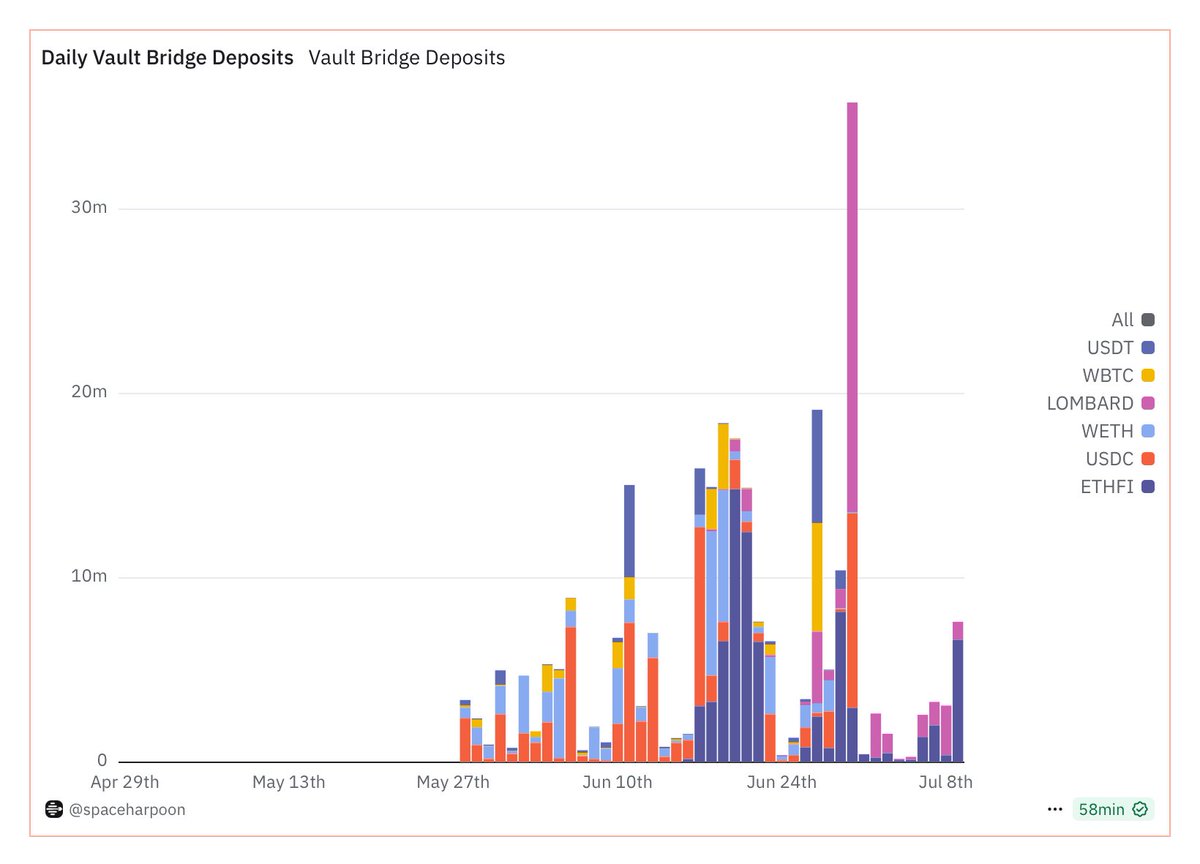

The numbers tell the whole story.

@katana hitting $270M TVL since launch shows smart money recognizing something different.

While most chains throw tokens at problems, Katana's building actual revenue streams.

Sequencer fees + protocol revenue = sustainable yields that don't rely on endless printing.

Instead of being everything to everyone, they picked the best DeFi primitives & said let's make these work perfectly.

Sometimes the best strategy is doing fewer things better. This feels like the mature phase of DeFi finally arriving.

