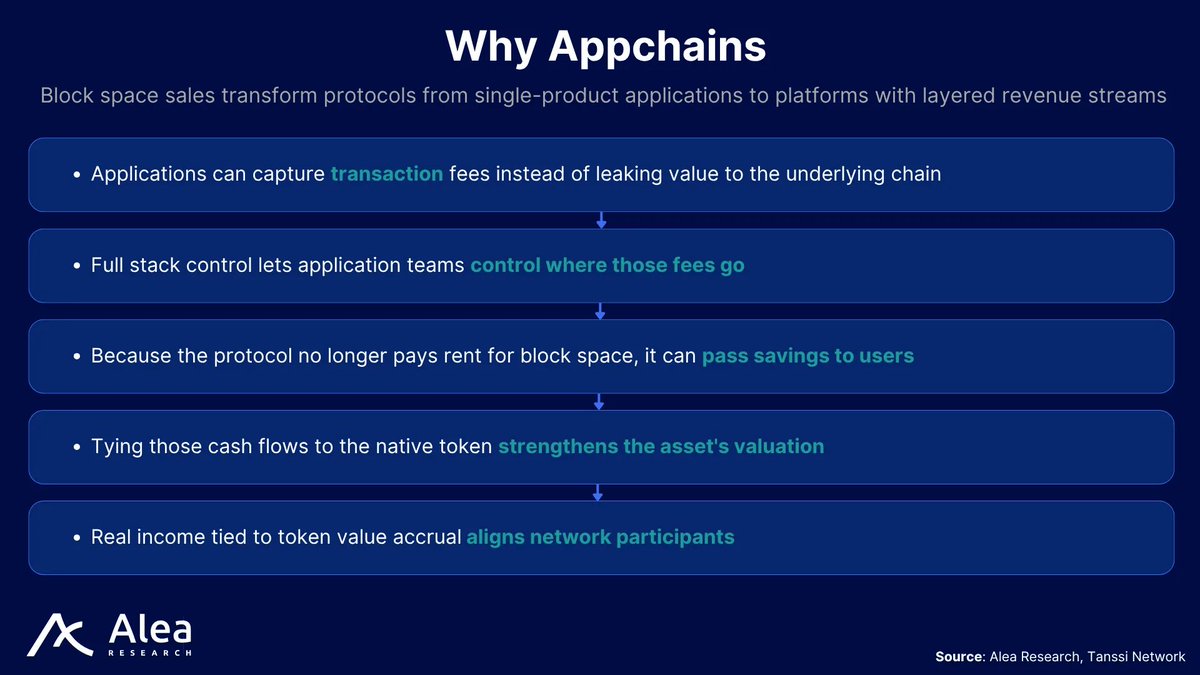

Protocols increasingly insist on owning every layer of the stack, including their own chain.

