1/ BTC derivatives form a foundational layer in any thriving ecosystem.

Their expansion signals a new frontier in unlocking latent DeFi potential.

@SuiNetwork remains early-stage w/ only a few key players.

Now, @tBTC_project is entering the arena.

Insights & opportunities👇

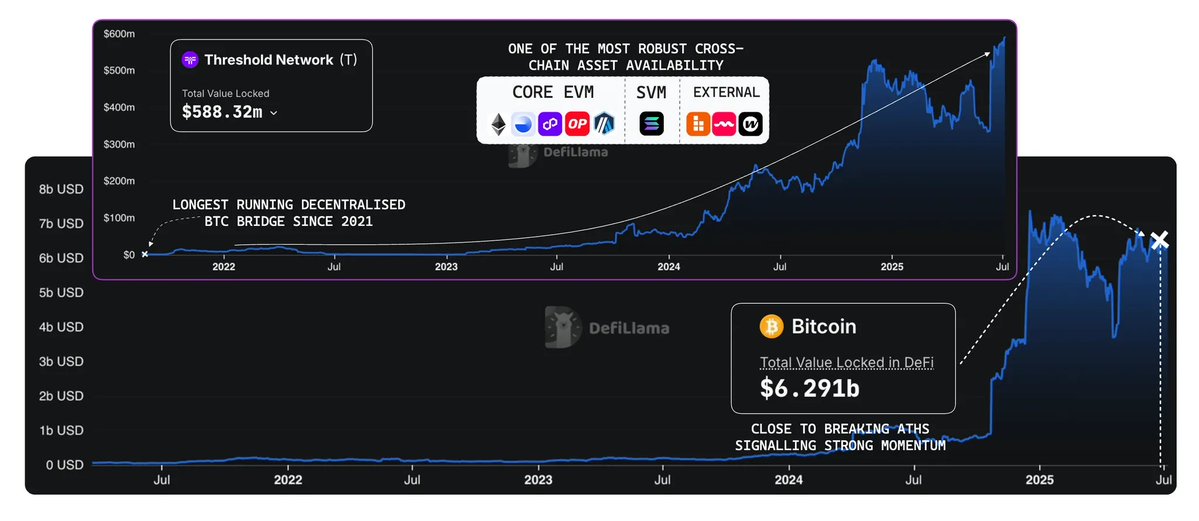

2/ Let’s set the stage.

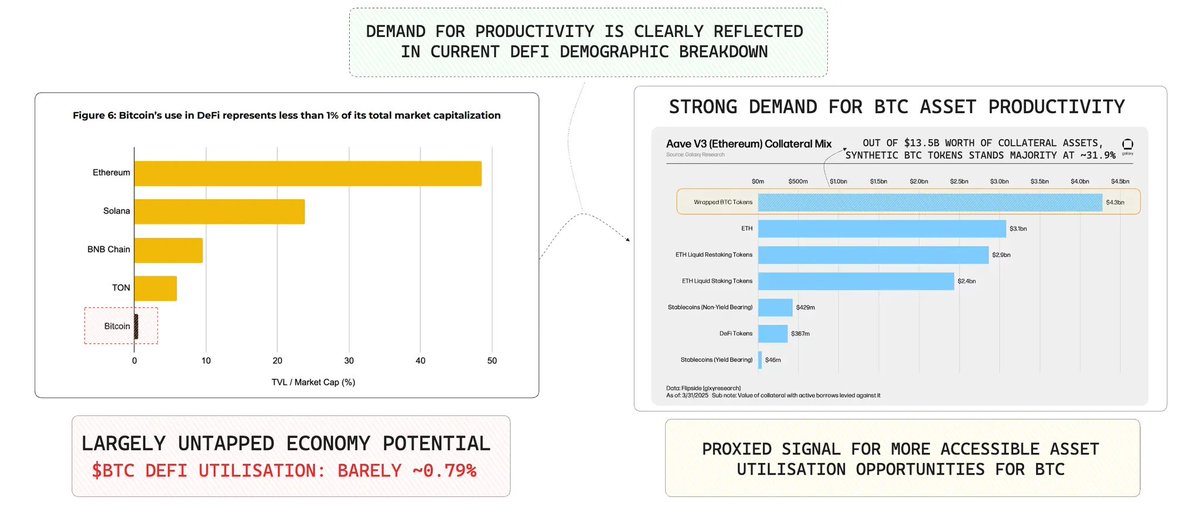

BTC remains crypto’s most pristine asset & its footprint across DeFi is undeniable:

