Speaking of BTCFi, the first project I got involved with was definitely Lombard. Through Lombard, I learned about @satlayer, and the two later formed a partnership, which is why I gained more insight into satlayer. Today, I not only want to introduce satlayer but also discuss the opportunities for everyone to participate.

Some might say that satlayer is just a BTC staking platform, and on the surface, that’s true. For example, you can deposit Lombard's LBTC into satlayer, allowing you to earn BTC staking rewards, LST rewards, satlayer points, BVS rewards, and more.

But today, I want to talk about a satlayer you’ve never heard of, the ambitious satlayer that aims to be the crypto version of Berkshire.

Satlayer positions itself as the BTC economic layer, and one of its core products is a yield-generating BTC insurance fund. The basic logic is that your staked BTC becomes an on-chain insurance fund pool, with a programmable forfeiture mechanism = automatic claims, and the staking rewards = insurance premiums, where the insurance premiums are the earnings of the insurance fund!

To promote this insurance fund, satlayer is collaborating with Nexus Mutual, the largest decentralized insurance protocol, and several top traditional insurance companies to cover various aspects, such as staking/re-staking liquidation protection, loan protocol liquidation insurance, and insurance coverage in non-crypto areas (like farm/agricultural property insurance, workers' compensation insurance, etc.).

Once you participate in satlayer, you are no longer just a BTC holder but a builder of the insurance ecosystem, a builder of the on-chain Berkshire!

In addition to the insurance fund business, there are also collaborations in the stablecoin sector.

Stablecoins are undoubtedly the leading narrative of this cycle, and satlayer certainly won’t miss out. It has already partnered with the stablecoin project @capmoney_ from the megaETH ecosystem, which will unlock a new layer of earnings and security provided by re-staked BTC through SatLayer's BVS framework.

Cap × satlayer collaboration announcement:

Is that the end? Of course not! Besides the insurance fund and stablecoin businesses, satlayer is also exploring other directions, such as RWA and liquidity pools. Otherwise, why call it the BTC economic layer? However, due to time constraints, I won’t explain each one in detail.

Finally, let me tell you how to participate:

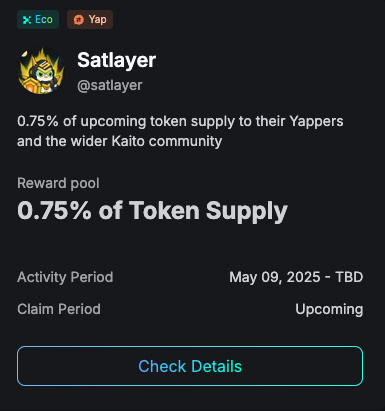

1. Mouth-to-mouth, satlayer has offered a 0.75% token reward for content creators. You can check the rankings here:

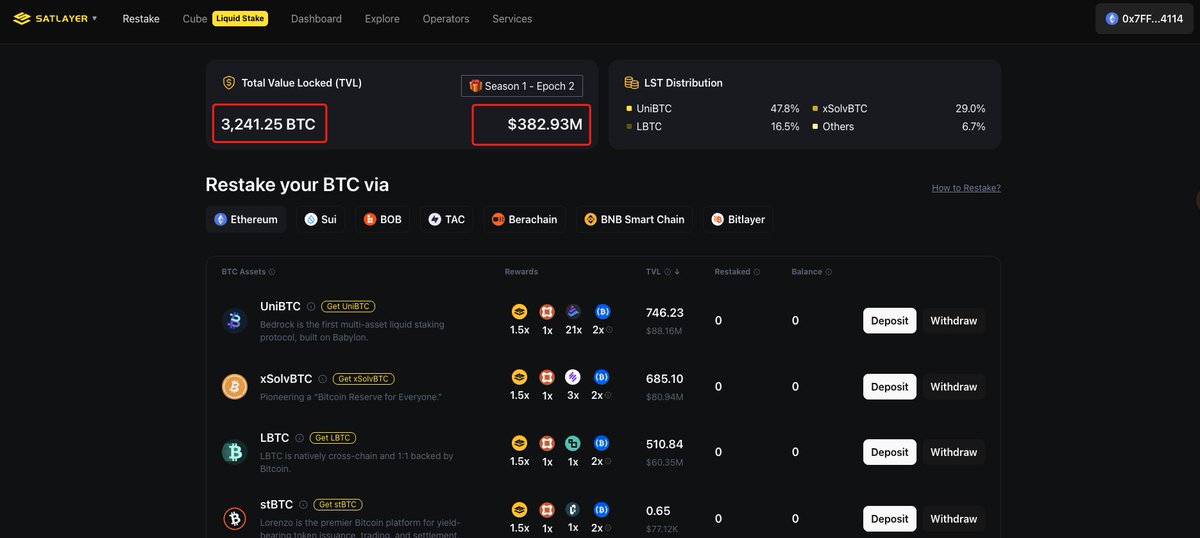

2. Deposits, you can deposit BTC-related LSTs, and I recommend depositing Lombard's LBTC.

-------------------------------

About satlayer, it was co-founded in early 2024 by MIT and Stanford alumni Luke and Arun, who raised $8 million in a pre-seed round from top institutions like Castle Island Ventures, Hack VC, Franklin Templeton, and OKX Ventures. The current TVL is $384 million.

Official website:

Twitter:

TG:

Discord:

Show original

17.61K

55

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.