This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

W

W price

2eKSjb...Egn2

$0.0011198

+$0.00081388

(+266.06%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about W today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

W market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$111.98K

Network

Solana

Circulating supply

99,999,991 W

Token holders

210

Liquidity

$126.04K

1h volume

$4.49M

4h volume

$4.49M

24h volume

$4.49M

W Feed

The following content is sourced from .

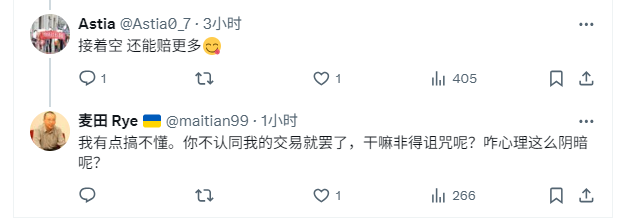

I just received a code from @EJseong95 and tried @Surf_Copilot for the first time. After getting my first research, I immediately went for the annual subscription.

I use ChatGPT and even Grok for paid services, but honestly, it's hard to find detailed information related to crypto, especially since price-related info is sensitive and not always readily available. However, with Surf, it finds and provides all the information I want from various sources.

For fun, I first asked how much the allocation for this @PortaltoBitcoin job would be. After receiving the answer, I thought it was a huge allocation, and I felt like, "Oh, this can't be right," but it did give me a pleasant number.

What I like about Surf is that, unlike others, it looks for comparative projects to calculate actual prices. For example, when I asked about Fragmetric, which recently launched and saw a catastrophic price drop, it accurately explained why I made a bad investment. Sigh...

For Potubi, it evaluates that the Korean allocation is absolutely larger than the global allocation. The problem is that when they allocate, they tend to assign too many quantities to the top grades. However, I also asked what a reasonable price would be at launch.

