Aave Is Betting Big on BTC eco

The leading DeFi protocol @aave isn’t ignoring the world’s most dominant crypto asset. From the very beginning, Aave has been experimenting with Bitcoin integrations—and in recent years, its efforts have only intensified.

Why? Because Bitcoin is the primary asset for TradFi, and whoever successfully builds infrastructure around it will unlock enormous growth.

Aave’s Growing BTC Ecosystem

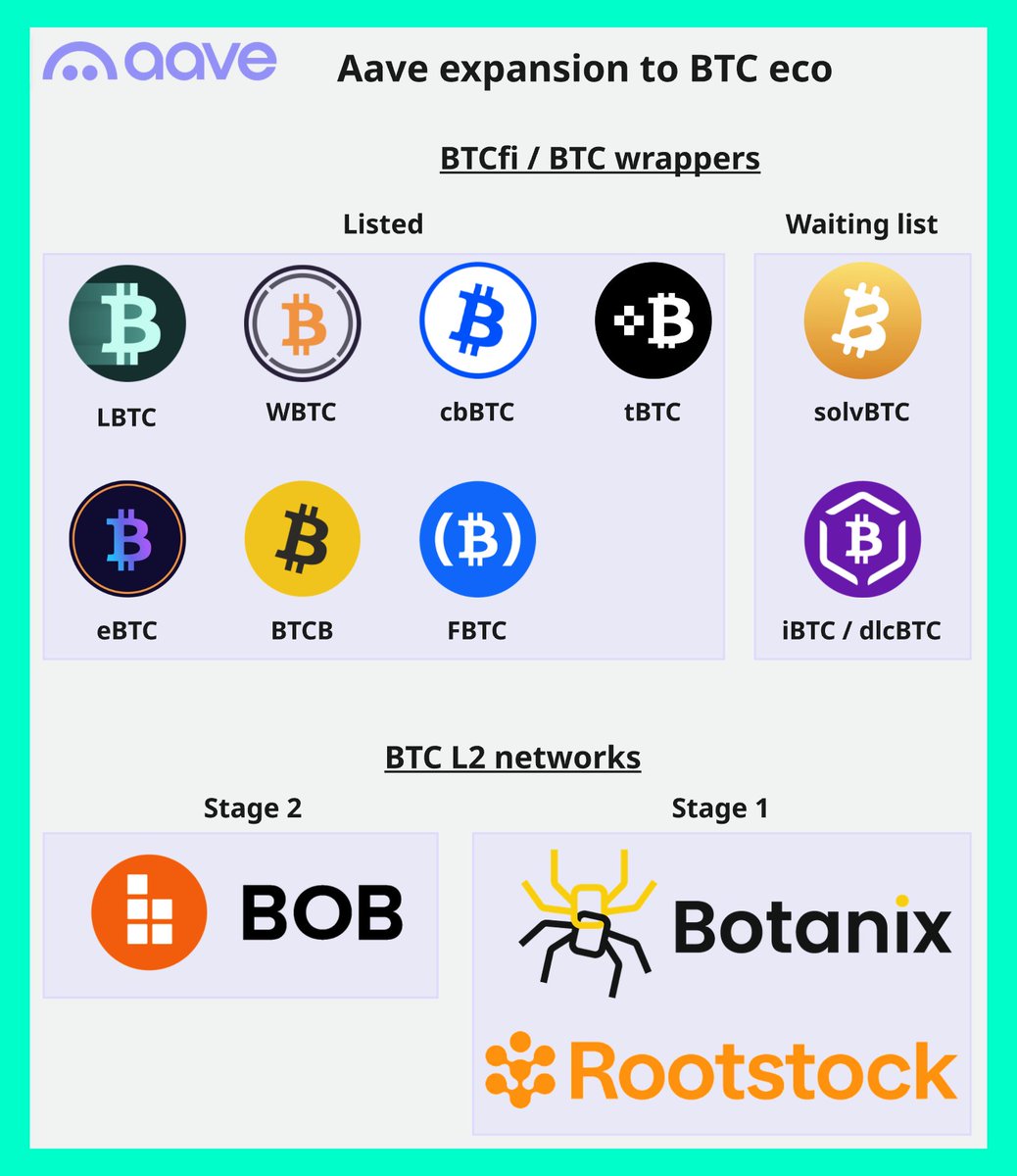

So far, Aave has listed 7 BTC wrapped assets, with 2 more wrapped BTC and 3 Bitcoin L2 networks currently in the approval process.

Wrapped BTC Assets on Aave

1. WBTC – The first wrapped BTC, custodial and centralized, managed via multisig with BitGo

2. cbBTC – Coinbase’s wrapped BTC, fully centralized

3. LBTC – The largest decentralized wrapped BTC from @Lombard_Finance , with high security and transparency

4. tBTC – The original decentralized wrapped BTC based on @TheTNetwork

5. eBTC – BTC wrapper by @ether_fi, a leading LRT protocol

6. BTCB – Binance’s wrapped BTC, centralized and primarily based on BNB Chain

7. FBTC – Wrapped BTC from the Mantle/ByBit ecosystem, also centralized (multisig-secured 3of3)

Upcoming Wrapped BTC (Pending Approval)

1. solvBTC – Wrapped BTC designed for BTC staking protocols from @SolvProtocol . Currently centralized via multisig, but roadmap includes full decentralization.

--- Expected to be added to Aave within a few months.

2. iBTC (formely dlcBTC) – A decentralized BTC wrapper from @BitSafe_Finance using DLC technology. Tailored for institutional-grade use cases.

--- Will be approved once sufficient TVL/liquidity is reached.

BTC Layer-2 Networks on Aave’s Radar

1. BOB @build_on_bob

L2 that works with both Ethereum and Bitcoin blockchains, using the EVM-environment and bridge, with the publication of batches in the Bitcoin network via BitVM technology. in the future they plan to work on a decentralized sequencer based on BSN technology from Babylon.