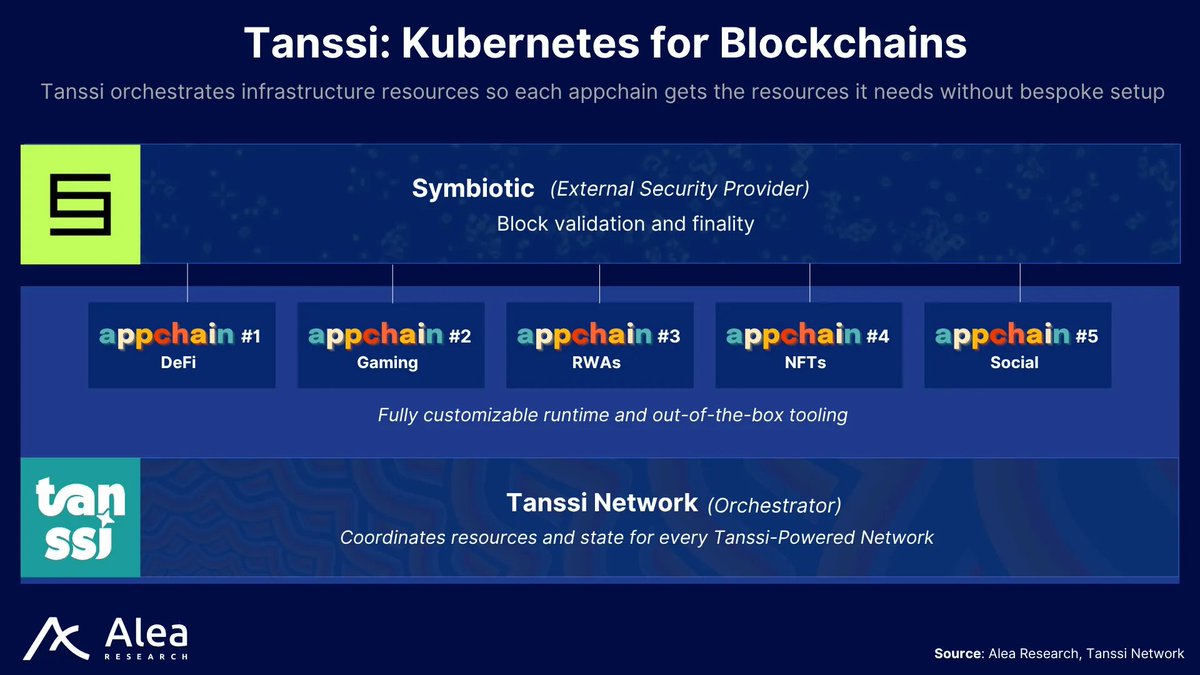

Tanssi streamlines the launch of custom appchains in minutes, not months, allowing teams to keep more of the value they create.

Today, we've released a Deep Dive report on Tanssi👇

Applications are growing their leverage in crypto, & we're seeing a new generation of hugely profitable apps.

Appchains are the only way to guarantee performance, economics, and governance align with a single application’s needs while accruing value to their token.

.@TanssiNetwork simplifies appchain creation, so builders can focus on business logic and UX, their differentiated edge.

Tanssi abstracts away the heavy lifting of deploying a chain, which includes:

- block production

- security

- data availability

- tooling

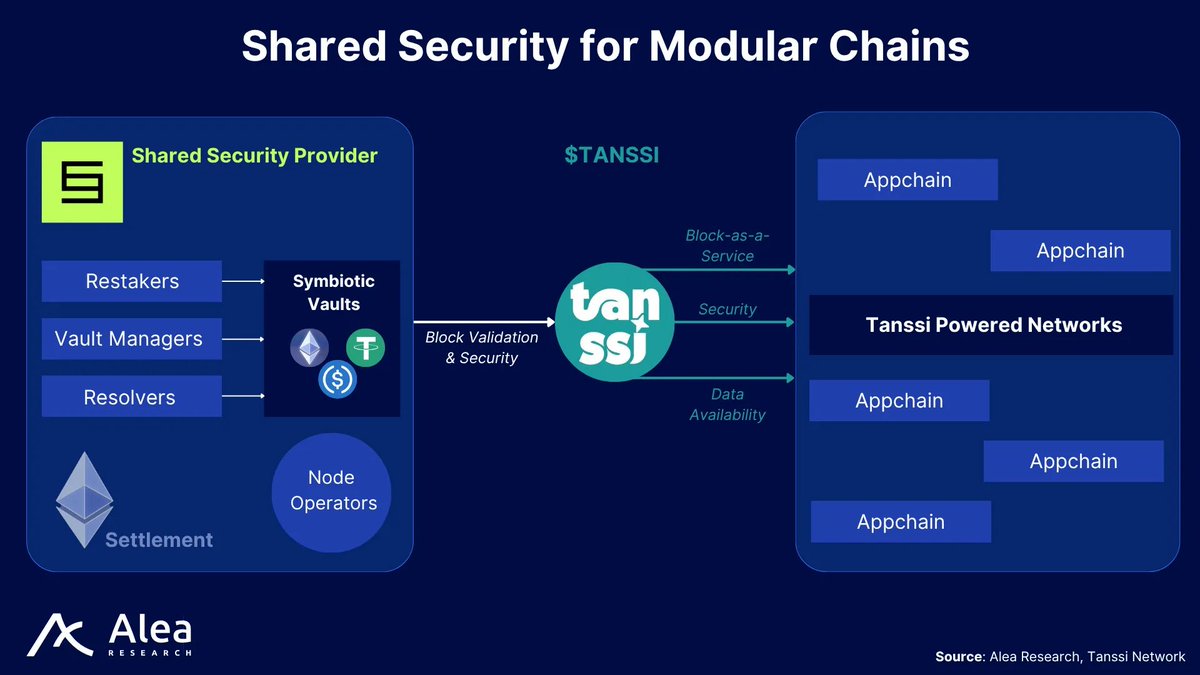

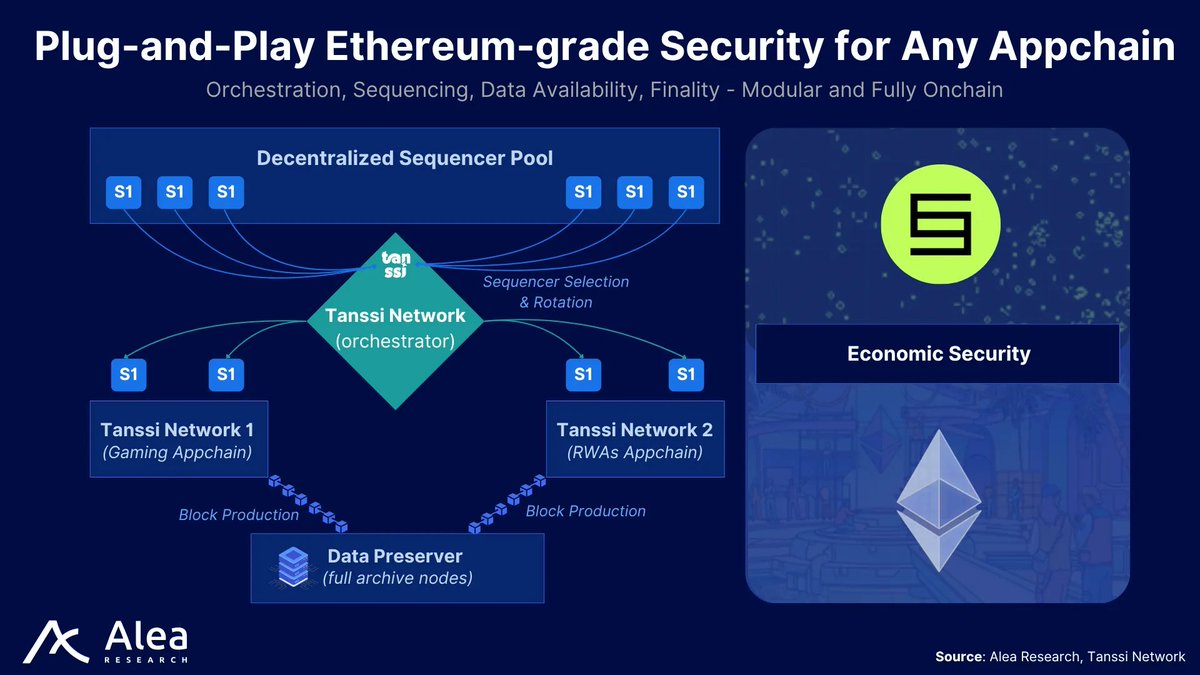

Tanssi’s architecture consists of 4 interconnected layers:

- Tanssi Network as the orchestration chain

- Tanssi’s sequencer pool

- Tanssi-Powered Networks

- Shared economic security layer.