🔹 ~31.9% of Aave’s TVL is BTC-backed

🔹 $WBTC leads BTC derivatives with ~$14B in TVL

*where custody & control are primarily centralised under Justin's Sun owned entity Bit Global (wBTC mint/burn rights).

Even with the momentum BTC-Fi gained in 2024, only 0.79% of BTC is actively earning yield.

Moreover, BTC-Fi today is largely permissioned & trust-based which ironically is the antithesis of Bitcoin’s foundational ethos.

The case for native decentralised BTC yield is clear & still massively underserved.

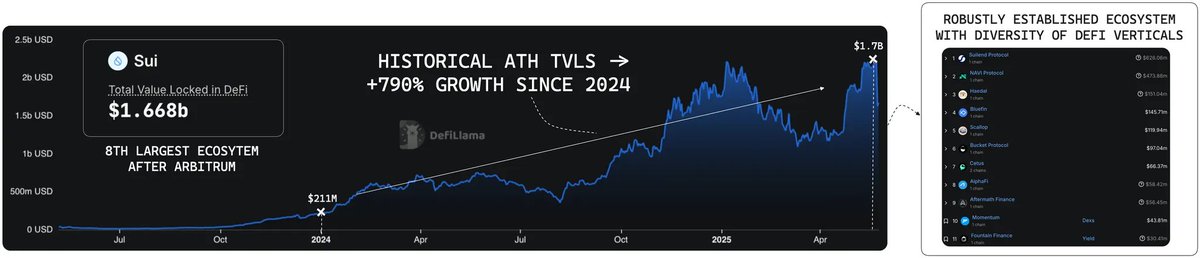

3/ As the DeFi landscape matures, here comes the next opportunity:

Emerging alt-VM ecosystems like @SuiNetwork.

Sui is already showing signs of organic demand (+790% TVL since 2024) w/ a diverse ecosystem even w/o a robust BTC-Fi adoption yet.

But the upside isn’t priced in.