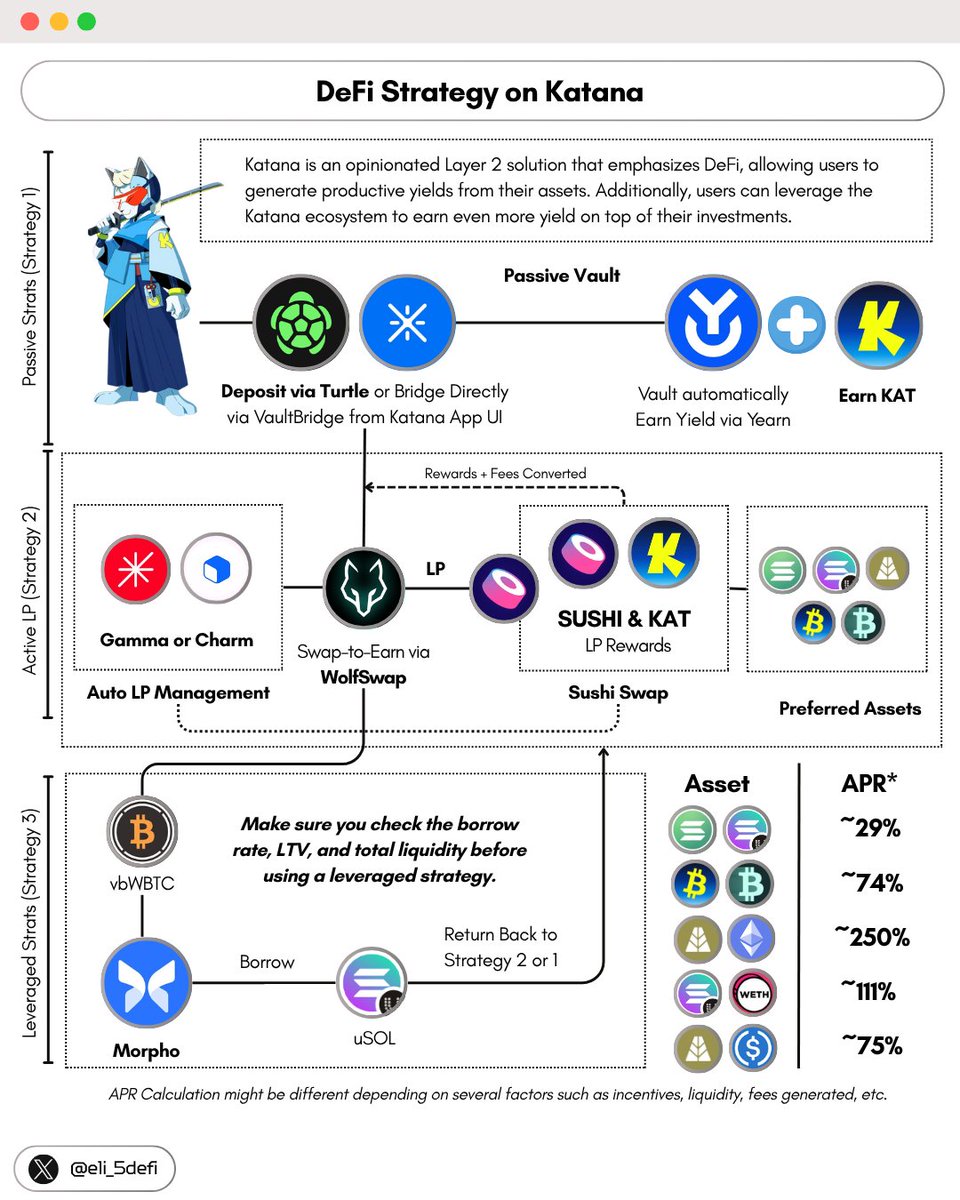

My friend @eli5_defi just shared strategies that you can try on @katana to get those juicy yields!

➥ DeFi Strategy on Katana

If you're using @katana (like me), I think this is the perfect time to explore DeFi opportunities, as several excellent options are available right now.

Let's check them out in our concise guide:

...

— The Big Picture

✧ $SUSHI and $KAT incentives are live on @SushiSwap

✧ $uSOL from @universaldotxyz is live on Katana

✧ jitoSOL from @jito_sol is live on Katana, leveraging @LayerZero_Core

✧ $BTCK and $LBTC from @Lombard_Finance are highly composable for Katana DeFi

...

— The Strategy

Katana offers a straightforward approach to earn yield on your assets via @yearnfi Vault, but you can do much more than that and optimize your yield (and KAT accrual) even further.

Also you can earn more by depositing on @turtleclubhouse Ecosystem Vault or External Partner Vaults.

...

➠ LP Strategy

The strategy will largely depend on your LP choice, so let's start by exploring the pools on Sushi V3. Choose one with high APR and dual rewards: KAT and SUSHI.

Some of my favorites (in no particular order):

✧ uSOL <> wETH (111% APR)

✧ AUSD <> USDC (75% APR)

✧ AUSD <> ETH (254% APR)

✧ BTCK <> LBTC (74% APR)

✧ jitoSOL <> uSOL (29% APR)

Your asset choice will largely depend on your preferred blue-chip pick or stablecoin strategy. For a simple approach, just create LP positions in Sushi. If you want a hands-off approach, you can use:

✧ @CharmFinance

✧ @GammaStrategies

Both protocols will manage your LPs automatically without you worrying about rebalancing and LP range management. The fees will be reinvested back into the LP, increasing your LP position over time.

You can stop here, or if you're feeling adventurous, go for a leveraged strategy.

...

➠ Leveraged Strategy

Please note that leveraged strategies are high-risk with the possibility of losing your principal through liquidation. Make sure you understand what you're doing.

For leveraged strategies, there are more nuances, but I'll use vbWBTC as the starting asset.

✧ Go to the borrow section in @MorphoLabs and borrow uSOL (LTV is 86%) with vbWBTC as collateral at approximately 1% borrow rate. I usually go with 60-70% LTV.

✧ With uSOL in hand, you now have the freedom to choose your strategy and LP. For me, let's swap 50% to AUSD, but rather than using Sushi, try swapping on @wolfswapdotapp to get rewards from swapping and other benefits.

✧ Once you have AUSD, you can pair it with WETH on Sushi, and you're all set. You can choose other assets based on your preferences; just ensure you receive double rewards on your targeted LP to optimize yield.

And don't forget that you can claim the rewards regularly or use the LP management protocols mentioned above if you want to convert all rewards into LP positions.

...

— Wrap-Up

Katana, as a DeFi-focused L2 blockchain, offers many strategic opportunities to explore DeFi. The great thing is that many blue-chip assets here earn more yield than their original counterparts.

I will update with more strategies as additional protocols go live on Katana.

26.55K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.