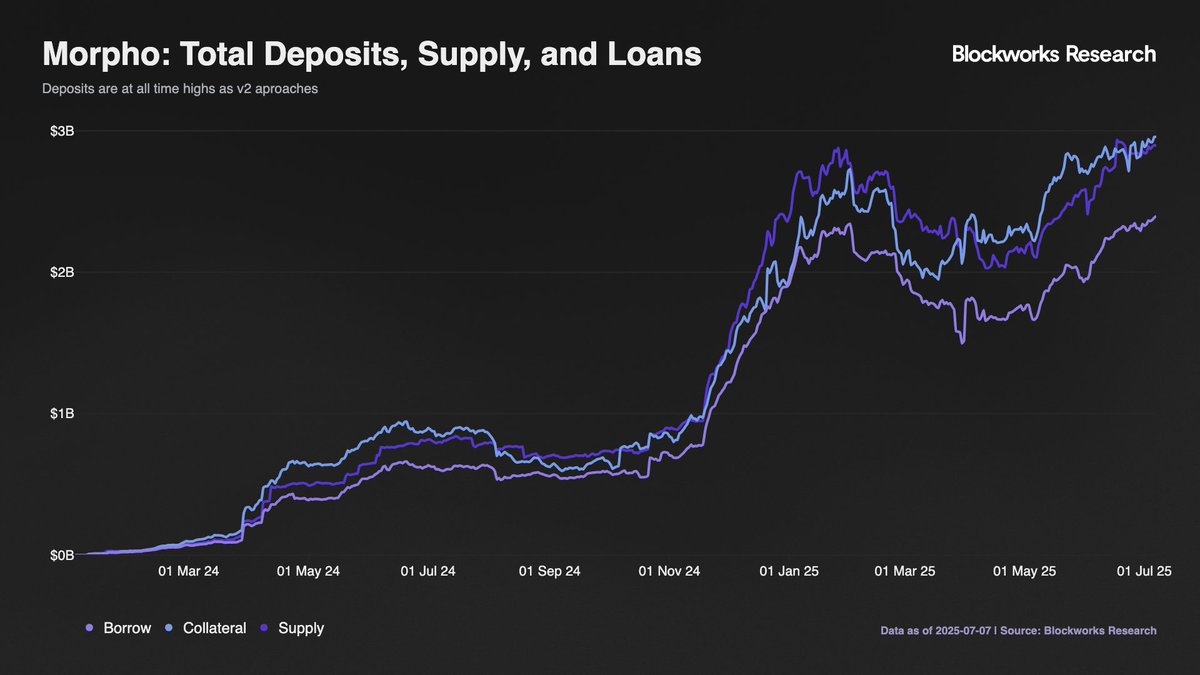

1/ With deposits, supply, and loans at all time highs, @MorphoLabs is in a strong position heading into the rollout of V2.

The new architecture will allow borrowers and lenders to propose customized loan terms, enabling functionalities such as fixed-rate, fixed-term loans and the use of multiple assets for collateral.

2/ The transition to V2 addresses the requirements of institutional participants by providing predictable financial terms and features that support compliance.

The protocol incorporates open market pricing discovery, optional Know Your Customer (KYC) whitelisting, and is designed for future cross-chain settlement capabilities, connecting decentralized and traditional financial systems.