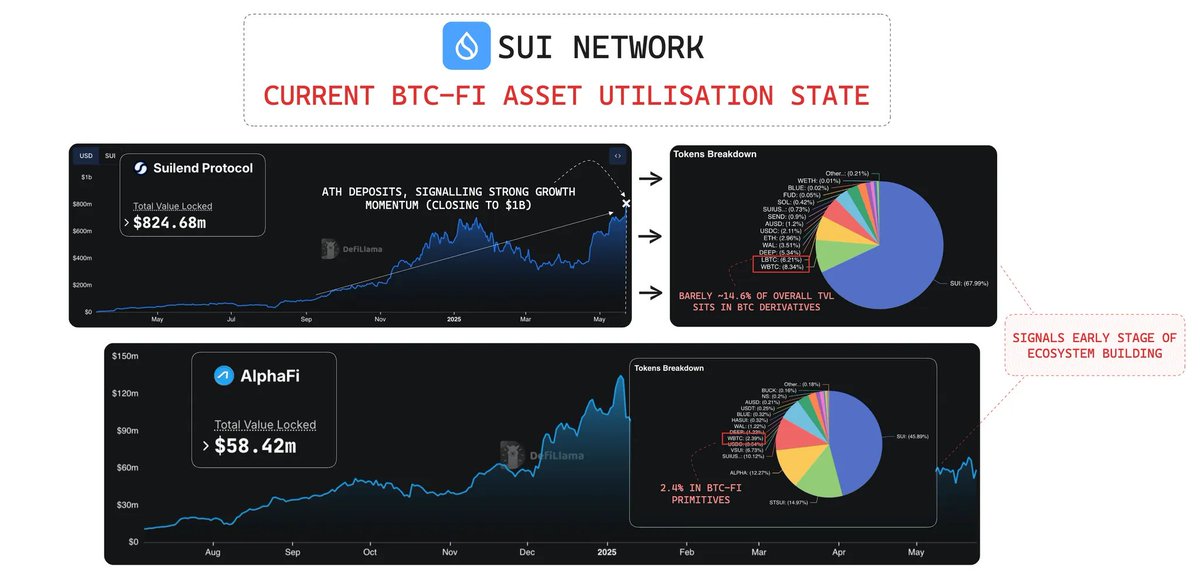

4/ Here's the cur. state of BTC-Fi on @SuiNetwork:

🔹 @suilendprotocol: Only ~$100M in BTC-based deposits (14.8% of TVL)

🔹 @AlphaFiSUI: Just 2.12% of TVL is in $WBTC

These numbers scream one thing: nascent, underexposed, ready for growth.

