This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

LBTC

Lombard Staked BTC price

0x3e8e...LBTC

R$651,063.3

+R$7,910.78

(+1.23%)

Price change for the last 24 hours

BRL

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about LBTC today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

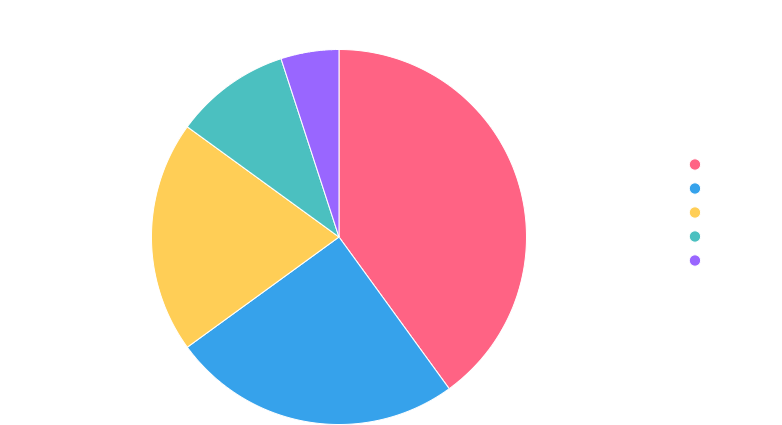

LBTC market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

R$0.00

Network

SUI

Circulating supply

0 LBTC

Token holders

3257

Liquidity

R$22.79M

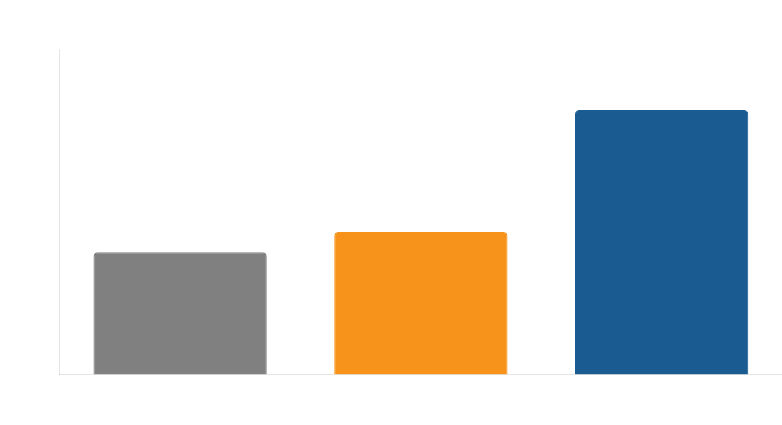

1h volume

R$181.96K

4h volume

R$2.19M

24h volume

R$16.60M

Lombard Staked BTC Feed

The following content is sourced from .

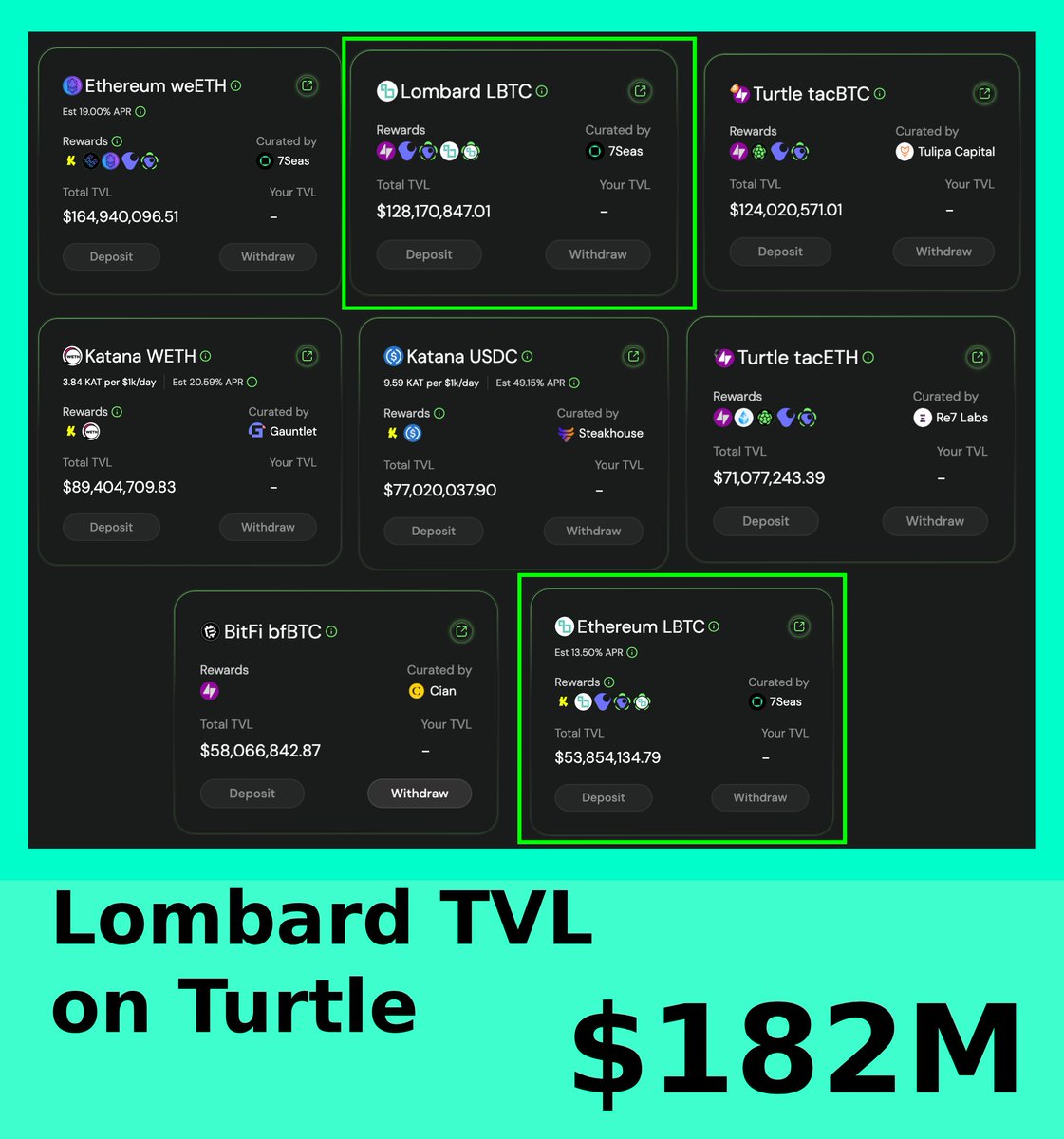

Turtle already manages $1.13 billion in TVL split between 2 campaigns:

- TAC Summoning: $675M

- Katana Samurai's Call: $458M

I must admit that this is already a very successful result.

Looking closely at the pools, I noticed something interesting:

- Turtle has 59 pools

- Top-8 pools are holding $665M or 59% of TVL

- Lombard's pools hold on 2nd and 8th by TVL, total $182M or 59%

What does it mean for Lombard?

Lombard is already a big player in DeFi, allowing protocols and networks to raise hundreds of millions of dollars of TVL. This opens up great opportunities for the team in terms of business development:

- significantly increased demand for their integration services

- increased project reputation

- better distribution

- potentially increased economic incentives and revenue

These are the very things that LBTC plans to become the new standard for BTC wrappers.

This is why Katana and Turtle chose Lombard as a strategic partner for growth - because it will bring them not only new users and liquidity in the short term, but also growth for the entire business in the long term.

P.S. And this is not the end, the team is preparing something very powerful in the coming weeks. Stay tuned for announcements. You will definitely like it.

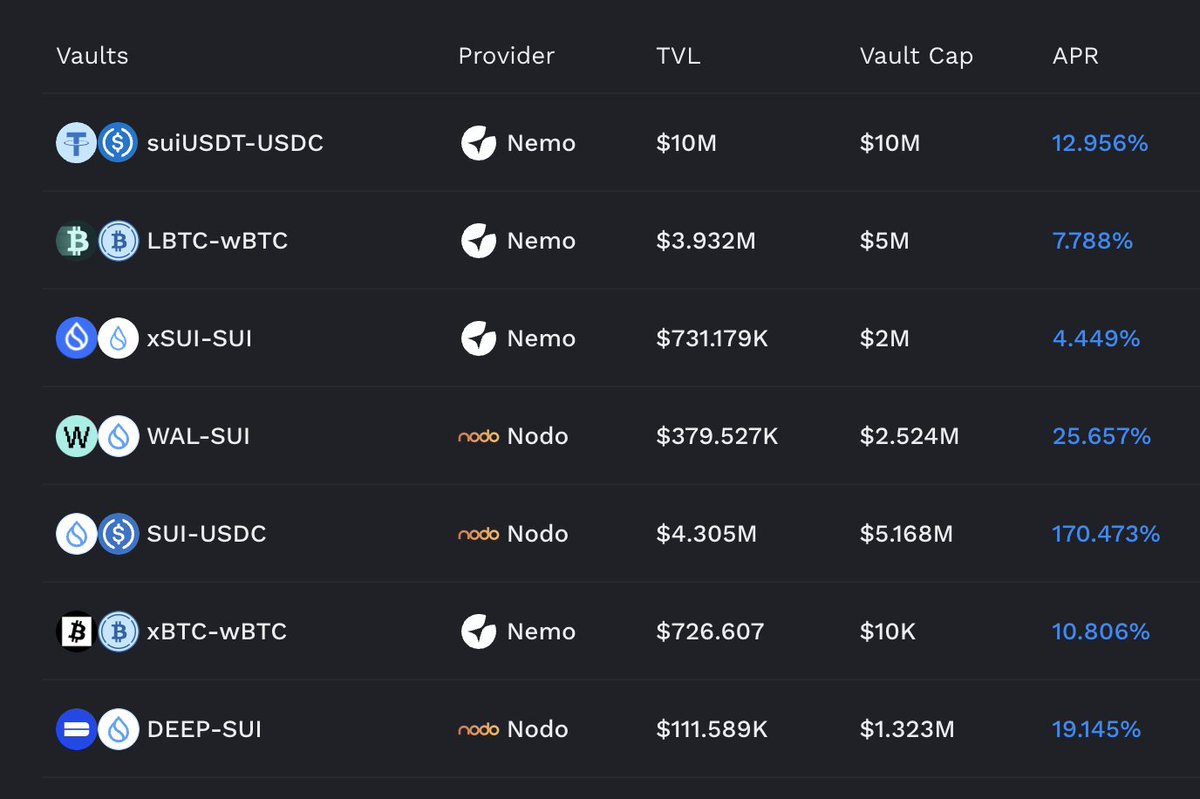

sui yields are absolutely cooking rn

170% on sui-usdc? 25% on wal-sui?

these numbers are wild

sick of constantly rebalancing your lp positions just to stay in range and actually earn those yields?

@MMTFinance auto-vaults (powered by @Official_NODO + @nemoprotocol) handle everything

- keeps you in range automatically

- no babysitting positions

- no liquidation surprises

- max yields, zero stress

literally just deposit

and

watch it work

sui defi different different

Big brain post about LBTC 🧠

SENU

Was thinking how, now we have $LBTC the next Bitcoin halving cycle will be interesting

In 2024, right after the halving, BTC denominated yields spiked across protocols

Not because the tech suddenly got better, but because liquidity dynamics shifted fast: higher demand for BTC collateral, more staking activity, more DeFi strategies chasing a now scarcer asset

If that pattern repeats, LBTC doesn’t just preserve your BTC exposure, it amplifies it

Even a modest 1%+ BTC APY becomes a base layer of compounding. Layer on vault strategies like Sentora, Concrete, or Veda... add in restaking... throw in point farming campaigns, and now you’re looking at multiple streams of BTC-native upside, without ever having to leave the asset behind

With every new vault integration, every chain supported, every Finality Provider that onboards, LBTC keeps edging closer to becoming the default primitive for Bitcoin in DeFi. Like how stETH became synonymous with ETH staking

NFA obviously but if you’re in Bitcoin for the long arc, LBTC is the most productive way to stay exposed while letting your BTC work

@Lombard_Finance has become the infrastructure bet on the whole BTCfi movement. Ignore it if you want. But don’t say you didn’t see it coming.

And here’s the thing a lot of BTC holders miss: halvings bend the baseline

After April 2024’s cut to 3.125 BTC block rewards, BTC yields on some platforms shot up to the 4–6% range for months. Not because those platforms suddenly evolved overnight, but because demand shifted. More people wanted BTC collateral. More protocols needed it. Suddenly, those yield strategies you were sitting in pre-halving got supercharged.

Now imagine this in 2028

If LBTC’s integrations are as sticky then as they are now, across Ethereum, Berachain, Sui, Katana, and whatever new L2s pop up, that post-halving surge increases APY.

But that’s when “just holding” LBTC starts looking more like an active accumulation strategy.

Let’s put it in perspective

>Say you’re holding 1 BTC.

>You mint LBTC with it, keeping full BTC exposure, and start earning a modest 1% APY just by holding it. That’s ~0.01 BTC/year in passive yield.

>Now, you take that LBTC and deposit it into a vault let's say Sentora, which targets 6%+ APY. Combined with the base LBTC yield, you’re looking at a 7%+ BTC-denominated return, or ~0.07 BTC/year, without selling your BTC or taking on additional price risk.

>Then you restake that position on a network like Berachain or Sui, where you're farming ecosystem points, airdrops, and validator rewards on top. Even conservatively you’re actively accumulating more BTC from multiple sources.

Now fast-forward to the 2028 halving cycle

BTC supply gets cut again. Demand for BTC collateral spikes, just like it did post-halving in 2024, and yield opportunities accelerate. That 0.07 BTC/year you were earning? It compounds faster, and it’s now worth more in USD terms as BTC climbs

Yield → Accumulation → Appreciation → More Yield.

And all of it without ever leaving Bitcoin

Halvings are predictable

LBTC’s position in BTCfi is already proven

Combine the two, and you’ve got one of the most compelling Bitcoin native strategies heading into the future.

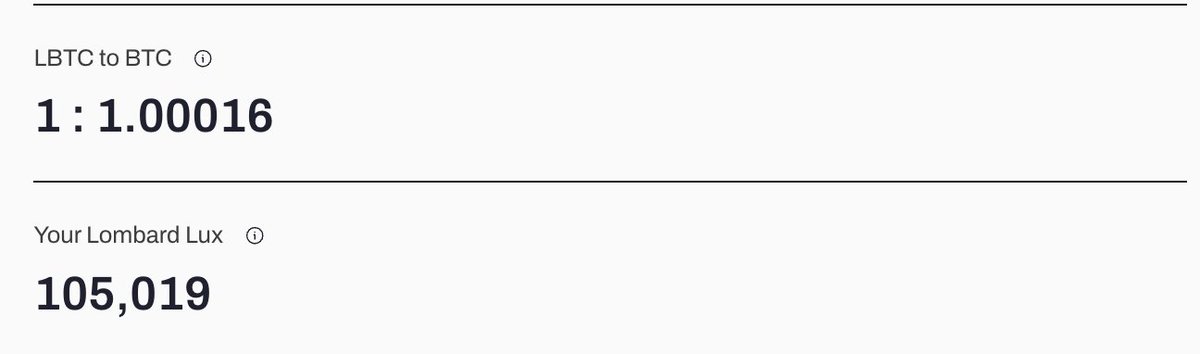

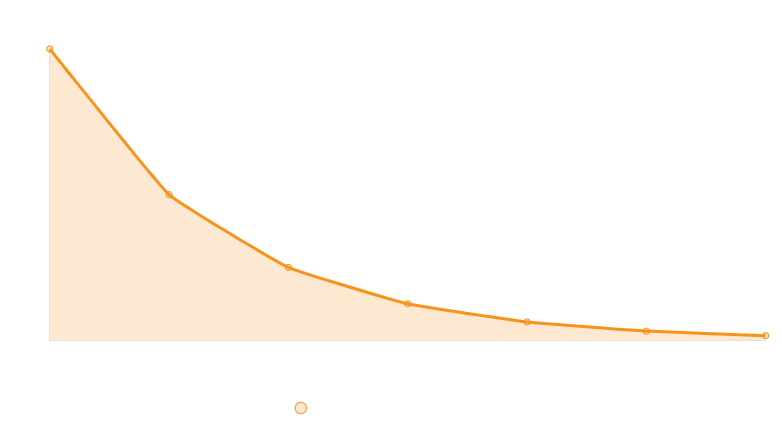

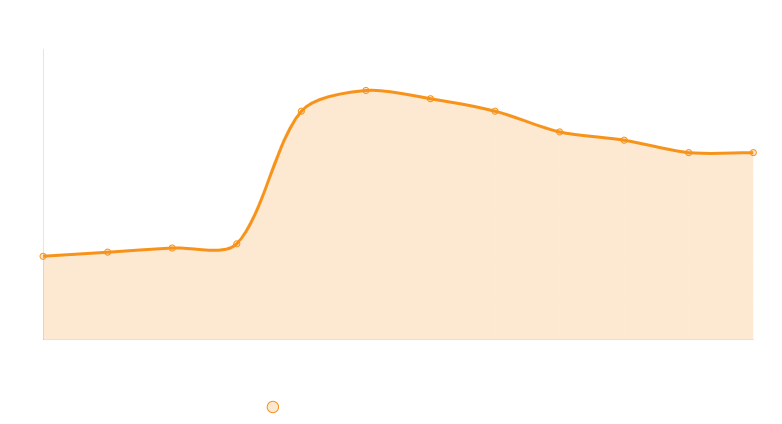

LBTC price performance in BRL

The current price of lombard-staked-btc is R$651,063.3. Over the last 24 hours, lombard-staked-btc has increased by +1.23%. It currently has a circulating supply of 0 LBTC and a maximum supply of 0 LBTC, giving it a fully diluted market cap of R$0.00. The lombard-staked-btc/BRL price is updated in real-time.

5m

+0.37%

1h

+0.51%

4h

+0.55%

24h

+1.23%

About Lombard Staked BTC (LBTC)

LBTC FAQ

What’s the current price of Lombard Staked BTC?

The current price of 1 LBTC is R$651,063.3, experiencing a +1.23% change in the past 24 hours.

Can I buy LBTC on OKX?

No, currently LBTC is unavailable on OKX. To stay updated on when LBTC becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of LBTC fluctuate?

The price of LBTC fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Lombard Staked BTC worth today?

Currently, one Lombard Staked BTC is worth R$651,063.3. For answers and insight into Lombard Staked BTC's price action, you're in the right place. Explore the latest Lombard Staked BTC charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Lombard Staked BTC, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Lombard Staked BTC have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.