This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

USDtb

USDtb price

0xc139...ac1c

$0.99950

+$0.000000000035748

(+0.00%)

Price change for the last 24 hours

How are you feeling about USDtb today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

USDtb market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$1.46B

Network

Ethereum

Circulating supply

1,457,118,248 USDtb

Token holders

185

Liquidity

$20.08M

1h volume

$110,693.98

4h volume

$110,693.98

24h volume

$1.07M

USDtb Feed

The following content is sourced from .

Ethena Labs

We're excited to be launching the USDtb Liquidity smart contract in collaboration with @Securitize and BlackRock BUIDL

This product makes USDtb the stablecoin liquidity pair for all BUIDL users to atomically swap BUIDL for USDtb instantly onchain 24/7/365

10.68K

143

Campbell | real-time oracle arc ⚡️ reposted

RedStone ♦️

Hey, what stablecoins does RedStone support?

Only:

$USDT

$BUIDL

$USDC

$sUSDe

$SUDSz

$sfrxUSD

$gmdUSDC

$sUSDX

$USDe

$wUSDM

$sUSDs

$USD3

$sdeUSD

$tacUSD

$GUSD

$frxUSD

$USD1

$USD+

$scUSD

$deUSD

$USDtb

$USDP

$USDD

$eUSD

$crvUSD

$USDX

$fxUSD

$aUSD

$MUSD

$ALUSD

$USDB

$LUSD

$TUSD

$DOLA

$OUSD

$USDM

$CUSD

$DAI

$sDAI

$USR

Show original13.96K

82

動區動趨 BlockTempo

BUIDL surges to $2.8 billion, BlackRock turns tokenized U.S. Treasuries into a mainstream cash tool

The BUIDL fund launched by BlackRock has skyrocketed by nearly $1 billion in just three months, capturing almost half of the growth in the entire tokenized U.S. Treasury market, now reaching a total size of $2.89 billion. It is not only the world's largest tokenized currency fund but also a flagship representative of the entire RWA market, accounting for 40% of the $7.3 billion market with just this one fund.

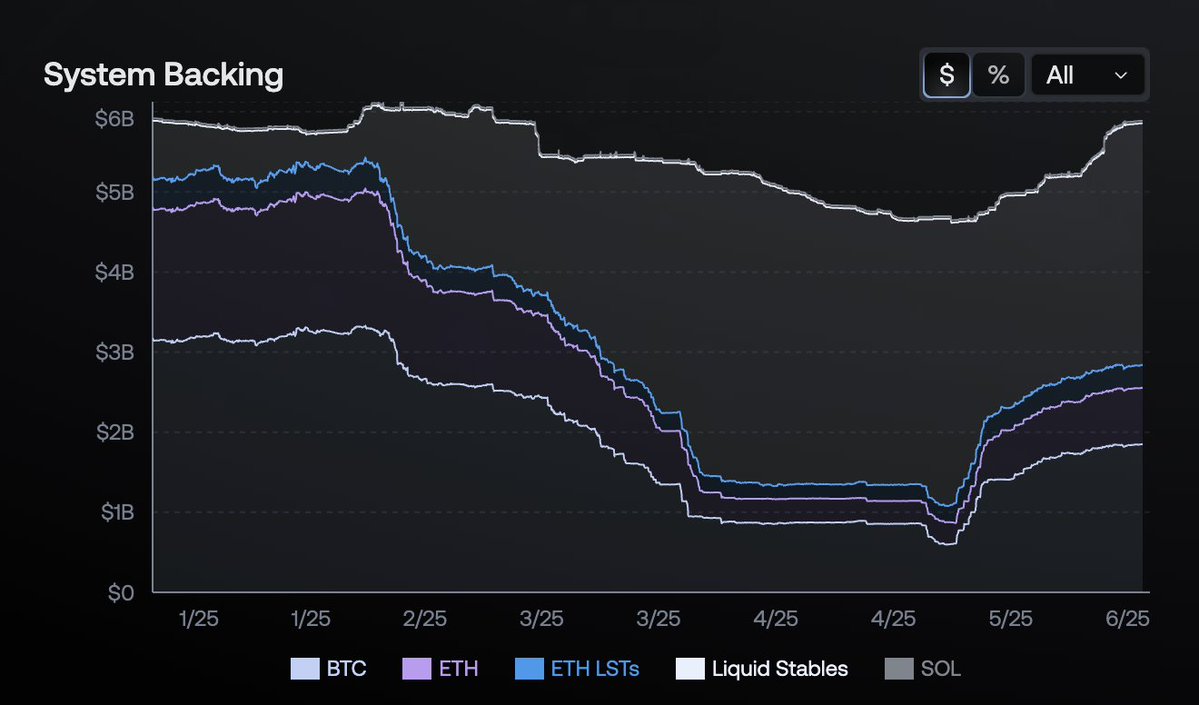

Ethena Labs has stopped using BUIDL as a source of asset backing for USDtb, as USDtb has been the main driver of BUIDL's growth this year, accounting for 90% of past capital inflows. The current influx of funds is purely driven by demand without the support of stablecoins.