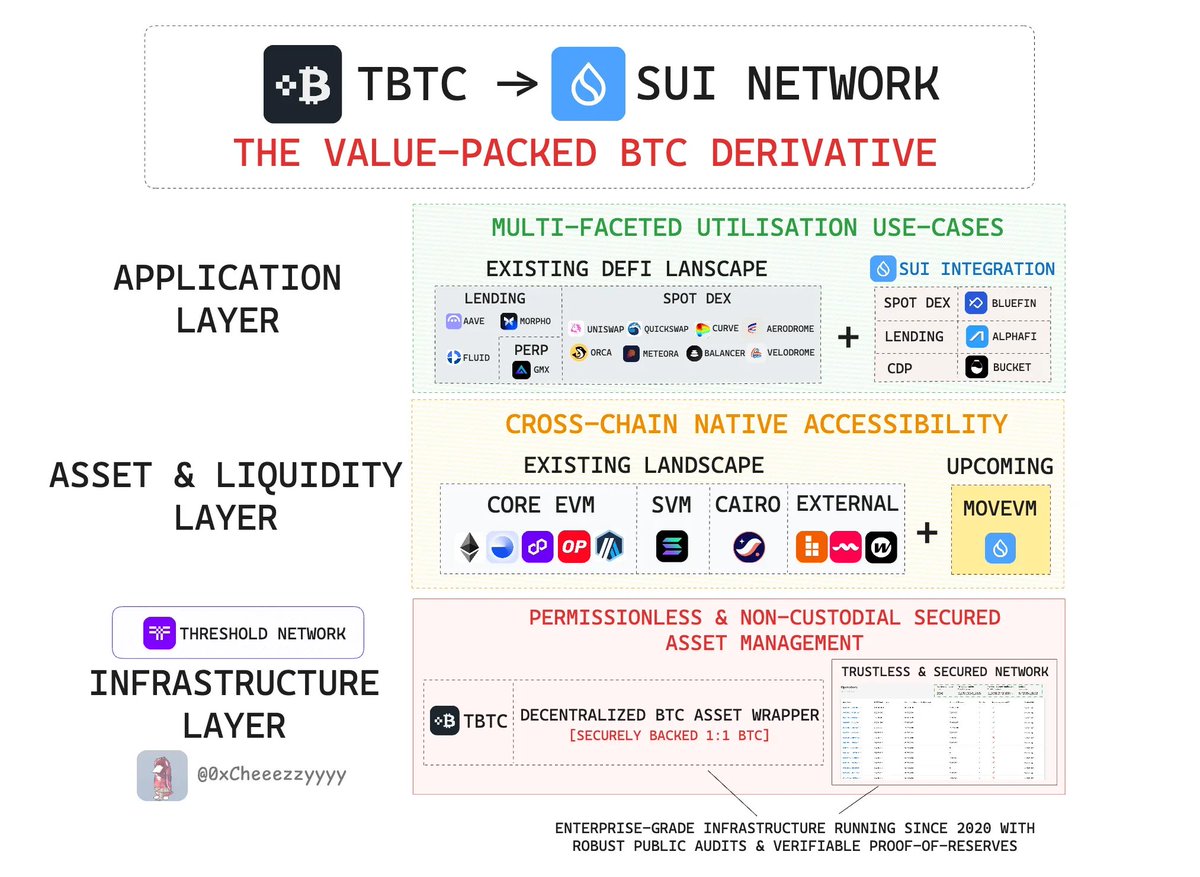

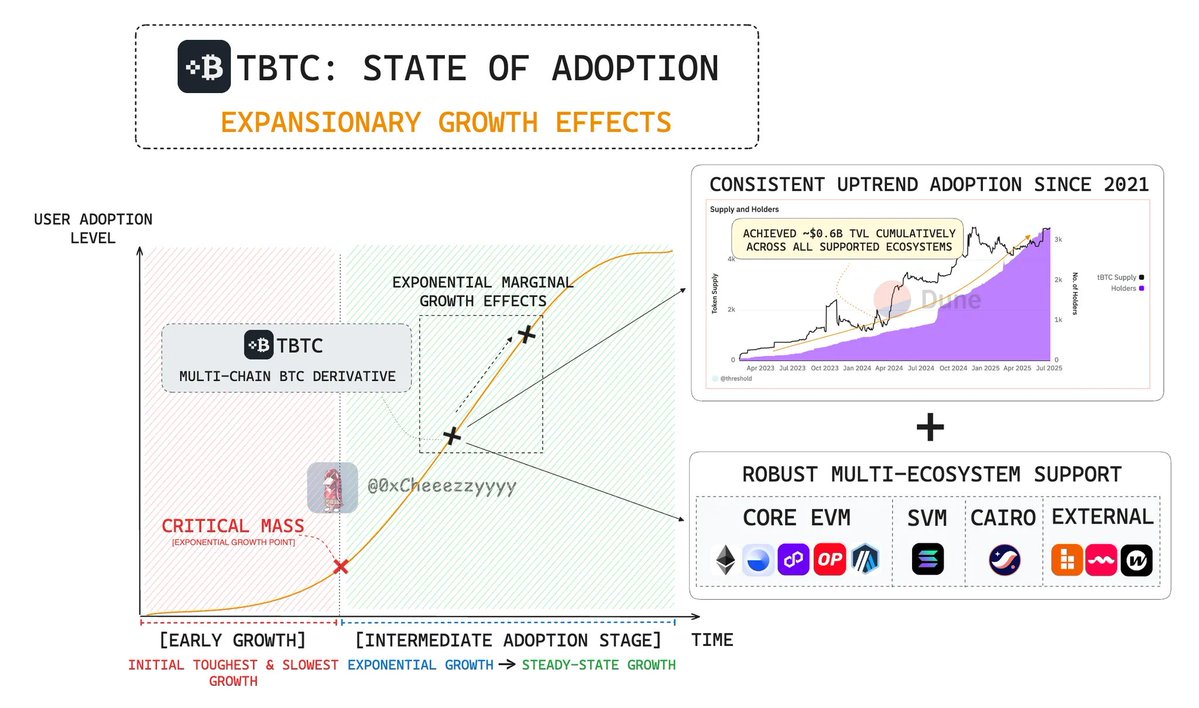

5/ This is where @tBTC_project comes in to capitalise on this opportunity.

$tBTC powered via @TheTNetwork infra enables:

🔸Fully decentralised native minting

🔸Built since 2021 w/ multi-layered audits

It's long-standing resilience in bear & bull has proven to be a trusted & scalable exogenous BTC primitive.

With BTC-Fi trending toward new ATHs ($6.3B+), the strong momentum deserves a shift in decentralised alternatives.

This isn’t just another wrapper, it’s Bitcoin’s full-stack gateway.

