Everyone can recall the time when BTC L2 was booming. Which chains did you participate in, which chains went down, and which chains came up?

TVL can be temporarily inflated, but in the long run, it still reveals a lot.

GOAT's pre-market price skyrocketed 7 times, is BitFi in the calm before the storm?

The current cryptocurrency market is undeniably fragmented; on one hand, BTC is reaching historical highs, while on the other, the entire crypto space is stuck in a bottleneck of innovation and application. Personally, I feel a sense of fragmented emptiness. Just a few years ago, BitFi was a hot topic in the industry, but now it seems to be forgotten.

Back then, BitFi had a plethora of proposals aimed at tapping into the trillions of dormant assets behind BTC. As the hype faded, many proposals fell by the wayside, but only the true gems emerged from the sands. GOAT @GOATRollup stands out in my memory as a "counter-current builder," who continued to persevere even after the first wave of BitFi's hype receded, actively promoting its ecosystem and technological iteration.

So, a fundamental question arises: is the BitFi track a fleeting moment, or is it a true blue ocean market? This directly relates to the significance of perseverance.

When GOAT's pre-market trading price surged 7 times at @aspecta_ai, it indicated that the market isn't as desperate about the BitFi track as it seems. The market is still willing to assign a reasonable price, which reflects a bet on the future explosion of BitFi.

Like many tracks, when the first wave of hype fades, market sentiment tends to lean towards the idea that the track has been disproven. However, the market's tolerance for error is far greater than we think. DeFi was also disproven countless times before its real explosion, including the recent hyperliquid, where many believed that dydx had already validated its track. "This time is different" may be a trap for investors, but it is indeed an objective phenomenon in the industry over the years.

It is precisely because some people firmly believe that "this time is different" that the industry can experience one innovation explosion after another.

Returning to the main topic, the root of BitFi lies in how to effectively and safely tap into the dormant "trillion-level BTC assets." First and foremost, this demand is not a false demand; it is a genuine expectation from a large number of BTC holders. I know many BTC whales who are genuinely asking about safe financial management for BTC. This demand is the source of BitFi's continuous development.

Therefore, I have never given up on observing the BitFi track, and I am particularly focused on the development of GOAT. It's simple: GOAT has the ability to survive the winter and has been actively building even after BitFi's tide receded.

Currently, GOAT's pre-market price on Aspecta is $7.45 per Key, with a total supply of 0.00005%. The post-pricing FDV is $149 million. This pre-market price provides a calculation benchmark, allowing early participants, incentive task completers, and Airdrop recipients to assess the potential value of GOATED Token incentives based on the real-time price of BuildKey on Aspecta.

This pre-market pricing on Aspecta can effectively stabilize the confidence of early participants in the current BitFi track. One obvious benefit is that the TVL on the GOAT chain has increased by 52% this week, as on-chain participants have a more objective assessment of the price, giving them more confidence.

Returning to GOAT's fundamentals, which is its ecosystem, the Staking TVL of @Artemisfinance has been steadily increasing, with $2.92M coming from individual users. Its Total APR is currently around 120%, with the native yield of BTC reaching 7.99%. The native yield of BTC comes from GOAT's decentralized sequencer, where more transactions lead to higher gas fees, resulting in higher BTC staking rewards.

On-chain users can also place their BTC on @okutrade and @Goatswap_fi to further earn DeFi yields, such as the LP combination of artBTC and wgBTC, which are different types of BTC, essentially representing single-coin financial management for BTC.

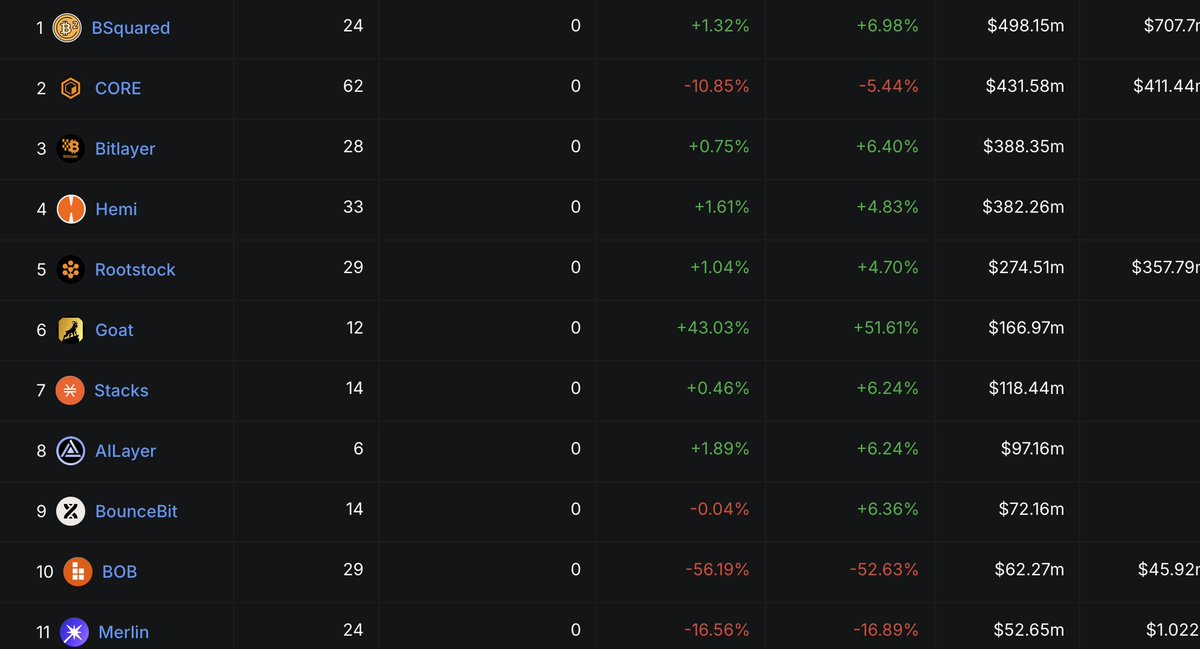

Currently, GOAT's ranking in the entire BTC L2 ecosystem is continuously improving, with a TVL of $167 million, ranking 7th. You might want to look at the past popular BTC L2s; many have fallen, while GOAT is the only one that continues to refresh its ranking against the trend.

In the development of the entire BitFi track and GOAT, I believe the most crucial step is BitVM. To put it simply, the breakthroughs brought by BitVM technology directly determine whether it is possible to safely tap into the "trillion-level dormant BTC assets," which is also the key technology that decides whether BitFi is in the calm before the storm.

GOAT has been working on the commercial landing version of BitVM, and currently, GOAT's BitVM plan has evolved to BitVM3, which significantly accelerates the large-scale adoption of Bitcoin zkRollups. This is also the core reason why I am most optimistic about GOAT among all BitFi projects; GOAT has been following up on BitVM and continuously optimizing BitVM technology for commercial implementation.

Sometimes, we can only sense the undercurrents by delving deep into specific tracks and projects, rather than just glancing at the market sentiment and concluding that a track or project is doomed. Countless innovations and breakthroughs in tracks will go through a long incubation period, and what we need to do is discover new variables in tracks that the market has forgotten and continue to uphold the "true gold" that is rapidly growing and iterating.

And the true gold in the BitFi track is GOAT, just waiting for the BitFi track to welcome its spring.

24.9K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.