I saw the call from charming and took a look at the $BSTR project @BSTRInc, bought a little at 13m. Quite interesting.

In simple terms, what they are doing is an on-chain version of micro strategy for $WLFI and USD1.

Considering that recently $WLFI invested in falcon, with frequent actions and the wallet about to be released, everything related to $WLFI will continue to have heat. This angle is indeed well taken, so I got in.

————————————

A brief introduction to the mechanism:

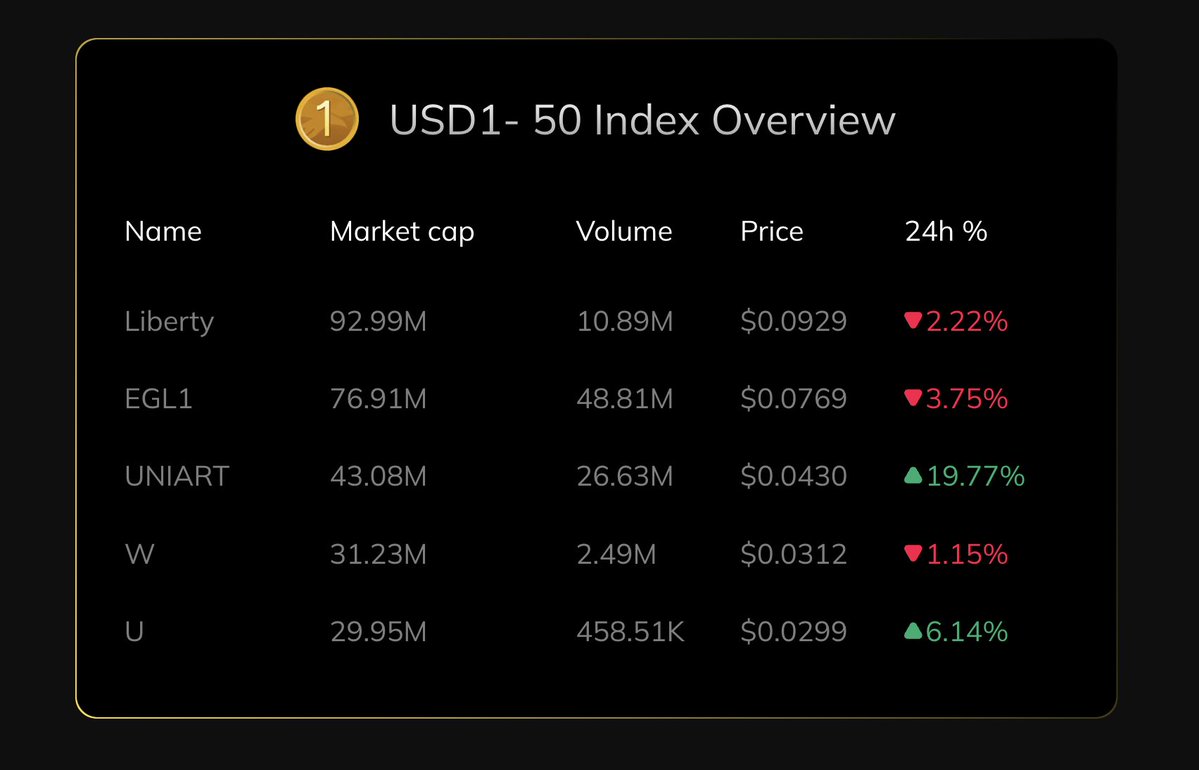

1. First, they created a USD1-50 index:

Tracking the 50 strongest and most representative assets in the USD1 ecosystem.

Weight calculation basis: market capitalization, liquidity, and on-chain activity.

Dynamic adjustment: assets that perform well will have their weight increased, while poor performers will be eliminated by DAO voting.

2. Every time the market capitalization of $BSTR rises by 5 million USD, the protocol automatically allocates 100,000 USD to the Reserve Pool.

The funds in the Reserve Pool will purchase the corresponding target assets according to the weight ratio of the USD1-50 index.

If $BSTR falls by more than 10%, the protocol will use 10% of the funds in the Reserve Fund to buy back and destroy $BSTR, creating deflationary pressure.

