Gmino, it’s finally here! 💉

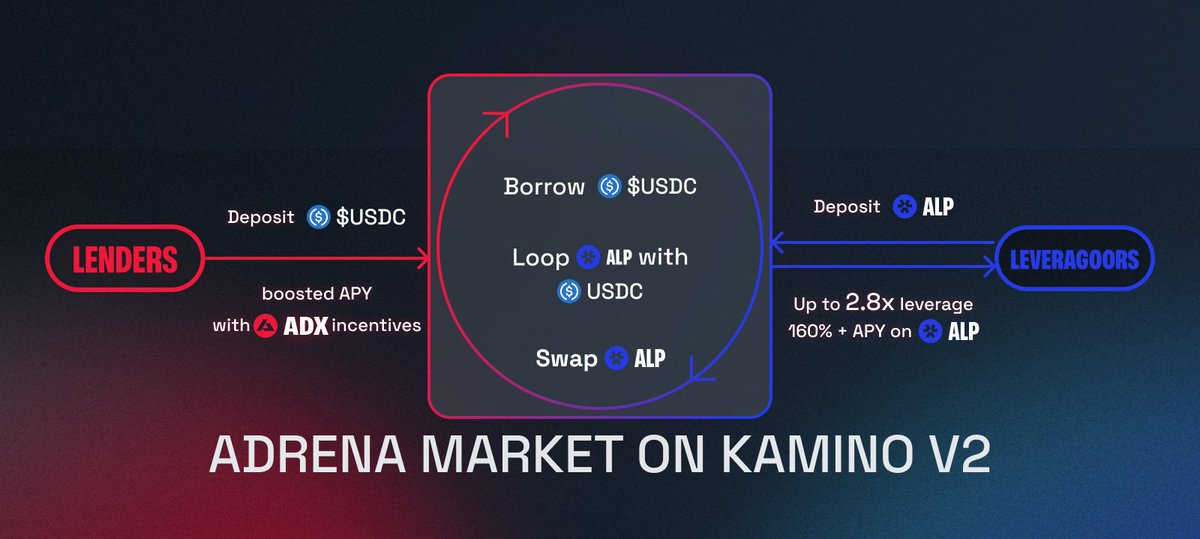

Adrena Market is now LIVE on @KaminoFinance V2, curated by @allezlabs.

Borrow $USDC against $ALP with up to 2.8x leverage to boost yield up to 160% APY — fueling deeper liquidity for Adrena traders and LPers.

(1/5) 🧵

Introducing Adrena Market on Kamino V2 💉

With Kamino’s V2 lending architecture, $ALP holders can now increase the exposure by borrowing $USDC and loop up to 2.8x, pushing $ALP APY to 160%+.

Core Metrics:

▪️ 2.8M $ADX in incentives to bootstrap the USDC Lending Pool over 2 months — unlocking the lowest borrow rates and supercharging your APY

▪️ 65% LTV — optimized for capital efficiency without compromising security

Designed for advanced yield strategies by @allezlabs, this integration makes it seamless to amplify the yield to one of Solana’s top-performing PerpDEX LP assets.

(2/5)

ALP Highlight 💉

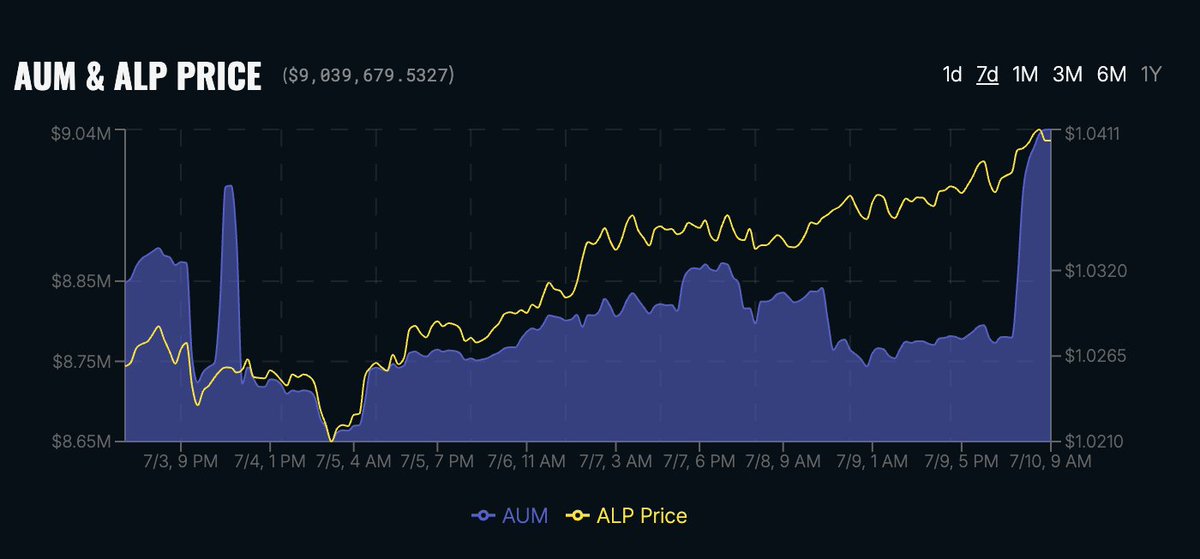

$ALP (Adrena Liquidity Provider) is the counterparty vault behind Adrena’s PerpDEX. It’s a multi-asset pool containing $JitoSOL, $WBTC, $BONK, and $USDC, with 70% of protocol fees automatically compounded back into the pool.

Think of $ALP as a blue-chip index on Solana: low risk, high yield, and delta-neutral by design.

Its value grows through both protocol-generated fees and the appreciation of its underlying assets, consistently printing 50%+ APY.

Since launch, Adrena has generated $6.4M in fees, and 70% of fees has been compounded to the pool timely since March 19th, making $ALP one of the most outperforming PerpDEX LPs.

As $ALP’s performance strengthens, it’s being adopted across more DeFi integrations — now serving as collateral in Kamino’s Automated Lending Vaults. Users can leverage $ALP up to 2.8x, boosting yields to 160%+ APY.

(3/5)

Loop Your Way to 160%+ APY with ALP 💉

Supercharge ALP's yield with Kamino’s Multiply Strategy by one click.

▪️How to loop:

• Mint $ALP by providing liquidity on Adrena:

• Deposit $ALP into Kamino’s ALP/USDC Multiply Strategy:

• Leverage up to 2.8× to boost APY up to 160%+

Curated by Kamino’s expert Vault Manager @AllezLabs, the ALP market enforces robust risk controls for efficiency and sustainability:

• 65% LTV to start

• Yield-sensitive interest curve

• Caps on deposits/borrows to mitigate risk in early phases

(4/5)

Looking Forward 💉

Since $ALP went fully liquid on March 19th, we’re eager to make $ALP a key building block in Solana’s DeFi landscape, brick by brick. 🧱

The Adrena Market on @Kaminofinance, Solana’s leading lending protocol, marks the beginning of a flywheel effect for Adrena’s ecosystem.

• For LPers: Earn amplified yields through looping, plus access to potential airdrops and yield farming opportunities as ALP adoption grows.

• For Traders: Enjoy more accessible liquidity, driving higher yields for LPers.

Let's $ALP a scalable, composable, high-yield asset at the core of Solana’s perp trading.

(5/5)

24.45K

44

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.