Not-so-daily Vol 2025-07-07

Staying long bias, but staying hedged for now.

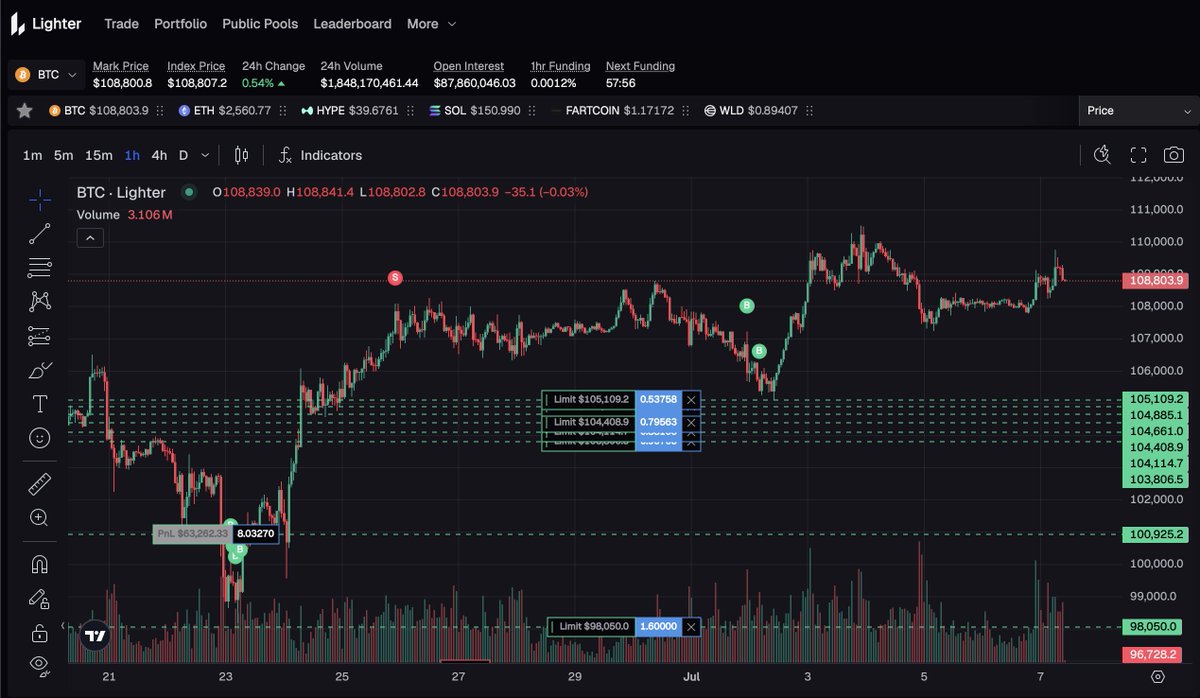

BTC

Think BTC is still in summer mode, just paying my funding while keeping longs.

Adding on larger dips for potential run up in Q3Q4

CB and Koreans all on holidays, so no need to rush things.

ETH

I like how ETHBTC is just creeping up over the past few weeks following Tom Lee's new DAT. Looking quite healthy.

Positioning-wise same with BTC; Long and adding on dips

SOL

Not seeing much demand here despite the PUMP token launch in July.

Price looks janky and books feel thin.

Regaring PUMP, consensus seems to be to fade it, so probably a decent long if you can catch it early enough.

Also some PvP going on as Bonk narrative seems to be taking Fartcoin attention.

Seems like the pre-game party before the main event.

MACRO

In the words of Lyn Alden, there is no stopping this debt train.

Pricing in of BBB and rate cuts might hit trad markets first and crypto may end up playing catch up, so staying long bias but no rush and keeping short hedges.

POSITIONING: L/S 2.5:1

- Big Long : BTC ETH

- Small Long : HYPE

- Shorts : ENA SEI SUI BERA APT TRUMP WIF etc

🕹️Currently trading mostly on @Lighter_xyz

Closed beta. Zero-fees. Points. ZK-tech. 70% apy LP-Vaults. Backed by big names.

DM for access as I'm running short on codes. Only serious players apply.

19.26K

55

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.