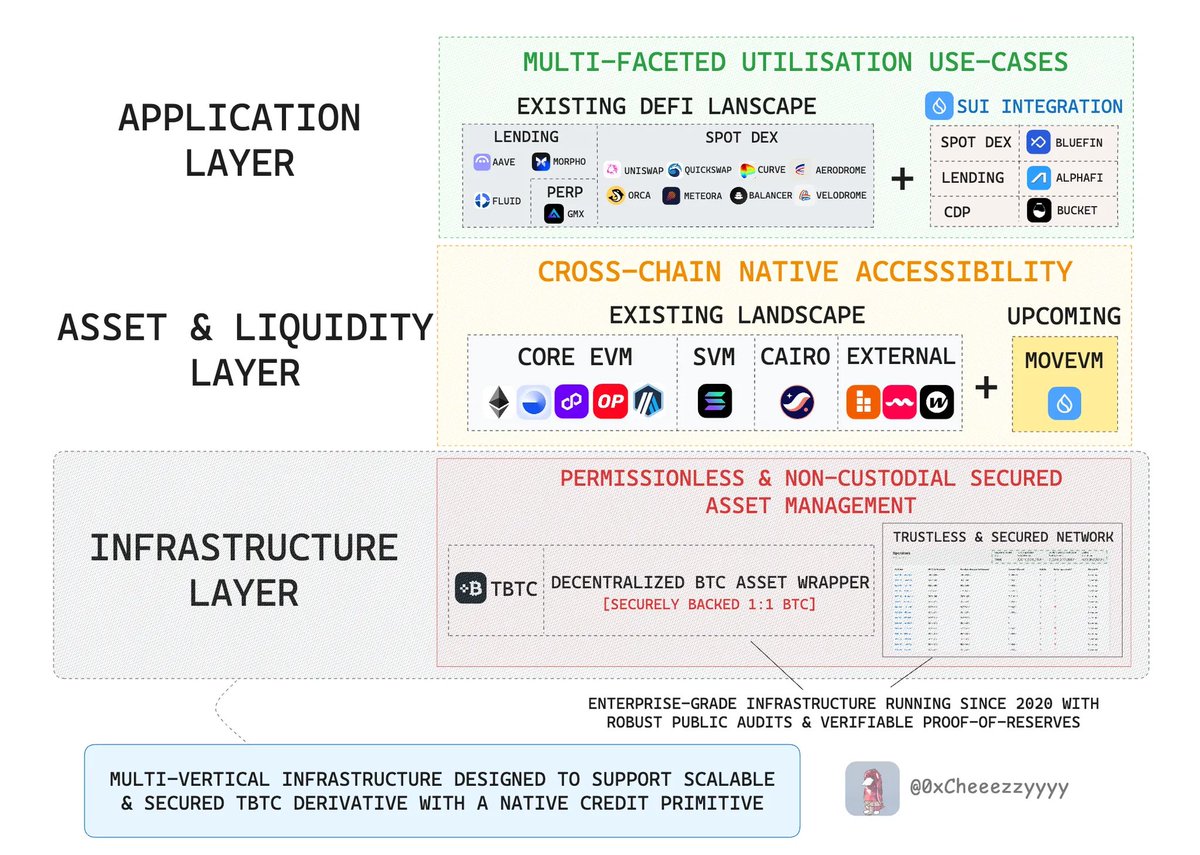

6/ With $tBTC, @SuiNetwork unlocks the full value stack for BTC-native assets.

This brings a virtuous flywheel across DeFi verticals driven by composability, secured by Bitcoin’s most battle-tested trust layer.

Asset availability → More utility → More adoption.

