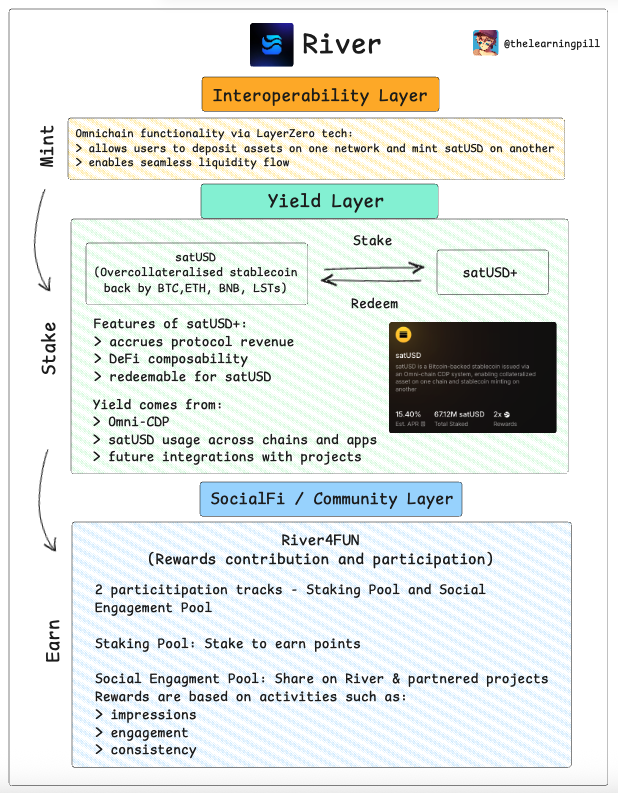

@RiverdotInc is where stablecoins become economies - liquid, omni-chain, and powered by both capital and community

For one, they've got satUSD - River’s collateralised stablecoin

• Chain Abstraction Stablecoin: composable on any chain due to LayerZero tech

• Backing: BTC, ETH, BNB, or LSTs like solvBTC and wstETH

• Cost to mint: 0% interest through River's Omni-CDP (yeah, you read that right - ZERO)

• Yield mechanism: Stake your satUSD to get satUSD+, a yield-bearing token that quietly fattens your bag as protocol revenue flows in

The numbers show demand:

➟ $389M TVL - people are paying attention

➟ 730K users - the community is real

➟ ~15.4% APY - what satUSD stakers getting

3 things worth knowing 👇

Omni-CDP → deposit assets on one chain, mint satUSD on another. zero bridges, zero wrappers, powered by LayerZero tech

Yield → satUSD+ grows from protocol earnings: minting fees, liquidations, redemptions

@River4fun → seem likes a easy, fun, and participative socialfi layer where you get rewarded for your tweets, stakes, votes on @RiverdotInc. you can rack up River Points, and swap them for $RIVER at TGE

Pill will be sharing on more opportunities w satUSD, things are about to get fun (triple-digit stable yields kinda fun)

nfaaaa

10.4K

57

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.