To add, if you only look at the fundamentals, Allora is indeed a very glamorous project

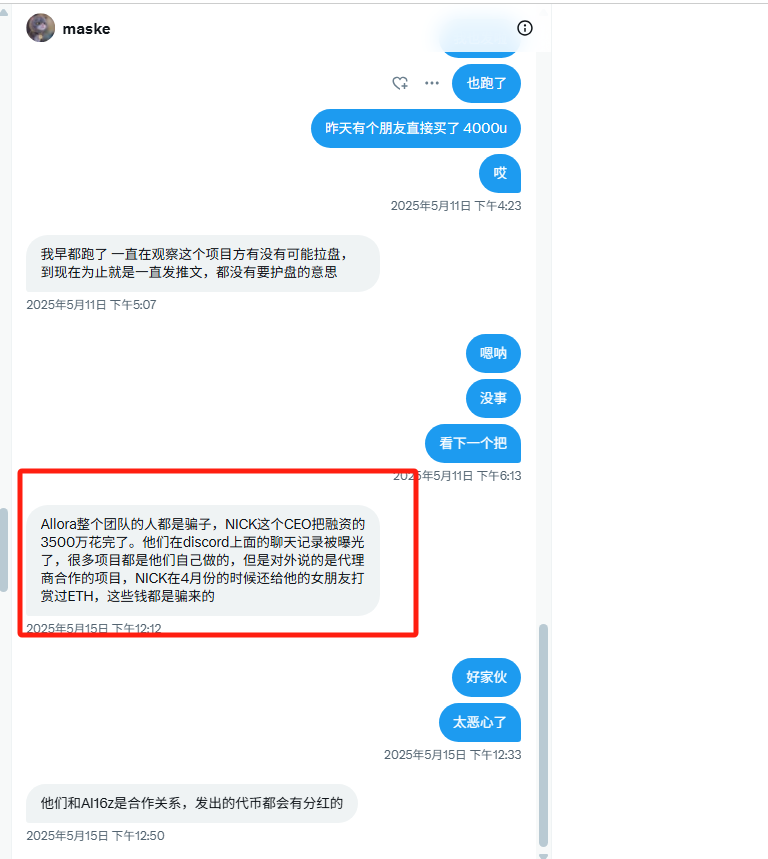

But if you get involved, you find that the whole team is a huge liar, the scam project

@AlloraNetwork

@Squidllora – used to advertise the use of their predictive model to trade SOL tokens and rebuy $SQUID tokens with proceeds

A month has passed, nothing has happened, only a non-stop selling

『Allora Project Analysis』

Disclaimer: This article is not extensive, and aims to explore and analyze the project in a multi-dimensional and rational manner. It is summarized at the end of the article

1️⃣ Project positioning

Allora's core positioning is the infrastructure protocol for decentralized AI models to coordinate the network

It addresses a series of problems in the field of AI models, such as the phenomenon of "hallucinations", information inefficiency, etc. By optimally aggregating the outputs of multiple models, it continuously produces intelligent results that are better than any single model, and intelligent services with context-aware capabilities are also known as "inference synthesis" mechanisms

Here is also a brief introduction to the phenomenon of "hallucinations", which is still common in most AI models today. Specifically, it refers to the AI model "making up" or "" content in order to complete a task, which looks like it is real, but it is actually fake. Like what

You ask an AI model, "What paper did Albert Einstein publish in 2000?" ”

The AI replied: "He published the paper "Space-Time Distortion and Quantum Gravity" in 2000. ”

However, the reality is that Einstein died in 1955, and it was impossible to publish a paper in 2000

2️⃣ Team background

The overall background of the team is okay, and the core members basically have 6-7 years of industry experience, and cover a number of well-known projects. However, it has experienced a wave of blood exchange

➣ Nick Emmons @nick_emmons, co-creator and CEO. Prior to that, he was the chief blockchain engineer at John Hancock, a century-old life insurance giant in the United States, and then started his own business as Allora in 19

➣ Bryn Bellomy, Co-Founder & CTO. Former head of core development at Chainlink and founder of ConsenSys Venture Studio

➣ Seena Foroutan @SeenaForoutan, Chief Commercial Officer. Prior to that, he spent 3 years as Global Head of GTM at Coinbase and 3 years at Chainlink as Global Head of BD, and currently chairs a consulting firm in addition to Allora where he has worked on several high-profile projects such as LayerZero, Ondo, Nillion, Eclipse, and more

