Truth be told, in this DeFi world where even "stablecoins" are starting to roll up yields, I rarely feel like "this thing is not easy" for a certain protocol. But this time, @levelusd's lvlUSD really made me stop, and I couldn't help but take a few more looks and dig deeper.

Web3 DeFi players often say that "stablecoins are the blood of the chain", but in reality, most stablecoins are just delivering liquidity, and few people really care about "whether it is working for you and making money for you", and Level is rewriting this narrative.

Level @levelusd is a protocol endorsed by Dragonfly and Polychain, but its ambitions go far beyond "who's behind it". Its core stablecoin, lvlUSD, is an asset fully backed by USDC and USDT, and each of them is continuously working and generating income in blue-chip lending protocols (such as Aave, Morpho). It sounds like DeFi 101, but what really struck me about it was that it had all three of its best: low risk, high yield, and on-chain transparency – very rare and rare.

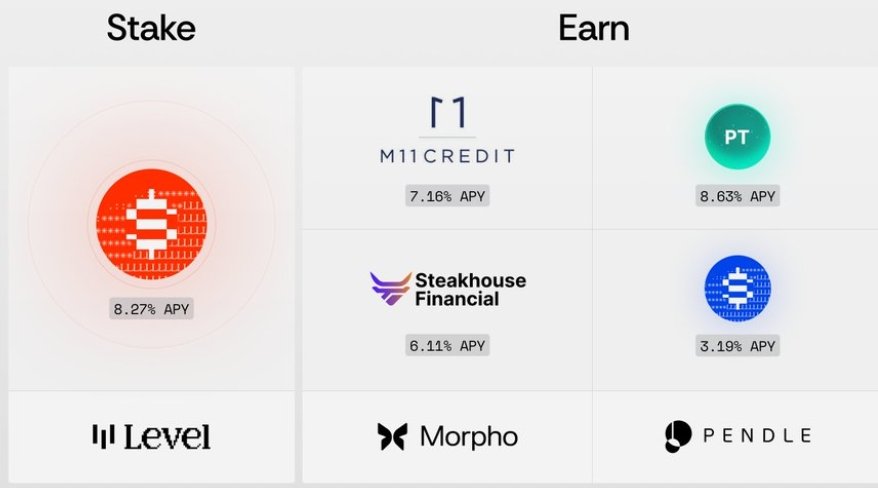

Even better, the Level doesn't "lock" earnings into a closed system. It goes a step further with slvlUSD, which is a yield vault (based on the ERC-4626 standard) where you can stake lvlUSD and directly participate in the distribution of yield - what's even more amazing is that since only about 30-45% of lvlUSD is currently staked, that is, fewer people share all the gains, and the annualized yield of slvlUSD naturally "rolls up".

I don't like to talk about the rate of return, because many projects have uncontrollable high risks behind them. But I agree with Level's strategy - all the income comes only from blue-chip lending protocols like Aave and Morpho, and there is no "if it crashes" anxiety of DeFi Lego's over-stacking. As an old Web3 user who has been struggling in a bear market, this sense of security is, to be honest, more important than the yield.

Not to mention, the integration ability of Level is also a must. lvlUSD and slvlUSD have penetrated into the core ecosystems of Morpho, Pendle, Spectra, Curve, etc., making this "stablecoin + income" system truly have DeFi native liquidity and application capabilities. For example, you can borrow USDC with lvlUSD collateral on Morpho, and then go back and continue to mint lvlUSD to form a stable cycle of compound interest strategy. Or use the slvlUSD and PT/YT product combination on Pendle to achieve yield locking + secondary trading, and even in some pools, the liquidity depth of the Level has exceeded aUSDC.

It's been a long time since I've seen a project so systematic, planned, and not pompous, and not relying on airdrops to cut leeks. It's not about attracting attention with emotional hype, it's about moving you through product mechanics and actual integration.

At the end of the day, Level doesn't feel like a short-term flashpoint, but a deep, future-proof infrastructure for stable income. In this new cycle of "wanting to be stable, but not lying flat", the value of the level may be far from being truly discovered

🌟🌟🌟 The next wave of stable earnings that truly "eats on technology" may start with lvlUSD. If you're ready, don't just "wait and see", get stuck on the chain, and always get better as soon as possible.

After reading the introduction of Lao Cha, it is estimated that you also want to start to understand the level and participate, the following Lao Cha has compiled a simple tutorial for reference: Casting and Pledge Tutorial:

1: You only need to prepare a wallet that supports EVM (such as MetaMask), deposit a small amount of ETH in the wallet as a gas fee, and prepare any asset such as USDC, USDT, ETH, WBTC or USD0, and then visit the official website to get started.

Step 2: First, click "Sign In" in the upper right corner to connect your wallet, then select "Buy" in the left menu bar to exchange your assets for lvlUSD. After the transaction is completed, the system will pop up three options: you can choose to stake lvlUSD to earn Earn Yield, participate in XP Farming, or go to Curve to provide LP to get more incentive points (20x XP).

3. If you choose to stake reward, just click "Earn Yield", enter the amount of lvlUSD you want to stake, click "Approve" to authorize, and then click "Stake" to confirm the transaction, you can get slvlUSD, and automatically receive compound interest every Thursday (⚠️⚠️ Note: A 3-day cooldown period is required to unstake).

Four: If you prefer to play with points, click "Farm" on the left, find the lvlUSD line, click the "+" sign, enter the quantity, authorization, and deposit to start earning XP at a 10x multiplier (if you provide LP, you can also enjoy 20x rewards). Finally, if you want to see the rankings, go directly to the "Leaderboard" page to check your farming results and current ranking.

Staking to get income, farming to get points, and providing LP rewards to be full, so easy? Visit now

Finally, I saw that they released a cooperation between Level and Morpho @MorphoLabs, and users can use lvlUSD collateral to borrow USDC in Morpho, with a maximum borrowing ratio of 91.5%, but it is recommended to keep it lower in case of liquidation. The borrowing interest rate is about 1.2% annualized, and you need to pay attention to the cost and risk. The borrowed USDC can continue to mint lvlUSD and achieve recycling. Through staking, liquidity mining, etc., you can also obtain a high multiplier Level XP, which greatly improves the efficiency of asset use. This cross-protocol integration not only enhances the utility of lvlUSD, but also brings more possibilities for users to earn income, which is worth trying!

Show original

38.43K

164

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.