Now that $BTC and $ETH are close to previous ATHs and $SOL is almost at $200, it's time to take some profits and put them to work.

These are my favorite strategies 🧵👇

1. @Backpack exchange - Probably my favorite one 🎒

APY might not be as high as other platforms right now (currently at ~6.6%). But the most exciting thing about having your stables in Backpack is that you can use them for trading while also having them in auto-lend. This is something unique in Backpack, and you can use your money to make perpetuals or anything and still earning rewards for lending.

Also remember that we are on season 2 and you earn points too just for lending. These points will be converted for a potential Backpack airdrop in the future. A win-win if you ask me.

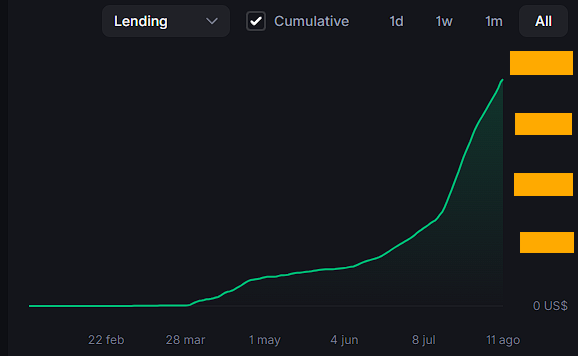

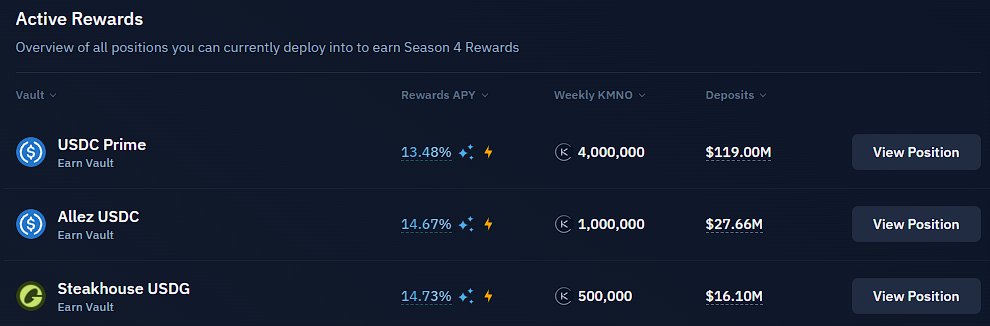

2. @KaminoFinance - One of the safest ways to get juicy APY on your stables.

Now that season 4 just kicked off, you can earn up to ~14-15% on your USDC. This APY comes from $KMNO rewards that will be given to us at the end of season 4, which is November 6.

So you are getting APY on your stables and $KMNO rewards just for lending them.

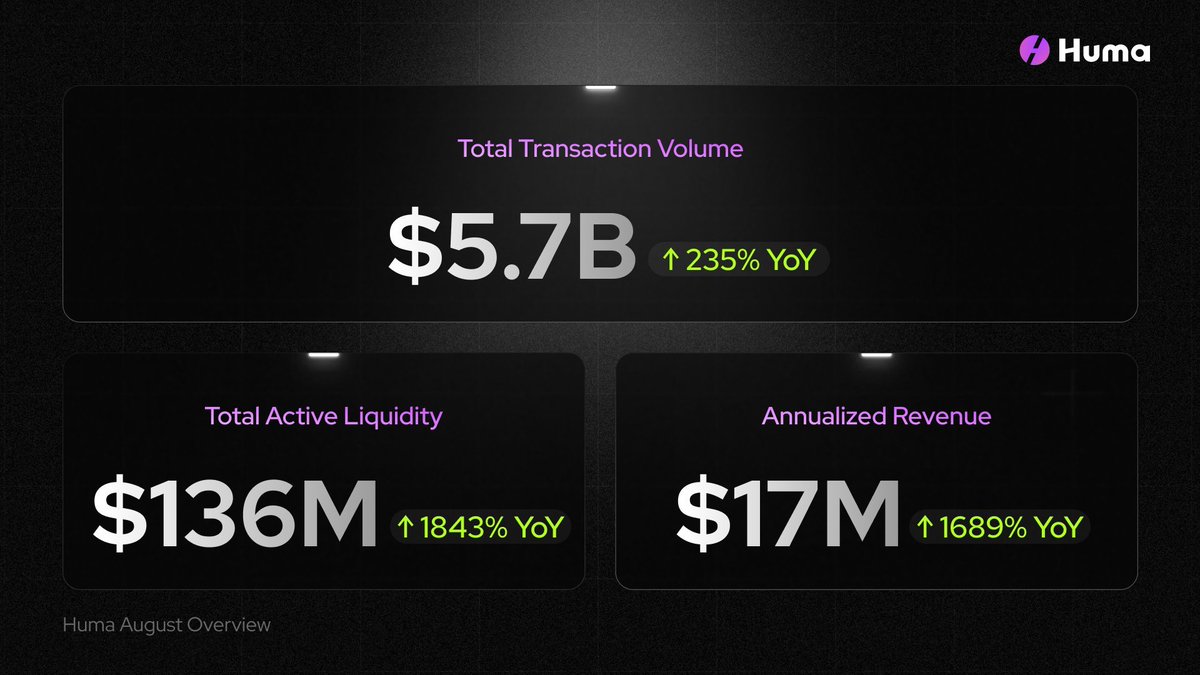

3. @humafinance - Another great option for a platform that has been growing non-stop for the last months.

