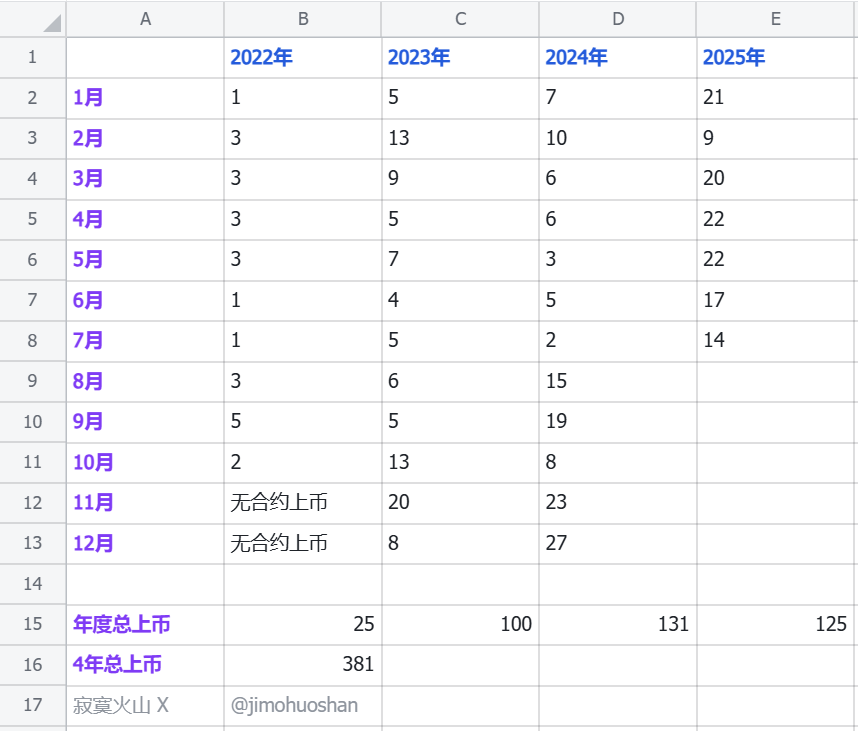

Binance's 4-year crazy listing statistics,

Will there really be a copycat season?

Statistics of all the [Contract Tokens] on Binance every month since 2022

It can be clearly seen

In 2022, the listing is still relatively restrained

On average, about two or three a month

It was a bear market and BTC was below 2W

Later, as the market gradually improved, the number of coins listed increased

By November 2024, with Trump coming to power, the big market will begin, and the listing will begin to enter crazy mode, with an average of about 20 per month

From this point of view, even if it is not a violent bull market now, it is definitely a relatively lively market

But why isn't there a copycat season yet? Binance's listing strength may be part of the answer in itself

This is just Binance contract listing

Not including the more crazier alpha lately

It does not include the small and new MEME coins that are difficult to count every day

How much liquidity is needed to support so many new tokens every day, and there can still be a "copycat season" with "10,000 coins flying together" and "ten times a hundred times"?

When I was sorting out the table, I looked at the names of the coins on the 22nd year, many of them were familiar and unfamiliar, and I remembered the symbols of the tokens, but I had completely forgotten what this coin was for, as if it were a different world!

If ordinary people cannot judge whether the market is overheated

The frequency of currency listings on leading exchanges is actually a good indicator for judgment

Because the project team needs to get the support of three parties to get together:

1. The project party itself

2. Relevant stakeholders of the project party

3. The exchange itself

If all three parties are concentrated on a certain period of time, they will rush to list

This period is likely to be the hot stage of the market

Because the data held by these three parties is much more accurate than that of ordinary retail investors

6.9K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.