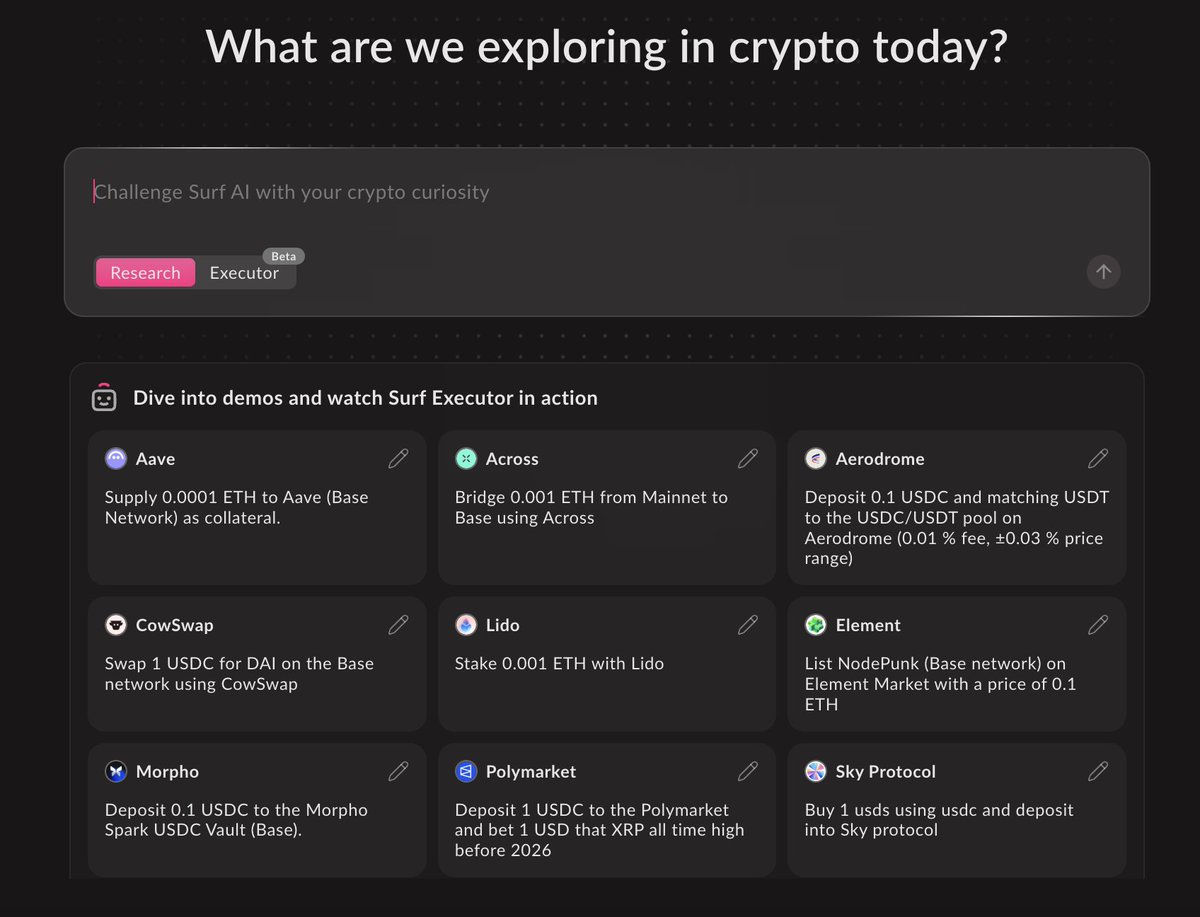

At this time, it compared with friends who are doing BTC bridging using Wormhole and Thorchain.

It also informed me whether the initial circulation and FDV were appropriate for each price range or if there was too much hype.

At $0.04, it seems like a good buy in the market, at $0.1 it's a reasonable price, and if it goes above $0.12, it would be considered overvalued as it would take a market leader position. This level of judgment seems quite good.

I calculated about $230 for a one-time payment and completed the payment for a year. This way, I can conduct 50 deep researches a week. I plan to use it well for a year and also start doing some yapping about @Surf_Copilot while trying to earn coins and minting. Let's go earn that $230! (But seriously, the reports are really interesting)

If anyone reading this wants to try it out and make a paid subscription, let me know as I still have some codes left. Haha.

I saw the call from charming and took a look at the $BSTR project @BSTRInc, bought a little at 13m. Quite interesting.

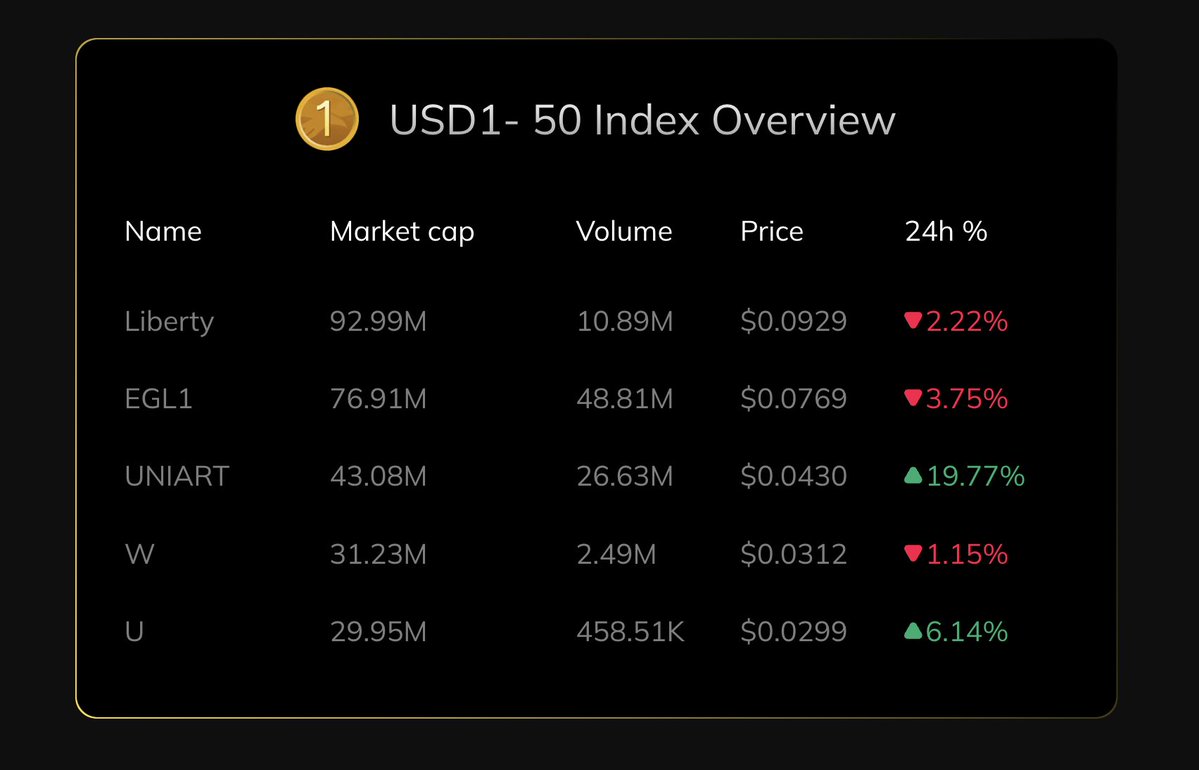

In simple terms, what they are doing is an on-chain version of micro strategy for $WLFI and USD1.