--- They applied to Aave DAO for the 2nd time, are in the final stage of approval, acceptance is expected within a few months.

2. Botanix @BotanixLabs

Sidechain that operates on the innovative "spiderchain" tech through the connection of hundreds of multisig wallets, which provide network decentralization and a trustless bridge between Bitcoin and L2. They use BTC as a gas token.

--- The project received approval from Aave DAO with the condition of entering the mainnet. Last week, Botanix launched the mainnet, the addition is expected within 6 - 12 months.

3. Rootstock @rootstock_io

It is one of the very first L2s on the Bitcoin network with an EVM environment, operating since 2019, with transaction processing via Multisig with 9 signatories and a gas token RBTC.

--- The project received approval from Aave DAO with the condition of entering the mainnet. Last week, Botanix launched the mainnet, the addition is expected within 6 - 12 months.

Strategic Outlook

Aave has already dominated Ethereum and EVM-based DeFi. Now it’s looking toward the BTC ecosystem—and for good reasons:

- BTCFi is gaining serious momentum

- TradFi interest in BTC-native yield is growing

- L2s and wrapped assets are unlocking new utility for BTC

For Aave, this is a massive growth opportunity.

For the Bitcoin ecosystem, it’s a chance to integrate DeFi functionality and finally tap into TradFi liquidity.

P.S. Special thanks @StaniKulechov and @lemiscate for supporting of BTC eco!

======================================

If you liked the research, plz like/retweet and follow to

@Eugene_Bulltime

And follow on strong visioners and analysts:

@0xBreadguy

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@Moomsxxx

@hmalviya9

@Mars_DeFi

@rektdiomedes

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@0xCheeezzyyyy

@0xKaveh

@arndxt_xo

@Picolas_Caged

@dudu_bitcoin

22.82K

60

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.