Recently, there is also a trading competition for $BSTR on bg where you can share in bgb, you can participate. There are three days left.

⌠ What is the WLFI USD1 Ecological Reserve Project $BSTR? ⌡

Today, let's briefly talk about the target of $BSTR ( @BSTRInc ), which I called everyone to get on the bus at 8m in the @unicornxdex, and now it has directly doubled its ATH to 18m! The whole group is comfortable, if you don't want to miss it, you can join my UnicornX community now! For details, please see the message area, anyway, this is an article about milk my bag, by the way, to show the strength 🫡 of the call target

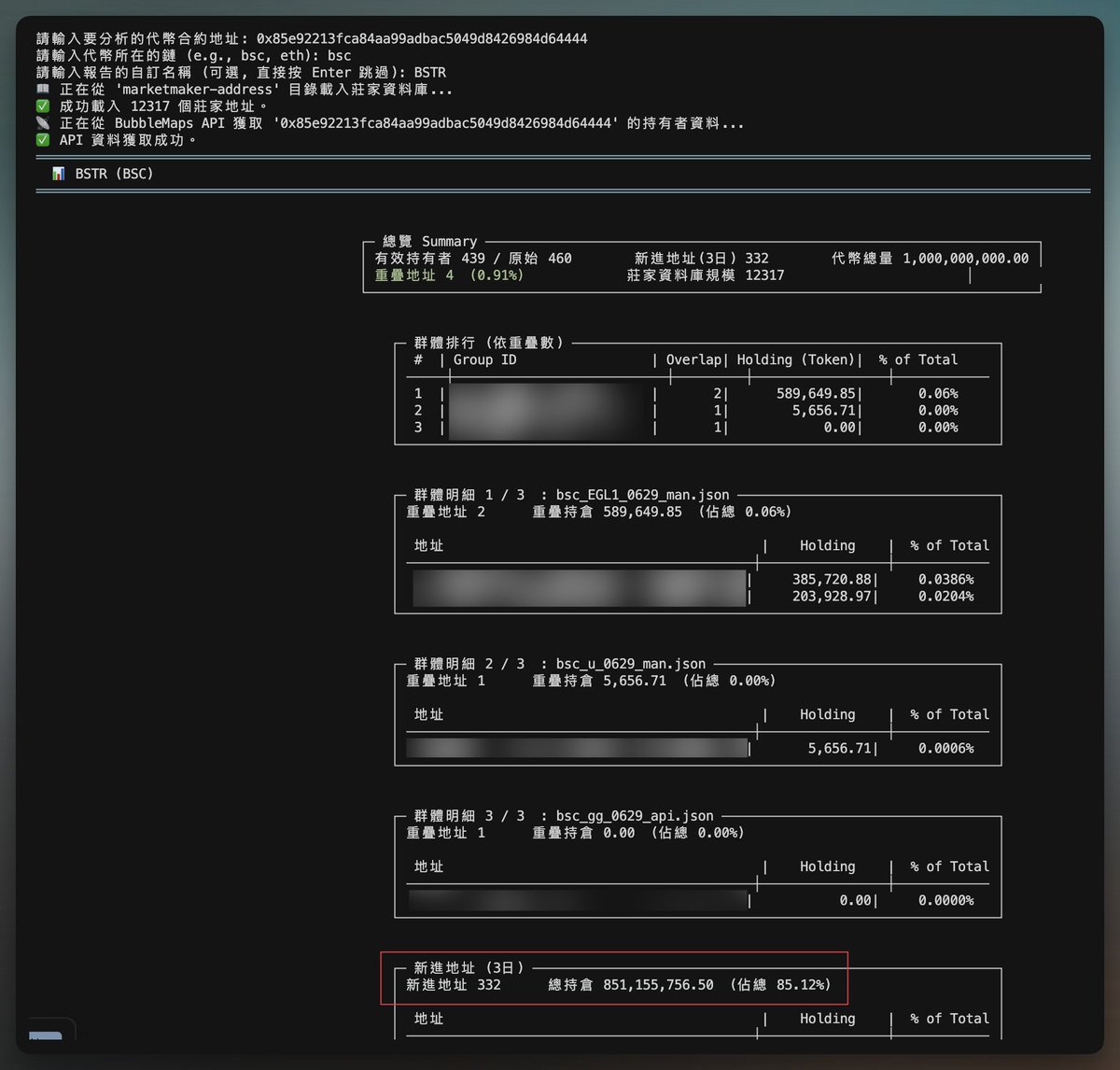

In fact, there are many points that can be analyzed in this project, I noticed last night, they opened a lot of plates in a row to test and selected the most successful to control chips to do, so as I used my system to do chip analysis last night, this CA is obviously the most strange, but I am very afraid of abandoning the plate and then replacing it, so I only ate a few hundred dollars at the bottom XD

▌ Introduction to lazy bags

Because it was announced, I just did some urgent research, and what they wanted to do seemed to be $WLFI's MicroStrategy, which should be the first project in the @worldlibertyfi camp to propose this concept, which was to play the Treasury Company narrative, which has been particularly popular in recent months, and he moved it back to the chain to do this.

Specifically, they proposed a "USD1-50 Index" that tracks the most representative and powerful 50 assets in the USD1 ecosystem. Similar to traditional large-cap indexes, weights are calculated based on three indicators: market capitalization, liquidity, and on-chain activity.

Then here's the interesting thing, whenever the market value of $BSTR rises by 5m, it will automatically allocate 100k to the Reserve Pool, and Treasury will buy the underlying in proportion to the weight of the index. Therefore, it is directly conceivable that there may be related bribes and project parties to strive to enter the list, get resources and exposure.

In addition, the main currency $BSTR also has a very important burning mechanism, if it falls by more than 10% in the past week every Monday, the protocol will use 10% of the funds in the Reserve Fund to buy back $BSTR and burn it directly, forming deflation.