Considering that recently $WLFI invested in falcon, with frequent actions and the wallet about to be released, everything related to $WLFI will continue to have heat. This angle is indeed well taken, so I got in.

————————————

A brief introduction to the mechanism:

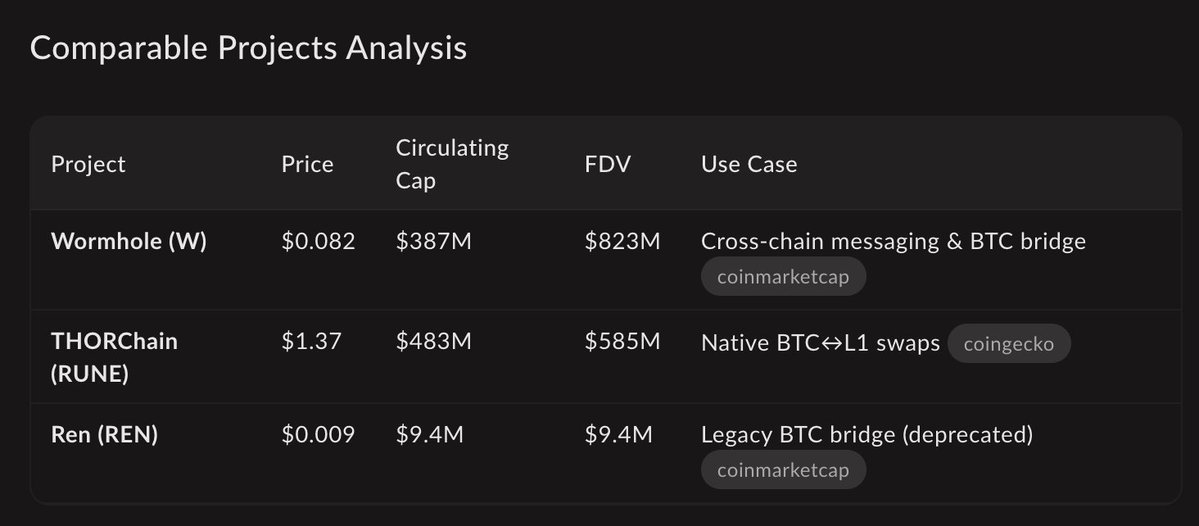

1. First, they created a USD1-50 index:

Tracking the 50 strongest and most representative assets in the USD1 ecosystem.

Weight calculation basis: market capitalization, liquidity, and on-chain activity.

Dynamic adjustment: assets that perform well will have their weight increased, while poor performers will be eliminated by DAO voting.

2. Every time the market capitalization of $BSTR rises by 5 million USD, the protocol automatically allocates 100,000 USD to the Reserve Pool.

The funds in the Reserve Pool will purchase the corresponding target assets according to the weight ratio of the USD1-50 index.

If $BSTR falls by more than 10%, the protocol will use 10% of the funds in the Reserve Fund to buy back and destroy $BSTR, creating deflationary pressure.

Recently, there is also a trading competition for $BSTR on bg where you can share in bgb, you can participate. There are three days left.

CryptoCharming 🐟

⌠ What is the WLFI USD1 Ecological Reserve Project $BSTR? ⌡

Today, let's briefly talk about the target of $BSTR ( @BSTRInc ), which I called everyone to get on the bus at 8m in the @unicornxdex, and now it has directly doubled its ATH to 18m! The whole group is comfortable, if you don't want to miss it, you can join my UnicornX community now! For details, please see the message area, anyway, this is an article about milk my bag, by the way, to show the strength 🫡 of the call target

In fact, there are many points that can be analyzed in this project, I noticed last night, they opened a lot of plates in a row to test and selected the most successful to control chips to do, so as I used my system to do chip analysis last night, this CA is obviously the most strange, but I am very afraid of abandoning the plate and then replacing it, so I only ate a few hundred dollars at the bottom XD

▌ Introduction to lazy bags

Because it was announced, I just did some urgent research, and what they wanted to do seemed to be $WLFI's MicroStrategy, which should be the first project in the @worldlibertyfi camp to propose this concept, which was to play the Treasury Company narrative, which has been particularly popular in recent months, and he moved it back to the chain to do this.