Without Ethena's support, BUIDL has still managed to grow by 35% in three months, with demand for the on-chain version of "regulated, high-yield dollar assets" increasing rather than decreasing.

RWA is no longer just a "conceptual topic"; the tokenization of U.S. Treasuries is experiencing explosive growth.

From March to June, not only did BUIDL grow, but the entire RWA market increased by nearly $5 billion, with almost half of that being the tokenization of U.S. Treasuries. BUIDL broke through the $1 billion mark last March, taking a year, but this time it took less than 90 days to go from $1 billion to $3 billion.

In addition to the increase, it can also continue to distribute dividends, achieving a new high in dividends for three consecutive months. BUIDL's monthly dividends have set new records for three months in a row, soaring from $4.17 million in March to over $10 million in May, with total dividends exceeding $43 million. This should be one of the very few on-chain tools that can provide stable cash flow returns outside of the USDC stablecoin, serving as a cash pool or a foundational safety anchor for on-chain assets.

Show original5.51K

5

zefram.eth

Ethena is goated fr. Tokenizing the basis trade was attempted before Ethena but none were as well executed.

Ponyo

I Don’t Think You Understand How Great Ethena Is

Anyone can replicate delta-hedging at a small scale.

Scaling to $5B and rebalancing collateral across multiple venues 24/7 is another universe; yet just 26 people (@gdog97_, @ConorRyder, @sshxbt, @n2ckchong, @lingchenjaneliu among them) keep USDe’s peg rock-solid every single day. That’s insane.

Analytics, automation, and credit lines all balloon with size, making it nearly impossible to match Ethena overnight.

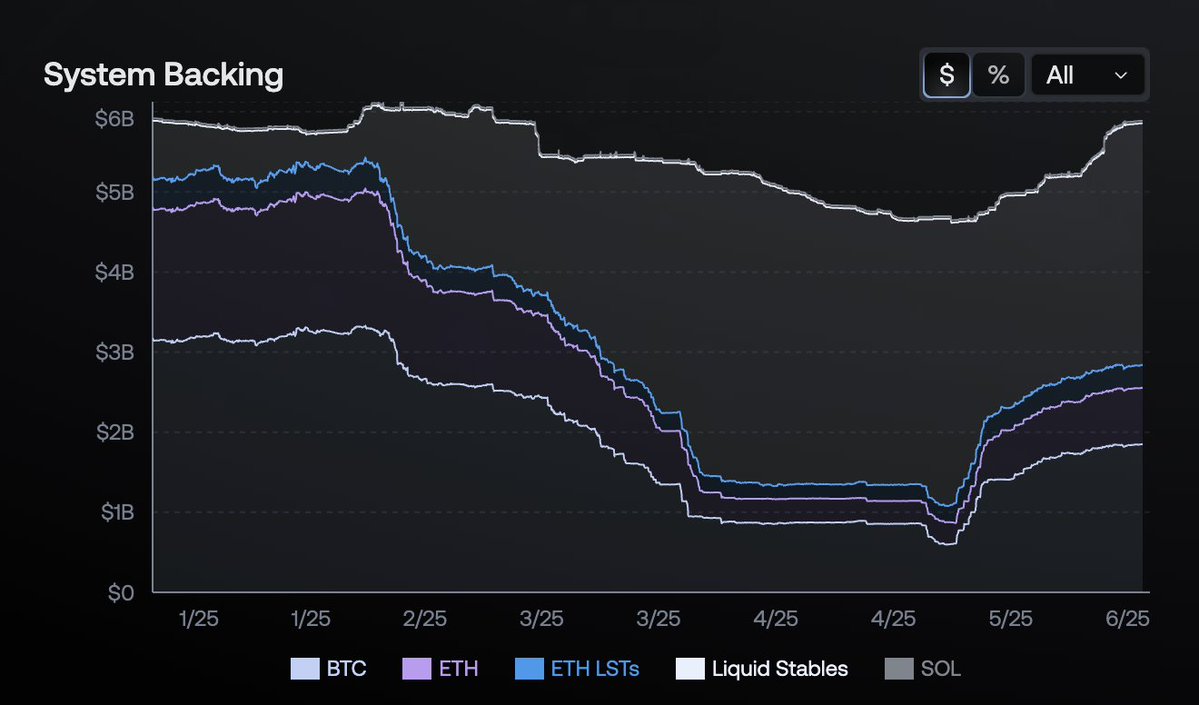

Instead of parked dollars, Ethena holds ETH, BTC, SOL, LSDs, USDtb and shorts the same stack on Binance, OKX, Bybit (Hyperliquid probs next). Price zigs, hedge zags, net $1.

