<Where is the current liquidity going?>

These days, the stablecoin market is quite interesting. It's not just that the market size has grown or that institutions are showing interest. We are now in a phase where real 'plays' are being created. At the center of this is the combination of @aave + @ethena_labs, along with the Loop strategy.

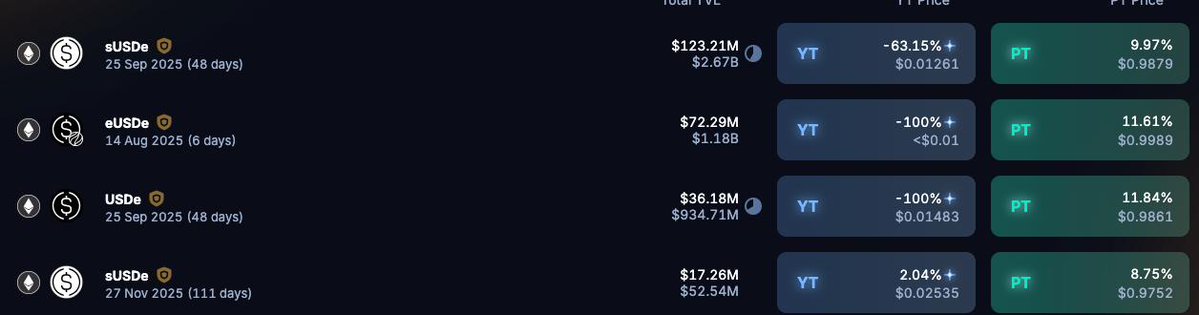

A representative example is Ethena's PT-USDe, which, as of September, has an LTV of around 91%, theoretically allowing for up to 11x leverage. Even after deducting the 5.4% interest on USDC loans, you still have a margin of about 38% after looping just 10 times. With this level of activity, it's not surprising that DeFi has amassed over $3 billion in TVL.