Specifically, they proposed a "USD1-50 Index" that tracks the most representative and powerful 50 assets in the USD1 ecosystem. Similar to traditional large-cap indexes, weights are calculated based on three indicators: market capitalization, liquidity, and on-chain activity.

Then here's the interesting thing, whenever the market value of $BSTR rises by 5m, it will automatically allocate 100k to the Reserve Pool, and Treasury will buy the underlying in proportion to the weight of the index. Therefore, it is directly conceivable that there may be related bribes and project parties to strive to enter the list, get resources and exposure.

In addition, the main currency $BSTR also has a very important burning mechanism, if it falls by more than 10% in the past week every Monday, the protocol will use 10% of the funds in the Reserve Fund to buy back $BSTR and burn it directly, forming deflation.

Therefore, it can be simply understood that it is a project dedicated to serving the $WLFI and $USD 1 ecosystems, and will assist the ecosystem in exposing and pulling platforms to help, and there may be USD1 Pair memecoins for bribery and pulling to promote the purchase of reserves.

▌From the perspective of the Twitter community

I also noticed that many other big memecoin contributors or project peripherals have tracked, and I also saw a few credible KOLs shouting, it is estimated that there should be a lot of cooperation after that, and the current official website is listed @liberty_bsc,

@W_coin_1, @EGLL_american, @Uniart_AI, @usagibnb and other items I didn't have the confidence to bet when I saw it yesterday, which was a bit of a pity, but I felt that I should still have time to get on the car.