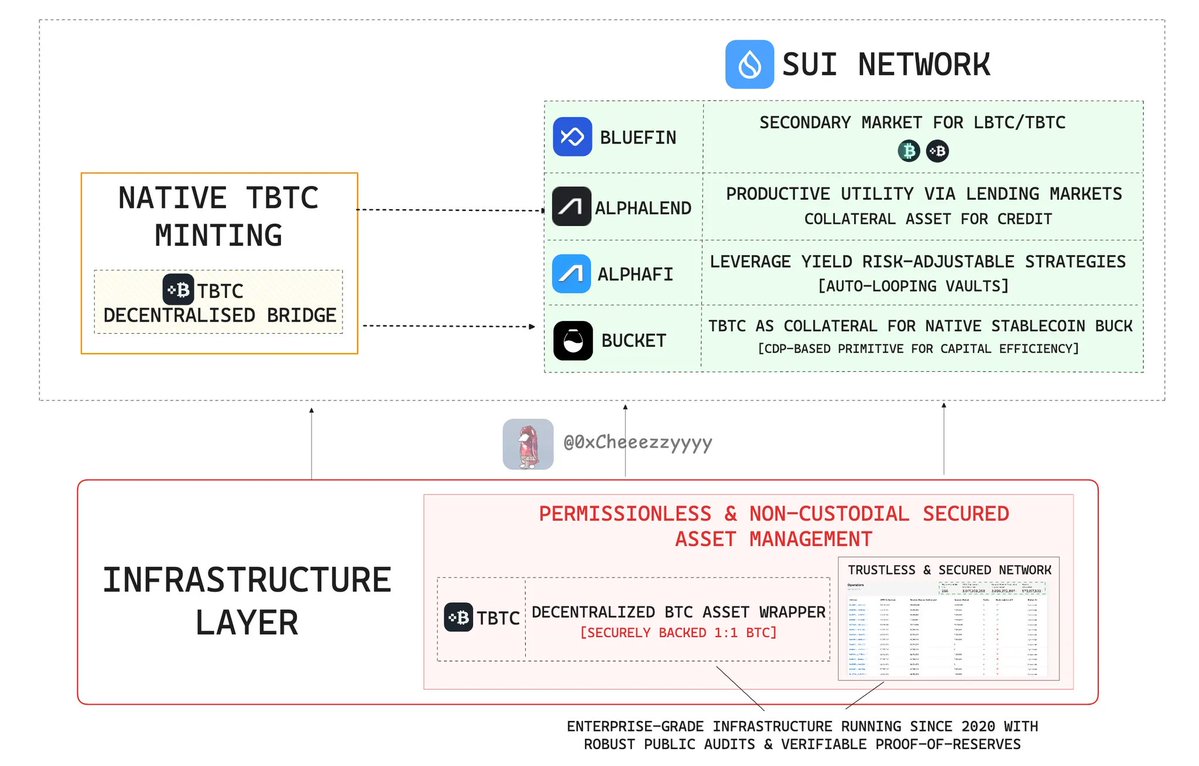

7/ $tBTC on @SuiNetwork presents strong utility across the stack:

🔹 @bluefinapp: Spot markets via LBTC/tBTC pair (live with $1M TVL + ~40% APR in $BLUE & $stSUI)

🔹 @AlphaLendSui: BTC-backed credit layer to unlock liquidity (live with ~39% APR)

🔹 @bucket_protocol: CDP minting of $BUCK with tBTC as collateral (coming soon)

🔹 @AlphaFiSUI: Leveraged yield risk-adjustable strategies via auto-looping vaults (coming soon)

This forms the solid start for a credible BTC-Fi presence + utility on Sui's ecosystem.

To get started on live integrations:

1⃣ Bluefin’s TBTC/LBTC Pool:

2⃣ Alphalend TBTC:

8/ Establishment across matured ecosystems w/ robust productivity serves as quality asset availability.

$tBTC is heavily integrated across top-tier DeFi protocols proving strong utility.

Any expansionary effect into a new ecosystem gives a superior edge in terms of credibility + utility.

9/ BTC-Fi is early on @SuiNetwork.

$tBTC unlocks credible BTC onboarding w/ strong DeFi integrations are live or underway.

@TheTNetwork offers an unmatched track record + infra robustness to enable a valuable full-stack BTC layer.

As the ecosystem matures, $tBTC is likely to form a significant part of it.

10.01K

77

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.