At its core, the Tanssi Network acts as an onchain orchestrator that manages a global pool of resources, such as decentralized sequencers.

For each active appchain, the Tanssi Protocol takes care of sequencer selection and rotation, recording this work onchain.

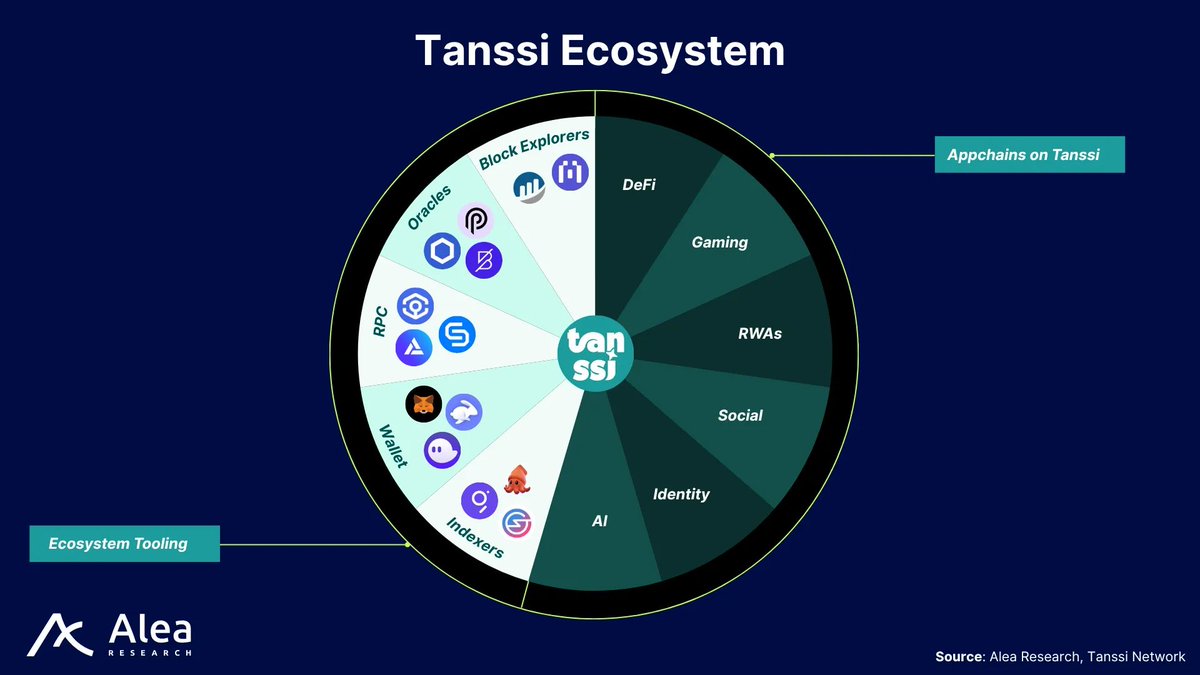

Developers can leverage a modular stack and ready-made templates, receiving bundled essentials including:

- wallet integrations

- block explorers

- data indexers

- bridges, oracles

- crosschain messaging

$TANSSI powers the Tanssi Network coordination layer & captures value from the ecosystem of Networks deployed on top.

$TANSSI is used to:

- register & operate appchains

- pay sequencer & operator rewards

- stake & earn yield

- cover tx fees

- govern protocol upgrades

$TANSSI binds every actor and ecosystem participant through one cohesive token model.

Sequencers can earn fees from network activity as block-production revenue, but they must win a spot in the active set by posting stake.

Projects can launch Tanssi-Powered Networks to gain:

- total runtime control

- immediate, large-scale economic security

All while avoiding the overhead of bootstrapping a dedicated validator and tooling stack.

1.01K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.