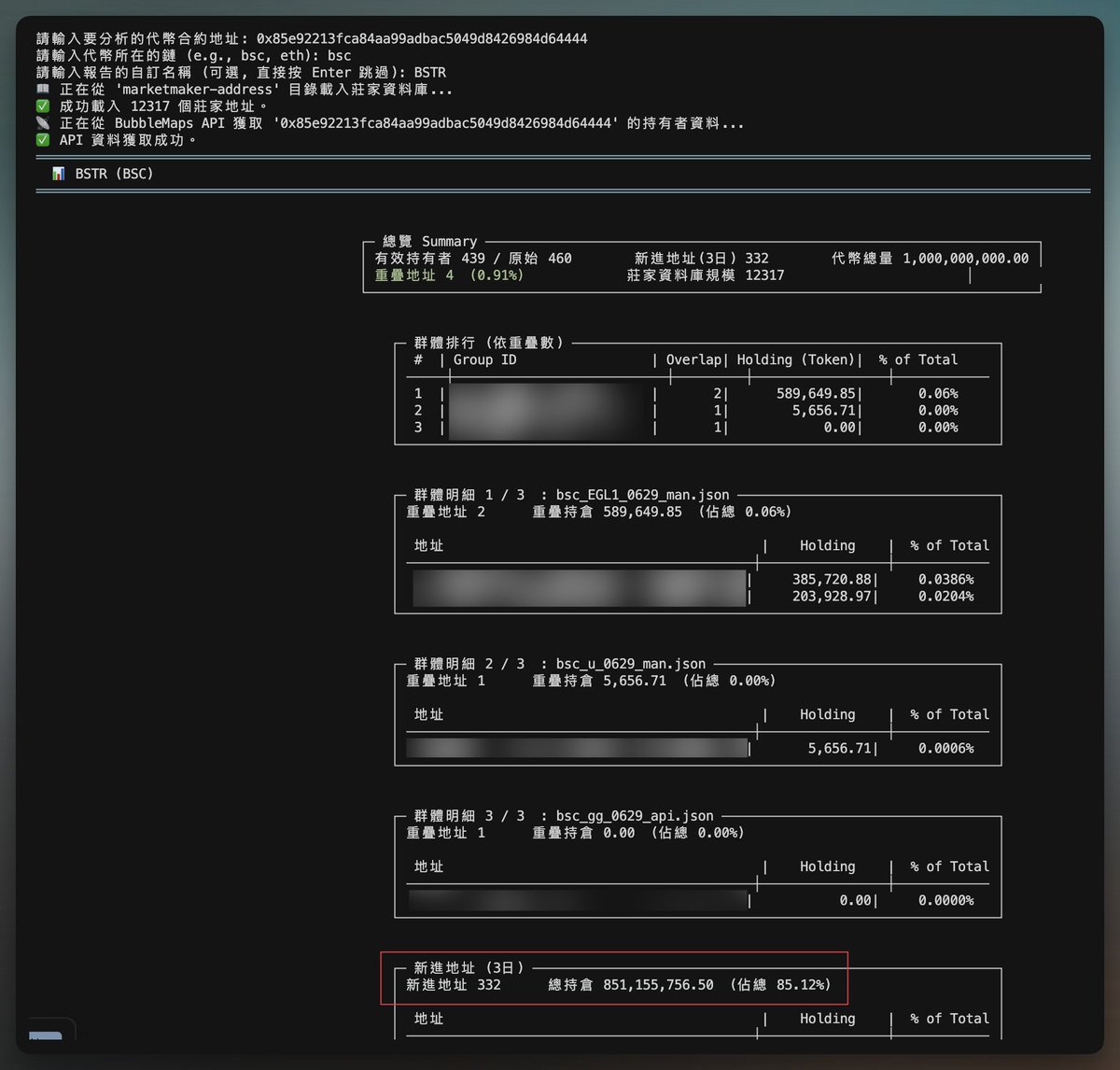

▌From the perspective of cluster and new wallet control

Looking at the picture, it can be found that the project party has controlled at least about 90% of the fundraising, the pool is not very large at present, the pull should be relatively easy, currently about 10m, if it is me, I will wait to see if there is an opportunity to pull back into the market and now try to go to the bottom position first.

▌From the perspective of the flywheel

1. Price ↑ → Market Cap ↑ → Reserve↑

2. Price↓ → Repurchase burn → Supply↓

3. Index positions generate profits and return Treasury → 1. flywheel

Simply put, the price rises → the reserves are larger→ investor confidence is stronger → the "positive feedback flywheel" that continues to rise in prices, and there will be enough Treasury to support and achieve deflation when it falls. In short, I think speedrunning the last alpha should be a breeze.

However, this set is also risky, and the bad thing must also be said, that is, if the market liquidity is weak and frequent declines cause the Reserve to be cut (accumulation speed is faster than the speed of market selling pressure), the flywheel is easy to stop or even accelerate the decline in reverse, so it is a project party to do things. (They work at the speed of light on @MEXCZH and @wellowealth The relationship should be very hard...) )

In addition, I noticed that there were also some big players guessing this plate last night, and the result was really taken away together, and these people's shipments will also be selling pressure that takes time to digest, and they are still out 🤡.

CA:

0x85e92213fca84aa99adbac5049d8426984d64444

Always DYOR I have a very low cost, so I chase high no matter what, and I will consider my own betting chips!

$7.5 Trillion. that’s how much money changes hands in the FX market every single day. 🤯

and now, for the first time ever, it’s going onchain thanks to @wormhole $W.

@MentoLabs, the team behind the world’s largest onchain FX platform (8M+ users, $18B/year in volume), just picked Wormhole as its official interoperability provider.

here’s what that means:

✅ real-time FX trading across 40+ chains

✅ 15+ stablecoins (USD, EUR, JPY, GBP, etc.) with zero-slippage swaps

✅ 24/7 currency exchange > no banks, no middlemen, no closing hours

✅ native support for cross-border payments, treasury ops, and remittances

this is more than a bridge. this is the plumbing for programmable global money.

and Wormhole $W isn’t new to scale:

- $60B+ in cross-chain volume moved

- 1B+ messages sent across Ethereum, Solana, Aptos, and more

- 200+ applications built on top

- used by giants like Google Cloud, BlackRock, Apollo, and Uniswap

traditional FX is broken > slow, fragmented, and shut on weekends.

Wormhole + Mento is building its replacement - open, instant, and borderless.

W price performance in USD

The current price of w- is $0.0011198. Over the last 24 hours, w- has increased by +266.06%. It currently has a circulating supply of 99,999,991 W and a maximum supply of 99,999,991 W, giving it a fully diluted market cap of $111.98K. The w-/USD price is updated in real-time.

5m

-3.79%

1h

+266.06%

4h

+266.06%

24h

+266.06%

About W (W)

W FAQ

What’s the current price of W ?

The current price of 1 W is $0.0011198, experiencing a +266.06% change in the past 24 hours.

Can I buy W on OKX?

No, currently W is unavailable on OKX. To stay updated on when W becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of W fluctuate?

The price of W fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 W worth today?

Currently, one W is worth $0.0011198. For answers and insight into W 's price action, you're in the right place. Explore the latest W charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as W , are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as W have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.