This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

wstETH

Wrapped liquid staked Ether 2.0 from Mainnet price

0x6c76...6ea6

$4,613.05

+$90.4520

(+2.00%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about wstETH today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

wstETH market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$98.44M

Network

Gnosis

Circulating supply

21,339 wstETH

Token holders

0

Liquidity

$23.00M

1h volume

$1.67K

4h volume

$33.55K

24h volume

$1.75M

Wrapped liquid staked Ether 2.0 from Mainnet Feed

The following content is sourced from .

How to earn 13-50%+ APY with your ETH:

I just read this @blocmatesdotcom article on Altidude regarding some insane strategies…

Strategy 1: ETH-Backed Passive Yield (Low Risk, 13% APY)

If you’re holding ETH but not farming yield with it, you’re bleeding opportunity.

This is a passive loop to earn on your ETH without selling or stressing.

Step-by-step:

1. Convert ETH to wstETH

2. Deposit wstETH into Altitude

3. Borrow USDC at a low LTV (10 to 20 percent)

4. Altitude auto-deploys your collateral into Curve, Morpho, Pendle

5. Yield from those protocols pays off your loan

6. You use the USDC for other plays or let it sit

You’re earning 13 percent APY on your ETH while holding it.

Set it. Monitor it. Farm with it. Repeat.

Strategy 2: Cross-Protocol Yield Farming (Mid Risk, 15 to 20+ percent)

Want higher yield and more flexibility?

Here’s a capital-efficient cross-platform strategy using Altitude and Pendle.

1. Convert ETH or BTC to wstETH or cbBTC

2. Deposit into Altitude

3. Borrow USDC at 40 to 50 percent LTV

4. Deposit USDC into Pendle for PT-sUSDe (12.6 percent APY)

From there, choose your path:

Option A:

Hold PT-sUSDe until maturity for fixed yield

Option B:

Use PT-sUSDe as collateral on Inverse Finance

Loop it up to 8x for over 50 percent APY

Option C:

Bridge USDC to emerging L2s like Fuel or Sonic

LP, trade, interact with protocols

Farm native yield plus possible airdrops

This is how DeFi users stack both stable yield and upside exposure.

Strategy 3: Looping for Higher APY (High Risk)

This one’s for users who want to leverage intelligently and auto-farm as they go.

1.Convert ETH to wstETH

2.Deposit into Altitude with 50 to 60 percent LTV

3.Borrow USDC

4.Use USDC to buy more ETH

5.Convert new ETH to wstETH

6.Repeat the loop

Why this works:

• Your ETH earns passive yield

• Your borrowed USDC is active capital

• Altitude puts idle collateral to work

• Loans repay from yield

This is how to turn ETH into a self-repaying, auto-looping filthy hot sexy steaming vault.

Yield estimate: 11 to 13 percent plus price exposure.

Bonus: ALTI Token Rewards

Altitude has its own token, ALTI.

Here’s how it boosts returns:

• Every deposit earns ALTI on top of yield

• Borrowing at 5 to 25 percent LTV gives a 20 percent reward boost

Example:

If daily incentives are 15 percent APR

Borrowing at low LTV = 18 percent APR via ALTI

There’s also a referral program for further stacking.

This is native alignment. Capital efficiency meets token upside.

I can’t believe all this was inside the article below.

I bet you never read it?

YOU NEED to pay attention to Altidude.

YOU NEED to pay attention to Blocmate articles.

Alpha is written in plain sight…

I’m working with the Altidude team to get the word out on these insane strategies…

blocmates.

There’s no shortage of money-making opportunities in crypto, but yield strategies that require minimal effort are often overlooked.

Altitude is one of the best players in the game. Think of it as an onchain financial manager that’s available 24/7.

When you deposit assets on Altitude, it monitors for the best rates and allocates assets accordingly.

From passive plays to looping and high-yield cross-protocol strategies, Emiri explains how Altitude helps you earn more by doing less.