➣ Diederik Kruijssen, Research Leader. CDO of @Nabu, who was once one of the most cited astrophysicists in the world, (over 270 peer-reviewed publications; Over 14000 citations)

➣ Tayeb Kenzari, Head of Marketing. Previously, he was in charge of Marketing at WIF @dogwifcoin, Head of Accounts at design firm R/GA @RGA, Head of Accounts at creative firm Wunderman Thompson @vml_global, Head of Accounts at brand marketing firm Razorfish @WeAreRazorfish, and founder and consultant of a strategic growth firm. Overall Web2 experience is the majority

➣ Francis Kang @DeGeneralissimo, Head of Asia Pacific. He was the head of Berachain Korea and the conference leader of Korea Blockchain Week

➣ Michael Zacharski, Head of Marketing. Previously, he was the BD Lead and @Ten-X BD at Chainlink

3️⃣ Financing

So far, there have been four rounds of public financing, with a total of $33.76 million raised

➣ $1.26 million in the first seed round, led by Blockchain Capital

➣ The second round raised $7.5 million, led by Framework Ventures, CoinFund, Blockchain Capital, and multiple angel investors such as Aave co-founder Stani Kulechov, Synthetic founder Kain Warwick, Messari founder Ryan Selkis, etc

➣ $22 million in the third round of funding, led by Polychain

➣ $3 million in the fourth round of strategic funding, with participation from Archetype, CMS Holdings, Delphi Digital, ID Theory, DCF GCD

➣ Among them, Delphi Digital participated in three consecutive rounds of financing, Framework Venture, CoinFund, Blockchain Capital, Mechanism Capital, CMS Holdings, and Slow Ventures participated in two rounds of financing

➣ It is important to note that the first three rounds of funding were obtained in the previous cycle, and the latest strategic funding was obtained in 24 years

———— The following is purely speculation————

Based on this, we can know that:

➣ There is a high degree of overlap between investors in multiple rounds of financing, and institutions are optimistic about the project or team at that time. After all, only bullish will bet multiple times

➣ Combined with the team's background and project positioning, the project should be pivoted from other directions to the current AI field, which is likely to be the main reason for refinancing in 24 years

➣ The benchmark objects that are more compatible in this field are Bittensor @opentensor and Delysium @The_Delysium. The former peaked at 15 billion FDV and now stands at 9 billion FDV; The latter peaked at 2 billion FDV and now stands at 160 million FDV

———— The above is purely personal speculation————

4️⃣ Relevant data and how to participate

As of May, the Allora testnet has generated more than 692 million intelligent inferences, with more than 288,000 participating models covering more than 55 active task topics

There are currently two ways to get involved with Allora:

➣ Participate in testnet activities, such as creating conversations, introducing new ML models into the network, and interacting with other integration projects

➣ Actively participate in community activities, including tweeting, community chat, etc. At present, Allora has cooperated with Kaito, but no specific incentive share has been announced, but the official Twitter will regularly announce the weekly Top 10 yappers

5️⃣ Overall evaluation

Personally, I believe that the hype value is greater than the landing value, and cashing out is the main purpose, and it is not recommended to be too patterned

From the perspective of narrative positioning, it belongs to the Crypto AI infrastructure, which is in line with the current mainstream market trend. And the valuation and imagination of infrastructure projects are much higher than those of application agreements

From the perspective of the team's background, although the experience in the industry is not bad, the team as a whole lacks AI-related experience and has experienced personnel changes. Coupled with the length of the interval between the fourth round of financing, there is a possibility that the original project will be transformed from an application protocol to the current AI infrastructure protocol

From the perspective of financing, the in-depth support and repeated participation of a number of leading VCs in Europe and the United States indirectly indicate that the project has unique advantages or resources, and will have certain bargaining power in the subsequent listing process

Of course, it may also be because the project before the transformation was not doing well, and due to the pressure of having to make a difference, the transition to the direction of AI to improve the valuation and imagination space

Finally, the project has not been TGE since 19 years of development, combined with the current market heat and the recent actions of the project party, such as paying attention to the weekly Top10 yapper. There is a high probability that the TGE will be conducted within this year, and there is a certain possibility that the TGE will be conducted in the next month

16.54K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.