Base bullish continues, Trump pressures the Federal Reserve to cut interest rates Expectations Rise - 0620 Currency Research Weekly Report

🔥 [Cross-chain net inflow TOP 1] @base +42 million

🔥 JPMorgan Chase Enters @base with JPMD: JPMorgan Chase Launches JPMD on the Base Network for a Trial Launch. Base ecosystem tokens are worth paying attention to, including @AerodromeFi, @virtuals_io, @KaitoAI, @GAME_Virtuals, @clankeronbase, etc.

🔥GENIUS STABLECOIN BILL PASSED QUICKLY: THE U.S. SENATE OVERWHELMINGLY PASSED THE GENIUS BILL BY A 68-30 VOTE. The total market capitalization of stablecoins exceeded US$250 billion, with the combined market share of the @Tether_to and @circle reaching 86%.

💡 Featured Content - Stablecoins: Stablecoins and AI Financial Innovation By @Defi0xJeff

【Recommended Reading Links】

credit to @jd950108 @0xfomor

A new issue of the weekly report of the currency research, look 👇 down

It's been five years! The stablecoin track finally ushered in the dawn!

The U.S. passed the GENIUS Act Stablecoin Act 🔥

The U.S. Senate announced the passage of the stablecoin bill last night, which can be said to be the most landmark bill 💪 for us in the cryptocurrency circle

After the passage of the stablecoin bill, it may further benefit the track ecology such as RWA and PayFi, which are closely related to stablecoins!

@ethena_labs @MakerDAO @ResolvLabs @OndoFinance @Ripple @humafinance @levelusd @worldlibertyfi @SkyEcosystem @PayPal

What are the contents of this bill, and what twists and turns have it experienced in between? 👇 🧵 🌪️

To view the full content, welcome to subscribe to the weekly report

Stay on top of weekly macro trends and ambush alpha 💥 together

💡 Broader market movements

Bitcoin exceeded $106,000, and the short-term bulls regained their dominance, driving the mainstream coins to rise simultaneously. The promotion of the U.S. stablecoin bill and the successive interest rate cuts by the European Central Bank have strengthened market expectations for easing policy. Trump pressured the Fed and put forward the idea of a strategic reserve for Bitcoin, adding room for policy imagination. Enterprises are accelerating their allocation to Bitcoin to support the medium- and long-term demand outlook.

📍 @coinglass_com Greed & Fear Index 48 Neutral (-6 percentage points)

📍 @CoinMarketCap Fear & Greed Index 48 Neutral (-6 percentage points)

📍 BTC Dominance 64.84% (Top 64.76%)

💡BTC ETF Net Inflows - Significant inflows this week

This week, BTC spot ETFs saw net inflows of nearly $1 billion, highlighting the rising demand for safe-haven amid geopolitical risks. Institutions mostly adopt arbitrage strategies, buying ETFs and selling futures to lock in profits.

ETF fund flow has a high positive correlation with BTC price, providing evidence for long-term value. However, the short-term macro environment is still full of uncertainties, and whether more institutions will continue to increase their positions in the future, or turn to the sidelines, will become the key to observing Bitcoin's safe-haven status and market risk appetite.

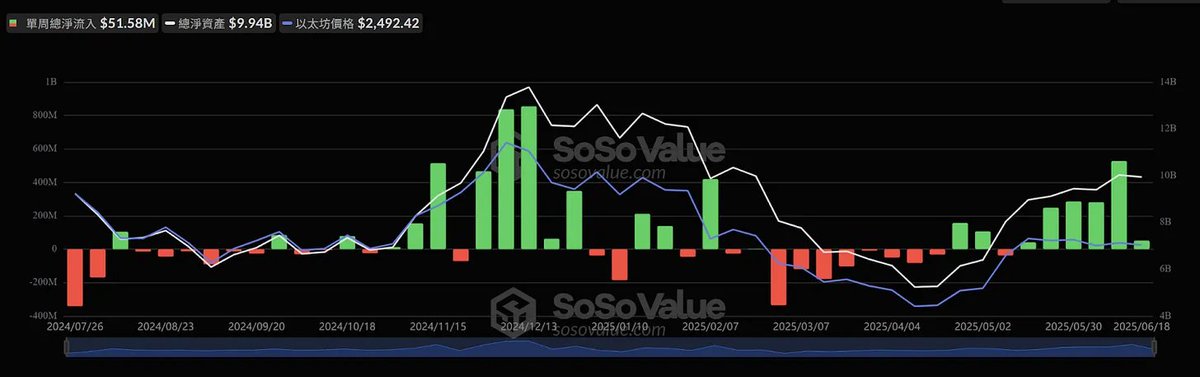

💡ETH ETF Net Inflows - Six consecutive weeks of net inflows

The ETH spot ETF has seen six consecutive weeks of net inflows, accumulating nearly $50 million, setting a record for the longest streak of inflows this year. However, inflows have narrowed significantly this week, suggesting that some institutions may choose to take profits.

On the other hand, the increase in short ETH orders on exchanges such as the CME hedged the momentum of spot buying, resulting in higher selling pressure. Despite the continued influx of funds, ETH's lack of a clear fundamental catalyst, coupled with geopolitical uncertainty, makes funds more inclined to flow into BTC, highlighting the difference in market sentiment and capital allocation between the two.

The full content is available on Substack, welcome to subscribe 🔥

4.14K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.