🔗

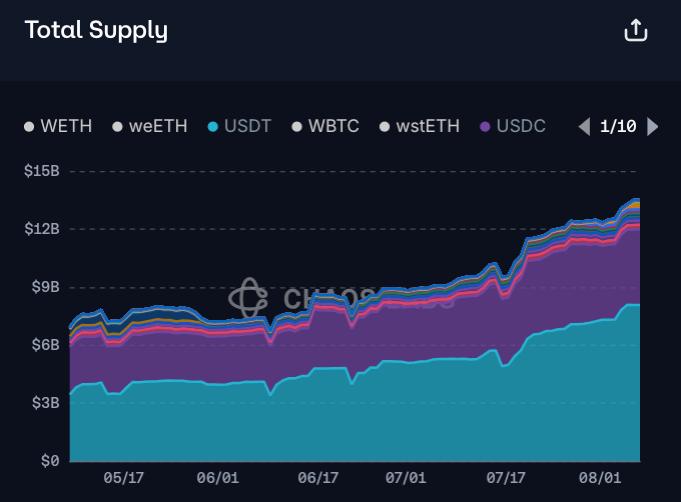

<Where is the current liquidity going?>

These days, the stablecoin market is quite interesting. It's not just that the market size has grown or that institutions are showing interest. We are now in a phase where real 'plays' are being created. At the center of this is the combination of @aave + @ethena_labs, along with the Loop strategy.

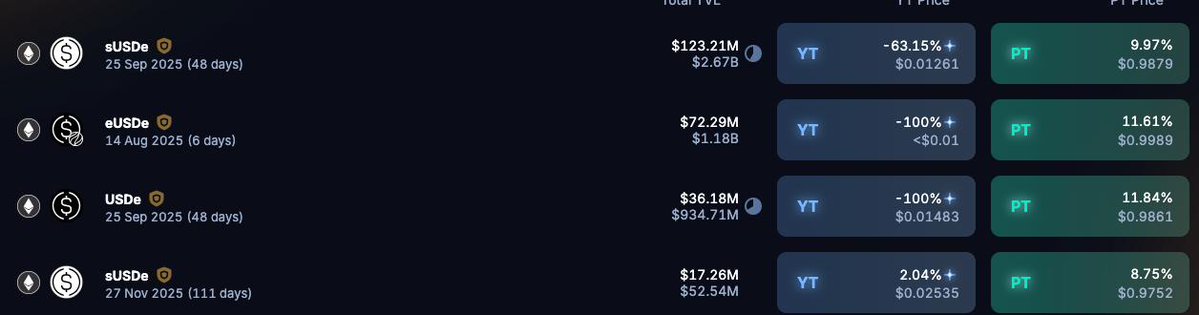

A representative example is Ethena's PT-USDe, which, as of September, has an LTV of around 91%, theoretically allowing for up to 11x leverage. Even after deducting the 5.4% interest on USDC loans, you still have a margin of about 38% after looping just 10 times. With this level of activity, it's not surprising that DeFi has amassed over $3 billion in TVL.

