In a market full of hype and complex points farming, one projects stands out for so many reason:

You get:

> Clear yields

> Daily compounding point rewards

> Overcollateralized backing behind the $USDf synthetic dollar

> Two simple strategies for earning

The numbers are better🧵

In 2024, DeFi was flooded with points farms that offered no real yield, just speculative airdrops.

Over 60% of active wallets chased these empty promises, locking up $3B+ in TVL with no clear reward value or timeline.

@FalconStable fixes this.

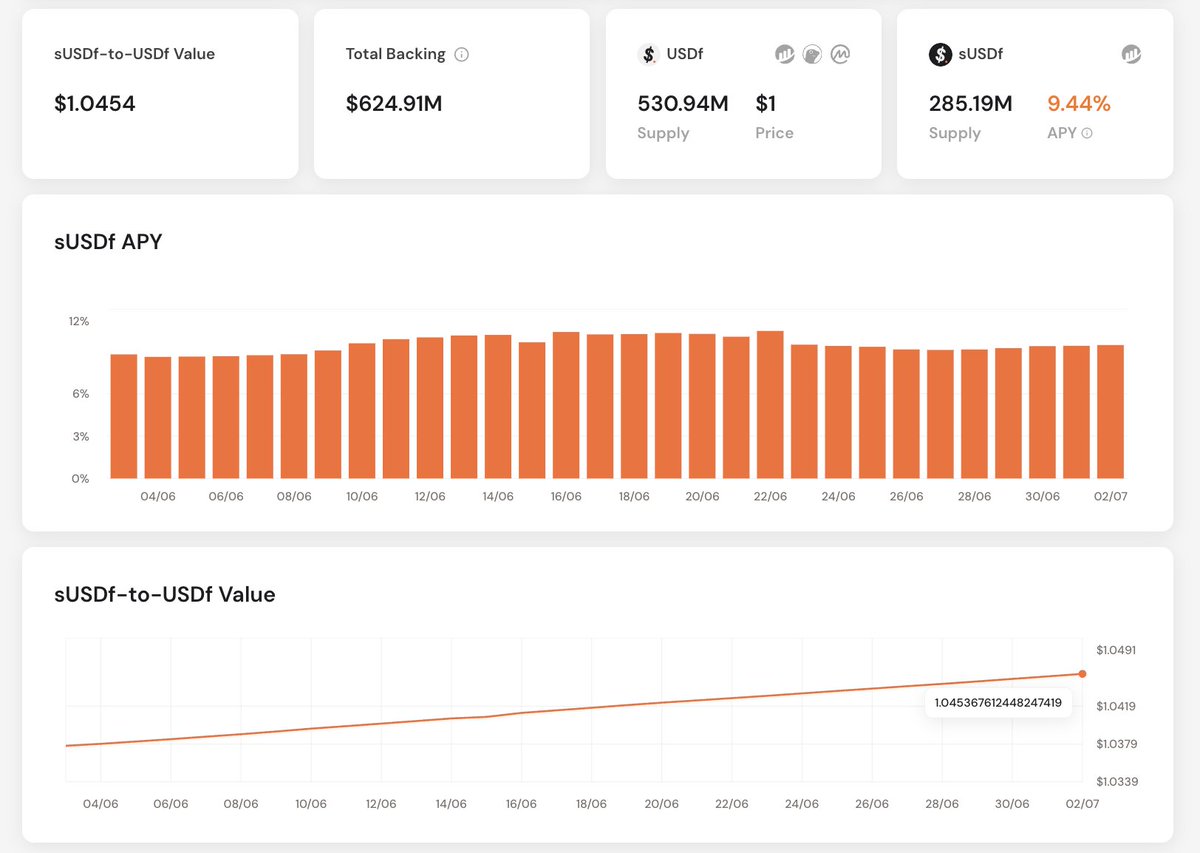

Now, Let’s Run the Numbers

> Say you buy $1,000 worth of YT $sUSDf (~40k YT tokens) on Pendle.

> $sUSDf earns 5-12% APY depending on the market

> You earn Falcon Miles: 60x per day

> Hold for 90 days: 40000 YT tokens x 60 x 90 = 216M Miles

> If each Mile is worth $0.00000625, that's $1350

> Total Return: $1,350 on $1,000 in 3 months. That's 135% return!

> No guessing games. Just simple, compounding yield

This is the kind of setup early users of Kamino and EigenLayer caught before they took off.

● The Structure Behind the Yield

Falcon’s core architecture centers around a dual-token model:

> $USDf: An overcollateralized synthetic dollar

> $sUSDf: A staked version of $USDf that earns yield.

This dual structure unlocks two complementary yield strategies:

1️⃣ Yield Tokenization

Split your $sUSDf or $USDf into YT and PT through Pendle.

Buy YT directly to:

> Earn high variable yield

> Skip principal exposure

> Stack Falcon Miles (36x $sUSDf LP and 36x YT-sUSDf daily)

This is the best for users who just want pure yield exposure.

2️⃣ Liquidity Provision

Provide LP on Pendle with $sUSDf or $USDf and earn:

> Swap fees

> Staking yield from the underlying

> $PENDLE or other protocol incentives

> Falcon Miles: 36x $sUSDf LP daily depending on pool

LPs gain more surface area for reward accrual. Especially when combined with flexible exit via Pendle AMMs and no lockups.

● What Are Falcon Miles?

Every action on Falcon earns you points called; Miles.

Here’s the current multiplier:

• LP $sUSDf: 36x

• YT $sUSDf: 36x

• Lending: 30x

PS: Miles will be criteria for airdrop

● Potential Airdrop

Let’s use a conservative estimate:

> Airdrop = 5% of supply

> Valuation = $250M FDV

> Total Miles = 2T

> Value per Mile = $0.00000625

And that’s on top of your regular yield and LP rewards.

● Here’s How To Maximize Your Capital By Looping:

Use my link:

Each layer earns points ; so the loop becomes a compounding engine.

● Conclusion

@FalconStable isn’t chasing hype.

It’s building a real DeFi engine; one where stable yield, compounding rewards, and user incentives all align.

That’s rare. And you shouldn't fade it!

6.21K

94

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.