➥ Where To Park Your Stablecoins?

With $BTC seemingly on a fast track to $200,000 (God willing), many friends often ask where they should park their stablecoins.

In this risk-on market, making profits is easy, but preserving them is the real challenge.

I have several recommendations, but @SiloFinance is always at the top of my list.

Why? It supports a hands-off approach through managed vaults, operates across multiple chains, offers isolated markets for those who prefer active management, and provides solid APR rates.

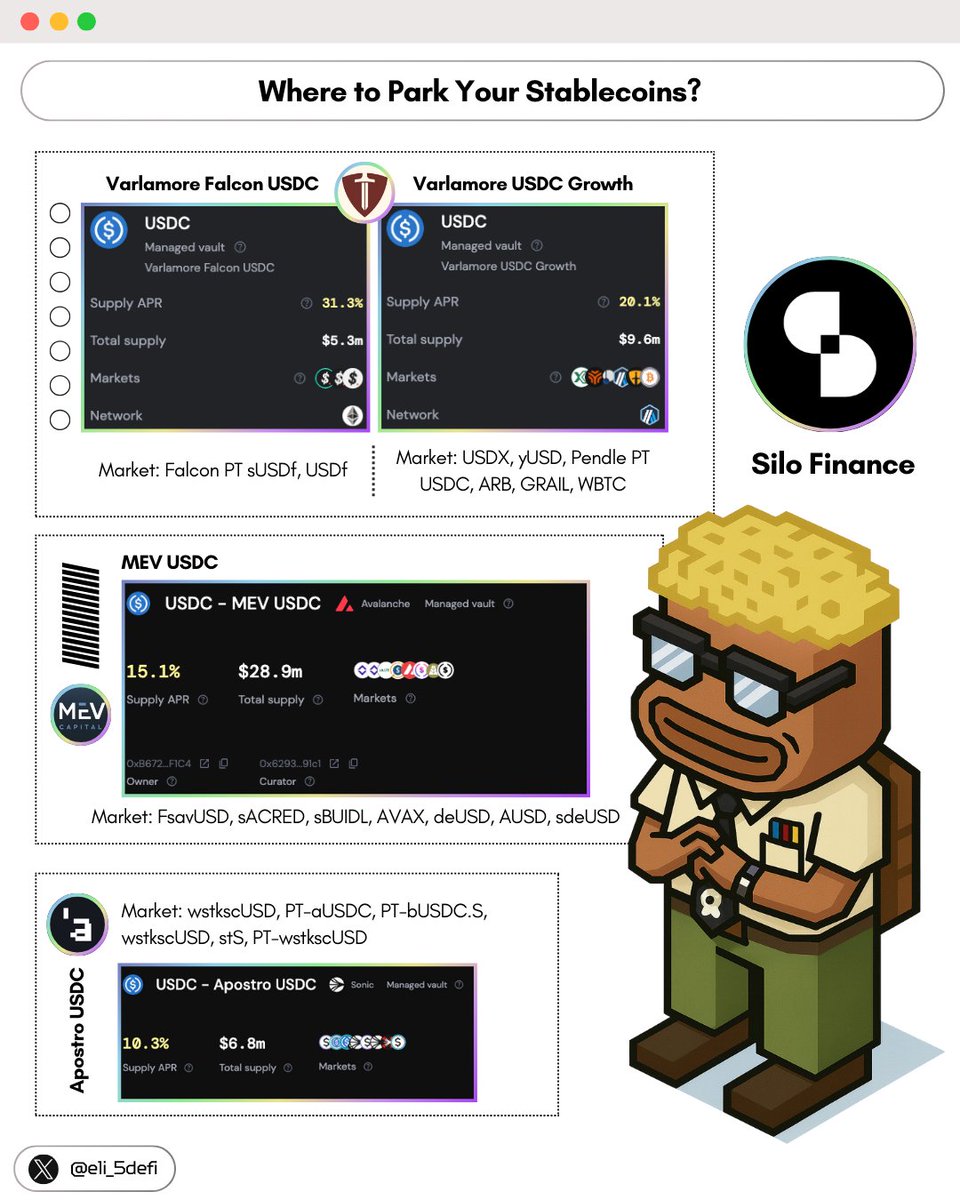

Today I'm highlighting several managed vaults by @varlamorecap, @mevcapital, and @apostroxyz to get you started with Silo:

➠ Varlamore Falcon: ~31% APR on @ethereum using @FalconStable

➠ Varlamore USDC Growth: ~20% APR on @arbitrum

➠ MEV USDC: ~15% APR on @avax

➠ Apostro USDC: 10.6% APR on @SonicLabs (Silo Points and Sonic Points included)

Simply deposit your funds, and watch them accrue yield.