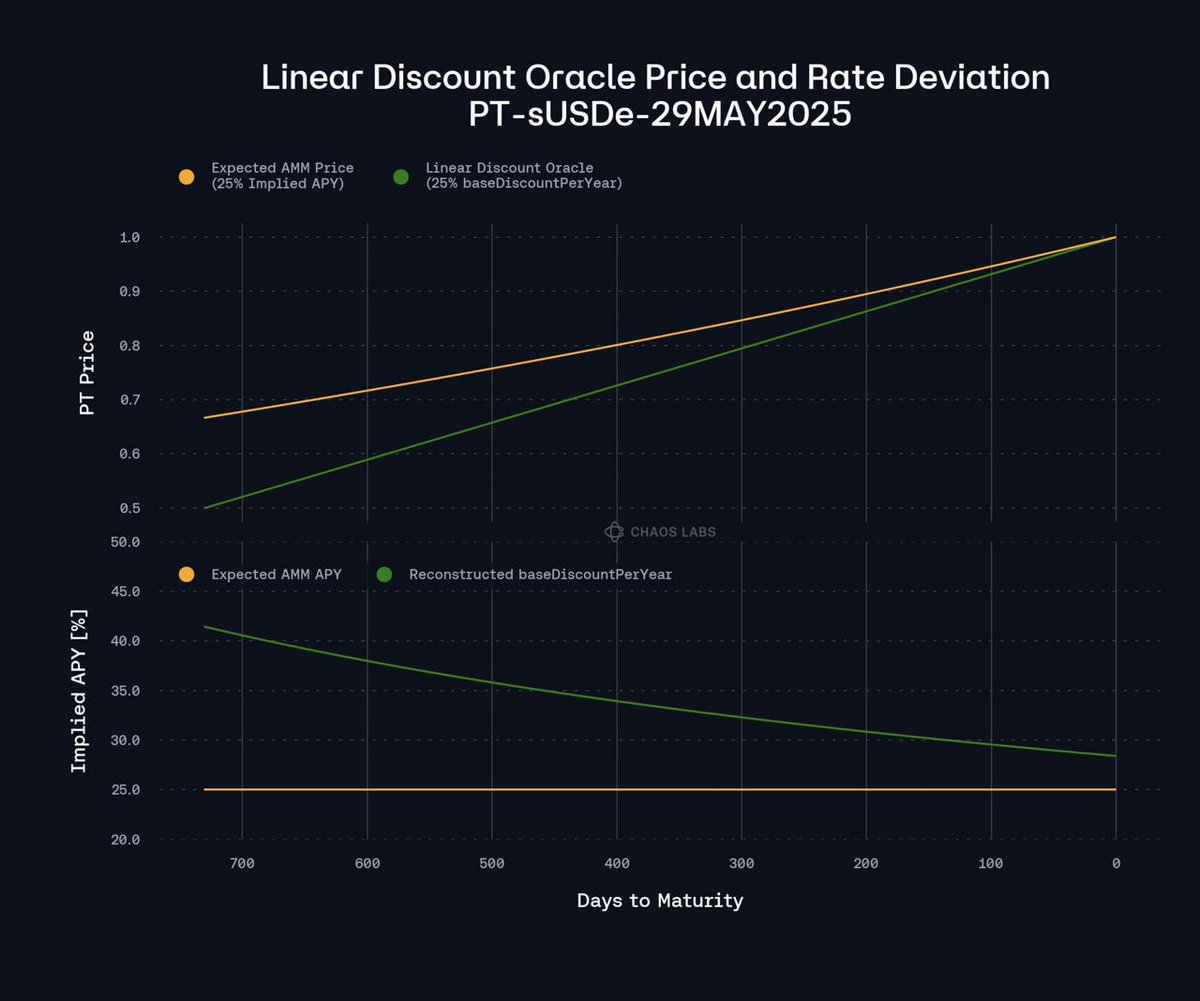

@pendle_fi has also played a significant role in this trend. Currently, out of approximately $7 billion in managed assets, $4 billion is based on Ethena. The structure itself is designed in such a way that liquidation is difficult without a Full Loop strategy. PT-USDe is fundamentally an 'upward trending asset,' and Aave has designed its oracle accordingly. They do not use external oracles like Chainlink but develop them internally. Aave originally didn't want to conduct such experiments, but since Morpho was performing so well, they eventually followed suit.

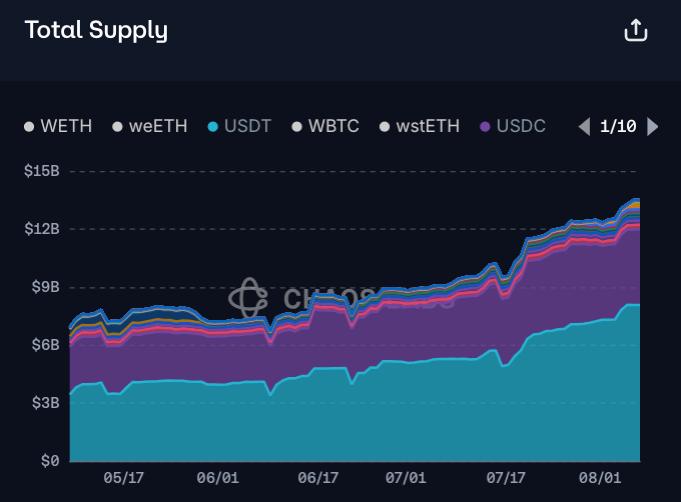

The key point of this structure is that even though the interest rates that need to be paid for the loop are rising, funds continue to flow in. The recent surge in Tether supply is also related to this. With interest rates at 30%, why wouldn't you participate? The liquidity is good, and especially for institutions managing over $10 million in capital, there is no better strategy.

Interestingly, the status of Tether deposits within Aave has changed. Originally, USDT was not a commonly used asset on Aave. USDC was much stronger in terms of liquidity. However, now the amount of Tether deposited in Aave has skyrocketed to $5 billion, reaching levels similar to USDC. This is largely due to institutional funds minting Tether for the looping strategy. In fact, there are accounts that have taken leveraged positions exceeding $200 million.

In other words, it's not that there is no money in the market. It's just that altcoins have lost their appeal. In the current environment, the real beneficiaries are Aave and Ethena. Looking further ahead, there is a high possibility that next-generation stablecoin models like Ethena will significantly expand the market.

A prime example is @maplefinance's SyrupUSD. Although it hasn't launched on Aave yet, the proposal has already been approved. Only the actual implementation remains, and there is significant upside potential here.

Also, what if Ethena implements a fee switch? The story would change completely.

Assuming a fee rate of 10% and annual interest income of $900 million, $90 million would flow into the protocol each year as fixed income. Most early investors have already exited with ENA financial strategy stocks, and since ENA has a low circulation, the remaining tokens allow for various plays. This is why I believe that among the current DeFi options, Ethena is the only one that is truly 'usable.'

Show original

6.7K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.