Arbitrage/Hedging on exchange rate differences, with a profit margin of around 6%!

Yesterday afternoon, I was still complaining that @Berachain was not optimistic, and the iBGT exchange rate from @InfraredFinance kept falling.

Last night, Infrared's official Twitter posted a long article, stating the protocol's security while revealing that the unstake for iBERA is about to go live.

Although the update for iBERA cannot solve the exchange rate difference issue of iBGT, there are still opportunities.

➤ Logical Analysis:

1) iBERA is the liquid staking token for BERA;

2) The theoretical relative value of iBERA to BERA gradually increases over time, with a current annual value growth of 4.36%;

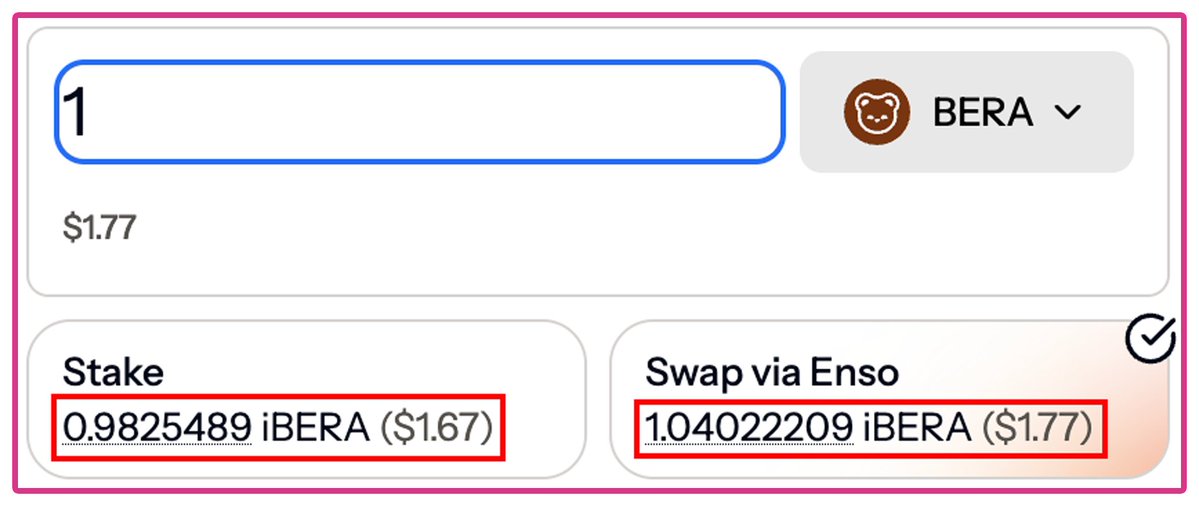

3) Currently, through Infrared's official staking channel, 1 BERA can only get 0.9825 iBERA;

4) However, since the official redemption (unstake) channel for iBERA has not been opened, the relative value of iBERA to BERA has been determined by the market;

5) About two months ago, after Berachain modified the emissions, the mining rewards for iBERA plummeted, and the demand for iBERA was weakened, keeping its ratio to BERA above 1;

6) Currently, based on market prices, 1 BERA can get 1.0422 iBERA;

7) Therefore, it is clear that obtaining iBERA through both the official staking and market liquidity channels presents a price difference of 6%.

8) Clearly, there is an arbitrage opportunity here, and the key lies in the opening time of Infrared's official redemption.

Based on the common liquidity token redemption mechanisms, it is likely that a fee of around 0.1% and a certain waiting time will be required to redeem iBERA at the official staking ratio of BERA, which would allow the market price of iBERA to rise to the official staking price.

The only uncertainty here is the timing of the official redemption opening.

If redemption opens in a week, then the APR would be around 312%.

If redemption opens in a month, then the APR here would be about 72%.

Thus, using borrowing or contract hedging for BERA is likely to be a stable happiness! (Currently, the borrowing APR is around 20%, and the actual APR after a month of redemption would be 52%, faster would be higher)

To elaborate a bit more on Infrared, the importance of its two LST tokens in Berachain is extremely high. From Berachain's perspective, it must stabilize the exchange rates of these two LST tokens.

Official Tweet:

Note: The above is for information sharing only and is not investment advice. Please do your own research!

DeFi Enthusiast: BitHappy

Show original

10.02K

51

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.