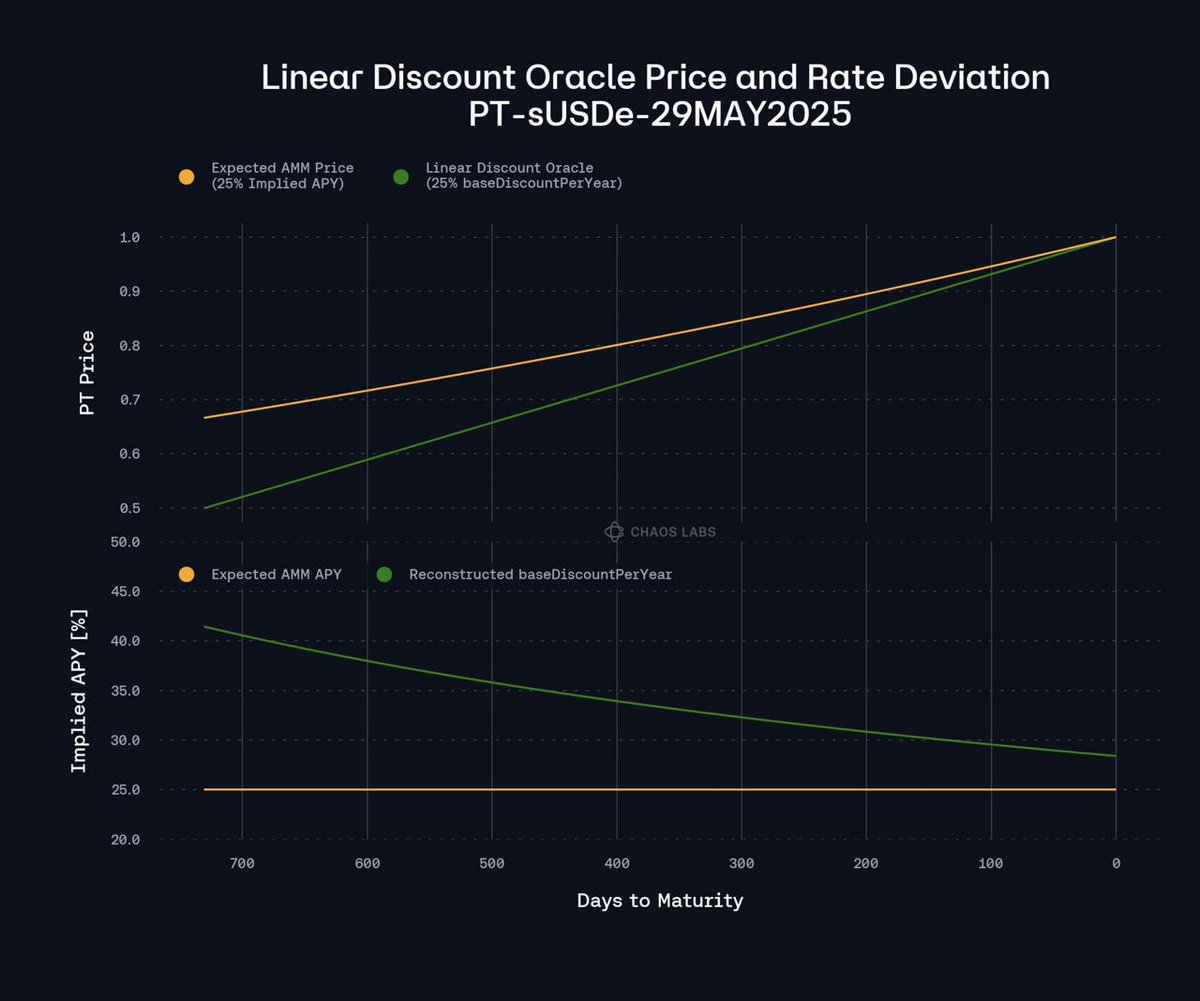

@pendle_fi has also played a significant role in this trend. Currently, out of approximately $7 billion in managed assets, $4 billion is based on Ethena. The structure itself is designed in such a way that liquidation is difficult without a Full Loop strategy. PT-USDe is fundamentally an 'upward trending asset,' and Aave has designed its oracle accordingly. They do not use external oracles like Chainlink but develop them internally. Aave originally didn't want to conduct such experiments, but since Morpho was performing so well, they eventually followed suit.

The key point of this structure is that even though the interest rates that need to be paid for the loop are rising, funds continue to flow in. The recent surge in Tether supply is also related to this. With interest rates at 30%, why wouldn't you participate? The liquidity is good, and especially for institutions managing over $10 million in capital, there is no better strategy.

Interestingly, the status of Tether deposits within Aave has changed. Originally, USDT was not a commonly used asset on Aave. USDC was much stronger in terms of liquidity. However, now the amount of Tether deposited in Aave has skyrocketed to $5 billion, reaching levels similar to USDC. This is largely due to institutional funds minting Tether for the looping strategy. In fact, there are accounts that have taken leveraged positions exceeding $200 million.

In other words, it's not that there is no money in the market. It's just that altcoins have lost their appeal. In the current environment, the real beneficiaries are Aave and Ethena. Looking further ahead, there is a high possibility that next-generation stablecoin models like Ethena will significantly expand the market.

A prime example is @maplefinance's SyrupUSD. Although it hasn't launched on Aave yet, the proposal has already been approved. Only the actual implementation remains, and there is significant upside potential here.

Also, what if Ethena implements a fee switch? The story would change completely.