Obviously, there are more sophisticated strategies involving looping that you can use with Silo to optimize your returns, but let's save that for the next post. 😉

What is the difference of Managed Vaults and Isolated Vaults? I'll let @SiloIntern explain it in here ⤵️

One of the inch resting thing about Silo v2's design is we now have a:

1. Base layer of isolated markets

2. Aggregation layer of managed vaults

Such a design is actually better for lenders, borrowers, AND external protocols alike - allow me to explain. 👇

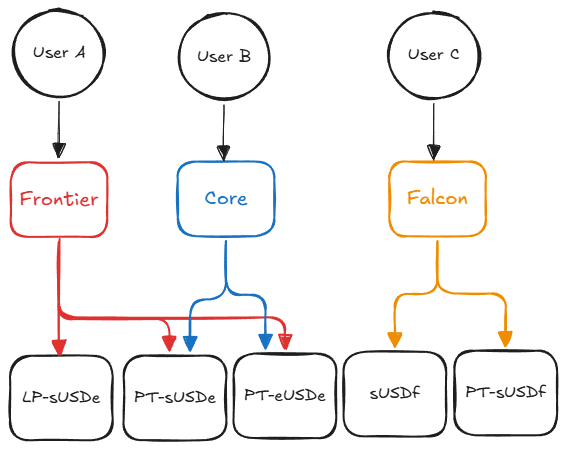

We now have 3 core vaults on Silo Ethereum:

1. Apostro's Core Vault

2. Apostro's Frontier Vault

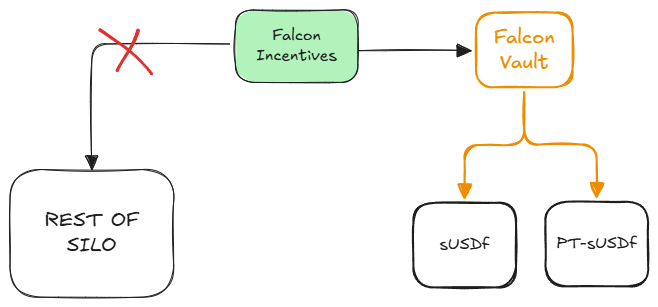

3. Varlamore's Falcon Vault

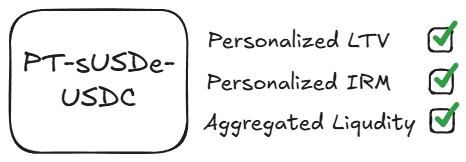

Since the Silo base layer is STILL our isolated markets, we can select parameters that are specialized to the counterparty asset. This means defining LTVs (risk) and IRMs (reward) specific to an asset rather than globally while still able to tap into multiple vaults of liquidity!

This gives borrowers maximum efficiency when using Silo.

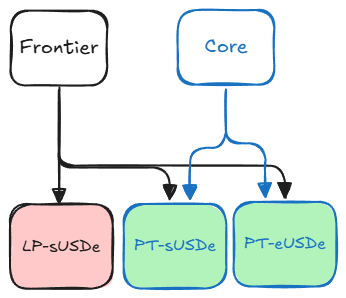

Lenders in the Core Vault (blue-chips only) can earn interest WITHOUT additional exposure from non-blue-chip tokens. This is reserved for the Frontier vault which is ideal for lenders with a more adventurous risk profile.

This lets lenders to continue defining their own risk exposure at the vault level.

For protocols looking to grow their credit facilities vaults provide a single interface where they can allocate incentives. Since vaults have defined allocation strategies, protocols know every $ they incentivize is a $ supporting their growth.

This lets protocols supercharge growth without other externalities.

From this, we have the VEEEEEEEEEERY barebones ingredients for a lending infrastructure to support ANY token.

Things to look forward to:

- A complete overhaul of our UI making yield + loooping opportunities more visible

- Several brand new products to make your lending experience even more excellente

i) Autoleverage

ii) Fixed rates (hehe)

Lot's here but lot's to come.

SILOOOOOOOO

10.87K

83

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.