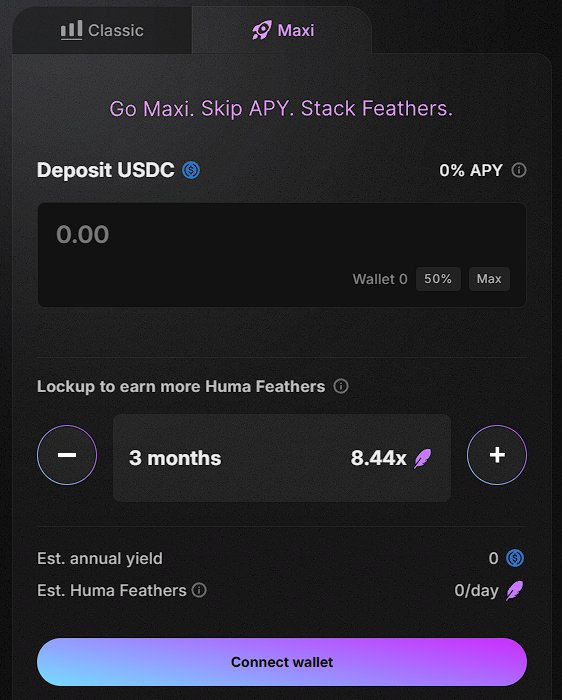

You can use classic mode or maxi. For classic mode, you get $PST in return for a ~10% APY and, on top of that, you also can use your $PST in other DeFi platforms like @RateX_Dex or @KaminoFinance to maximize your rewards.

Also you get Feathers (points) that will be exchanged for the next $HUMA airdrop.

Maxi mode skips APY but stack more feathers.

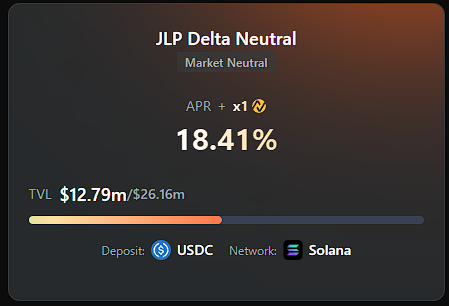

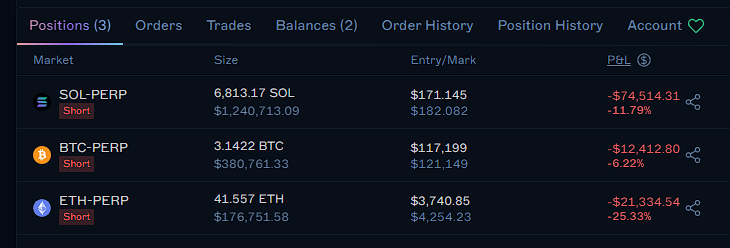

4. @TradeNeutral - This platform offers more strategies based on your risk tolerance.

You can go safer with some delta neutral strategies or try with riskier ones. $JLP Delta Neutral is one of my favorites, for example.

Good thing about this platform is that you can see every individual strategy in @DriftProtocol.

5. @DeFiTuna - Lending and farming with pools is also a good option.

You can just lend your USDC there for a current ~7.42% APY or make DCA out from your bags to USDC through leveraged pools (risk is higher of course).

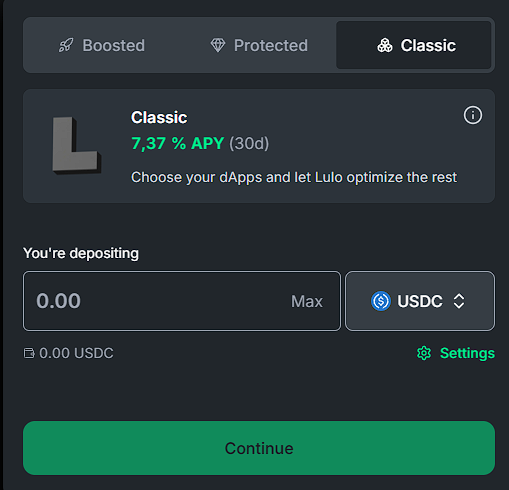

6. @uselulo - Forget about checking the highest APY daily and let your stables get some rewards without any effort.

Add your stables and choose between:

- Boosted: earn higher yields by protecting others funds.

- Protected: safe and steady returns and your capital is protected by boosted participants.

- Classic: Lulo moves your funds between platforms trying to catch the highest APY.

I use classic mode!

These are only 6 strategies that Ive been trying for my stables in Solana, but there are many more options out there.

Which one is your favorite? Do you know more strategies?

Feel free to share the thread and I hope it helped you 💙

8.97K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.