When perps lean long, shorts collect funding; add staking rewards and USDe pays double-digit APY with zero printed subsidies. If funding turns negative, hedges shrink while reserve + staking carry the yield.

Ethena’s edge is less about clever hedging math and more about what can’t be forked:

- Institutional rails: You only run multi-billion shorts at Binance, OKX, Bybit if you’ve cleared the legal, credit-line, and custody gauntlet.

- 24/7 risk desk: Bots rebalance exposure across venues in milliseconds; assets live with Copper/Fireblocks, not in hot wallets. One exchange hiccups, collateral evacuates before X notices.

- Elastic yield. When perp funding is positive, USDe pays double-digit APY. If funding flips negative, Ethena dials hedges down, leans on staking, and taps its reserve.

Execution, not the idea, is the moat.

Next stop: $25 B float. iUSDe will wrap the same engine in compliance for funds and corporates. Telegram onboarding + the Converge chain pull in retail and TradFi simultaneously, a flywheel of liquidity → stability → yield.

Ethena turns volatility into cash flow and does it calmly. If USDe scales like T-bills did in TradFi, we’re only in inning one.

4.05K

17

Ponyo

I Don’t Think You Understand How Great Ethena Is

Anyone can replicate delta-hedging at a small scale.

Scaling to $5B and rebalancing collateral across multiple venues 24/7 is another universe; yet just 26 people (@gdog97_, @ConorRyder, @sshxbt, @n2ckchong, @lingchenjaneliu among them) keep USDe’s peg rock-solid every single day. That’s insane.

Analytics, automation, and credit lines all balloon with size, making it nearly impossible to match Ethena overnight.

Instead of parked dollars, Ethena holds ETH, BTC, SOL, LSDs, USDtb and shorts the same stack on Binance, OKX, Bybit (Hyperliquid probs next). Price zigs, hedge zags, net $1.

When perps lean long, shorts collect funding; add staking rewards and USDe pays double-digit APY with zero printed subsidies. If funding turns negative, hedges shrink while reserve + staking carry the yield.

Ethena’s edge is less about clever hedging math and more about what can’t be forked:

- Institutional rails: You only run multi-billion shorts at Binance, OKX, Bybit if you’ve cleared the legal, credit-line, and custody gauntlet.

- 24/7 risk desk: Bots rebalance exposure across venues in milliseconds; assets live with Copper/Fireblocks, not in hot wallets. One exchange hiccups, collateral evacuates before X notices.

- Elastic yield. When perp funding is positive, USDe pays double-digit APY. If funding flips negative, Ethena dials hedges down, leans on staking, and taps its reserve.

Execution, not the idea, is the moat.

Next stop: $25 B float. iUSDe will wrap the same engine in compliance for funds and corporates. Telegram onboarding + the Converge chain pull in retail and TradFi simultaneously, a flywheel of liquidity → stability → yield.

Ethena turns volatility into cash flow and does it calmly. If USDe scales like T-bills did in TradFi, we’re only in inning one.

Show original

18.7K

209

USDtb price performance in USD

The current price of usdtb is $0.99950. Over the last 24 hours, usdtb has increased by +0.00%. It currently has a circulating supply of 1,457,118,248 USDtb and a maximum supply of 1,457,118,248 USDtb, giving it a fully diluted market cap of $1.46B. The usdtb/USD price is updated in real-time.

5m

+0.00%

1h

-0.01%

4h

-0.01%

24h

+0.00%

About USDtb (USDtb)

USDtb FAQ

What’s the current price of USDtb?

The current price of 1 USDtb is $0.99950, experiencing a +0.00% change in the past 24 hours.

Can I buy USDtb on OKX?

No, currently USDtb is unavailable on OKX. To stay updated on when USDtb becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDtb fluctuate?

The price of USDtb fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 USDtb worth today?

Currently, one USDtb is worth $0.99950. For answers and insight into USDtb's price action, you're in the right place. Explore the latest USDtb charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as USDtb, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as USDtb have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials