Big brain post about LBTC 🧠

Was thinking how, now we have $LBTC the next Bitcoin halving cycle will be interesting

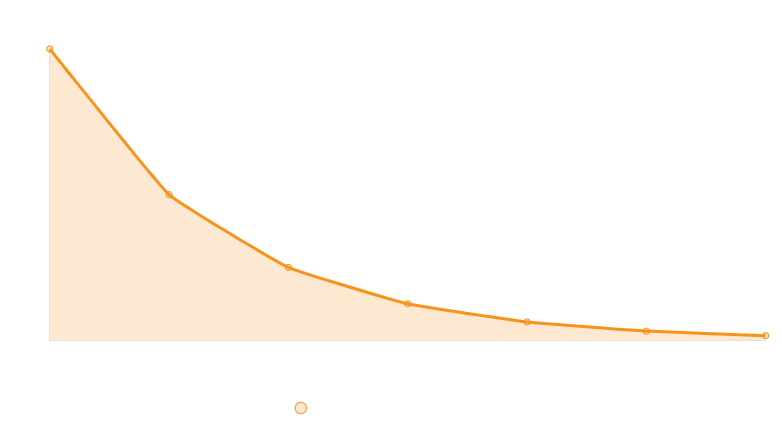

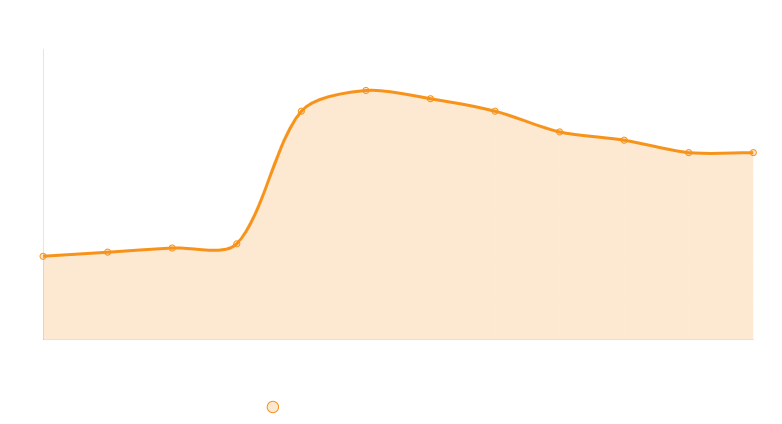

In 2024, right after the halving, BTC denominated yields spiked across protocols

Not because the tech suddenly got better, but because liquidity dynamics shifted fast: higher demand for BTC collateral, more staking activity, more DeFi strategies chasing a now scarcer asset

If that pattern repeats, LBTC doesn’t just preserve your BTC exposure, it amplifies it

Even a modest 1%+ BTC APY becomes a base layer of compounding. Layer on vault strategies like Sentora, Concrete, or Veda... add in restaking... throw in point farming campaigns, and now you’re looking at multiple streams of BTC-native upside, without ever having to leave the asset behind

With every new vault integration, every chain supported, every Finality Provider that onboards, LBTC keeps edging closer to becoming the default primitive for Bitcoin in DeFi. Like how stETH became synonymous with ETH staking

NFA obviously but if you’re in Bitcoin for the long arc, LBTC is the most productive way to stay exposed while letting your BTC work

@Lombard_Finance has become the infrastructure bet on the whole BTCfi movement. Ignore it if you want. But don’t say you didn’t see it coming.

And here’s the thing a lot of BTC holders miss: halvings bend the baseline

After April 2024’s cut to 3.125 BTC block rewards, BTC yields on some platforms shot up to the 4–6% range for months. Not because those platforms suddenly evolved overnight, but because demand shifted. More people wanted BTC collateral. More protocols needed it. Suddenly, those yield strategies you were sitting in pre-halving got supercharged.

Now imagine this in 2028

If LBTC’s integrations are as sticky then as they are now, across Ethereum, Berachain, Sui, Katana, and whatever new L2s pop up, that post-halving surge increases APY.

But that’s when “just holding” LBTC starts looking more like an active accumulation strategy.

Let’s put it in perspective

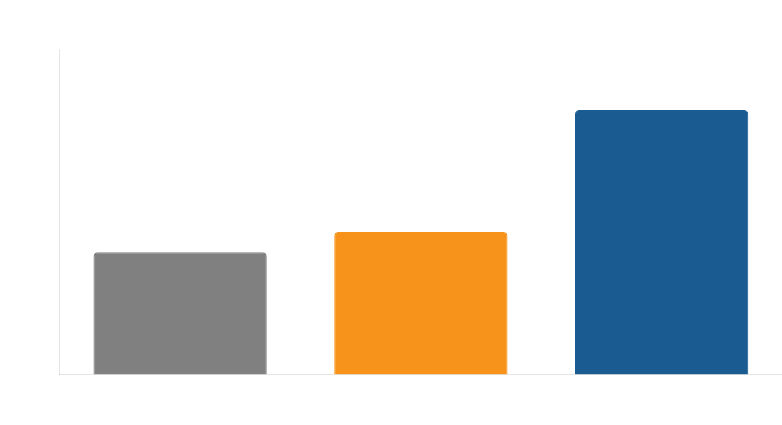

>Say you’re holding 1 BTC.

>You mint LBTC with it, keeping full BTC exposure, and start earning a modest 1% APY just by holding it. That’s ~0.01 BTC/year in passive yield.

>Now, you take that LBTC and deposit it into a vault let's say Sentora, which targets 6%+ APY. Combined with the base LBTC yield, you’re looking at a 7%+ BTC-denominated return, or ~0.07 BTC/year, without selling your BTC or taking on additional price risk.

>Then you restake that position on a network like Berachain or Sui, where you're farming ecosystem points, airdrops, and validator rewards on top. Even conservatively you’re actively accumulating more BTC from multiple sources.

Now fast-forward to the 2028 halving cycle

BTC supply gets cut again. Demand for BTC collateral spikes, just like it did post-halving in 2024, and yield opportunities accelerate. That 0.07 BTC/year you were earning? It compounds faster, and it’s now worth more in USD terms as BTC climbs

Yield → Accumulation → Appreciation → More Yield.

And all of it without ever leaving Bitcoin

Halvings are predictable

LBTC’s position in BTCfi is already proven

Combine the two, and you’ve got one of the most compelling Bitcoin native strategies heading into the future.

4.58K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.