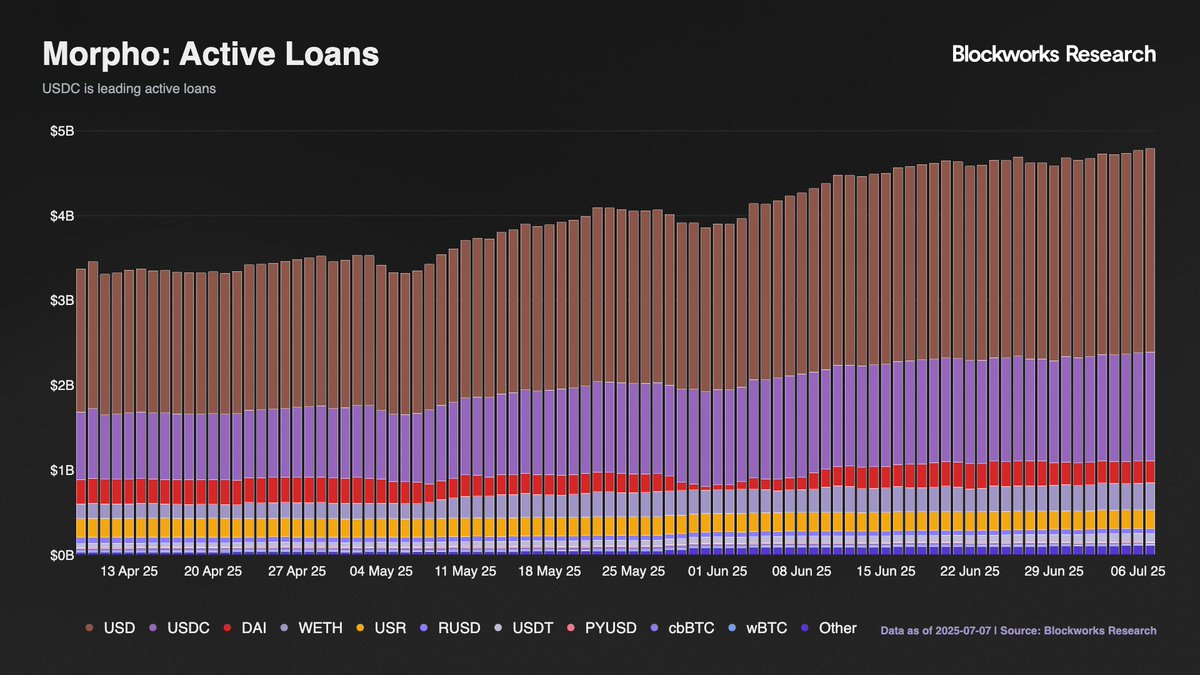

3/ The V2 rollout will be phased to ensure security and stability. With a strong foundation of active loans on the current protocol at nearly $5B, Vaults V2 will launch first.

Markets V2, with the full feature set, will follow after the completion of all security audits.

4/ Security is a primary consideration in the deployment strategy.

Morpho Labs has mandated that all components of the protocol undergo thorough security audits prior to their public release.

This phased rollout ensures that new functionalities are introduced in a secure and controlled manner.

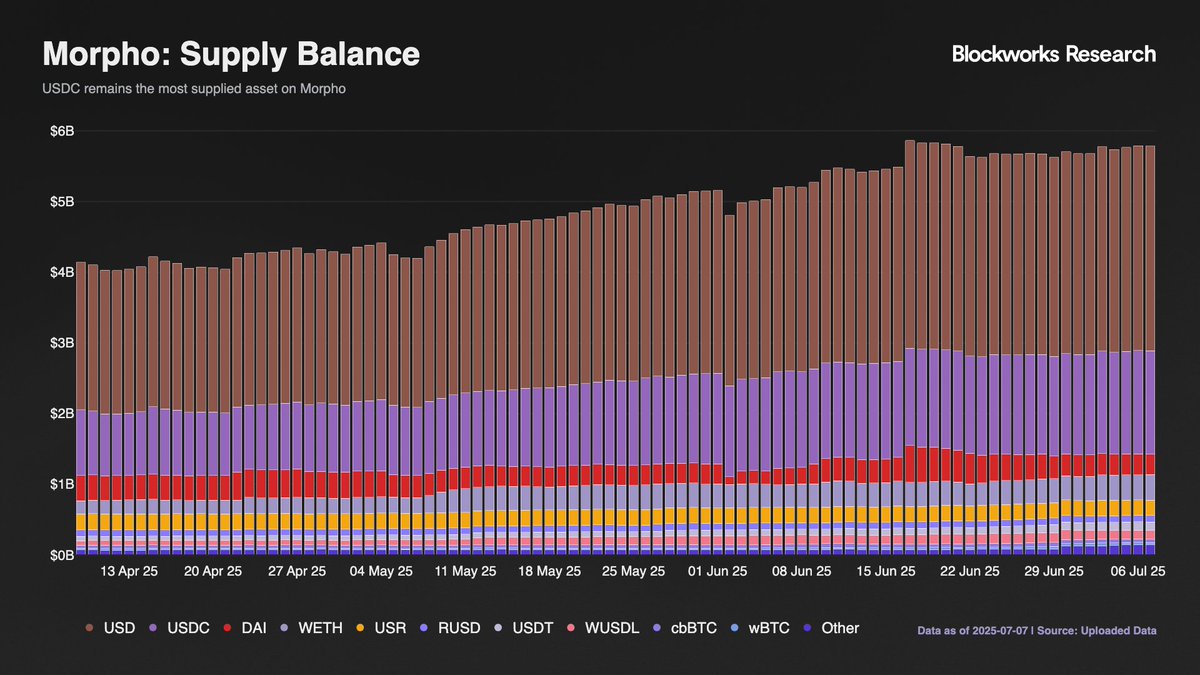

5/ With a robust supply balance providing deep liquidity with nearly $6B in supplied collateral, early access to Vaults V2 will be given for institutions and power users.

General access and the full Markets V2 launch will follow in the coming weeks as the rollout progresses, per Morpho.

6/ With over $5.8 billion in deposits and established integrations with platforms such as @Coinbase, Morpho is advancing its position from a lending optimizer to a full-stack lending protocol.

Subscribe to @blockworksres to view our comprehensive Morpho dashboard.

11.37K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.