Therefore, it can be simply understood that it is a project dedicated to serving the $WLFI and $USD 1 ecosystems, and will assist the ecosystem in exposing and pulling platforms to help, and there may be USD1 Pair memecoins for bribery and pulling to promote the purchase of reserves.

▌From the perspective of the Twitter community

I also noticed that many other big memecoin contributors or project peripherals have tracked, and I also saw a few credible KOLs shouting, it is estimated that there should be a lot of cooperation after that, and the current official website is listed @liberty_bsc,

@W_coin_1, @EGLL_american, @Uniart_AI, @usagibnb and other items I didn't have the confidence to bet when I saw it yesterday, which was a bit of a pity, but I felt that I should still have time to get on the car.

▌From the perspective of cluster and new wallet control

Looking at the picture, it can be found that the project party has controlled at least about 90% of the fundraising, the pool is not very large at present, the pull should be relatively easy, currently about 10m, if it is me, I will wait to see if there is an opportunity to pull back into the market and now try to go to the bottom position first.

▌From the perspective of the flywheel

1. Price ↑ → Market Cap ↑ → Reserve↑

2. Price↓ → Repurchase burn → Supply↓

3. Index positions generate profits and return Treasury → 1. flywheel

Simply put, the price rises → the reserves are larger→ investor confidence is stronger → the "positive feedback flywheel" that continues to rise in prices, and there will be enough Treasury to support and achieve deflation when it falls. In short, I think speedrunning the last alpha should be a breeze.

However, this set is also risky, and the bad thing must also be said, that is, if the market liquidity is weak and frequent declines cause the Reserve to be cut (accumulation speed is faster than the speed of market selling pressure), the flywheel is easy to stop or even accelerate the decline in reverse, so it is a project party to do things. (They work at the speed of light on @MEXCZH and @wellowealth The relationship should be very hard...) )

In addition, I noticed that there were also some big players guessing this plate last night, and the result was really taken away together, and these people's shipments will also be selling pressure that takes time to digest, and they are still out 🤡.

CA:

0x85e92213fca84aa99adbac5049d8426984d64444

Always DYOR I have a very low cost, so I chase high no matter what, and I will consider my own betting chips!

16.43K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.