Assuming a fee rate of 10% and annual interest income of $900 million, $90 million would flow into the protocol each year as fixed income. Most early investors have already exited with ENA financial strategy stocks, and since ENA has a low circulation, the remaining tokens allow for various plays. This is why I believe that among the current DeFi options, Ethena is the only one that is truly 'usable.'

I think you're all not bullish enough on this launch.

First, Extended is unlocking a use case that Starknet still doesn't have: perpetual trading.

And not just a simple GMX fork or some random stuff, no, a next-gen Perp DEX that's actually very efficient.

- ~60 trading pairs

- 7 TradFi markets: gold, silver, oil, Nasdaq 100, S&P 500, EUR/USD, USD/JPY

- up to 100x leverage

- vault yielding 26% in USDC 🤯 (+ you're stacking Extended points by the way)

In the future, users will be able to put any kind of asset as collateral, even yield-bearing ones, so traders will earn yield while trading (xSTRK for example).

Wild, wild.

Secondly, they are making onboarding as smooth as possible:

- migration from StarkEx to Starknet for current users = 1 click (literally)

- they are completely abstracting Starknet, so even EVM users will be able to interact with it from 6 major chains using their favorite EVM wallets.

So we’ll get it all-in-one: a new use case on Starknet, more activity (TPS), and more TVL on the network. In addition, I think some people will cook up yield products on top of Extended's vaults -- DeFi on Starknet will truly be great again.

Lastly, Starknet needs more veteran and experienced builders -- well, Extended is built by an ex-Revolut team, I don’t need to say more here.

So with Extended, the DeFi foundation of Starknet will be top-tier:

> avnu to get the best trading rate for spot trading

> ekubo to get the best yield on liquidity provision (this is the most efficient AMM of the entire space, just look at the volume it generates on Ethereum with only $15M TVL)

> vesu for lending/borrowing + looping strategy

> endur for liquid staking of STRK + BTC

> extended for Perp trading and yield farming.

ELI5: Extended is the biggest DeFi launch we get on Starknet in ages.

Anyway, see you next week, back to shitposting now.

Extended

Extended is migrating to Starknet – Stage 1 begins August 12

The migration from StarkEx to Starknet will take place in three stages, with Stage 1 starting on August 12.

Starting that day, only Starknet trading will earn points — activity on StarkEx will no longer be rewarded. Users who migrate during Stage 1 will receive additional incentives. Both StarkEx and Starknet instances will remain fully operational for trading during this stage.

Vault behavior in Stage 1:

- The StarkEx vault will stop trading and will not accrue fees or handle liquidations (liquidations will be managed by a separate insurance fund).

- The Starknet vault will operate normally, including trading, fee accrual, and liquidation handling.

Migration is automatic — there’s no need to withdraw funds. Users simply need to close positions and click “Migrate” in the UI.

wstETH price performance in USD

The current price of wrapped-liquid-staked-ether-2-0-from-mainnet is $4,613.05. Over the last 24 hours, wrapped-liquid-staked-ether-2-0-from-mainnet has increased by +2.00%. It currently has a circulating supply of 21,339 wstETH and a maximum supply of 21,339 wstETH, giving it a fully diluted market cap of $98.44M. The wrapped-liquid-staked-ether-2-0-from-mainnet/USD price is updated in real-time.

5m

-0.01%

1h

-0.28%

4h

+1.26%

24h

+2.00%

About Wrapped liquid staked Ether 2.0 from Mainnet (wstETH)

wstETH FAQ

What’s the current price of Wrapped liquid staked Ether 2.0 from Mainnet?

The current price of 1 wstETH is $4,613.05, experiencing a +2.00% change in the past 24 hours.

Can I buy wstETH on OKX?

No, currently wstETH is unavailable on OKX. To stay updated on when wstETH becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of wstETH fluctuate?

The price of wstETH fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Wrapped liquid staked Ether 2.0 from Mainnet worth today?

Currently, one Wrapped liquid staked Ether 2.0 from Mainnet is worth $4,613.05. For answers and insight into Wrapped liquid staked Ether 2.0 from Mainnet's price action, you're in the right place. Explore the latest Wrapped liquid staked Ether 2.0 from Mainnet charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Wrapped liquid staked Ether 2.0 from Mainnet, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Wrapped liquid staked Ether 2.0 from Mainnet have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.